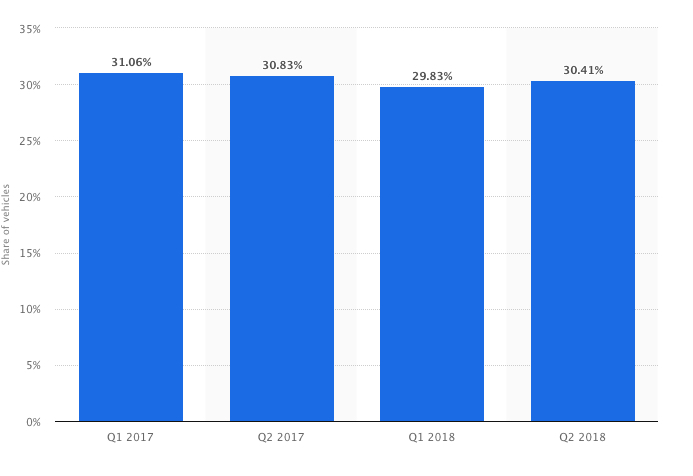

Did you know that the percentage of new cars sales that are actually leases has risen from about 3-5 percent in the early-mid 2000s to more than 30 percent as of this year?

It appears about a third of the population – about five times as many as used to be able to – is no longer able to afford to buy new cars.

At least, not the cars they want – the $30,000 and up ones, laden with all the latest gadgets they want (plus the ones mandated by Uncle).

There are still new cars priced under $20,000 – and most people can still afford those. But they’re the slow-movers. And they’re disappearing – both because they are slow-movers and also because the government-corporate nexus is pushing electric and hybrid-electric cars, which are on track to become the only kinds of cars we’re allowed to buy.

The average car transacted for more than $30,000 last year. The average electric car will transact for much more.

But the monthly nut on a $30k-plus transaction is too high for about a third of the car buying population to grapple with – even when the payments are stretched out over seven or more years.

And so they rent – just like people who can’t afford to buy a house.

But there is an important difference. A house (or an apartment) is a thing of enduring value while a car is a depreciating appliance, like a washing machine or toaster.

But a house or apartment that X rented for $800 per month this year will cost the same $800 per month when Y signs the new lease next year.

Possibly, it will cost more. It is not unheard of for landlords to raise the rent.

Cars are very different.

They leak value almost from the moment they leave the assembly line – and hemorrhage it the moment they are driven off the dealership’s lot. At the end of its lease, a car is always worth less than it was worth at the beginning.

Usually it is worth about 30-40 percent less.

There is even a term for this – residual value.

As in, what’s left of its former value.

This is why payments can only be stretched so far. The new car’s price goes up, consistently – while its value goes down over time, just as consistently. That’s not good math – if you’re trying to sell new cars.

Or finance them.

Meanwhile, the ex-lease car goes on the used car market – where it will be sold for 30-40 percent less than its original value.

This is very good news for people in the market for a used car.

But the unprecedented deluge of ex-lease cars that are now flooding the market is very bad news for those trying to sell new ones. Because of the alternative they present to high-priced new cars. Keep in mind that most of these ex-lease cars are hardly used cars. Most will have less than 50,000 miles on them – and be less than five years old.

These cars may have lost 30-40 percent of their original value, but most have plenty of life left.

When good used cars were hard to find, it made sense to buy new – particularly for people who haven’t got the time, interest or ability to nurse along a fixer-upper.

This is what has driven the record-high number of new car sales (and leases) over the past ten years, since the crash of ’08.

One reason good used cars were hard to find circa 2008 was that Uncle had so many crushed. You may recall the odious Cash for Clunkers program.

We may see a repeat of this orgy of gratuitous destruction – in order (as before) to “stimulate” demand for new cars.

Another ominous harbinger of something not-good coming is the news last week that the private banking cartel which controls the country’s money supply – the “federal” Reserve – will be raising interest rates.

Dracula just saw the dawning sun.

Even a slight uptick in the cost of money will result in more leases – and an ongoing tsunami of hardly used off-lease vehicles flooding the market, each successive wave stronger than the last.

The car industry is utterly dependent on ready credit – and cheap money. If a third of new car “buyers” can’t – and have to lease – because the monthly payment is too high when there is no (or almost no) interest tacked onto the bill, what will happen when it is?

