There is a tax which most of us pay that isn’t morally objectionable. Probably because it’s not really a tax.

It is the tax on motor fuels.

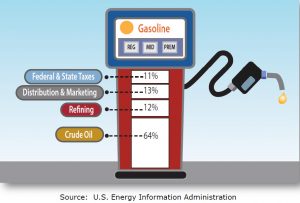

Yes, it’s proportionately high – currently, about 25 percent of the price of every gallon is actually the tax.

And yes, it can be argued that it’s “regressive” – a word used often by leftists to describe a tax that imposes more of a burden on people with less ability to pay (leftists prefer to impose their harms on people more able to “take it,” in the manner of beating up a healthy young man rather than a frail old lady – the assumption being that it’s not the beating that’s morally objectionable).

But it’s not really a tax – because you don’t have to pay it.

And if you don’t pay it, armed government workers won’t come Hut! Hut! Hutting! to your home, to drag you away in chains.

It is a legally and practically avoidable tax – and therefore, not a tax at all.

Unlike, say, sales and income taxes – which you are required by law to pay and which you cannot realistically avoid paying, because everything you buy (including food and shelter) is taxed and most people cannot go without food or shelter, both of which require income – which will be taxed as earned and also when used to buy anything.

The only way to avoid such taxes as those is to live in the woods like Sasquatch – and even then, you will stay pay tax on your food unless you survive on wild-growing plants and game you bring down with a bow and arrow you obtained via barter.

But there is no law requiring one to drive – much less own a car – and many people manage to live quite successfully – in homes with electricity and plenty of food in the ‘fridge – without driving at all and so avoid the motor fuels tax altogether – without any worry about Hut! Hut! Hutting! armed government workers (AGWs) descending.

You can also lower the tax you pay, by driving less – or by driving a car that uses less gas to travel a given distance. Or a motorcycle. Or a Scooter – which uses almost no gas at all and so virtually no taxes are paid.

Or a bicycle, for that matter – which uses no gas and so no tax is paid.

The “tax” on motor fuels is more like a road user fee, built into the cost of fuel. In fact that is exactly what it is.

Or at least, what it was and ought still to be.

Motor fuels taxes – as originally conceived – were to be used to pay for the building and maintenance of the roads and there’s nothing objectionable – from the Libertarian standpoint, certainly – about expecting people to pay for the products and services they use.

The roads are thus – ironically – one of the most Libertarian of government projects in that they are to a large extent voluntarily (as well as anonymously) funded. They are a lot like theme parks or restaurants or any other like thing which people aren’t forced to pay for but can pay for if they deem it worth the money they are asked to pay.

The Libertarian objection is to forcing people to pay for products services, especially those which they do not want and don’t use. For example, the subsidization of electric cars they prefer not to drive – but which they are forced to “help” others drive.

In principle, the tax – the user fee – added onto the price of motor fuels is as Libertarian a thing as can be imagined. It is non-coercive, it is anonymous (unlike income and property taxes) and it is something one can avoid paying without resorting to the Sasquatch Lifestyle in the woods.

It also makes practical large-scale projects such as roads – the very thing which anti-Libertarians invariably claim could never exist in a Libertarian society.

Nonsense.

The right-of-way for a road could be acquired without violence (i.e., eminent domain) and its construction and maintenance costs could be covered entirely by the user fees paid by those who freely choose to drive on the road.

The problem we’ve got is that the taxes (user fees) we pay for the roads are being diverted to things besides the roads – such as saaaaaaaaaaaaaaaaaaaaaaaaaaaafety checkpoints, “public service” announcements (i.e., government propaganda) and “environmental” programs and other such things which are exceptionally un-Libertarian because many if not most of the people paying for these things would probably choose not to pay for them, if they had the option.

But they are – effectively – forced to pay for them, if they want to be able to make use of the thing they do want to pay for (i.e., the road).

Those other things are the reason why the taxes (road user fees) are disproportionately high as well as “regressive.” And also why the roads are in such a state of disrepair. If the monies diverted to things besides the roads were sluiced back to the roads, there’d be more and better roads and (probably) lower user fees, too.

And if the other taxes – the real ones, the unavoidable ones we’re forced to pay in order to live and which we’re subject to Hut! Hut! Hutting! if we don’t pay – were to go away, we’d all of a sudden have a lot more money to pay user fees for things we actually use and want to use.

Like roads.

…

Got a question about cars – or anything else? Click on the “ask Eric” link and send ’em in!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet (pictured below) in return for a $20 or more one-time donation or a $5 or more monthly recurring donation. (Please be sure to tell us you want a sticker – and also, provide an address, so we know where to mail the thing!)

My latest eBook is also available for your favorite price – free! Click here.

Fuel taxes were INTENDED as a “user fee” for “pube-lick” roads and highways…since larger, more thirsty vehicles also impose greater wear and tear on roads and bridges, inherently one paid their way at the pump! Worked as long as the fuel taxes were ONLY put into the highway “trust” fund. But like the Social (In)Security “Trust” fund, who, pray tell, was put in charge of the “trust”? The same politicians whom have less scruples than the fox left to guard the hen house!

