Almost every negative thing happening in the car business – in particular, ludicrous technical complexity for the sake of electronic gimmickry and also to cope with diminishing returns federal “safety” and emissions mandates – could be gotten under control by the simple expedient of cutting off the monopoly money/debt-financing that makes it all possible.

The seven year loan.

“Free” money (zero or very low interest).

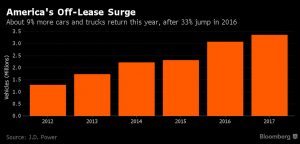

The car industry is riding a bubble that’s proportionately as large as the housing bubble of a decade ago. And it is going to pop. For the same reason that a wave has to crest and wash ashore, once set in motion.

Signs of trouble abound. They build them – but no one comes. Not without inducements that amount to give-aways.

For several years now the car manufacturers have been resorting to truly desperate measures to prop up new car “sales” – in air quotes because it’s a dubious proposition to describe as a “sale” a transaction that involves exchanging the item for a sum insufficient to cover the cost of its manufacture, plus a profit sufficient to make the exercise worthwhile.

Yet that is exactly what is going on.

As new car prices rise, the cash back offers, dodgy leases and other “incentives” necessary to move them off the lot also rise in frequency and inanity. Examples include the leasing of electric cars for less than the cost of a monthly cell phone contract (Fiat made just such an offer; see here) and “below invoice” transactions that rely on the manufacturer (e.g., Ford) paying a dealer to “sell” a car (e.g., manufacturer to dealer incentives) for the sake of getting rid of it, getting it off the books.

Or rather, onto someone else’s books.

This financial flimflam works for awhile because – just like the housing flimflam – a shell game is being played.

The dealer finances the acquisition of a new car, which he buys from the manufacturer; he then puts the car on his lot for sale. He pays interest each month on his loan, just like an ordinary person who has bought a car on debt (the honest name for a loan). Each month that comes and goes with the car still on his lot is another month of carrying costs for him.

Selling the car – that is, transferring the debt load – becomes a matter of increasing urgency.

In order to entice a buyer – that is, the next-tier-debtor – he resorts to every measure available, including “special offers” and (here we go again) extremely dodgy financing. His goal is not so much to sell the car to someone who can afford it but to offload the debt.

Onto a bank or other lender.

Eventually, the taxpayer – when the bank collapses and the government bails it out.

Once the papers are signed and the car is driven away, it is no longer the dealer’s problem. He no longer has to worry about it. If the “buyer” fails to make the payments, it is now the lender’s problem.

And that problem is written off, in its turn, when it becomes necessary to do so. The bank makes up the loss via interest and fees on other debt. Or by re-selling the repo’d vehicle at exorbitant interest to another debtor.

Rinse, repeat.

The dealer, meanwhile, has made a “sale” – and it is so recorded and reported, adding another log to the swaying Jenga tower.

Sound familiar?

But wait – there’s more!

As the ever-more-desperate measures to prop up new car sales become ever-more-desperate and more and more people who really can’t afford new cars “buy” them anyway, it depresses the used car market. Why “buy” a used car, after all, when you can “buy” a brand-new one for about the same monthly payment?

The used car market is cratering – and that is a sure sign the fat lady is clearing her throat.

Remember: Interest rates on new cars are lower (even nonexistent) and the loan/debt can be extended over a preposterously long period – seven years is now routine – while the loan/debt on the used car must be of shorter duration because of the greater and faster depreciation on the used car. The typical three-year-old car is worth about 75 percent of what it was worth when new – and will only be worth about 50 percent after another three years. Writing a loan/debt on an asset that will almost certainly be worth less than the balance due on the loan before the loan can be paid off is what you call a bad deal.

It cannot go on much longer.

The loan/debt limit has probably already been reached. Seven years is a kind of Event Horizon for car loans because after seven years, almost every car – regardless of make or model or what it sold for when it was new – will be worth less than 50 percent of what it sold for when it was new. They can’t keep pushing off the paid-for date in order to keep “sales” from wilting, permanently.