And what will happen 40 percent – or even 50 percent – of all new car transactions are leases? Will everyone sign up for perpetual revolving debt? Or will the government simply order the destruction of hundreds of thousands of owned cars in order to “stimulate” demand for the new ones fewer and fewer of us can afford to buy?

Consider it fair warning – like that odd lump in the water, way out in the middle of the ocean.

. . .

Got a question about cars – or anything else? Click on the “ask Eric” link and send ’em in!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet (pictured below) in return for a $20 or more one-time donation or a $5 or more monthly recurring donation. (Please be sure to tell us you want a sticker – and also, provide an address, so we know where to mail the thing!)

My latest eBook is also available for your favorite price – free! Click here.

Ford just announced it is suspending monthly reporting… because.

2019 is coming bitchuz.

I love leases. They provide lots of barely-broken-in used vehicles for me to pick from. Usually they’re well-equipped models, too.

The average car payment this past year was $530, and the average lease payment was $430/month. That’s a lot of moola for something you can’t live in. And no surprise – those with poor credit are paying more for their cars.

https://www.nerdwallet.com/blog/loans/auto-loans/average-monthly-car-payment/

Hi Chip,

I cannot get my head around spending $500 (or even $400) a month on a depreciating appliance. Car payments are now, on average, about two-thirds the cost of an average monthly rental payment on an apartment and about 50 percent the cost of a typical monthly mortgage.

Madness.

Eric, I’m always AMAZED when I drive by some local factories/call centers.etc where people are making $11/hr.- and some a good deal less- to see the parking lots crammed full of late-model cars!

These people are working an entire week out of every month just to make the car payment- and part of next weeks paycheck for insurance, registration, taxes, gas, maintenance, etc.

If doing 60 hours a month labor just to pay for the car doesn’t deter people, what will?

And the process never ends, because as soon as it’s paid off…it’s time for a new one, because you don’t want to have to fix all of that high-tech crap, 10-speed automatic non-servicable tranny, and electronics when it’s out of warranty!

And these people vote, and choose the tyrants who rule us!

And these are the people who will have the woe-is-me news stories and the legislation that will follow. The more socialized services that will come about. And of course the higher tax bills on anyone more productive than them.

I am just so tired of it. All these people who never developed any skills or learned anything and then they are supposed to be a burden upon others. Because anyone who is more productive didn’t make sacrifices for it. Didn’t work to learn those skills. They were just lucky.

….and they euphemistically refer to the irresponsible who refuse to live within their means; who buy everything on debt, because they have to have instant gratification; and who have more children than they can support, as “the poor”.

And they want us to believe that you being responsible and providing for yourself and your own, is somehow responsible for the plight of “the poor”, and therefore justifies you being robbed even more.

But if you were a human waste who did nothing but sat on a couch and ate Doritos and popped out babies, they would reward you with the spoils of other responsible people.

It’s sickening- and even if there were no other factors in any other area of society or culture, that alone would be sufficient for any sane person to realize that any society which practices such ass-backwards values is doomed to extinction; for a society built upon robbery, which rewards the lowest most incompetent people and increases their ranks by subsidizing their reproduction, while penalizing the most competent, productive and moral, and discouraging their reproduction, will soon become a society of worthless rabble.

And that is exactly what is happening- and to make matters worse; to compensate for the dwindling numbers of valuable citizens, they are just importing more rabble- thinking that quantity alone will solve the problem- but of course, quantity, without quality will just worsen things even more- which we see already here in the US, Europe and former commonweatrh countries.

People are a combination of strengths and weaknesses and what they do is consider anyone who has strengths in marketable skills, knowledge, ability to look ahead, work hard, etc ‘lucky’ and then penalize these people and take what they produce, store, build, etc. Meanwhile those strengths usually came at certain sacrifices and weaknesses in other areas. In a free market it evens out with people as whole individuals but instead these certain strengths are acceptable to steal, leach off of, etc. It’s a crummy system and as such it will collapse because the reason those things have value is because they build civilization. When the value is taken people stop using these skills and stop developing them.

What good is developing yourself as a builder when those with ‘social skills’ with political skills steal everything? It’s like when people just walked away from their farms rather than work the fields so Rome could take everything.

