Antique cars are special cars – and need special insurance coverage. If you don’t take the time to get a policy issued by a company that deals specifically with insuring antique and collectible cars, you’ll probably pay more – and get less coverage.

Here’s why:

If you buy a conventional insurance policy for an antique vehicle (in most cases, this is defined as a vehicle that is at least 25 years old) the coverage will probably be liability-only, because most conventional insurance policies base their coverages on the average “book value” of a vehicle according to used car value guides. And the average car over twenty years old is, typically, a rolling wreck. If it’s even capable of rolling under its own steam. What this means is that if there’s an accident, only the damages to the other person’s car will be covered. You will have to cover the cost of any needed repairs to your vehicle yourself.

And if the car is beyond fixing, you lose everything.

The second problem with conventional insurance is the assumption that the vehicle is driven regularly. This means – you guessed it – you pay more. I don’t like the way most insurance companies do business, but I must concede that it’s not unreasonable to at least partially base premiums on risk exposure: The more a car is driven, the higher the odds that eventually, a loss will be incurred. Whether as a result of a deer springing into the road or a sail fawn-addled oblivio piling into you from behind when you’re stopped waiting at a red light – the odds stack up against you the more you’re in circulation. Well, conventional insurance assumes you are in circulation often. Even if the car is not listed as the “primary” car the policy will still assume it is driven regularly – and your rates will be charged accordingly.

Result? You pay probably more than you should be paying – and get minimal coverage in return.

With specialty antique/collector car insurance, the equation is reversed. You should end up paying less – and getting much better coverage. Coverage that will actually pay to get the car fixed if some bozo hits you – or, in the worst case, console you with a check for the car’s fair market value, so that you can go out and buy another.

Specialty insurers such as Hagerty, J.C. Taylor, Condon and Skelly, and American Collectors Insurance issue what’s known in the biz as “agreed value” policies. These are based not on generic “book values,” like conventional insurance policies – but on individual car-by-car appraisals and the more accurate valuations of the collector car (vs. used car) marketplace. Such insurers know that (for example) a mint condition ’76 Trans-Am like mine is not just an old car, but a classic muscle car. And they know that my specific car is in excellent condition – not a decayed hulk with weeds growing through the floorpans.

The policies acknowledge explicitly – in legally enforceable, contractual terms – that it would cost a lot more than the generic amounts listed in most used car guides to replace such a car. So, to use my situation as a case-in-point, the policy I’ve got has “agreed value” comprehensive coverage that’s in line with the actual market value of my specific car. If someone hits me and totals the car, I get a check for that specific amount – not an “adjuster’s” lowball.

Of course, it was necessary for me to document the actual condition of my car before the policy was issued. Most specialty insurers will either send an an appraiser to look the vehicle over – or ask that you provide documentation, such as detailed photographs of the car, receipts, etc. to back up your statement as to its condition. You’ll also be asked (and may be required to document) whether the car is kept in a secured, protected environment such as an enclosed garage – as opposed to being parked outside where it’s exposed to the elements. And potential thieves. Also, any modifications performed on the car – such as engine upgrades to boost the factory-rated horsepower – may affect the final quote.

Another point: Almost all antique vehicle insurance policies are issued with the caveat that the car can’t be driven regularly. There are typically mileage restrictions of about 2,000 or less annually. It’s common for the insurer to require that the vehicle be registered as an antique with your state DMV and wear Antique Vehicle tags, which are limited use tags.

In my case, each year at renewal time I am required to provide an odometer statement. If I exceed the stated maximums, I have violated the terms and conditions of the policy. And if the cops see me driving my old Pontiac every day, I could be ticketed, too.

So, if you drive an older car every day, or use it as your primary form of transportation, antique vehicle insurance is probably not for you.

The upside is that, because of the decreased exposure to risk that’s inherent in insuring an infrequently driven antique, the premiums tend to be much lower. For example, when I first switched from conventional coverage that treated my classic Pontiac as though it spent two hours every day in heavy Washington, D.C. traffic – with all the risk that entails – to an antique policy that assumes the car mostly sits under cover inside my garage – I cut my insurance costs in half and also increased my coverage from nil to “agreed value.”

It’s peace of mind – and a great way to save a good chunk of change.

Throw it in the Woods?