This is why the bum’s rush to ride-sharing; to the rent-by-the-hour (via an app) business model that GM (Maven) and Ford (the firing of Mark Fields) and pretty much the entire car industry have embraced as their only possible savior. The people running major companies are many things but idiots they are not – some superficial evidence to the contrary notwithstanding.

Poltroons and greedheads, certainly. But not dummies.

They know that they can’t keep pushing out loans indefinitely to sell cars. It is not tenable, both because of the debt load (unsupportable) and depreciation, which imposes a physical limit on loan duration. Hence the new rent-by-the-app (and hour) business model. It is the only way the business can continue without going out of business.

Either that or economic sanity returns.

The government stops mandating diminishing returns emissions rigmarole, for instance. And here’s a real whopper of an idea: We get scientists, not politicians and regulators – to prove that harm (real harm, not some ugsome bureaucrat’s hypothetical) would result from dialing back the current rigmarole to, say, model year 2000 standards.

Consider: Were new cars “dirty” in 2000? Were the skies suffused with smog? People choking and coughing, falling comatose into gutters? No, to all of the above. The fact is the cars and the air have been clean for decades – but the EPA continues to pretend otherwise, to maintain the fiction of the need for its continued existence.

And it goes without saying – or should – that how many air bags a new car has (whether several or none at all) ought to be none of the government’s business.

Same for the presence or absence of back-up cameras and anti-whiplash head rests and whether the car can do an egg-beater roll without its roof crushing. The fact that some people want to be parented doesn’t mean the government has the right to parent the rest of us. Let those who want and need adult diapers go ahead and wear them, if they like.

So, the good news out of all this bad news is that it must soon come to an end. The cost-no-objecting and mandating; the noxious, suffocating parenting.

It is going to end – because it cannot continue.

If you like what you’ve found here, please consider supporting EPautos. (Latest radio guest appearance can be heard here.)

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: EPautos stickers are free to those who send in $20 or more to support the site.

For this financing reason and a host of others, I suspect we’ll look back on the years 2010–2016 as the last of the good old days for new motor vehicles. New cars are about to become a big pain in the ass to own and operate as government fuel economy, safety, and emissions regulations continue to tighten, forcing vehicles to become ever more complex to comply. And that’s not to mention they’ll also become a lot more expensive.

To go with that are all the predictions that today’s children might never actually learn to drive, get a driver’s license, or own their own cars because of ride-sharing services and self-driving vehicles that act as de facto taxis. While I suspect many of these predictions about self-drivers are overblown, the increasing prices of new vehicles will discourage the youngsters from driving and car ownership.

It all appears to be downhill from here. Here’s my prediction: we’ll never see new vehicle sales in the US at the record levels of the past couple of years again. Ever.

I should add that I work for one car company at a very low level, and everything said here is just my opinion. But I have seen what’s right around the corner that I cannot yet discuss, and the complexity issue is about to go off the charts. This will affect all the automakers. If you have bought a new car recently, enjoy it. Many of you might not want a newer one later even if you are able to afford it.

I have a question for the finance experts present here: I am well aware of the fact that banks create mortgage loans and new money out of thin air via fractional reserve banking policies; but are car and credit card loans also secured by a 10% reserve cash savings account by a bank customer? Might these loans be backed 100% by newly created money out of thin air?

I just bought a brand new 2015 Honda CTX 700. I had been paying cash for everything for nearly 2 decades and I thus had no credit score. I have a strategic reason for establishing credit for myself; but I promise that I will never borrow over $10K. I put $4K down for this bike and financed the rest. I owe less than $4K for it and I intend to pay it off with-in 6 months for credit establishing purposes. I earn about $1K gross per week, so I could realistically pay it off in less than 3 months, and I will pay it off as quickly as possible. The loan is for 3 years at 17% interest! I will not allow myself to be raped for 3 years. I will have _a_ positive credit rating in 6 months.

