In Cuba, they’re still driving cars from the ’50s. Not to antique car shows on nice Sunday afternoons, but every day.

Because Cubans can’t afford new cars.

Soon, most Americans won’t be able to afford new cars, either.

Whatever ephemeral, manufactured, smoke-and-mirrors “growth” the economy has supposedly undergone since the last collapse, back in ’08, has just been undone, son. We’re back to where we were – only we’re worse off this time. Because the jig is up. It is no longer insider baseball that the U.S. economy is in its late – probably terminal Ed McMahon stage: Old, tired – and broke. You can only spray so much ether into the carburetor… and people are cluing in. Not just the elites in DC and New York who run the show. Us. You and me and thee.

In the space of about four days (since last Friday) the Shyster Market has lost 4-10 percent of its value – value that may have been entirely paper value but nonetheless, the effect on the paper sent to millions of Americans (their next 401k statements) is going to be less-than-stimulating. Correction. It will stimulate them. But in an entirely different direction than the cheerleaders of “recovery” intend, hope and pray. It will make the sensible (yes, such still exist) batten down the hatches, where previously they perhaps had them open juuust a crack, suspicious but cautiously hopeful. No mas. Only an idiot (or someone who no longer cares about tomorrow) would continue to spend more than absolutely necessary for everyday life in this pre-Weimarian nightmare that is early 21st century America.

Meanwhile, life is going to get much harder for the not-sensible; the people who live on credit, in the moment – and well beyond their means (just like Uncle). It is a safe bet that interest rates are going to skyrocket while the value of a dollar plummets and the price of commodities goes through the proverbial roof. This triple tag team will make loans unthinkable – and new car purchases all-but-impossible for anyone who can’t lay a stack of bills on the table, a la Tony Montana.

Is it even necessary to ask how this will affect the car industry? Buying a new car – when not absolutely necessary – amounts to a vote of confidence in the future. It reflects the buyer’s belief that he will be able to pay for it; that his job will be there tomorrow – next year – and that he has the luxury of disposable income to spend on something “extra.” How optimistic is America feeling right now? Imagine how optimistic most Americans will feel when they discover they’ve been cheated (again) out of (for most 401k holders) thousands of dollars they thought they had last week.

The big question (well, one of the big questions) is whether the industry can survive another street beating in the space of less than four years. Ford is doing ok but GM (and much more so) Chrysler-Fiat are still pretty rickety. None of them can probably withstand a protracted downturn.

Meanwhile, the Great Seer in the White House – with his usual impeccable timing and mastery of all things economic – has just imposed another billion-dollar-mandate on the car companies; a near-doubling of federally-required “fleet average” fuel economy requirements – known inside the Beltway as CAFE. The Car Czar has decreed that new vehicles shall be “x” more fuel efficient – without also telling the rubes that they will as a result also be much more expensive.

That, of course, doesn’t even factor in the great likelihood that the cost of a new car in two or three years is likely to be 5-10-20 percent more than it is today even without the add-on costs of CAFE as a result of “QE3” (more Fed funny money “stimulating” the dying economy) and all the rest of it, including possible double-digit interest rates to compensate lenders for the effects of the former.

The ultimate result of all this will probably end up looking something like an American version of Fidel Castro’s Cuba. We already have the bleak, dead-looking cities; listless people shuffling around with little more to look forward to than their next slice of government cheese (for as long as that lasts). All that differentiates the United States is the still-extant appearance of prosperity.The shiny new cars we see all around us, in particular.

But it is a mirage.

If you were to put a big red dot on every car currently on the road that’s still being paid for, it would amount to more than half the cars on the road. Of these, a large percentage – around 20 percent – are “under water” (the owners owe more than the car is worth) just like the suburban McMansions many of these same people live in. For now.

The people driving paid-for cars are going to hold onto them – and forget about buying a new car. The people driving cars with outstanding notes aren’t going to be buying anything, anytime soon. And the rest – the Payday Lender frequent flyers and equity-spending “consumers”? Well, the music has stopped and all the chairs are occupied. Sorry.

And where does that leave the car industry?

Viva Fidel!

Why People Riot

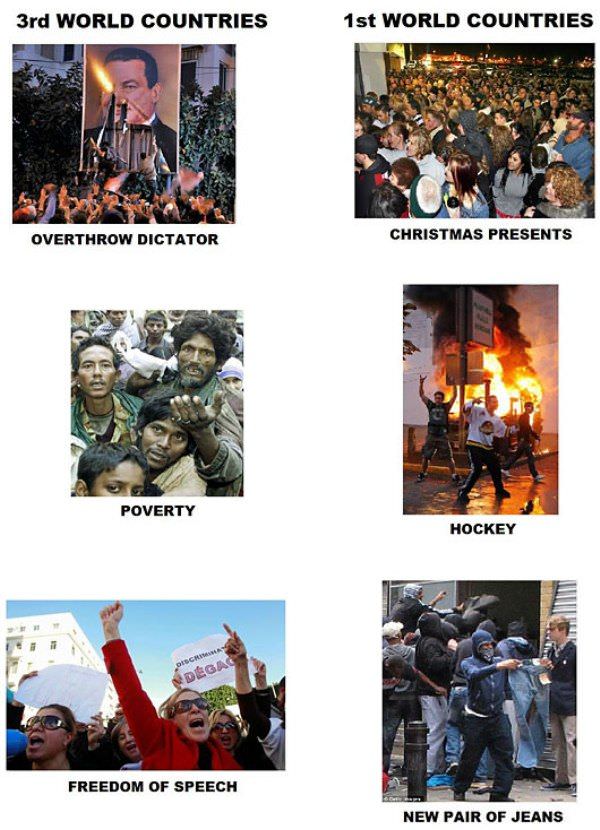

Why are Third World countries poor when they riot for freedom values?

“Freedom values” among rioters in Third World countries?

I assume (because it is hard to tell from the incoherence of this post) your are referring to the outbursts in Egypt and so on – and the (supposed) calls for “democracy.”

Well, “democracy” is not freedom, Aussie Clover. It is by definition majority (that is, mob) rule. The worst form of tyranny ever conceived, perhaps. Precisely because low-wattage Clover types salivate when they hear the word, equating it with that they perceive (because that’s what they were told in government schools) to be “the will of the people” – which they worship above all else. But it is simply mob rule, with the “will of the people” invariably “interpreted” by self-proclaimed tribunes of the people – what we call politicians today – who come to exercise near or outright dictatorial control and get away with it because, after all, it’s not them in charge – why, it’s the people – and they are just representing the people’s will….

If that picture is to be believed the Third Worlders would riot to overthrow a Dictator and for freedom of speech which in turn is what a Libertarian would agree to.

Most Clovers were infected with the false notion that the USA was conceived as a DEMOCRACY. They forget the origins of the political form of mob rule that democracy has become. In the’enlightened’ Greek city-states some 2,500 years ago, that is, those not under the rule of a local despot, or “tyrant”, like, for example, Sparta, the ‘voters’ were “free” men with PROPERTY, whom presumably had a vested interest in the affairs of the (city) state. Of course, this didn’t include slaves, women, or men, whom, otherwise free, didn’t have even a small plot of land and therefore had no ties to the state. Male citizens also had to answer the call to arms if they were capable, else they faced being voted “out” – LITERALLY, as a man whom was perceived as a coward, or troublemaker, or was otherwise unwelcome, could, by majority vote, be stripped of his lands, his family, and banished upon pain of death.

The best comparison of the difference between a ‘Democracy” and a “Constitutional Republic”…in a democracy, two wolves and a sheep vote on what to have for dinner. In the republic with a constitution that actually is respected, the sheep is armed and can fend off the ravenous wolves, whom discover the ‘advantages’ of vegetarianism!

Hi Doug,

Yup.

Democracy, in its essence, is nihilism. It proclaims that there is no moral standard beyond the majority. Whatever it or its claimed “representatives” decide to do is moral, ipso facto. It is impossible for there to be any principled defense of the inviolable liberties and rights of the individual in a democracy – because there are no inviolable individual rights in a democracy. The individual is allowed a few conditional privileges, as the majority and its “representatives” see fit.