I have a couple of older vehicles and would love to get agreed value classic insurance on em, but all the ins companies require the vehicle to be garaged, and I have a carport, not a garage. grrrr.

Hi Justin,

Yup. The garage requirement’s there because an exposed to the elements car is more likely to be damaged – or stolen. Leaving aside the insurance issue, I’d enclose your carport. For the sake of your classic car(s). They age much faster when exposed to moisture, extremes of temperature, sunlight, animals, etc.

Something I’ve found in the course of my professional and personal interest in urban design is the attitude that garaging belongs with dormitory suburban sprawl and that walkable neighbourhoods will have their cars parked on the street. Both logic and my own observation suggest the opposite: cars parked on the street either get used a lot or they crumble to dust on the spot. If we consider it desirable that cars get used only occasionally it surely makes sense that they are properly garaged the rest of the time. There is really no logic in the notion that cars get used less when they are despised and more when they are treasured.

Interestingly, in my work I’m finding the greatest demand for garages among the moderately wealthy. The seriously rich might have flashy cars, but they tend to regard them as short-term whimsies and have little interest in promoting their durability. So I find Audis being cosseted but Ferraris parked outside in a maritime environment.

I suspect that is a manifestation of anti-car sentiments more than anything else. The desire to make it more difficult to own a car, period.

If you have to park on the street, it means your car is vulnerable to the elements, to vandals and thieves – plus, there’s the hassle of parking on the street itself. Makes owning a car less appealing – which is the goal.

If you have a garage, on the other hand, you always have a secure place to park. The cars is safe – and stays cleaner longer. Probably lasts longer, too. It encourages the car owner.

Which is the last thing theywant.

I usually anger so called transit advocates because I tell them to make transit better and people will use it. Instead they concentrate on efforts to make driving worse. Less parking, more taxes, more fees, more revenue based enforcement, etc and so forth.

I have come to the conclusion they are simply anti-car and anti-mobility in general. There’s no reason to make driving worse to promote transit. Promote transit by making it better. If it worked better people would use it more, naturally, without coercion being applied.

Zoning is the reason. Walkable neighborhoods were built before cars and before zoning. After zoning cloverism at the time made neighborhoods less and even unwalkable. Demanding widely spaced homes, businesses far from residential, etc and so forth.

When new buildings are constructed in the old walkable neighborhoods, garages are constructed with them. Either underground or the building becomes taller or squeezed in the back, somewhere. A walkable neighborhood with garages from a blank sheet is possible. just not going to happen because zoning rarely will allow it.

Let’s say I live in Libertarianville and the houses are very close together. My neighbor is a grouchy old drunk but we respect each others property line. Past friction has made it clear that crossing the line bt either party will be viewed as trespassing.

So, he’s out there stumble down drunk again, music blaring and unwilling to even recognize that I exist.

Still on his property but only a few feet from my bedroom he has started his B-B-Q grill and in his stumble down drunk condition has inadvertently placed his gas can on the burning B-B-Q grill.

At what point, if any, do I have the right to intervene or have a third party private security person intervene? Must I wait for the explosion to destroy my house?

Put that into a drunk driving scenario.

Such situations do happen. But wouldn’t it be better to try to handle it on an individual level – by going over there and trying to reason with the guy, in your example – and if he’s not reasonable, taking reasonable steps on your own to protect your property – rather than accepting group guilt/least-common-denominator laws and all the henpecky harrassment and rigmarole that inevitably accompanies such?

I’ll give you an example – a true story from my own life:

Neighbors across the way – which is several hundred yards away – had a teenage kid who began playing cRap “music” all the time. We could literally feel the pulses of the bass. We put up with this for awhile, hoping he’d just stop on his own. He didn’t. One night, the Boooom…. Boooom …. brrrrrrrrr … Booom crap was going again. I was trying to get to sleep. It was past 10 at night. I blew a fuse. But I did not call the cops. I went out to me shed instead and found a moooo-sak maker of my own. My old – and loud – diesel tractor. I fired ‘er up and rode it out to our property line, pointed the nose at their house with my high beams on – and pushed the throttle all the way to high. Made sure the tank was full – and walked away. Would have left the thing running all night if I’d had to in order to get my point across. Perhaps kicked it up a notch with some Hitler speeches blaring at full volume on closed loop… all night long. It was not necessary. The cRap “music” shut off within minutes. So I shut off the tractor. They got the message. And we’ve had detente ever since!