I am just wondering if the Credit Union who loaned me the money was creating the entire loan amount out of thin air.

Brian, you should know what you paid for the bike. If the amount they loaned you doesn’t represent the amount you were short, something isn’t right for sure. If you’re wondering about the time and amount of interest, they’re just hoping you’ll be on for 3 years at 17%. They can’t keep you from paying it off in any amount of time less than the 3 years. I feel I’m missing something here.

Hi Brian,

Although your loan is all digital transfer, the lender did have to transfer actual funds to the dealer, who now possesses the money. But your lender didn’t create it out of thin air. Only the Federal Reserve has the power to do that. It is the source waters of “money” – that is, of fiat currency (paper and digital) and creates out of thin air the supply of it, which is then distributed to lesser banks within the Federal Reserve System, to be loaned at interest.

All banks in the FDIC system have the authority to engage in fractional reserve banking, which lets them loan up to 9 dollars for every single one deposited in their institution. It is interesting that the FDIC reserve account, out of which losses at member banks would be paid out, contains a bit over a penny for every dollar insured.

Thanks for your reply Bill. Do you happen to know if unsecured loans are financed by the same $9 to $1 ratio like home mortgages are? I am asking this because if unsecured loans are indeed created mostly from thin air; then the national monetary policy is in even worse shape than even Austrian Economists have reported on Lew Rockwells’ site to the best of my knowledge.

Security isn’t involved in fractional reserve banking. Every dollar deposited lets them loan $9 regardless of who borrows it, and they regard money in their banks as nonperforming assets. That’s why it is so hard to draw money out of an account. Everything that is deposited belongs to the bank under current federal law, and most of us are simply unsecured creditors to the banks. They’ll pay the secure creditors first. We’ll get the scraps, if any are left. Go watch the video at ATMcrisis.com Hillsdale College is a good source for details.

THe operating rules of the NCUA are virtually identical to those of the FDIC.

@ Eric Peters Autos:

You sez: “The government stops mandating diminishing returns emissions rigmarole, for instance. And here’s a real whopper of an idea: We get scientists, not politicians and regulators – to prove that harm (real harm, not some ugsome bureaucrat’s hypothetical) would result from dialing back the current rigmarole to, say, model year 2000 standards.”

Everything in your article up to this point I found myself doing the bobble-headed agreement dance, but then the above quoted paragraph screeched me to a halt…

…because it smacks of that dreaded new villain about to jump boots-first down out collective gullets: TECHNOCRACY!

Yeah, I don’t want “scientists” anything with any power to do any gov’t style fatwas or whatever. Scientists are LIARS, and 99.99% of them these days are bought~n~paid for shillbaggers for some industry or corporation, PAC, NGO, or some other entity that has MONEY as its root interest.

TECHNOCRATS are the ones who are trying to merge us with the “machine”. Technocrats ARE YOUR CLOVERS. You cannot disagree with them, and they know everything and you know squat. You cannot run your life efficiently or safely without THEM. Yes, Eric, those fancy minded “scientists” (like the liars who pushed global warming with Gore) will utterly abolish humanity. At least the psychopaths just want to extend evil and mayhem, but a few will slip past. The Technocrats will develop a machine and process to ferret you out: nowhere to hide.

Only a fool believes known liars. And our scientific community today is nothing more than faith-based delusional observations and commanded test results….or funding and tenure stops.

If the the scientists get their paychecks from the government, directly or indirectly, they will figure out a way to say what they are told to say so that it sounds scientific enough to fool the peasants, a la IPCC.

The American people are so indoctrinated that they will believe even the improbable if it spoken by a man with a chest full of military ribbons and/or letters after his name.

You are spot on. Keep flinging arrows into the bullseye!

After a very short period of time, they are going to constitute a pileup, with no access to the bullseye remaining.