It’s as if they’re using Atlas Shrugged as a script. Copying the Looters, while ignoring the consequences.

I think more people are figuring out that under such a system, it’s better to be a leech than a victim of robbery.

Sadly, the lowest echelon of society has figured that out first- so they just go out and make a few babies, and they’re set for life.

After the fall of Rome, look how long it took civilization to get back to that level of technologu and accomplishment. You’d think that the overlords would be smart enough to realize that what they are destroying will cause another Dark Age; and that they ultimately lose their power and wealth, as they are destroying the very machinery from which such is ultimately created.

Anyone who’s read Robert Caro’s unauthorized biography of LBJ doesn’t have to wonder if the Great Society bullshit was pushed on to LBJ. They can only wonder if he did or didn’t see the ills it would bring.

I grew up in a time that people were just on the verge of prosperity and those less prosperous were working hard to attain that goal. Did he see the long term implications? He he even contemplate them in any other way than their political value? Did any of the people pushing the nitty gritty of it not see where it would lead? Did they all simply wish to make political hay while the big hand of big guv shined down hard?

To quote the Fugs once again, “some times I wonder”.

Yeah, 8man- I was just a little kid in the late 60’s, but I distinctly remember that time period, before all of Great Society BS kicked in fully and wrought it’s havoc- and it truly was a different world; a world that was already extinguished by the time I was a teen.

People were still human, because their every action dictated by some government program; and we had much more freedom of association.

And that feeling of prosperity- no matter WHO you were (We were dirt poor, but still got to enjoy the benefits of what the prosperity around us had created- and it was wonderful!)- a little person just doing simple manual labor/blue collar work could live like an absolute king on a single income…better than a married couple of professionals could today.

And that richness wasn’t just about finances or possessions- it was just the spirit of the time, because we still had autonomy and dignity and much more freedom. Just being able as an 8 year-old, to walk into a store and buy a pack of Lucky Strikes for an adult who sent you to the store….

Even into the late 70’s, before Medicare and HIPs had fully taken their toll- when you could still go to the doctor, even in NYC, and the bill was $25 that you paid in cash….

Damn, what we have lost 🙁

On the old Andy Griffith show (which I’m old enough to remember from its first run), one of the things that strikes me is Emmett’s Fixit Shop. Back then there was nothing unrealistic about it – you actually could have a storefront and make a decent living, supporting yourself and a family on the proceeds from fixing small appliances. No suspension of disbelief necessary at the time.

Of course this was well before the Great Ripoff Society.

Absotively, Jason!

When I was a kid, we lived in the downtown area of a suburb 60 miles east of NYC. All of my friends were the kids of local small store owners.

It was a REAL community then. Everything ya needed was right there in a few square blocks; and everyone knew each other.

And it wasn’t some spiffed-up tax-funded “renewal” project- but just a real community of independent businesses and homeowners who lived and worked in their own community.

I consider myself really blessed to have experienced that.

Today, that downtown is half empty; and what stores are there are “junk” businesses like tattoo parlors and massage parlors, and a few fast-food joints.

The homeowners now commute to NYC to be able to afford the outrageous property taxes that fund the fancy inlaid brick sidewalks (That have weeds growing through them, because the town that collects those outrageous taxes doesn’t maintain them worth a darn), and fancy vintage-looking lampposts and ugly bus-stop shelters for the subsidized bus that runs every hour and a half, which only illegals, retards, and the the residents of section 8 housing use…..

My entire time there growing up, I don’t think there was one actual crime. Today, not a day goes by that some gas station or conveneince store isn’t robbed.

Yeah….what a great society Uncle created! So much better than the bliss of real productive people going about their business!

When I was a kid, the middle-aged guy who wasn’t quite right, used to walk all over toen pushing his lawn mower, and doing odd jobs and mowing lawns…

Today, they ride the subsidized bus, and live in a subsidized apartment, and get free money for doing nothing, so they can make babies, take drugs and get in trouble……

AAAHHHKK! It makes me sick!

There are still fix it shops but they mostly are for consumer electronics. It’s just a very different environment today and requires a modern marketing knack. Check out Louis Rossmann’s channel on youtube. He seems to have the modern fix-it shop stuff down. He also seems to be one of us.

