Every kid knows what happens when you try pumping up a leaking tire. As soon as you stop pumping air into it, the tire begins to go flat.

New car sales have been working that way for the past couple of years – with effectively free (zero or little to no interest) loans extended over the horizon – and leases counted as sales – serving as the “air” in the tire.

We’ve been told that business is great.

In fact, it’s as rickety as a Jenga tower.

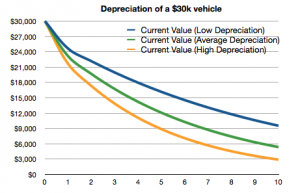

What’s happening in the used car market is a portent. Prices are collapsing – chiefly because of historically unprecedented depreciation. During the past twelve months, the average used car lost 17 percent of its value. This is almost twice the annual average depreciation rate just three years ago. It smacks of the post-2005 collapse of housing prices.

There are several reasons for what’s happening, all related and feeding off one another like chum-crazed barracudas.

The first is the inflated prices – as distinct from value – of new cars.

Things that have value – intrinsic worth – tend to retain it. Things that merely cost a lot – when they are new – but whose value is essentially a function of their newness and not intrinsic worth – hemorrhage value the moment after they are no longer new.

This used to be almost uniquely true of high-status cars, which people bought largely on the basis of their being the Latest Thing. A year – six months – later, of course, they no longer are. This is why a high-end car that sold for $80k three years ago is worth maybe $50k today.

And will be worth next to nothing – relative to its purchase price – five years from now.

But this canker now afflicts cars generally.

Part of the problem is that all cars are now priced – and sold – to a great extent on their being the Latest Thing. Not on the merits of the parts of the car that serve to make it go, which get you from A to B. The internal combustion engine is a near-perfected technology. Has been, for at least 20 years. There are few new Big Strides to be made.

Instead, little steps at big expense.

But there is not much value in this.

How does the buyer benefit from – as an example – the changeover from a six-speed transmission to one with nine or tend speeds? The car now gets 2 MPG better mileage – on the EPA’s test loop – but it costs $600 more than it did last year. And it will cost much more to repair when the more complicated components fail.

The price goes up – but the benefit doesn’t track with it.

Gadgets – electronic things – have an extremely short shelf-life. From the resolution of the touchscreen to the speed of the processor that runs it. And modern cars have become more gadgets than cars. Cell phones that roll. But very, very expensive cell phones. The average cost is now well over $30,000.

So people rent rather than buy. That is to say, they lease.

Leasing is a short-term (2-3 year) commitment; it is a revolving-door way to perpetually drive something new. And a way to avoid being stuck with something old.

It is also a way to hide the inflated value of new.

The monthly rental payment is much less than it would be if the car were purchased (i.e., financed). Leasing also helps the car industry hide the growing problem of people not being able to afford new. A 2-3 year lease (and revolving debt) rather than trying to spread payments over seven or eight years, in order to make them manageable. But then arises the almost-inevitable problem of the buyer owing more on the car than it’s still worth after making five or six years of payments on a seven or eight-year loan – which is becoming a general problem.

KAR Auction Services – a major industry player – expects vehicles repossessions to more than double this year, in the vicinity of 2 million or more than twice the number of defaults at the bottom of the post-housing collapse recession/depression (which we’ve never really recovered from, Happy Talk and Wall Street notwithstanding).

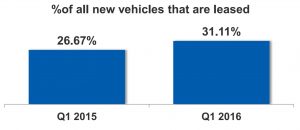

Leasing used to be a small slice of the new car business; something realtors and a few other professional people did in order to take advantage of tax deductions for their business-related car expenses.

Less than 10 percent as recently as the late 1970s.

Today, leases account for a third of all new car transactions (see here). This fact – which ought to send a cold chill down the spine of anyone with a stake in the health of the car industry – tells us a lot about the fundamental unsoundness of the new car business. When roughly triple the number of people who used to buy now rent, you have a problem, Houston.