This is an interesting discussion — more interesting than the story that initiated it. I believe the underlying problem is people playing by rules put forth by stakeholders in the process. When my wife and I sat with a realtor to begin the house buying process, he suggested we start by figuring out how much we could afford to pay for a home. I told him we already knew how much we could afford to pay — we needed to figure out how much house we could buy for that money. People have to come to the table with as much data as the seller/broker and a plan to get what they want — and be willing to walk away from a bad deal.

When I started saving, we invested mostly in one stock via a 401k account. The stock has been doing very well and I figured I could easily afford to pay taxes and penalties if I needed to withdraw for my kids college. If the stock stopped soaring, I could take the dividends out as regular income and use that. As luck would have it, the stock crashed and the dividend was slashed a year before my oldest started school. I left the money alone and took advantage of low mortgage rates to fund his education. Now the stock has recovered, the dividend is approaching pre-cut levels, and I have paid off the money borrowed for school. Dividends from the stock will pay for my younger child’s education.

I have taken two ‘ready loans’ against my 401k. I may soon take a third. I think of these as diversification of my 401k — kind of like having a CD in the savings plan. Again, it’s a situational thing. If I need money and interest rates are high or my holdings are expensive, I use the expensive holdings to finance a loan and the interest goes back into my account.

Getting back on topic, when I was young, I had more time than money and had an interest in how things worked. I bought inexpensive used cars and kept them running. When I got older and had more money and less time, I began purchasing inexpensive, reliable new cars. I was in the market for a new tow vehicle when I read that Ford had 90 days of F150 inventory on lots. Then I started seeing the discounts and rebates and now I own one.

My point is that spending, saving, and financing are situational. Following rules (the herd) is not the best idea and following the recommendations of those trying to sell stuff to you is a bad idea. The so called Car Bubble is a combination of factors not mentioned in this post. It’s pretty simply, actually. cars are built better, last longer, and cost more. Insuring and registering a new car costs much more than doing the same for an older car. People buy a car and hold on because it makes more sense economically. I don’t know why this is freaking people out. Isn’t this good for the planet?

I’m curious. Is the F150 a towed vehicle or a towing vehicle? If the former, what is the dinghy pulled by?

I’ve lived in a van since the mid 80’s and if the PMs go up appreciably, I’ll buy the motorhome or school bus I’ve long thought about. You are a lot braver than me in your use of 401k’s, but then, all of my savings are in PMs.

Hi Bill, I’m also curious. Are you “Uncle Rico”?

https://giphy.com/gifs/tds-throwback-rABd969kLbtlu

Good catch OldFatGuy. We would also like to extend you an offer of employment as one of our editors. Welcome to the Eric’s Thought Garage

Just saw my first GM Tahoe commercial for 0% 72 month finance on the 2017 models…that is in addition to the best price negotiated with your dealer…Wondering how low those trade in’s have to go for the dealership to make money?

I See a New to Me car on the horizon! Minus the GDI per Eric!

Why would any auto dealership take a trade that couldn’t be sold for more than crush?

IMO, what we will be seeing soon is used car leasing/renting. Businesses will buy the best trade ins from the new car sellers and lease them by the day, week, or month, to customers who will always have a working car, because there will be a loaner on the tow truck that comes to pick up the one that doesn’t work. If the business is really smart, they will identify the make, model, and year of the least expensive cars to maintain and endevour to build fleets of them. Then, they’ll always have a backyard full of parts to keep the best ones running. This happened just before the VW bug became untenable due to the emission scam.

The marked difference between a car loan, which is a consumer loan, and a mortgage, is that it is for a consumable. Houses are supposed to be an investment. Stating the obvious I guess.

The illusion of investments. All is vanity. Consumed by the Kings who translated such scriptures for our vulgar commoner languages. Cars are Fordism. The build consume junk repurpose paradigm on steroids.