And it’s much more loathsome than other forms of tyranny because most people do not see the tyranny because “the people” – which they idiotically believe to be themselves – exercises the tyranny rather than an individual king or fuhrer or Vozhd.

Appropriate quote on the 40th anniversary of U.S. President Richard Nixon ending the gold standard and ushering in, for the first time in human history, a global system of unconstrained paper money under full control of the state.

From DETLEV S. SCHLICHTER in the WSJ

Historically, all paper money systems ended either in complete collapse or a timely return to hard commodity money. Forty years after the start of the present paper money episode, we are facing the same choice.”

an article about sound money and how the least politically connected and poorest of society are affected most by fiat currency that can devalued at a moments notice.

As the article indicates:

“Only the initial recipients benefited from the credit expansion.”

The well connected (banks, governments, wealthy companies and/or individuals) are prepared to take advantage of easy money at the expense of the poor and disenfranchised.

//==================================//

Another article that in my opinion is related to devaluation of currency. Who is ultimately responsible for a nation’s debt?

People are reacting to austerity measures in Greece and other countries since: “I maintain that the vast majority of people do not consider the debt of their government to be the equivalent of their own personal debt, nor do they feel obligated morally to assume responsibility for any action that government officials undertake or any contract that they sign. This position is sensible.“

Amen! I have zero interest in the “national debt”. Show me where I signed on to that contract–no? Then beat it, post-haste. I will have nothing to do with paying it.

Unfortunately, the only way to enforce that truth is to either drop below a taxable income level and go dark, or renounce US citizenship and move.

I’ll probably take the latter in the near future. One can’t reliably “go dark” out in the country somewhere anymore, because Our Betters are now starting to enforce U.N. Agenda 21; living self-sufficiently in the country will be persecuted to death. Witness the SWAT raids on Amish dairy farms and peaceful, private organic food co-ops…the writing’s on the wall.

What’s frightening about these movements is not the bare facts–that Big Agra is muscling out the small competition with state help, a la Mussolini–but that this kind of government action in the past has presaged massive famines. Remember the Ukraine?

What’s really scary is that with food costs spiralling ever upward due to inflation, our illustrious gubmint is forcing more corn into our gas tanks. This further aggravates the problem by increasing the costs of feed for livestock, sweeteners, etc. I heard a shill for the state (masquerading as a news announcer) on the radio this morning explaining how food prices were going up because of climate change. I wanted to puke.

All costs should be spiralling out of control if hyperinflation has kicked in. If food prices are really going up in real prices then supply can’t keep up with demand. Then again Americans are so fat that higher food prices would actually increase their healthiness.

Aussie Clover: Consumer prices have been rising at an alarming rate. Food prices are an obvious example (and producers have been trying to mask the true rise in prices by repacking their items in smaller containers/units). A truckload of firewood that used to cost $270 in 2004 now costs $400. Etc. It is not – yet – hyperinflation. But it is absolutely inflation.

The money supply (the number of fiat currency “notes” in circulation) has been increased massively and tracks with this rise in prices. Do you suppose there might be a relationship?

What do you suppose happens when the amount of “money” (that is, of fiat currency) is doubled just by dint of printing new money? Do you believe new wealth is created this way?

If your answer is yes, then we should insist the Fed just print a few trillion new dollars, hand them out equally to everyone – so we can all be wealthy and have everything we could possibly desire….

If it’s just price rises due to standard inflation then incomes increased in kind too.

Wrong (again).

Individual and family incomes have been stagnant in real terms since the 1970s – while the cost of most consumer goods, as well as major things like land/homes/vehicles has increased by 20-40 percent, depending on the item.

Gil, you’re wrong once again. Inflation does not raise prices evenly. There are lots of people fighting inflation to keep prices of many products the same or at least not rising too quickly. This is done through greater productivity, material substitutions, cheaper designs, and so on. Where inflation shows up first and worst is where there is little margin to cut and no substitution is possible. Food is one of those things. Well non-processed food anyway. Processed food can often substitute less expensive chemicals.

Actually Gil, the reason that hyper-inflation hasn’t kicked in is because the banks have their excess reserves on deposit with the Fed. The credit supply is there for the lending, but the banks are warehousing that all that funny money with the central bank and collecting interest on it. It’s sitting there like a time bomb, but you probably still believe that inflation is an increase in the consumer price index.

As far as fat Americans go, the joke in Pakistan and India is; in America even the poor people are fat. That’s because we have such a generous social welfare system (redistribution of the wealth), that a large component of the population sits on their lazy butts, eats junk food and watches teeeeveeee for a living. Our so-called representatives keep this system in place for the votes. They keep borrowing and spending money they don’t have to keep the system in place.

I can assure you, prices have gone up tremendously in the last year alone. That doesn’t happen when the value of the money is stable. An ounce of gold, a pound of beef or a gallon of milk did not change in value Gil, the “money” did.

Dear Mr. Peters –

LOVED your article, Bears Stomping Cars! I have long been one of those still-extant conservatives who pay cash for EVERYTHING. Having seen the writing on the wall last year (and being Gulf Coast residents made seriously ill by the Corexit which is “safe as dish soap”), we sold all our livestock, cars, boat & most personal possessions & have come to Uruguay. Here, it is a daily non-event to see even 1938 Studebakers & old Bedfords driving about… We happily purchased a 1968 VW Beetle (all original, one owner), with a new radio/CD unit in it…

My husband quit his $70k job at AustAlUSA Shipyard in Mobile. We packed 7 suitcases & moved. We hope to get 5 hectares which, under this govt’s “back to the land” program will qualify us to receive free medical/health/dental care, as well as greatly reduced annual registration fees on the vehicle. We pay about $7.60 for gas, a bit less if we cross the border into Brazil to fill up.

We hope that by becoming breeders of Anglo-Nubian (improved with frozen semen from the US) dairy goats and Uruguayan llamas, we have found a niche market, as NOBODY up here has dairy goats & all love goat cheese (very expensive, as it must come from Colonias de Sacramento, on the opposite side of the country). I make 6 kinds of goat cheese, as well as goats’ milk soaps & lotions, which I hope to flog off on the international tourist trade in Punta del Diablo.

Fortunately, we received my husband’s pension (not full, of course, as he has just turned 50). However, with that & my Social Security check (for however long it lasts – a gamble at best), we will be able to build a house with our own hands for less than $5k USD. Of course, I do our laundry by hand in 2 buckets & the kitchen sink, boiling his socks on the stove. Most Americans would be lost if they found themselves in our circumstances (no dishwasher, no TIVO, no washer/dryer or A/C or even heater in the house). Our hot water comes from the shower tap & our heat comes from red eucalyptus & acacia which we split ourselves (cheaper than buying split wood). Our little “luxury” is having it delivered, at $60 per half cord… Our other little luxuries include the fine Tannat wine, which the Uruguayans wisely choose not to export. We eat luxuriously – 2″ thick prime rib steaks (I can buy 4 of these for $5.50). We entertain ourselves by building our own furniture for our future home (kitchen shelving last weekend, bookcases & an open-faced “closet” today).

Soon, we will plunk down $10k on land with/without a house. Whatever the case, we plan to rent the house out after building our own, in our own style. Much wood, etc. can be had either free for the asking or very inexpensively here. Ditto other building materials. Most Americans would curl up & cry at the amount of work we’re facing… (Thinking of my mom, the last true “Southern Belle” makes me ache with laughter.)

Anyway, thanks for the great article. Yes, Americans have “snurled up their noses” at Cuba for far too long… The future is coming & damned fast. I hope there are enough tarps in the US to house the future homeless.

Keep the great articles coming!

Melanie Cady

Punta del Diablo, Uruguay

I wish you and your husband well Melanie. From the map, it looks like you are near the coast. (Although in Uruguay most places are within driving distance of the ocean)

There is something to be said for self sufficiency.

I think that when one limits getting the “things” in life one can find that one does not need as much money to get by in life.

If you have food/shelter/good health you are on your way to having the basics for a good life.