Eric,

We have had some simular experiance here in MI during the dry heat wave. The key for homeowners is the reasable clause in the insurance policy.

By the time the drunk wakes up about 20 homes have burned. Call 911, the fire people and run like hell.

When those gas cans go off they are a bomb. You run the risk of no payment from your insurance if you do not.

That is in the contract with the insurance co. It is reasonable to call 911, it is not reasonable to let that fire burn.

If you see an illegal burn, call it in. In the above fire story, the jerk is a health risk to talk to.

Your story on noise makes sense, but not 100+ dry days with fire..

I’ve also had an amplifiers-at-dawn situation, with a neighbour who seemed to need a strange combination of Booom! Booom! Booom! and German pop to get himself going in the morning. A bit of good metal one morning solved that.

Yes!

The key thing is to return the favor at a time of day or night they like things to be quiet. I had my plan all laid out. The cRapper cracker liked the night, but preferred to sleep in. I was gonna mount the speakers way up in my trees, for good projection – then hit him with Hitler at Nuremburg (or Lawrence Welk, from circa ’77) at around 4 in the morning.

lawrence welk…enforcer!

and there you have it…just one more reason to go buy a tractor…peacekeeping!

in reality the ‘tractor of detente’ deserves a nobel peace prize more than obama.

Clik, as something closer to an anarchist than a mainstream libertarian I tend to put a lot of emphasis on structural aspects of situations. In the example you mention the fact that zoning regulations enforce a pattern of settlement that leaves us mutually vulnerable (and, incidentally, mutually economically isolated at the same time) springs to mind. One would surely expect a settlement established or developed under conditions of real liberty to be structured differently as regards choice of building technology, building placement, use of open land, etc. This is not even to touch on the many more or less subtle changes one might expect in that civic stratum of social relationships which are trustful but not intimate; a stratum of relationships currently rendered vestigial by State functions.

Likewise the drunk-driver scenario is socially problematic, as opposed to personally tragic, in proportion to the predominant density of vehicular traffic (which includes also the degree to which one’s participation therein might truly be said to be voluntary.) Abolish the commuter treadmill and the situation reverts to the realm of shit that happens – and shit will continue to happen no matter what, and some of it will continue to be tragic.

I think they should wait until you have an accident that is your fault and then let you pay it off by the month. The good drivers lose money by buying auto insurance. You paid 900$ for liability insurance and that has turned out to be a bad decision. It is the same as if someone did 900$ damage to your car and you have no way to recover your losses. And you will probably be losing money year after year for the next 50 years. Why don’t they wait until you have an accident??? I agree with you.

Absolutely.

We don’t (yet) punish people because they might litter (as an example). They have to actually litter before the men with guns and costumes enter the picture. Merely having some garbage in your car is not sufficient reason (yet) to assume the person is going to litter.

Having some sort of liability insurance may be a good idea. So is eating sensibly and exercising. But should these things be mandated at gunpoint? Not as I see it.

Also: Even the utilitarian premise of Clover-mandated insurance is faulty. The law notwithstanding, countless people continue to drive without insurance (or licenses) and they don’t give a flip about “the law.” Just as criminals aren’t going to stop using guns because “the law” says not to.

These laws only serve to impose hassle – and expense – on the people who are not the problem.

Michelle Obama tells a Maximum Security DC Youth Prison Camp “Let’s Move”

I’ve been carrying agreed value on my ’85 for years. These past 3 it hasn’t been insured at all since it’s being re-built, but I used to insure it through my PCA club membership, it’s worth mentioning that lots of car clubs have negotiated deals with specialty insurance companies and they’re worth looking into. Last time i had insurance, it was $75/year for $17,000 on an 85 928S. Pretty darned good rates.