Mortgages are on property consumed in different ways. Consumed by laws and officialdom. By wars which are the consumption of real estate and all assets. Hitler eats Kaiser. Uncle Sam eats Kaiser. Kohl eats Uncle Sam. Merkel eats Kohl. Junker eats Merkel. UN eats EU.

Christians eat Jews and Pagans. Lions eat Christians. Barbarians eat Romans. Mualims eat Christians and Seculars. Always it is consume consumue consume. Wars are cyclical harvestings. Most human effort is consumed and then defecated out as something similar. But more shitty.

BLM. Natural Parks. Land use restrictons. We didn’t start the fire. But it’s always burning since the Langoliers are churning.

Nomadic hunting grounds become fenced ranchs. Mining camps. Woods are cut. Praries burned. Wild animals holocausted. Wetlands become farms. Beavers die no new lakes and bogs. Railroads highways. Eminent domain.

More cannibalism than capitalism. The biggest slaughterers and feasters get on top. The road to serf debt consumptions. Your wealth and sustenanced plucked from you. So you beg your bankers for loans to buy more consumables to replace what’s been taken or converted.

Vast tracts become bedroom communities, retail and office complexes. Light and heavy industrial parks. Become decaying ruins. Become graffiti and litter teenage mental capacity wastelands.

This is a like a long piece of poetry.

“houses are an investment” is another government/banking fairy tale!

I think he’s right in there’s a difference, and it’s worth lots of time to find out how permanently attached to the Earth assets differ from mobile ones.

But yeah. As Mencken says there’s For every complex problem there is an answer that is clear, simple, and wrong.

The primary reason why houses didn’t depreciate is because the appraisals could be continuously goosed up to keep up with inflation. The value of a house doesn’t increase any more than any other durable good, but it is subject to the vagaries of the real estate business, and it has a longer lifespan, so it can be inflated for longer. Many people change their homes as often as they change their cars, and Gary North isn’t the only economist that will tell you it makes no sense to buy a house unless you intent to die during the mortgage. He also buys only used minivans.

Hi Bill,

I disagree with Gary… a bit.

A house is a tangible asset and fungible. It may not be an investment, but it can be a safe store of value, especially as a hedge against inflation.

Example: I bought my house in 2003. It is currently worth at least what I paid for it, in today’s inflation-adjusted dollars. In other words, I still have the money I had in 2003.

I also have a place to live that doesn’t cost me ordinary rent (the house is paid off). While I am still obliged to pay property taxes (so is the renter, by the way; these are folded into the cost of his rent) the amount is much smaller than a monthly rental/mortgage payment, taking a considerable burden off my back.

Hi Eric,

While it is true that you still have your value, because you probably didn’t buy your house with real money, gold and silver, and real estate is overbuilt in many places, it is unlikely that you could get back what you invested.

On the other hand, I started buying gold and silver back in the late 80’s, when gold was $250 and ounce and silver $5. Gold has since gone to $1900 and silver to $44. While I could get several times, in dollars, what I invested, the value of those dollars won’t buy more now than it would have then. That is known as the fine suit premise, that one could always buy a fine men’s suit for an ounce of gold. Because mass production has lowered the cost of most men’s suits, the qualifier “fine” is key. I’m with Dave Ramsey on the fact that gold and silver are not truly investments because they don’t pay dividends. With the price of stock and its PE ratio both at historic highs, their dividends are pretty much gone as well. A piece of metal can’t disintegrate, but paper is very good at it.

PM may not be an investment but it’s no gamble either. Investments all come with risk. After a decade of retirement I am not concerned with “return on my money” because I can’t assess risk if I am not “in the club”. I’ll stick with hard assets, like PM. I will not have to worry about “return OF my money”.

The “vagaries of the real estate business” have nothing on the heavy hand of Government which can literally crush the values of entire sections of a town or city by declaring the need for “affordable housing” in an area and implementing their tools for “fairness”.