My dad always told me it does not matter how much money you make if you spend more than you make you will be poor.

I enjoyed your recent column on car buying and took particular notice of the line that read, “The people driving paid-for cars are going to hold onto them – and forget about buying a new car.” So true! I drive a 1995 Toyota Corolla that gets 35 MPG, and it has about 370,000 miles on it – much of that from the years I was driving to far-off Army Reserve drill weekends assemblies. (I used to put nearly 1,000 miles on my car each drill weekend for several years.) My car still runs great and probably gets better mileage than many newer cars. I keep it maintained and don’t let small problems become big ones.

My wife’s car is a similar model and is even two years older, although it doesn’t have nearly as many miles on it.

When people ask when I’m going to buy a new one, I tell them, “Never,” and that I’ll keep driving this one until it blows up. Then I tell them that, because I haven’t bought a new car in so long, I take full credit for the collapse of the American auto industry.

It’s nice not having to make a monthly car payment. I intend to keep it that way.

Amen sir! I have two rules now: never buy a new car, and PAY CASH for that used car.

Taking care of a high-quality used car is a pleasure; I really feel invested in the machine. Every little engine sound, the little “tick” sound the brake pads make on going from forward to reverse braking…it’s mine in a way a brand-new dealer-serviced car just isn’t. It’s a more intimate relationship. And a huge money-saver.

Guys –

Me too!

I guess I’m a control freak in that I don’t like to be helpless and dependent; I’d much rather dig into an engine than dig into my wallet. It’s not just about money, though. It’s enjoyable – satisfying – to be able to fix stuff on your own.

Speaking of which, there’s the S1’s crank seals… looks like a fun job!

Well, my newest car is my ’97 Miata (with the hard top), it only had 105K on it when I picked it up for three grand. It has some dings (last owner was 19) and only gets about 31 MPG (my driving methinks), but a generic OBD II scanner works just fine on it. To Mazda’s credit, it’s about as tough a little two seater as I’d ever hoped for.

I’d love to have a beemer, but ever since my old boss brought me the climate control module out of his Mercedes to troublshoot (they’d ground all the identifying marks off the components), I lost interest in German cars. I can only imagine how proprietary they must be now. It doesn’t surprise me though, because the Germans probably figure most of us Americans are too stupid to work on much of anything besides a pizza and a beer belly. So they probably figure it would be better to take it to the dealer before the owner screws it up.

After listening to you guys, I think my next truck will be over 30, have a carburetor, points and a condensor.

Excellent! I picked up a ’92 Miata for 2400 bucks for track use, and I landed up driving it much more than the M5! They’re absolutely fantastic cars. You’re getting excellent mileage…I average 21, my driving, methinks 🙂. You can wrap that little engine to 6500 all day long. It won’t break, but if it does? $750 will buy you a new core…maybe another grand to rebuild?

It’s making me rethink my lust for BMW M-cars; maybe I’ll go Japanese next time.

I like buying new because I don’t want a car someone else messed with, drove, maybe didn’t take care of right. It seems like I’m always playing catch up. Scratches here, dirt there, little customizations to undo… arg. Oh and the engine compartments haven’t been kept clean either. I don’t care about the hit driving it off the dealers lot because I’m keeping it for a very very long time.

Buying new: Nothing wrong with it; just different pros and cons. As with buying used.

On a purely economic level, buying new can definitely make sense if you keep the car for most of its useful life, which makes depreciation irrelevant in addition to amortizing the initial expense. I think the reason that buying new ends up being a bad move for the typical person is that they don’t keep the car long enough. That’s fine, if you just like driving the latest thing, or like to drive something different more often, etc. But it’s also a money-loser, which is why I don’t do it!

The new car market is way off from what it was even 5 years ago. I know because I was one of the Top 20 US Salespeople for a particular import brand at that time, and I was making $85K per year, which was quite the income for the rural area I live in. I got out of the business, but the people that I know that are still in that game have seen their incomes decline by 70%, and one is working nights at a national shipper just to try to make up some of the difference.

I’ve been told that Henry Ford paid his workers $5.00 an hour early on. That’s five 90% real silver dollars! He did that so that the people that worked for him could actually buy the products they built. Nowadays one plain 1921 Peace dollar will bring around $32.00 (in Federal Reserve Notes that is). Hmmmm? That equates to about $160.00 an hour in modern devalued wages. If the average assembly line worker were collecting 5 silver dollars an hour now, he could easily afford a new car.

But what happened? In 1913 the wheels were set in motion for a group of dastardly men to take control of our economy and steal the value out of our money. When the Federal Reserve act passed in 1913 you could buy the same amount of goods or services for 4 cents that will cost you $1.00 today. Don’t believe me? Go to minneapolisfed.org and use their cute little calculator (upper right hand corner of the page for you clovers). The Fed in cooperation with “our” government took our gold in 1933, then took most of our silver in 1965 and finally disconnected their funny money completely from anything of value in the 70’s. In under 100 years, they have succeeded in devaluing our currency by 95.57%

If we still had real money and the big corporations compensated their workers the way Mr. Ford did, most of us would be driving new cars (at least the folks that are willing to work). Not only that, but we’d be able to retire wealthy. Instead, the Fed has given us debt backed paper to trade in and a constant barrage of boom-bust cycles. But don’t worry, they and their cronies in government, banking and the military-industrial complex bought on the dips and have done very well while they screwed the rest of us.

BrentP is right: learn how to fix things. When times get tough, people repair rather than replace. That bachelor’s degree in underwater basket weaving won’t do you a lot of good when your neighbor want’s to pay somebody to figure out why his Taurus has a random multiple cylinder misfire. If you can turn a competent wrench, you won’t ever go hungry.

In addition there’s the geometric increase in “mandate costs” that have driven new car prices up by at least 20 percent, on average. The air bag mandate alone has added $1,000 or more to the up-front cost of every new car (and a potentially huge repair cost down the road, if the bags deploy – which has also increased the cost to insure these cars). The government has decided that “we” need these things – even if many of us would rather not be forced to purchase them. If the car companies could make cars based on what buyers (vs. DC Clovers) are willing to pay for, one would probably be able to purchase a 50-plus MPG compact economy car for around $8,000 instead of $13,000 and up (and maybe 40 MPG).

Eric on the mandate costs–absolutely, and it goes way beyond just cost.

The goofy damn bulging hoods? Thanks, EUrocrats; it’s so there’s sufficient clearance between the hood and the engine so you don’t injure the f***ing Clover who just jumped in front of your moving car. The near-impossibility of finding a sub-3000 pound car? Thanks fed-gov for safety regulations that have added 1,000 pounds of steel and airbags. BTW they mandate crash safety for unbelted occupants, necessitating even more “protection”.

Predictably they’re now fighting against themselves, for the safety nazis will soon collide with the CAFE-nazis; no better way to improve fuel efficiency than reduced mass. But of course neither will give way, so we’ll have $100,000 Camries with carbon-fiber tubs and 1.2L fours straining their lives away against a generator charging batteries driving motors…all of course made of hyper-exotic materials that are scarce and/or in politically difficult areas (lithium, neodymium, etc)

Oh sorry I started ranting 🙂

I’m going to build a kit Lotus 7 and put a socially irresponsible engine in it. With no catalysts or airbags. Then do donuts in front of the DMV. While smoking a cigar.

Wow, lithium huh? I heard there was about $1.2 trillion worth of lithium under the mountains in Afghanistan. Hmmm? What a strange coincidence that the U.S. government has a compelling interest in the remaining 23 members of the Afghani Taliban…….

Of course there may also be an even more valuable commodity available in “The Graveyard of Empires”…dare I say it…poppies? Heroin: the better way to fund warfare and espionage without having to trouble congress for the money. Besides which, a little heroin helps clean up the inner-city gene pool. It’s alway better to let the “weed people” off themselves with dope. You avoid any unnecessary Nuremburg trials, they pay you handsomely to commit suicide and it gives you a good excuse to perpetuate the war on drugs. It just doesn’t get any better than that for the ruling elite, now does it?