You also have blowback.

The main factor driving today’s alarming depreciation rates is the glut of used cars on the market. And a very large number of these cars are ex-lease cars. The presence of vast fleets of 2-3 year-old cars on the so-called secondary market depresses the primary market. Why buy a new car for $35,000 when you could buy the same car – more or less – with 30,000 or so miles on it (hardly broken in, for a late-model car) for $20,000?

Conversely, it’s hard for the new car salesman/dealer to make a decent profit on a new car given the downward pricing pressure created by all those barely-used/ex-lease cars sitting on the lot.

Either way, margins are slimmer than a Dachau inmates thighs at this point. And that is unprecedented. Usually, new car sales are strong – and profits good. Or used cars are selling at a healthy profit. Today, there is the scent of desperation in the air.

The earnings being reported are Enron-esque. A spreadsheet Potempkin village. There is a reason why the entire car industry is frantically investing in ride-sharing and “transportation as a service,” the latter amounting to leasing by the hour and day.

It is like a starving man scraping the bottom of the barrel, hoping to find some leavings.

If you like what you’ve found here, please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: EPautos stickers are free to those who send in $20 or more to support the site. Also, the eBook – free! – is available. Click here. Just enter you email in the box on the top of the main page and we’ll send you a copy ASAP.

Car jacking an Uber driver

https://www.liveleak.com/view?i=44f_1500967059

Uber driver’s car gets destroyed by drunk chicks

https://www.liveleak.com/view?i=2cf_1503267351

I think this may be a massive case of unintended consequences from legislation where the incentives differ drastically from what the central controllers want to happen.

Basically, the federal mandates and CAFE standards are causing auto manufacturers to do things that don’t add value to the vehicle, causing a plummmeting interest in buying new – giving potential buyers a incentive to fix up older vehicles – or wait for the new vehicle prices to depreciate to the value that buyers think they warrant, after the vehicles come off lease.

The ginormous rental pickup I had for a couple of days recently was a case in point. It had an eight speed transmission and a small (relative to the massive bulk of the vehicle) V6 to squeeze a few more MPGs out of it, to avoid catastrophic CAFE fines. But, gas here is about $2 a gallon — so cheap that they didn’t even bother to put a gas cap release on it, since who is gonna bother to try and steal a low value commodity like gas, especially with the risk that the driver is gonna be armed?

But, the cost of that FN 8 speed transmission is probably thousands of dollars more than a five or six speed transmission, far in excess of the value of the gas savings over the lifetime of the vehicle. And, the cost of that technology to make the V6 perform adequately, compared to the cost of a simpler V8, again doesn’t justify the cost. Then there’s the cost of all the steel needed to make this vehicle meet federal safety standards.

Right there, you have three mandated costs that buyers rationally don’t value, because they don’t make economic sense. So the truck sits on the lot. And the manufacturers, in desperation, lease it to the rental company. And it still sits, until the rental company gives me a free upgrade from the standard size vehicle I purchased.

So, because of the feds doing crazy shit, I’m rolling around in this very expensive vehicle with an MSRP on the disclosure in the glove box in the mid- high-$30Ks — for about $35 a day. Because that is what it took to reach a market clearing price.

Welp: Used *truck* prices aren’t dropping! I would agree that used car prices are dropping, but not pickups. I concur about the diminishing returns for fuel economy. However, my daughter has a ’16 VW Jetta 1.4L turbo, 5sp and she gets 40mpg! Outstanding for a car as large as the Jetta is.

Hi Eric, came across another major bubble some days ago, one to throw water on the hopes of ride sharing saving the car manufactures.

My brother drives a Lyft in SF (he’s a millennial hipster, and apparently it gives him time to do the stuff he wants). 3 years ago, when he left his job and started this, he got a slightly used Camry for financed with payments over 6 years. Now he’s driven it quite a bit, over 100k miles in the past 3 years (ok he works hard as he’s trying to write and promote a book and a podcast or something).