But it takes Goldman Sachs selling the same ounce of gold 200 times on paper to hold its spot price down. The government’s ability to manipulate property is keyed to its ability to tax it, and there is a move on in many states where PMs are subject to sales tax to make them exempt so there isn’t a tendency to treat them as commodities instead of as money. If you dance to the tune of the piper of government, you are stuck with whatever tune they play, and increasing, that is a tune to which the dance appears combative.

The key similarity is that they both are substantially secured by collateral.

Not so much with modern cars, but there are plenty of surviving vehicles that are being used as daily drivers and that are companies that specialize in providing part and service to keep them going long enough to become classics. Modern cars are just another disposable consumer product.

“how many air bags a new car has (whether several or none at all) ought to be none of the government’s business.”

The nonlibertarian response might be that the government has to make decisions for people that are either too irrational or stupid to make their own decisions. This is for the greater good as the gov will end up needing to support people who make massive mistakes that involve major injuries.

I would also point out that if the Libertarians were actually in charge, the highways and possibly all roads would be privatized. The owners might not let you on their roads at all, and if they did they might require even more safety measures, including upgraded license requirements and insurance. Operating a highway for maximum profit might mean speed minimums, not limits. For example, if you cannot go 100 mph safely, you cannot enter the highway. Maybe you would pay tolls by the second not the mile of usage. I am of course speculating as no such system actually exists, as libertarians have never been in power. I am not claiming private ownership of roads would be a bad thing, only that some people would have to change their ways if such a thing were to exist.

On the subject of electric cars and the destruction of Germany, Germany is planning on sticking ordinary electric customers with the cost of charging stations for e-cars. But don’t worry they need to make up the lost gas tax revenues somehow.

Using Google translate.

“The federal government plans to launch one million electric cars by 2020, six times as many by 2030. To this end tens of thousands of new charging columns have to be connected to the power supply – which has consequences for consumers. ”

Expansion of e-mobility Electric cars: There is a price shock for all German electricity customers

http://www.focus.de/auto/elektroauto/auto-stromnetz-muss-fuer-elektro-autos-kraeftig-wachsen_id_6951838.html

So I hope for Germany’s sake the refugees turn into productive citizens, Greece pays off it’s debt from buying too many U-Boats, and it is:

Spring time for Musk and e-cars, winter for fossil fuels and nuclear. (parody of Spring Time for Hitler for those that don’t get it)

The centralization of power in the Northest US corridor is a large part of the problem.

General Lee Speaks: Had it Figured Out

https://fredoneverything.org/general-lee-speaks-had-it-figured-out/

Which northeast US corridor? There are several.

Bos-Wash http://media.diercke.net/omeda/501/100790_143_2.jpg

The BosWash Megalopolis

In the course of the centuries, the cities between Boston in the north and Washington in the south have fused into an approximately 750-kilometre-long agglomeration comprising numerous large city cores, a so-called megalopolis, for which the term BosWash has been coined. With some 45 million inhabitants, the band of cities accounts for 15 % of the US population – on less than 5 % of the country’s territory.

Most importantly, that 15% of the population lacks the resources to grow its own food. Since an increasing amount of American’s food is imported, a simple flash crash could bring on starvation in the cities. I drive past farms and ranches on my way into the little town I call home, and most of the former grow cash crops rather than anything I’d eat, but given the land, food is a matter of planting seeds.

From the comments above, it is apparent that the MATRIX has reared its ugly head among the writers.

The Deep State cheers every time someone appeals to the government of fix something. And the rapacious bankers run to create more debt to cover their theft.

The whole cycle of events described in this good article is only made possible by a criminality on a Killery Scale seen in their pseudo foundation deceptions. To wit: The American economy is being fleeced by the banking kabbalah through the automobile sector. Loans can go on almost forever as long as the FIAT money machine can be bailed out by transferring bad debts, car loans in this “matter”, through writing them off the books and moving them to the “National Debt”. Then we all get to pay !