Methyl, don’t be sorry for ranting. That thar’s whatcha call righteous indignation (somebody explain what that means to the clovers, wouldja’?). Ditto on the donuts in front of DMV, but I think I’d rather do it in an AC Cobra kit.

ROFLMAO nothing says “F U” like a 427 at redline burning up wide Goodyears! 🙂

And thanks. I think it’s high time for some good old anger at the situation the lying, thieving sociopaths in Gubmint have contrived.

Spare some of that for the Clovers who put them in place, too–yeah Gil that means you.

But I do think you’re a mean ol’ cynic. As someone explained to me at work yesterday, the reason our troops are guarding poppy fields and carrying fertilizer is so we don’t make the natives mad by cutting off their cash crop. See? We are there to win hearts and minds and spread Democracy, and to do that we have to tolerate some native’s deviant practices.

See? It all has a good explanation. Sheesh. I can explain Mena, Arkansas too AND why CIA planes laden with coke keep crashing also.

If you can turn a competent wrench, you won’t ever go hungry.

But if you want to work on modern cars, you need much more than a wrench and other hand tools, right? Don’t you also need a specialized computer to attach to the car’s onboard computer?

Yeah – that’s definitely an issue. For example, one of our posters here mentioned that to do even basic work on a new BMW, you need to have the proprietary BMW scanning/diagnostic equipment – which he tells me costs $10,000!

Dang, that’s worse than I thought; I fantasized that a single piece of diagnostic equipment could interface with the computers in many brands of cars. Of course, one can do many things (brake pad replacement, for example) that require only visual inspection followed by manipulation using non-electronic tools.

You’re right, a basic OBD-II reader will work on any car and give you the basic codes. I love mine–it works on my M5, my wife’s Infiniti, my Miata, friend’s Volvo and Isuzu, etc.

BUT it only gives you the generic code. Good readers also translate it to English–something like (not a real example):

“P00402–Left Bank O2 sensor number 1 bad reading”

The codes are super-useful diagnostically, but they can be misleading. You still have to use your brain; is it really the O2 sensor or is there a leaky fuel injector, a bad plug, a bad coil, a bad catalyst, etc.

The proprietary computers–like BMW’s GT1 (which I understand is soon to be supplanted by a newer tool) allow much deeper digging and most importantly let you actually TELL the various computers what to do–not just read them. For example on my M5, there’s a procedure in GT1 to stop the engine in a position conducive to removing the variable cam timing system.

The REAL bummer is that even straightforward maintenance will require the damn proprietary computer on the newest BMW’s–and I have heard Porsche, Benz, and Audi too. Replaced your battery? Gotta tell the computer. Replaced a headlight? The computer(s) need to know about it. In a sick way the computers resemble a gaggle of federal regulatory agencies!

I’m seriously debating whether to get the new 135 M-Coupe when it goes on the used market, because I don’t want to spend big bucks on the computers. Right now you can buy a Chinese knock-off of the GT1 for about $1500; I don’t know if the latest is available as a knock-off yet.

Or will I simply abandon my beloved BMW M cars, and go Japanese? My uncle and cousin have WRX STI’s that are lightning-quick, and fun and easy to work on. My wife’s Infiniti is a joy to behold and easy to work on. Hell, the new Mustang 5.0 engine is identical in spec to my M5’s V8–5 L, quad cam, variable cam timing, 7,000rpm redline, 400+ hp…

BMW has shot themselves in the foot with the “take it to the dealership” mantra. No longer will young guys buy a used BMW and fix it themselves while they save up to buy a new one. Moreover, their used prices will plummet as people realize how exorbitant their maintenance will be out-of-warranty.

It’s true! It’s true! Our standard of living is only 95.57% of what people had in 1913.

Non sequitur.

You’re trying to imply that because people in 1913 didn’t have sail fawns (or heart transplant surgery) that we, the people of today, have a higher standard of living because we do. In fact, we’d have those things – and much, much more, if a 2011 dollar had the buying power of a pre-1913 dollar.

That’s the essential point, Aussie Clover – which of course escapes you completely.

No we wouldn’t. If the dollar was mostly fixed didn’t inflate then neither would paycheques. People nowadays would be taking home a few dollar a week (but what a dollar!) Who cares if inflation “is a tax”? The government would have simply resorted to another tax. Doubly so since direct taxes and borrowing are the preferred methods anyway.

@Gil,

It would depend on what that dollar could buy.

If I could live well with USD $500/month then that would be fine with me.

If I made USD $50,000/month but I had trouble paying for my basic needs then this salary is not good enough for me.

Gil you’re displaying some economic ignorance I’m afraid.

Inflation is the most regressive of taxes, as it raises the prices of the most basic necessities first, thereby injuring the poor the most.

It’s an insidious tax, too; because wages don’t keep up with it, it leads to a grinding, incremental degradation of lifestyle over time.

Case in point: since America went off the gold standard in 1971, inflation has destroyed the dollar–to the tune of 85-90%. Whereas once a middle-class man could work at a moderate wage and support his stay-at-home wife and two children, while saving enough for retirement, now both parents must work and barely make ends meet.

The fallacy of “who cares about inflation, if my paycheck keeps up?” are unaware of the history of inflation–the paychecks don’t keep up.

Furthermore it’s hugely destructive to business investment by punishing savers–whose money devalues over time–and therefore driving a casino mentality with low savings rates.

Does great for the banks, though–the only “capital” is debt.

And THAT, sir, is by design!

Read “The Creature from Jekyll Island”, some Ludwig von Mises, some FA Hayek…you’ll get it.

Ahh typical cloverite “logic” of helping the foolish at the expense of the prudent. Inflation is a tax that causes all sorts of decay in a society by shifting time preferences alone. Even if wages kept up. It destroys savings, capital formation.

So instead of saving for something, like a car. People buy _NOW_ because it’s going to cost more tomorrow. People don’t save. People start living in the moment instead of thinking things through.

A regular tax would result in people getting very angry and involved. Most people don’t even understand inflation and blame the shop keepers and the like.

No ability to inflate means that people would start opposing things the state loves, like its wars.

What rubbish by you two – Brent and methyl. Deflation is good because it’s taxes borrowers and producers? Puh-lease. How the reason the American can’t make the same wages is because of global competition – suddenly the American is now competing with workers from all around the world and as such wages are going down which is good news for the consumer. People are already “regularly” taxed and should know about it when they fill in their tax form but still presume “everyone’s a saver”. Consider most people semi-save but are quick to borrow means they’re not exactly harmed by inflation.

See:

http://www.optimist123.com/optimist/2007/05/sound_money_ver.html

Ahh Gil… that author of that article and you sound like you’ve never produced anything in your life. By inflating the money at ‘just the right pace’ to keep prices “stable” the bankster insiders are racking off the productivity gains.

I don’t know about you, but I keep seeing my hard work raked off by the bankers. My employers never even got it. I had to do all this cost reduction work just to keep the cost and price of the product the same. Usually inflation can’t be beat and profits (and then my bonus) suffer. The bankers get it instead.

Borrowing money costs. By making a dollar tomorrow buy more than it does today people will build capital. It is long term society, because people can gain by saving for tomorrow. This makes a society rich. It brings about advancement because there is capital to borrow. The additional savings makes interest rates stable and probably falling over time as people were able to save more. Prices fall because the productivity gains are passed on to the customers.

Making money tomorrow worth less creates a short term society. A society that consumes for today because tomorrow there will be LESS.

If deflation were bad, the electronics industry would have died long ago because its productivity gains beat inflation. Instead it remains a very prosperous industry that advances rapidly. It proves that libertarian / Ron Paul view is the correct one simply by its rapid advancement, wide variety of products, and ever falling prices.

BrentP:

What makes your income is going to stay static in a deflationary period? Real income does grow regardless of inflation or deflation since it’s all about technological progress and productivity.

On the other hand, the electronics industry makes its money from turnover – they don’t ye olde hardware dirt cheap but sell the latest which happens to have more capacity than before but the price is more or less the same.

Unlike you Gil, I and many other people don’t live paycheck to paycheck. I assume you live paycheck to paycheck because you’re not concerned about savings only what your income can buy at any point in time. People who have savings are stolen from through inflation.