Here’s today’s video:

https://www.youtube.com/watch?v=hdZ37PQzIBE

Indeed Nunzio, I actually bought packs of cigarettes for myself from vending machines as a child back then in northern Indiana. I quit smoking over 10 years ago, but I still would like to see those same vending machines around! You can have no freedom without having genuine choices!

Slightly off topic, but watch this video about electric vehicles (EVs) vs. internal combustion engine cars (ICEs) for a deep look into the mindset of eco-madness.

https://www.youtube.com/watch?v=aUC6lsLr04I

This video is very useful for anyone suffering from low blood pressure.

Not one mention of the tax incentive for leasing vs owning a car. Depending on your situation, leasing may make sense.

I have been working on and building houses for nearly thirty years and my advice is to avoid home ownership. Houses depreciate just like cars do, they are a liability trap. The mortgage was created by the banks, for the banks, it’s a money creation scam. This scam is used to sell overpriced vehicles and houses.

Hi Derick,

I sort of agree, in re houses. A big mortgage and debt for most of your life is a bad idea. It locks you in, ties you down.

However, if you can buy a house – and own the thing – then it’s a good thing.

Houses rarely lose value the way a car does; most will increase in value over time. So you have a store of value that is also fungible (i.e., you can convert it into cash) and at the same time, provides you with an essential thing – a place to live. If you own the house, then your living costs are very low, including relative to renters. You still have property taxes and maintenance, of course. But these generally don’t even approach the typical $800-plus monthly rental for an apartment and the much higher monthly mortgage payment on a house.

As an example: I own my house, so my main fixed expenses are utilities (about $60/month) and the “rent” I have to pay the government (i.e., property taxes) which is about $120/month. So, my cost to live is about $200 month in expenses I can’t avoid. Every now and then, something comes up – like having to put in a new water heater, or drain the septic tank – but (so far) no huge expense. I am pretty sure I am better off than even a renter who only pays $500/month. He not only pays more for certain each month, every cent he pays is gone forever once he pays it.

I own my house and could sell/cash it out anytime.

Owning as place of your own- I mean, some actuial land on which you can do what you want (Becoming rare in much of the civilized world these days) and your own shelter, in which you get to call the shots, is essential to freedom.

Yeah, a mortgage is not the way to go- as it is self-induced slavery; but the economics, as far as appreciation or depreciation aren’t as important as are things like the quality and style of life owning your own place conveys, and the freedom of being able to do what you want (if you choose the locale wisely).

Home ownership can be downright liberating, in that it can enable you to live apart from the state economy by being self-sufficient. But of course, none of this is true about the average city or suburban home with a big mortgage, little land, zoning and code enforcement, and an astronomical price which requires that you spend 30 years of your life toiling away the majority of your waking hours to pay the mortgage and property taxes.

Owning land and a house means you can fence it, post “no trespassing” signs, and sit on the front porch with a shotgun on your lap.

You certainly can. …and when the PoLeez come to serve their Red Gun Law court ruling you’re not even aware has happened, you can use your AFR to hold them off till multiple helicopters with SWAT teams come to blast your pore àss to kingdom come. That’ll teach you to be an “unknowing” threat…..to somebody, quite possibly somebody you may not know exists.

You’re a grand ol flag, you’re a high flying flag and forever in peace may you wave. You’re the emblem of the land I love, the home of the brave and the free….yeehaw

Which is why I don’t worry too much about ending up in a nursing home.

But I aim to take a few with me if it comes to that.

Nice thing is that our county is so heavily armed that the sheriff has at least to this point been pretty circumspect about fokking with people.

That’s the way it is here, too, Anon.

Funny, how when the power is equalized, or there is fear of the unknown (We can buy, trade and sell guns here without gov’t interference or paperwork) the cowardly badged thugs suddenly learn some respect; when they’re not the only ones who are heavily armed.

If it were still thios way everywhere, we might still have a little freedom in this country. Instead, what we have here is slowly being eaten away, and one day soon, they’ll make a grab for those guns, and what little we have left will all be gone.

Speaking of Dracula: The best vehicle I’ve ever owned, I bought from my friend’s business partner….who was born in Transylvania. (Unlike Dracula though, he was a Jew. Wait; maybe Dracula was a Jew- some of them sure are good at sucking blood! 😉 )

They sure are. Right now (((they’re))) draining the blood out of the stock market.