Only the collectors of Usury benefit from this scheme, and we know who they are.

Very insightful.

The housing market. The commercial and industrial real estate market. Both of which are far more massive. Are the same story.

This is one of the greatest comments I’ve seen in years.

I’m appropriating this and adding a Happy Merchant Banker illustration meme and peddling it to the altright redpill sites en masse.

http://i.imgur.com/AAslkv6.png

So brilliant even a dull millenial will see the brilliance of the light.

http://i0.kym-cdn.com/photos/images/original/000/393/847/520.jpg

http://i2.kym-cdn.com/photos/images/newsfeed/000/561/329/765.png

A debt-backed currency can only survive for as long as it can be turned over in new transactions while generating the bankers’ ability to loan more than deposited through fractional reserve lending. Eventually this scam has to breakdown, and the trick is to be able to sell it all short. Only the best managers will do that, consigning the rest to the dustbin of insolvency and bankruptcy. Tangible assets are an easier way to manage this risk, and the most tangible assets are gold and silver.

Practically a textbook pyramid scheme.

you said “Consider: Were new cars “dirty” in 2000? Were the skies suffused with smog? People choking and coughing,”

We sure were & still are because pollution is a huge problem worldwide. Even in my small country town, air pollution from cars/trucks is a huge problem (the town is addicted to cars…….). What also exacerbates the problem is there is still many old diesel vehicles aka “hillbilly Hilux’s”(or landcruisers) getting around which belch out horrible diesel fumes. Noting that these vehicles receive little TLC & are usually in very poor condition.

I experience this 1st hand since I work in the main street of the town. Makes me glad I live out of town to breath cleaner air. I guess my reply here also harks back to your article on “retiring” 20 year old diesels a few weeks back. I’d make the case that these old diesels should be.

I stopped reading after I saw “suffused” and then the 4 leafed Schmuck of the Irish. You sure do attract them here.

You can place a clover in the middle like that if you’d recommend not reading much past that. Put it at the top to completely ignore. Put it at the bottom if it’s worth a read or good for a laugh at least.

Pasting the clover is an important and unique feedback mechanism.

http://crazywebsite.com/Pg-Free-Clipart-Graphics/Saint-Patricks-Day-Free-Clipart-Gallery/Funny-Irish-Images-LG/Leprechaun-Silly-Shamrock-1LG.gif

Maybe for people like me or other types of problem posters, you could lay down a 3 leafed shamrock?

http://www.crazywebsite.com/Pg-Free-Clipart-Graphics/Saint-Patricks-Day-Free-Clipart-Gallery/Funny-Irish-Images-LG/Funny-Cartoon-Shamrock-02.gif

This site has tons of freeeee clover and shamrock stuff. It even says its freeeeee.

http://crazywebsite.com/Pg-Free-Clipart-Graphics/Saint-Patricks-Day-Free-Clipart-Gallery/

If I wrote something incoherent put the the shamrock at the top. If too long, insert Sam the Sham at the point where a normal reader would give up. Put it at the bottom if it’s worth a read for a laugh or is too widely afield or for whatever the fuck reason cause you’re sick of this whole gig and I’m the nearest deadbeat blog lurker or wall of diarrheal tester.

Maybe you should put a shamrock or clover on all my posts since I just blew 40 bucks on a random handy on the way back from the dentist which is money I could have just as well have mailed to you guys. Sad.

important correction:

I meant diarrhea texter

Please adjust your bookmarks accordingly.

Some unsolicited writing tips:

Overuse of scare quotes (not “air quotes,” which is what you do with your fingers) can be irritating to the reader, especially if they are completely pointless. There is no part of the definition of “sale” that requires that the purchase price cover the cost of production. Likewise, I don’t know how the word “loan” conceals the fact that it is a debt contract. It gets confusing when you write things like “loan/debt;” at first I thought you were talking about some ratio.