Price reductions (what you call deflation) outside the boom-bust cycle come through productivity increases. The ability to do more dollar value work per unit time. Thus in a properly functioning system there are no pay decreases because the products are getting cheaper because they can build them in less time, less material, and less energy.

As to the electronics industry, it’s more for less. When was the last time you paid thousands of dollars for a cell phone? Let alone thousands in 1980s dollars? Exactly, never. So no, it’s not always the new stuff at the same price. Further more a computer at $2000 in the early 1980s was VASTLY more expensive then than a computer for $2000 now.

Brent, I suspect that Gil either works for the gubmint or is on public assistance. People who don’t have to do productive work (which excludes practically every gubmint job) have no benchmark with which to gauge value. As you so aptly pointed out, they live for today so savings are unimportant to them (or they think they’ll get a fat gubmintpension at the next generation’s expense). These are the same class of people who frequently don’t use birth control; another action requiring forethought based an understanding of cause and effect, hence the large number of them (public dependents) outbreeding us (the productive) in modern society. Then they expect the rest of us to foot the bill for their offspring, because we’re “better off” than they are. They think we should be punished because we thought ahead and are successful. Sooner or later the hosts start picking off the parasites. The sooner the better…..

This portion of your comment really hits home:

“These are the same class of people who frequently don’t use birth control; another action requiring forethought based an understanding of cause and effect, hence the large number of them (public dependents) outbreeding us (the productive) in modern society. Then they expect the rest of us to foot the bill for their offspring, because we’re “better off” than they are. They think we should be punished because we thought ahead and are successful.”

I can work myself up into a real fury just thinking about the spandex-wearing, obese “moms” (and their “duhhs,” too) who whine at county government public meetings about the taxes on real estate not being high enough to support the (government) schoooooools where “our children” go. Why is your child my problem? Why does someone else’s decision to breed – or failure to use birf control – impose an obligation on me?

On this issue, “conservative” Republicans are as useless – as statist – as the worst left-liberal Clover.

Really? Who in the serious financial world wishes evyerone used gold coins? Most people in the business want ilquidity and ongoing movement on money rather wait for gold coins to go through their cycle in which those who make a profit slowly decide where to invest it when holding onto the gold coins doesn’t lose their value anyway? The world has moved on and the old worlders can buy gold with their spare change so I don’t see what the problem is.

Gawd! This has been explained to your thick self a dozen times now… but, one more time: It’s not necessary to carry physical gold around; just that paper notes be tied to gold. That they represent real, convertible value. If I own $100 “in gold” it does not matter whether it’s a piece of paper or the actual gold, so long as the paper is convertible into the gold and people can rely on that.

Gold-backed money can be as liquid as fiat dollars; only gold-backed currency is not fraudulent and destructive – as fiat currency always is (except to the elites who control the printing presses, of course).

@Gil on August 16, 2011 at 3:45 pm

I think you mean liquidity.

If two things are of equal value, the one that is more liquid is better, since it is easier to exchange it for something else.

Nothing is inherently wrong with gold coins. They have been used at different times throughout history. I would consider gold coins to be a very liquid form of wealth.

According to Aristotle, money needs to be:

(Paraphrasing)

1.) It must be durable.

2.) It must be portable.

3.) It must be divisible.

4.) It must have intrinsic value.

Gold does fit this, but it does not have to be the only kind of sound money.

Using sound money does not prevent business transactions from occurring.

Using sound money does make it more difficult for a government to spend beyond its means. It forces a government to make decisions in what it wants to accomplish.

Ultimately money needs to serve peoples needs and not the reverse. I think sound money is better than unsound money.

Social credit would help keep money as a servant of people instead of people being slaved to money. If you are interested is reading up some on social credit, I recommend visiting Michael Journal

Social Credit proclaims to the whole world: It is money that should be issued in keeping with actual and potential production; and not production which should get in step with money.

Eric, a typical clover/statist/bureaucRAT response doesn’t involve (a) understanding all sides of a concept (usually only one side), (b) rational or logical thought (only emotion, how they “feeeeel”) or even (c) responding in kind (it’s easier to change the subject than to build an informed response). Hence Gil’s flat worm like responses (apply heat to the beaker it swims up, remove heat it settles back to the bottom).

Gil the whole point is that big business men, bankers and government bureaucrats don’t want us, the “mundanes”, to use gold coins or a system of exchange based on a gold coin standard (which is a completely different concept than a “gold standard”, BTW). You can still carry on e-commerce, international trade and everything else we do right now with the “IOU nothing standard”. No problem.

The main differences are: if we start feeling a little uneasy that our bank isn’t dealing honestly, we can go get our money out at a fixed rate in a tangible asset. There may be a bank run and the bank may go bust(that happens with the funny money standard as well), but forcing them to have specie on hand or go to jail tends to make the bankers more honest.

We can also take our gold or silver out and exchange it privately which makes it very difficult to tax, which limits the size and scope of government, which is a very good thing for those of us who are non-aggressive and productive. Yes Gil, we can do that right now with bullion coins, but it’s more difficult, due to a lack of understanding by the general public intentionally created by our educational bureaucracy.

And when the money supply is based on tangible assets, people are less inclined to lend it out os freely which slows the credit cycle, rewards savers and investors with decent interest rates and stabilizes the economy. Once again thwarting scams by international bankers and bureaucRATs, not the masses.

Right now with the FDIC in place (meaning the full faith and credit of my and my American peers’ future productivity), bankers feel liberated to take all kinds of risks (e.g. the derivatives market, junk mortgages, etc.) without having the threat of potential bad consequences (like bankruptcy and incarceration for fraud). Your fear appears to be that a true free market gold coin standard prevents inflation of the money and credit supplies. Growth and progress still occur, but just where the people (who are the free market) desire it to, not at a the whims of bureaucRATs and other parasites.

Some of your previous points of concern on the matter involved fraud and counterfeiting, which as you well know are crimes. As long as the government participates in these crimes, rather than providing equal protection under the law, nothing will change. It was government collusion with international thieves that put us where we are today economically. These are all just men Gil, who have taken over the halls of power to enrich themselves at our expense. They stockpile gold in their vaults, buy land, works of art, airplanes and yachts and maintain a paper / electronic “legal tender” for the masses to convert our productivity into their wealth. Somehow you seem to miss this point: the ruling class has and uses gold, they give us paper. It doesn’t get any plainer than that.

Gil, pray tell us what exactly is it that you do for a living?

Gil, I take your attempt to create ridiculing questions in a new direction as your admission of defeat in this debate.

As others pointed out, nobody is going to shipping gold coins around any more than they ship printed bills around today. Your argument is about as valid as an argument against paper money because it would have to be shipped from place to place. Those problems were solved ages ago and the solutions are the same regardless if the money is fiat based or gold based or oil based or anything else.

Henry Ford did a number of things the ruling elite didn’t like. Somehow he never quite fit in with the rest of them. From what I read Henry Ford tried and then discarded company town notions of managing people for their own good.

Back around 1900 when $20 double eagles (gold, just under 1oz) were currency an engineer made $5000/yr. At $20.67 an oz that’s 241.875oz, which at today’s price is roughly $423,281/yr or about 3-5 times today’s salaries.

Hrrummph!….see here young man….there just wasn’t enough money to go around! The Fed was necessary to prevent the business cycle from ruining the country. They had to take all your gold and put more paper money in circulation for your own good. You should be thankful that you don’t have to worry about a pocket full of gold and silver…paper is so much easier to carry….little plastic cards are even better. Confounded Americans, don’t even know what’s good for them…the nerve of these people wanting to audit the Fed! Next thing you know, these commoners will want to audit Fort Knox too! They act like it’s their country and their gold!

I think the worst part about fiat currency is that it deliberately punishes savers. It almost forces people to gamble in the Shyster Market as a way to try to prevent the devaluation of their assets via inflation. And also, to just spend it.

“Money in the bank” under a fiat-currency system is like trying to keep a leaking fish tank full. You have to constantly add “water” just to maintain what you had.

It’s a despicable system.