As cars arent really his thing, recently he realised its starting to fall apart and make strange noises, not start, etc, so he took it to a couple mechanics, and got bills in the thousands for a number of repairs, money he ofcourse didn’t have on hand.

The guy at the dealer however offered a brilliant alternative – just give us the car, take a new Corolla, zero down, zero interest, all we will do is add 40 or so dollars a month and re-start on a 7 year term. My brother was like brilliant, but called me to check the numbers and why they would be so kind, and sent me the details. Heres the shocker – His original car depreciated to less than half the value of the outstanding loan (on a simple KBB valuation based on milage). Dealer was kind enough not to account for the work needed (prob was keen on the sale and getting the commission on writing the loan). They were then just piling the outstanding loan balance onto the new loan, and giving him the new car.

Ofcourse my brother took the offer as he didn’t anticipate rather big repair bills so soon. Which brings me to the point – how sustainable is the whole ride share model at current prices (and if prices are raised, will it still be popular)? The model for pricing (and financing) assumes normal wear and tear, maintenance, and depreciation, which is far from the reality when a car is used in ride-share as it is driven much more, and much harsher. Suspect this issue will get even worse when cars move to smaller high compression turbo engines with 10 speed gearboxes as a norm.

Furthermore, most of those driving for ride share companies are most likely doing the exact same thing as my brother. Thinking ahead, when the new car doesn’t last the 7 years without needing major work, what will they get another one? Just imagine the loan bubble being created, and what will happen to that in the end?

I guess the next step- driver less cars……. if nothing else at least when the bubble bursts, they can repo themselves…..

Uber and lyft are not sustainable. They require two things. On the corporate level it requires a constant flow of newly created money seeking somewhere to go. On the driver level it requires not being able to do math and understanding the cost of wear and tear on the car.

With the current payout levels one needs a car as simple and durable as a crown vic with the fuel economy of a mid 1980s light weight and the cost of a Pinto. Even then it will be sketchy. In other words it does not work and at some point these people doing the driving have to figure it out.

However once the taxi cartel is broken my guess is someone will come up with more equitable and sustainable free market model provided the government doesn’t reassert itself.

Hi Nasir,

You beat me to it!

I am working on a rant about the effect of accelerated wear and tear/rapidly accumulated mileage on the ride-sharing business model. If my mojo doesn’t collapse, I ought to have it done shortly…

Look forward to hearing the rant. What I find most amazing is no part of the mainstream media ever mentions this…. i wonder what will happen when all the guys who took the 7 year loans go back for another 7 years when the car starts falling apart after 3 years, and then when that goes bad after another 3 years……. basically a classic case of kicking the can down the road….

I have a friend that was doing pizza delivery for a major chain franchise location. In typical fashion in that business, you use your own car, gas etc. You basically have to survive on tips since they only pay you the restaurant minimum wage (which is $2.75 something here).

Since the economy is sh*t here, the tips are terrible for the most part (tips typically were a dollar!). The chain then begin charging a delivery fee, but only gave half to the drivers (pocketing the other half, nice, huh). So the tips became even worse because most customers assume the driver gets all of the the delivery charge which of course they didn’t.

At video game night, he is talking about how it doesn’t seem like he was getting ahead of his bills. So I and another friend said, have you figured out what you typically are making when driving (he worked some hours inside the restaurant)? He of course hadn’t. So we sat down and figured out his costs vs income. We figured out wear and tear on the car (which was surprisingly expensive), gas, time, insurance etc etc.

Turns out he was not only not making money, he was LOSING money most of the time delivering pizzas. He never delivered another pizza. He ended up returning the car that was about to be repossessed anyway.

I imagine most ride share drivers have the same problem. If they are making money its probably not enough overall. It probably only works as a temp job if you already have a vehicle that they will let you use (you’re out of luck if your car is over ten years old for the most part). Do it too long and your car expenses rise too much.