PHILADELPHIA (CBS) — Could the secret to eternal youth be found in blood transfusions from young people? Some claim that transfusions with “young blood” from teenagers can reverse the aging process.

It’s being tested in patients over the age of 35 as part of a clinical trial called ambrosia, where people paid $8,000 to get the rich growth factors found in bloods plasma platelets.

“There are pretty much people from most states, people from overseas, people from Europe and Australia,” Dr. Jesse Karmazin said.

Wow, Bobster. This world just keeps getting scarier and scarier; and darker and darker. We are truly on the verge of a new Dark Age…..

Cars, technology, etc. like almost everything are subject to the law of diminishing returns. So sad that too many will have to learn the lesson the hard way.

Hey Eric – totally see what you are talking about in the market. Interestingly – ive been seeing a lot of “offers you cant refuse” in the market now on new cars – and what I mean by that is where the payments you pay for the term wont even be the depreciation on the car over the term (we have mostly PCP finance here in the UK, basically you agree say 4 years of payment, with a lump sum to pay at the end to own the car, or just give it back to the finance company). In normal more rational times – the payments are equal to depreciation plus financing on the outstanding balance. But as they are desperate, the total payments on some cars seem much less than the depreciation.

Now I hate buying shit I dont have money for, and I hate monthly payments and financing costs, BUT when you are effectively getting a discount for buying the car via financing without having to worry about what happens to it or residual value or anything – well it DOES seem very very tempting…..

I’m getting a really deep discount for driving an old junker!

Leasing cars never quits giving, for the dealers. If it’s not perfect, and none are when dealer inspected, bend over and assume the position.

Fortunately for the stearlerships, plenty new fools are born every day.

Lease a pickup and use it as such and it will eventually be the most expensive vehicle you ever bought.

Those thousands of dollars to pull dents out of the bed and repaint it per dealer price is manna from heaven for them since they’ll collect the money and time sell it as is.

The car bidness has become one of the best scams ever.

That’s why I got mine with a bed liner.

What the Fed did last week and what they stated that they will continue doing on “autopilot” is an economic 9/11.

Suddenly raising interest rates on fiat currency that had been kept low for a decade while simultaneously offloading billions in assets into an unstable market is akin to the “pull it” command uttered before WTC 7 mysteriously collapsed.

It is economic malfeasance worthy of what was done to Germany following WWI and will have the same effects. A stable interest rate was necessary to keep some semblance of an economy going that had come to depend on it. Savers were looted by 0.2% savings rates since 2008, they were forced into the markets for any hope of keeping up with inflation. The destruction of traditional economics in favor of what Obama’s economy had wrought forced so many to adapt. People are quite resourceful and adapt to new conditions if given ample time.

The Fed has killed millions of us by first making our money worthless, now siphoning off billions out of the economy and destabilizing an already oscillating economy.

Like a spiteful child burning ants with a magnifying glass, the Fed saw the despised American Kulaks begin to feel comfortable despite rendering their currency worthless, their careers nonexistent and their very lives and culture expendable and replaceable. Undoing years worth of work, financial planning and economics in a giant Fuck You just in time for Christmas.

There won’t be any money for cars next year if millions of retirement accounts have been obliterated.

Leases: Getting people primed for the car-subscription model….

Just another sign of the insanity of this world. Ever since I was a kid, I understood that leases were stupid. You pay a LITTLE less for the USE OF A CAR (and after they ding ya for “damage” and mileage overages, etc. that “little less” becomes even littler!) now….but at the end of the lease, have NOTHING to show for it!- No car to keep and drive for the next 15 years, sans payments, interest and collision & comp; no used car to sell for $15K or $20K, what ever the case may be; nothing! You start all over again from scratch, and are perpetually putting down down-payments and making monthly payments.

I just don’t understand why it is that everyone must always live beyond their means! I guess they’ll never know the freedom of not having debt/payments; and of laying down at night, not owing anyone anything, and not having to worry about your stuff being repoed or how you’ll make the payment. No one owns anything anymore.

That is slave mentality- and a good part of the reason why we as a people will never be free: Because 99% of those around us perpetuate their own enslavement- and if they do not care about their own liberty, they just don’t care about liberty, and thus will not be allies in it’s pursuit. In fact, they have a vested interest in perpetuating slavery, because they think that is the only way to live, and as such, want it to continue, so that they can make the payments, and “be kept safe” and all of that crapola.