It would been ironic if they audited Fort Knox and found no gold.

From Michael Journal

3. True wealth

Its wealth was not that of gold or of paper bank notes, but one of true value; a wealth of food and clothing and shelter, of all the things to meet human needs.

The definition of true wealth you offer is indeed correct. Gold, silver or paper are merely the means to facilitate exchanges without the hassles of a true barter society. A bag of gold to a man lost in the desert with no water is mere ballast. He’ll gladly trade it for a half full canteen, which in his case is real wealth.

All a medium of exchange does is allow you to store and transport your profit or labor long enough to acquire true wealth (i.e. the goods and sevices you want). When that medium medium of exchange has inherent value (like gold, silver, copper, platinum, etc.) and is universally recognized as a useful commodity, it is a long term store of value. When the medium is stiff paper with a lot of fancy ink on it and people start to see it for what it really is…well…it’s too rough to wipe with and doesn’t burn well.

@Boothe:

I’m dying, you had me at “Hrrummph!”

Well said. Soon, you can dispense with the pesky plastic pieces, for you’ll have an embedded RFID chip. Oh the wonders we’ll experience!

Actually…no….I won’t have the embedded RFID chip. You may find me at the bottom of that big ditch they dug outside town, but don’t look for me in the camp either….

It’s that Patrick Henry influence ya know.

I’m with you!

My Trans-Am and I will go out, hydrocarbons blazing…

Trying to equate wages via the price of gold is bunk. The price gold and dollars was fixed. Nowadays gold is free floating relative to the dollar. Using that method you would prove any who owned gold in Weimer Germany was superduperwealthy.

Aussie Clover, your comprehension of money (specifically, fiat money) is as lacking as your understanding of the concept of human rights. The fact is if you had gold in Weimar Germany, you had a way to beat hyperinflation because gold held its value (in fact, increased its value) and could be converted into currencies not being devalued into worthlessness like the German Mark, just as today a person who exchanged his fiat currency dollars for gold say three or four years ago not only preserved his wealth but increased it by a significant amount. Fiat currency steals people’s wealth; it is a tax on savings and prudence that impoverishes everyone except the shysters behind the scenes who manipulate the “boom-bust” cycle.

Gil, I suppose you also believe that wet sidewalks cause rain and that snotty noses cause colds. The inherent value of gold has barely fluctuated in 5000 years. Silver, since it is an industrial as well as monetary metal has been more volatile, but if you bought silver in the early 90’s……

The point is, the paper money is now free to float without the inherent stability of gold. If you look at what the economy did from 1800 to 1900 (excluding the War of Federal Agression) consumer prices went down (it only took 76 cents in 1900 to buy the same as a dollar did in 1800). The wealthy elite couldn’t have that. It’s too hard to control an affluent middle class, so you have to get rid of them through regulation, taxation, inflation, etc. So Gil, what kind of government check to do you get?

Gold has no “inherent value” it’s as valuable as people of the day make it.

Strangely, though, it has always been valuable – across time, in every human society that has ever existed. Since “value” is by definition a human construct – and clearly, humans value gold always and everywhere – then gold has intrinsic value if anything has value.

Why your antipathy toward gold? Unlike fiat (paper) money it is not subject to manipulation of its value because there is always a fixed amount, unlike paper currency, which can be inflated (printed) at will.

All we’ve “enjoyed” as a result of fiat currency is false and debt-driven “prosperity” – for which the bill is now coming due.

It’s quite true there would have been less growth under a gold standard, but the growth that did occur would have been real – sustainable – growth and real prosperity would exist rather than the illusion of it, as we have today.

Gil, gold is considerably rarer than most other metals, it is difficult to extract from the ground (or from rivers and streams), it is the only yellow metal, it is difficult to smelt and refine, it is vey soft and malleable yet very dense, it does not tarnish nor does it react with most chemicals and it is highly desireable for jewelry, artistic embellishment and certain industrial applications. These things and a few I’ve failed to mention make it a timeless store of value (i.e. labor), therefore a true monetary metal.

Which would you rather have Gil, an ounce of gold or a five trillion dollar note from Zimbabwe? After all the Zimbabwe government called paper good as they attempted to print their way out of the financial morass they had printed and borrowed their way into! The German Weimar Republic tried it, Argentina tried it, even ancient Rome devalued their currency by decreasing the size of their coins. Fiat money has ruined the economy and created privation and strife everywhere it is foisted upon the public by the ruling class. You don’t have to like it, but the only way to keep money honest is to have a precious metals COIN standard (i.e. any paper money must be a certificate representing and immediately redeemable in specie upon presentment to a bank). Anything else is a fraud that will be exploited by the ruling elite at our expense.

In the United States of America, one Constitutional dollar (the Constitution is the supreme law of the land according to our supreme court BTW) consists of 371.25 grains of fine silver, which equated to a 15:1 silver to gold ratio at the time when Thomas Jefferson (if you haven’t heard of him clover, look him up) was secretary of state. Now an actual silver U.S. dollar in well worn condition will sell for $32 to $35 paper dollars (bank notes issued by the private Federal Reserve Bank). That sir is serious devaluation, leading to economic instability, boom-bust cycles and wealth transfer from the people to banksters and bureaucrats. Like I’ve said before, if you like this type of monetary system, move to North Korea; you’ll love it there.

C’mon Gil, why do you think that governments and central banks stockpile gold and not paper? When Judas sold out Christ it was for thirty pieces of silver, not paper. You’re in denial: we’ve been screwed by the people we are paying to protect our life, liberty and property and you don’t want to accept that fact. Wake up.

One more thing Gil, women love gold jewelry. My first job out of high school was a gold smith’s apprentice in a jewelry store. I have cast, hand fabricated and repaired gold jewelry and still have a bench set up at home. You should see the look on a woman’s face when she picks up a custom made article or when you’ve repaired a piece of jewelry that has sentimental value to her. As long as men love women and seek their affection, gold will have a tremendous amount of value. For that matter, I did my share of work for the gay community too. So the “people of the day” will continue to place value on gold and will also continue to wipe their butts with paper.

No inherent value to gold? Back when I worked in the electronics industry many of the parts I was responsible for were plated with gold. Paper and digits in a computer are what have value assigned to them. Gold is useful.

Also gold’s physical properties make it extremely good for use as money. It does not decay like many other materials.

Let me pose a question to you. You’re going on trip through time. Either the future or the past. You will arrive somewhere there is civilization. You’re going to be staying awhile. You need money because you cannot carry the goods you’ll need to survive. You’ll arrive with only what you can carry to the check in desk of an airport. Pick your currency:

Your choice of paper bills in current circulation. Be it euros, dollars, whatever.

Your choice of silver and/or gold coins presently existing for sale from coin sellers.

You have to pick. You can land anywhere from 1000BC to 3000AD in a random city in normal commercial circumstances. What money are you taking with you? Are you taking the fiat money you argue for, or are you taking “libertarian” money?

Saying gold is better than paper/electronic money is akin to saying a chook shed and veggie patch is better than supermarkets because you’ll be safe when society crumbles. I s’pose I could have something better than “inherent value” perhaps it should have been “magical value”. The modern economy requires constant transactions and access to money, i.e. electronic money. Considering bank runs existed when paper money that was supposed to backed by gold wasn’t and the first runners got their gold and the last were holding dollars that weren’t IOUs after all then the modern economy would slow down as people use gold and silver ingots to trade and even slower if there’s word going around about fake metals and now everyone’s testing the ingots are real before comleting transactions.

Haha, Boothe you feel for the nominal prices versus wealth creation trap. Most people wouldn’t have seen much change in their living standards between 1800 and 1900 as most were still on the family farm by 1900. On the other hand, there’s been a huge change in the standard of living for people between 1900 and 2000. Yet sure enough Libertarians prefer the romance of the 19th century over the 20th century.

Deflationists seem to forget that when the currency is more valuable the harder it becomes to get more money. Workers won’t be blown away when wages are getting cut as prices are going down. On the other hand, how many people could stockpile gold in event of capturing the effects of deflation then as well as now? How many could currently spend ~$1700US for 1 ounce of gold just to have it idle? In a sense the currently is already convertable to silver and gold – just buy some and stick in a safe if you think precious metals are the only safe investment. No one’s stopping you and you’ll be laughing if the doom&gloomers are right and everyone else is holding worthless currency and stocks.