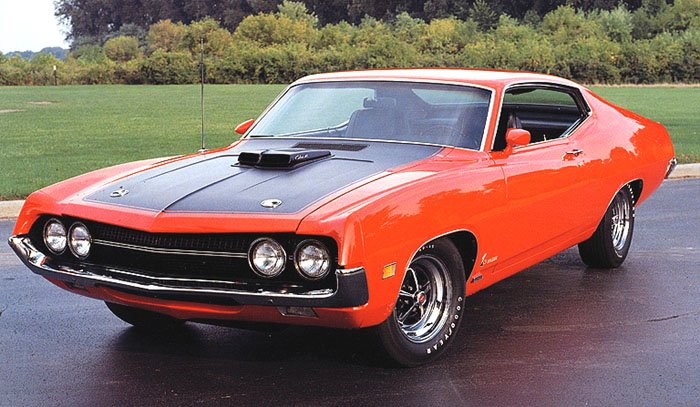

I wouldn’t have read this article if it weren’t for that Superbird picture on the splash screen. I used to live down the street from Richard Petty, he and I share an interest in that car 🙂

I recall the late LJK Setright’s objection to compulsory insurance on the grounds that it constituted a wager. As a religious Jew he considered himself under an obligation to abstain from gambling.

Strictly speaking, actual estimated value should be immaterial in agreed-value insurance, though it would naturally be in the insurer’s interest to ensure a vehicle for as close to its expected market value as possible. Technically it should be possible to insure an early Yugo upon which someone has sat for $8m, even if no owner would be willing to pay the likely premiums. Linking the agreed payout to any kind of intrinsic value just clouds the nature of the agreement.

Finally, I’ve got a political interest in people keeping older cars running as close to indefinitely as possible. “Antique” arrangements merely reward people for running a modern car as well – something I’ve stopped doing. That’s what environmental activists should be recommending, instead of the recent standard advice to trade up to a hybrid or “more efficient” new car. Here’s a recent blog post (admittedly aimed outside the automotive world): http://artisanalcars.blog.com/2012/05/06/occupy-the-motor-industry/

Eric, have you ever tried insuring a vintage race bike? I’ve got an 81 Suzuki that I race with WERA a few times a year. I’ve called every insurance company I can think of. I just want it insured against theft, fire (paddock fires happen, a buddy lost an SR500 at Road Atlanta two years ago) and falling off the trailer. Nobody will touch it.

You should come check the races out. We’ll be at Summit Point next weekend. You’d probably get a kick out of the Vintage Ghetto. Everything from museum quality 60s and 70s GP bikes to the more rat like creations out there racing.

I’ve never looked into it!

The racing part, of course, is the problem. Probably the same issue with race cars. They assume – not unreasonably – that a major loss is likely. If they did offer coverage, it’d probably be exorbitant.

Most of the guys I know who race use ex-street bikes that were dropped on the street and totaled out (mostly because of the cost of replacing the bodywork). But still sound mechanically and easy to bolt on aftermarket plastic and go have fun. If you wreck it, well, there goes $4k or so…

I used to go to Summit a lot when we lived in the DC area; now it’s too far a schlepp – and VIR is much closer!

Most club racers do exactly that. Salvage title street bike with race plastic. Of course, there are also a lot of guys that show up with a brand new Ducati that’s never even seen the street and a $300k motorhome. That’s what’s fun about vintage. It’s a cheap way to race. We spend as little as possible on our bikes so it doesn’t cut into the beer budget. They’re safe and mechanically sound, but they’re typically old and ugly. Most vintage guys also have to work on Monday mornings. I’ve actually thought about finding a baby Ninja and racing that. Those guys are as nutty as the vintage crowd and have more dates on the schedule. It’s another cheap way to go racing.

VIR is such a beautiful facility. It’s like a country club with a track instead of a golf course. It’s normally the first date on the Mid Atlantic schedule. This year it wasn’t for some reason. I have yet to run that track, I’ve only been pit bitch at VIR.

I am 16 years old, I got my license about 4 mohtns ago. I pay $ 24 a month for fire/theft/collision and a 15K mileage cap. My deductable is $ 125. It’s a 100% stock and original, restored 1973 Volkswagen Beetle worth about $ 9K. I live in the dense suburbs of Fairfield County, CT. How I managed to get the rate and my deductable that low is beyond me. I have no idea at all. I do have antique plates, but I have a 15K mileage cap.

Hi Irving,

That is outstanding! And not just car…. !

You’re paying less than $300 a month to the insurance Mafia – in Connecticut!

Just try to keep a low profile – and do your best to avoid The Ban Patrol… maybe put some of the money you’re saving on insurance toward a V1 radar detector.

Nice… I just contacted the last company you listed. I have a problem getting insurance for my antique because I have a carport. Most hommies don’t play that! We’ll see though.

Photoshop makes a great garage quick and cheap, ha! Ha!