How rare are people like my cousin, who bought her ’71 Mustang brand-new, and still owns it to this day? Talk about cheap transportation! And I’m glad to say that I have never had a car payment in my life. I once drove a car that cost me $125- and was very happy with it (Wish I still had it! 1978 LeSabre!). If I can’t pay cash for it…I can’t afford it.

The number of good jobs keeps going down, factories and industry still relocating overseas. They’ve been able to keep the show running with this financial engineering but sooner or later even this outstrips wages. The industry has a lot of storm clouds hanging over it. The younger generation is broke and would rather ride share, plus these electric cars and gov regulation Eric talks about. Anyone with any financial smarts isn’t going to pay $30,000 for a car or $40,000 for a pickup truck. These buyers are lost for good, unless they get caught in a mid life crisis.

Higher interest rates make leases more expensive too. It’s called the money factor.

https://www.investopedia.com/terms/m/money-factor.asp

Anyway car leases are largely for people who can’t do math. Also car leases pull people out of the used car market as well as from buying new cars.

What leases play to the social desire to appear to have more wealth for social reasons. Women do it for status and men do it to attract women.

I leased because I COULD do the math. My father worked for Ford, so my starting price was well below dealer cost. $100-$150 per month for a new car with no down payment was a good deal. I always had the option to purchase the car at the end of the lease but I never did.

How is a perpetual payment with interest on new price of the vehicle and a down payment cheaper than owning in the long run for an individual for personal use? Keep in mind that special employee pricing would apply to buying the car as well for that is how the lease payment is calculated.

My wife and I started paying ourselves a long time ago. was very hard to pay the car nut per month and then more on top of it to save. We finally got out of the cycle, continue to pay ourselves for cars and we have paid cash for the last 4 or so cars. It is very refreshing not to have to pay the interest on a cars anymore.

And then there is the complexity of new vehicles. If bought used, and out of warranty, repair costs could be excessive. I like some BMWs, but the thought of upkeep – post warranty – is scary.

I’m completely with you. I bought a 2009 BMW 335i stick shift in 2011, the warranty ended about a year later. I’m a competent mechanic, so I spent on the order of 40-50 hours over the next two years fixing the damn thing, and parts cost me about $1000. That would have been close to $10,000 in repairs if I paid the dealer. Then, my wife very gently tapped something with the rear bumper, it didn’t even leave a mark, but the car’s active headrests fired – airbags inside the seats which move the headrests forward. That was $1300 per seat to fix, as it rips the leather. That was the last straw. I fixed it and sold it.

Thanks for relating your distressing BMW experience. It’s good to hear the evidence, for confirmation.

If you wrench on a Beamer, you must be a pretty good mechanic. A lot of learning curve on them and VW.

I’d consider myself a mediocre mechanic–maybe better, but my brother is a professional and he’s my comparison–and I find the Japanese cars much cheaper and simpler to fix than their European counterparts. Especially if you go older. I highly recommend the first gen Tacoma for a vehicle that is very reliable and when it does break down, very simple and cost effective to fix. The only vehicle I own–or have owned– that is simpler and just as cheap to fix is my 73 Toronado. The benefit to the Taco, though, is how many people do builds on them. The shelf availability of parts is right up there with GM parts. Simplicity is right up there with GM too, in my opinion. My 2016 Tundra, not so much. Though, for its model my Tundra may be one of the most simplistic pickups out there since the tech hasn’t changed much from 2007. I have never had to wrench on a Tundra yet. But I haven’t put over 150,000 miles on one either.

“But a house or apartment that X rented for $800 per month this year will cost the same $800 per month when Y signs the new lease next year.

Possibly, it will cost more. It is not unheard of for landlords to raise the rent.”

No…”definitely” rents are going to increase dramatically. Truth is, home ownership is more threatened than car ownership.

The rest of your post is spot on. Especially good call about the likelihood of fedgov escalating the concept of “cash for clunkers” to the destruction of cars coming off lease.

Gotta watch that metaphor mixing though. Although not totally inaccurate, it’s quite a stretch to link “dawn for dracula” with tsunamis. 😉