Aussie Clover, you don’t understand what money is. It is a medium of exchange. When the medium is divorced from an objective value (gold, for example) it becomes a vehicle for theft-by-proxy. Shyster bankers (the Fed; whomever controls the printing presses) can increase the supply of money (but note carefully, not the value of it) which in fact reduces the value of the money in circulation – affecting the people further down the food chain the most; i.e, the oleaginous banksters, knowing the currency is about to be inflated, get full value of their dollars before the effect of the inflation (new money) permeates the economy.

Fiat currency does not create prosperity; it impoverishes the average person for the benefit of the financial elites; it discourages prudence and saving by penalizing savers and encouraging profligacy and debt-driven “finance” consumption.

As far as the rest, your historical ignorance is as stupendous as your economic illiteracy. The average person may not have had electronic baubles (or modern heath care) in the 18th and 19th century, but they were also not debt slaves fated to spend their entire lives in cube farms (or wearing name tags and fake smiles) in order to try to keep pace with the endless treadmill of earn-pay-tax-borrow-spend that is the new norm today. People owned their land and homes. There was the concept of the freeman. Beholden to none.

Are we richer – or poorer – today?

I know that, from the Cloverite perspective, it is preferable to be a “safe” debt slave. To be a good herd-animal, submitting and obeying and in return having a sail fawn and a PlayStation and an SMooVee and a mortgage on a suburban McMansion that you’ll never, ever pay off… waking up one day to look in the mirror and see an old person who owns nothing and whose entire life was as pointless and forgettable as that of an ant.

Oh noes! Better shut down gold and silver mines! Those bastards are diluting the stock of the existing piles! Imagine how much more valuable gold and silver would be if they were forbidden from mining!

Seriously the market has spoken: paper and electronic currency. People are not seriously going to be using precious metal ingots to pay for goods let alone ship bars across the world.

Yeah we soooo worse off today over a century ago. And so on.

Aussie Clover: You studiously avoid the point, which is that paper money tied to gold or silver has a fixed value, is much harder to inflate. It can increase, but only when the supply of real value behind it (gold or silver) also increases. And increase is not the same as inflate.

Real money represents actual value – tangible value. Fiat currency represents… nothing. It has no value as such; only the faith that people have in its value. And once that faith evaporates (as is happening right now) then – poof – there goes your fiat-denominated “wealth.”

People don’t need to exchange physical gold (or silver) either. So long as the notes representing the gold silver are sound (i.e,. not just slips of paper) then there is no problem. This obviates your red herrings about “the market has spoken” and “paper and electronic currency.”

The world is increasingly coming to grips with the fraudulence of fiat currency.

But Clovers, being the products of government schools, will continue recycling the bromides they were taught to recite.

Salamander-in-training says:

Yep, the market has spoken. Gold was $260/oz in 2000, now it’s $1750/oz. Silver was $5, now $39.

And seriously–your method of argument is so intellectually dishonest it’s maddening. Of course most people prefer paper or plastic to pay; it’s the underlying representation that matters. Look at GoldMoney or any of the other digital-certificate gold banks out there that freer people than Murrikans can use.

The marriage of public/private key cryptography with ages-old gold just makes my heart sing! FTW!

Someone else, I think Boothe, pointed out that gold represents labor. I would qualify it with gold represents labor augmented by the technology of the day.

Because its extraction is laborious and costly in capital equipment and energy, it is a fantastic proxy for “This is what man, with man’s ingenuity, can produce in X amount of time.”

As a medium of exchange, this proxy-value for augmented labor means it matches the same augmented labor value of products it is used to purchase.

So, going back to the “suit of clothes equals ounce of gold” going back to antiquity: gold-mining efficiency mirrors efficiency gains in most other industries very closely, as does its labor, fuel, and capital costs.

End result? Stable prices when expressed in gold!

There’s some variation, sure. But the fact is, economies, when growing at a healthy, organic pace (not the freakish steroid-rage fiat pace) grow at about 2% per year when things are good. Gold, too, grows at about 2% per year. We’ll discuss the sustainability of either curve later in the context of a closed vs. open Earth system 🙂

We could convert to a gold-backed system TOMORROW if we had the will; trouble is, the richest, most powerful people on earth (most of whom you’ve never even heard of) will and do kill routinely to prevent it happening.

Eric:

I suppose you’re like a lot of Libertarians who see savers as the good guys and borrowers as the bad guys?

Methyl:

Oh noes why did the market practically abandon gold and silver a decade ago? It was at an all time high 20 years prior to that? The historical of gold and silver price since gold was severed from the dollar shows people don’t place a fixed value on gold.

Once again, if YOU want to buy gold and silver coins/ingot with your spare change then knock yourself out. Likewise your suit analogy is crap – so a handmade suit was $250 in 2000 but $1750 in 2011? Conversely how many gold coins bought a TV in antiquity?

Aussie Clover:

Yes, saving is good and borrowing (that is, debt) at best a sometimes necessary evil.

Do you think it is good to be in debt? To encourage consumption before production (borrowing)?

To discourage saving?

If gold is really tied to inflation like some goldbugs think then was there a long run of deflation between 1980 and today?

Gil, the gold futures market, the silver futures market, the commodities markets in general are paper markets. They are and have been subject to price manipulation by the central banks and their peers. Right now they trade way more paper silver on the Comex than is even physically available. It’s manipulation at its finest, not honest free market economics.

Buying gold and silver bullion coins is actual inflation protected savings, not an investment per se. When one buys dollar denominated bullion like the U.S. Eagle, Canadian Maple Leaf or your own Aussie Kangaroo, they are actually doing a currency conversion from the central bank’s “notes” to specie, with the added benefit that the coin will never be less than face value (I have heard that people actually spent $5 Maple Leaf bullion when silver dipped to $3.50 an oz.). When the government sets and maintains a monetary standard based on a specific quantity of precious or industrial metal (i.e. copper or nickel), the currency remains stable and you have a level playing field. When the government allows the banksters to disconnect the money from tangible assets and inflate or deflate the money supply arbitrarily, you have the boom / bust cycle.

At the bust point the strong hands buy up the tangible assets as the weak hands panic and dump their holdings on the market. It really is that simple and it has been going on long before there were televisions, SUV’s or i-pads. Our mode of dress, means of transportation and communication have changed, we have creature comforts and ammenities our ancestors could scarcely dream of. But human nature has never changed and evil men will seek out ways to steal wealth and empower themselves. The best tool they had was paper money, until digital ledger entries became available to them. The amount of gambling going on in the derivatives market alone exceeds the entire GDP of all the countries in the world!

It can’t last, it is totally unsustainable and just like Zimbabwe, the results will not be pretty. But it may take a long time and during that time prices will continue to go up, but our wages won’t. In the United States real wage values have not increased since 1975 due to monetary inflation.

I ask you again Gil, if someone offered you the choice between a five trillion dollar Zimbabwe note and one ounce of gold, which would you take?

@Gil, (on August 15, 2011 at 1:16 am)

It is not a question of good guys or bad guys. A good guy can be a Borrower or a saver. A bad guy can be a Borrower or a saver. Think of the grasshopper and the ant. One planned ahead and one did not. The question is should the one that planned ahead have to pay for the poor planning of those that do not. (I know that this is not an exact analogy, but I think the general idea should work for this example)

A stable currency that retains its value is more of a benefit to savers and lenders of money.

Gold (or silver) generally keeps pace with

inflation. If you can find an investment that will get you a better rate of return, then you should consider if it is a good idea.

If the relative value of the currency is stable, the investment might be better than gold.

If the relative value of the currency is unstable and its value is likely to lose its value in the future, then your investment needs to offer a rate of return that is better than gold and make up for its loss of value.

Hypothetical:

Today you have:

$100 of gold

$100 of currency

Assuming a stable currency:

In 1 year the value of the $100 gold become $104 due to keeping pace with inflation.