Also, some numbers and cited sources would bolster your credibility when making statements like “The car industry is riding a bubble that’s proportionately as large as the housing bubble of a decade ago.” Otherwise it just seems like your talking out of your patoot.

You write that “Interest rates on new cars are lower (even nonexistent) and the loan/debt can be extended over a preposterously long period – seven years is now routine – while the loan/debt on the used car must be of shorter duration because of the greater and faster depreciation on the used car…Writing a loan/debt on an asset that will almost certainly be worth less than the balance due on the loan before the loan can be paid off is what you call a bad deal.”

I don’t see any reason why this should necessarily be the case. If someone pays no money down on a new car, the balance on the loan is greater than the value of the car the minute it’s driven off the lot. People making loans take more into account that the potential repo value of whatever is being purchased, like one’s credit history.

I think you also run into some contradictions, like “Or by re-selling the repo’d vehicle at exorbitant interest to another debtor.” I thought you were complaining interest rates were artificially low?

Lastly, I don’t understand the logic of your argument for why car companies are embracing ride-sharing programs. Why would they be attempting both to bolster new car sales while also creating a substitute for car ownership? The only way I can see this making sense is if they believe that the revenue gained from people using the latter service (especially those who weren’t in the market anyway for a new car) is greater than the revenue lost from people now choosing to use the ride-sharing service instead of buying a new car.

You’re hired as our freeee editor. Please do this for all three pages of the articles for June. Thanks.

https://ericpetersautos.com/2017/06/

Welcome to the team, Lysander.

When are you going to reissue updated versions of all of your well-known standards?

What a great idea, Bill.

I wish I had your temperance and contemporaneity.

Sadly I am like a bizarro version of Archie Bunker with a PhD from an online university.

Since contemporaneity is the quality or state of being contemporaneous or contemporary, a lack of it would be living in a dream world? Temperance is simply easier to deal with than the hangovers:-)

“…reason why…” is redundant.

I’ll add another: How about letting us have a little customization? Why can’t I buy the vehicle I want with the options I want? Why do I have to take the sunroof and nav system if I just want a better stereo? If I want to replace the factory speakers and head unit why do I have to do heavy modification to the interior? Why am I stuck with your idea of the perfect vehicle?

Oh and why do I have to leave with it “today?” It is a big purchase, and I’m stuck with what the dealer has on the lot? Dealers stick to the middle of the road, they’re not about to take a chance on something outside the norms in case someone like me comes along. And custom orders mean you’ll have a harder time negotiating just because it is another thing the salesman can use against you. It wasn’t always that way. Subarus used to come from the factory fairly stripped and the dealers installed options, even air conditioning. I think that might have ended when Uncle required fuel economy testing and changing the engine load by putting AC on a 4 cylinder engine changed the gas milage. Dealers used to have the factory build muscle cars with higher specs and have them branded with custom decals too.

For an idea of the alternative, just look at the motorcycle. It is fairly easy and somewhat inexpensive to build, from the wheels up, a custom bike using off-the-shelf components. Crate engines are widely available and shipped to your or your builder’s door. Brakes, suspension, frames, even handles can be had easily and in many different styles. And while not cheap, still within the orbit of a middle class American.

Kids these days aren’t into cars just because they’re priced out of the market, but also because they live in an app store world. We don’t think about all the customization we do to our phones because that all happens in software. It is extremely rare to see a stock iPhone, with no apps installed, in the wild. That’s the whole point. When kids do own cars they usually have done some “personalization” that people like me find ugly (and often silly), but hey, it’s your car do with it what you want. Once cars become generic, what’s the point of owning one? Might as well go with an Uber or self-driver you rent by the mile.

I have always assumed that the reason for owning a car is to be able to get around faster than walking.

Maybe you need a custom DeLorean:-)

Yep: I’m with you. It is very hard to find not only the options you want, but also the options you don’t want. I’m guessing w/domestic mfrs you can still factory order a car. But you would very likely get zero price break on it, yes? Curious….