That was the good think about Ford’s Panther platform that was used in so many taxis and police cars – the entire vehicle was simple to fix and the parts were cheap (because they made so many of them for so many years).

You’d have to be a real idiot to drive a complex vehicle like a hybrid as a taxi.

VW engineer sentenced to 40 months in prison for role in emissions cheating

German automaker asked its US employee to perfect the cheat code, and he did it.

https://arstechnica.com/cars/2017/08/vw-engineer-sentenced-to-40-months-in-prison-for-role-in-emissions-cheating/

Just another reason to go into finance instead of engineering.

The car industry is the canary in the coal mine, it’s one symptom of a larger overall decline (including economics) of society. Not just a USA problem but a worldwide problem.

As Margaret Thatcher famously said “you eventually run out of other people’s money.” I think we have gotten to that point. A lot of people are out of money. I should know, I am one of them.

Think of all the jobs and businesses that either don’t exist anymore, have declined not because something natural shifted away or it just don’t pay well anymore. Some examples: truck driving, salesperson in a department store, gas station attendant (or mechanic). All these jobs were once solid, stable middle class jobs. Now, not so much. Most of the truck drivers I know have to really hustle to make a living. Gas station attendants and store salespeople are now basically minimum wage clerks.

I used to sell real estate, and frankly, it’s not as good an investment that it used to be. It’s extra terrible when you consider that the vast majority of millionaires in the US got to be wealthy, by investing in it.

But few people seem to be able to put the pieces together. But if you look the evidence is really scary.

It’s not just those jobs. I am seeing _experienced_ engineering positions being advertised where the low end of the salary range is about what I made before overtime 20 years ago in numerical dollars when I just started working. (provided glassdoor isn’t BSing me) The high end isn’t too good either. Never mind these jobs require a lot more work and there is no paid OT anymore. Basically it means engineering salaries in a real sense are about 60% of what they were 20 years ago but require more work unless one has some sort leverage. It also means people who’ve been at the same place for awhile are vulnerable. Companies don’t care how much money you’ve made them if they can reduce salary cost today they will.

There are charts that show basically people have been compensating for all the increased costs and taxes with debt. Becoming debt slaves. But the saturation point has to be close given the data that’s being reported. People are living paycheck to paycheck. Few are willing to do like many of us here and just live poorly to avoid the trap.

Morning, Brent!

In my corner of the field – journalism – a competent reporter/editor could make a solid middle class living as recently as the ’90s. Today, there are very few openings and almost all are at MSM outlets, which require the bending of the knee to every PC orthodoxy imaginable. If you are a writer with heterodox views and you dare to express them, forget it.

Things are coming to a head as the cancer spreads, as more and more people cannot find work that pays the bills. It’s no wonder relationships are coming unglued and more and more people don’t even want to try embarking upon one.

The thing I dread most, though, is the rising Millennial Proletariat. It is ignorant, indoctrinated, aggrieved and entitled. I see in it a reincarnation of the Russian mobs that stormed the Winter Palace and served as the Useful Idiots of Lenin and Trotsky…

So I guess Detroit will really be booming again with all those bicycle sales from Shinola.

1996, Kenneth M. Ford and Zenon W. Pylyshyn, The robot’s dilemma revisited: the frame problem in artificial intelligence, pg. 28:

“See what I mean Shiela? You’ve got the logical form, the semantics, and all that, but you don’t know shit from Shinola, and with your stupid heuristic learner you can’t learn it unless somebody with authority tells you.”

You are right, Eric. The peak confluence of performance/mileage/pollution/safety was reached in the mid-1990’s. Since then the minuscule advances have come at a tremendous cost. That, plus all the electronic gingerbread, has driven car prices to where they are today.

The Law of Diminishing Return is ironclad.

But, just try explaining it to someone. Even people who are “educated’ don’t seem to understand that after a certain point you’re just throwing money away for very little benefit.

We live in an era of negative interest rates in some areas. This will not end well.

No “p” in Potemken.