In 1 year $100 of currency is ~$96 due to inflation.

You would need a rate of return better than ~8.3% to equal the value of the gold after one year.

If the currency drops 5% in value in addition to inflation:

In 1 year $100 of currency is ~$91.20 due to inflation and 5% drop in value.

You would need a rate of return better than ~14% to equal the value of the gold after one year.

Gold (and other tangible assets) tend to hold value when currency is losing value. It is one reason why people rush to buy tangible (and useful) durable goods if they sense their money is loosing its value. Someone may buy something (car. refrigerator, computer, etc.) today that will be useful for many years, if they can not find an investment that will keep its value ahead of (inflation, taxes, and devaluation). Get something now while you still can get it.

Inflation and devaluation of currency eats at the present value of money.

for example: 50 years from now $28,900 would only be worth $3,855

Source: How much is $100 worth in the future

Inflation helps borrowers since they pay back their debt with “cheaper” dollars since $1 today is worth more than $1 in the future. It hurts savers for the same reason (but in reverse). In order for savers to keep pace they need to find investments that keep pace with the rate of inflation + tax rate. If they do not keep pace then they lose money.

This is part of the reason why banks charge interest when they lend money. They want to try to get the same purchasing power in the future and make profit as well.

ie. the $100 they lend today will have the same $100 purchasing power when they get paid back at the end of the loan.

Some calculators for Future and Present Value of Money

An article by Warren Buffett regarding inflation.

costs and effects of inflation

Seriously, Mithrandir, check out the real price of gold over the past 50 years. If you listened domm&gloomers in late 1979 and stocked up on gold then you’d have to wait another 30 years before you broke even. In other words you would have sucked as an investor.

http://static.safehaven.com/authors/saville/19338_c.png

Gil, The only way gold is going to fall like that again is if Helicopter Ben is replaced with someone willing to raise interest rates to 22%. Furthermore you fail to understand that gold is only part of a person’s asset mix. At a 22% interest rate someone with a good mix of assets will quickly recover any losses in metals.

So, if you hate gold you should cheer on very high interest rates and in doing so you’d make me a very rich man.

What a total lack of understanding. Gold is the best way to compare wages and prices over a long period of time.

Did you know that gasoline is as cheap or cheaper as it was 50 years ago? You just have to use the silver based money of 50 years ago to see that.

Gil: No, no, and, No. Mein Gott it’s like training a salamander.

The “dollar” was a term for 1/20.67th ounce of gold. The ratio wasn’t “fixed”; the dollar was defined as a certain weight in gold.

Gold’s value relative to a basket of other commodities, and to common manufactured goods, remains incredibly constant.

In Roman times, a good set of men’s clothes–toga, sash, sandals, or whatever–cost an ounce of gold.

In 1800’s England, a fine suit of clothes–cost an ounce of gold.

In 1900’s New York, a fine suit of clothes–cost an ounce of gold.

Yesterday, a fine suit of clothes–cost an ounce of gold.

Here’s the trick: an ounce of gold actually represents a fixed and large amount of labor and energy. In Roman times, they didn’t have clever chemical extraction techniques and heavy mining equipment, so getting gold was quite a trick and relied mostly on laborious prospecting for surface gold.

Today, we have tremendous chemical and mechanical advantage–so it’s more efficient.

But guess what? Making a suit of clothes has also become more efficient; you don’t weave the cloth on a manual loom anymore for instance.

Gold is effectively a proxy for man-hours of labor and energy input.

Wow! “it’s like training a salamander”, what a wonderful analogy. I think I am beginning to understand the cloverite world view: it’s all based on introspection. Unfortunalely there is some type of disconnect from reality in the clover mind that prevents them from underdstanding that introspection is the act of examining oneself for his own betterment, rather than inserting inserting one’s cranium into the first dark smelly orifice they can locate below their belt line. This might explain the sh**ty outlook most clovers seem to have on life! 😉

An ounce of gold is just that – an ounce of gold. If you look at the price of gold over the past fifty years (a timeline within a person’s actual lifetime) gold hasn’t been on par with inflation and can suck as an investment if you buy and sell at the wrong times.

Here a Libertarian against goldbugs:

http://johntreed.com/golddisadvantages2.html

People like you – Clovers – often use dismissive terminology as a form of argument. For example, “gun nut” (that is, a person who objects to being disarmed and rendered defenseless against armed thugs) and “gold bugs” (that is, a person who believes in sound money rather than fiat currency).

Your entire argument is based on a false premise – a straw man. The world economy is (at present) completely artificial – manufactured (and exaggerated) “business cycles” of boom and bust driven by fiat currency. This creates all sorts of distortions in everything from the cost of goods to the price of labor to the volatility of investments.

The basic point here, Aussie Clover, is that a fiat system is controlled manipulation of the value of money by and for a small minority that has caged a monopoly right to perform said manipulation. A sound money system cuts such buggers off at the knees, making it almost impossible for them to destroy the value of people’s cash assets – which is why said elites revile sound money.

What’s astonishing is that “average Joes” like you not only don’t understand the fleecing being performed upon you – you cheer it!

Gee when a currency exist that a Libertarian would approve of? Oh yeah the Byzantine Empire! If coins were traded they were clipped or alloyed with cheap metal. If there was a gold standard more paper notes ended up being created and when people got a wiff that was happening there was a bank run. Now the world economy runs of money that based out loaning new money and charging interest or something. Darn non-Libertarians! Darn them to heck!

Idjit, how about pre-Federal Reserve (gold-backed) dollars? Once again you show yourself to be a graduate of government schools; that is, an ignoramus.

Gil, we had a gold coin standard in the U.S. until the early 20th century. It worked very well for holding prices stable, provided financial privacy and usually prevented the government from inflating the money supply to do things that would otherwise not be tolerated by the public. I say, usually, because during the Revolutionary War and the War of Federal Agression public fear and frenzy allowed monetary inflation (printing worthless notes) to wreck the value of the dollar and the men in government failed to pay it back in specie as promised. But that’s just fraud; failing to keep a promise or to perform under a contract. For some reason Gil, you seem to think that using paper currency / electronic transactions rather than specie eliminates the potential for abuse. Not so; it exacerbates the problem.

No doubt about it, coin clipping, shaking bags of coins to collect the dust, debasing through alloying or cladding and just about every other method you can think of have been used to defraud the public. Counterfeiting is another example of fraud. These are crimes Gil, not unlike burglary or armed robbery. But substituting a debt generated currency that must constantly be inflated to keep ahead of the interest payments on money loaned to the government that we have to pay for with our own labor and property is also fraudulent. Government money printing is the worst form of counterfeiting because they are the people we’re paying to protect us from this type of crime.

Whether you like it or not, Americans were prohibited from even owning monetary or bullion gold by the federal government, in this so-called Land of Liberty, for several decades. Why was that? It was done to create a inter-generational disconnect in the minds of the public between specie (Constitutional money) and “legal tender” or money by decree. People who were alive in the 1930’s didn’t trust banks or paper money for a very good reason! It took a couple of generations for the banksters to help the public forget what had been done to them. Some of us have not forgotten and prefer tangibles over promises to pay for some of the very reasons you have also pointed out.

Thou doth protest too much about honest money. What kind of government check are you depending on? Government employment? Welfare? Disability? Perhaps you’re incarcerated? Usually a productive and reasonable person, when confronted with the amount of information we have all provided to you would acquiesce to at least some of our points. I begin to believe you are merely an attention seeking troll and the free market method of dealing with trolls is shunning…….

What I think is a good reason for buying a new car in the short term is that they are going to get a lot more expensive (in dollars) and wouldn’t it be better to be the guy who had new ’58 to drive around in when things went to crap than the guy who had an old ’48?

New car sales will probably go well in the short term as people try to get while the getting is better. Long term they are going to be hurting. There will probably be a short time where auto rebuilding will be profitable. My guess is the government will make that illegal after it becomes popular. The government will see it as avoiding their new mandates and laws.

Skills will be important. Being able to fix things will become very important as new goods become difficult/expensive to get.