I recall about 25 years when there was a huge political fight over a then-proposition in Cali(porn)ia to keep California fuel taxes exclusively for roads, highways, and bridges. Of course, the Dummycrats, led by Assembly Speaker Willie Brown, opposed this measure, this back when he was schtumping our current junior senator, one Kamala Harris. Maybe her current delirium can be explained by her head bobbing up and down too much as she ‘serviced’ the Speaker, or maybe her skull impacted the headboard too hard!

It’s a user fee for using STOLEN property. That’s why your argument falls flat. I think you are incorrect that there would be more and better roads if people owned property instead of psychopathic rulers thinking they own people and property. Yes, lots or people like to drive on the roads, and a strong argument can be made (contrary to yours) that people are forced to drive on the roads. (Just because some people do not do so, is not an argument that anyone can refuse.) In any case, (almost) no one wants one in his back or front yard. Because of this, you have to force people to have the roads you want.

And if you wish to flirt with honesty, your argument is this: You like roads, so it’s dandy to force them on others. (lame)

Without the roads and forced automobile culture we have, we’d have the terrible fate of stronger families and communities—connection to and understanding of the sourcing of the necessities of our lives. What horror.

And “yes,” the same goes for power plants (nuclear and otherwise), oil refineries, fracking. Nobody wants those things in his backyard, so they have to be forced on others. And some of us are honest enough to say we don’t want them anywhere.

You can keep things out of your back yard if it is literally YOUR back yard. You are speaking figuratively it seems, in which case, it’s not actually your back yard.

In the case of fracking, if they aren’t in your back yard that you literally own, fracking hasn’t been forced on you.

It is not that I am speaking “figuratively.” It is rather that I am speaking hypothetically. Since all of these things (eminent domain, roads, nuclear plants, fracking) have been done under (and I suggest are predicated upon) the assumption that no one will own anything—except some fanciful notion of the great gods who are better than regular people and have decreed that they magically own everyone and everything and can tax, i.e., steal, with impunity, then (as you say) none of this has been done in anyone’s backyard. In reality, no regular person is allowed to have his own backyard or anything of his own. Were such ownership possible, then none of these things would exist as they do now.

Therefore, it is useless to try to cherry pick some aspect that one can point to as a “use fee.” And that is the point.

Hi Jim,

This is why I was careful to preface the entire article – and argument – with the caveat, in principle. So your argument is over something I never actually argued.

I don’t disagree with anything you wrote. The problem is you misunderstood what I wrote!

Hi Eric.

I have run into the same problem on occasion. It is not their inability to comprehend, it is, apparently, our inability to adequate explain. With women this has now become characterized as “mansplaining”; in the case of a man, who knows?

Hi Graves!

Cold enough for you today? It was 2 degrees this morning at my place… and yeah, reading comprehension is sorely lacking these days…

Brother, I just got done scraping the ICE off the INSIDE of my front door, and INSIDE the front picture window of the office! I moved the office up front since you were here last; you have to come and see! Now I just have to get motivated to remodel what all I tore up in the back, lol!

The saying I’ve heard for such situations is “I can explain it to you but I can’t understand it for you.”

Heheh. Exactly! Wait, can you explain that again? Lolol~

Good Morning Eric!

Apparently you are not the only one who is going to have his words twisted and used a fuel for irrational emoting. However, I will say that whenever I become despondent about my own shortcomings, I can always count on the dialog here to provide fuel for positive thought and discussion. Your articles attract philosophers, and fools, alike, but it is encouraging to see the thought processes of those of us here that work, not only at our careers and lives, but also come here to share the positive things we hope might benefit each other!

Here’s a little play:

Thug: Hey EP, I’m going to take your wife and daughter and sodomize them with this baseball bat until their insides are running out on the ground. I’m going to draw this chalk circle, and you stay inside it.

EP: Jumps up and down in chalk circle and claps hands saying: I put my toe on the chalk line! I put my toe on the chalk line!

JD: This is useless celebration. The point is what he did to your wife and daughter. Man, you’re being stupid.

EP: Yeah, I know, but you just don’t understand my celebration. I put my toe on the chalk line!

gtc and etc: Yeah! Dude just no comprehendy. Such a dumbass!

Jim,

What are you trying to say, exactly?

Eric,

Please see my response to Ancap 51 above. I don’t think I can explain it any more clearly.

You are trying to cherry pick some aspect of a fundamentally evil system of dispossession that no reasonable or rational person would countenance, and tell us how that thing (a “user” tax”) is something that is fine with you.

And I say: “So what is your point exactly?”

J

JD, I will disagree with at least one portion of your blanket statement:

“And if you wish to flirt with honesty, your argument is this: You like roads, so it’s dandy to force them on others. (lame)

Without the roads and forced automobile culture we have, we’d have the terrible fate of stronger families and communities—connection to and understanding of the sourcing of the necessities of our lives. What horror.

And “yes,” the same goes for power plants (nuclear and otherwise), oil refineries, fracking. Nobody wants those things in his backyard, so they have to be forced on others. And some of us are honest enough to say we don’t want them anywhere.”

Oh wait, that’s pretty much all of your argument, too bad. These aforementioned “evils thrust upon us unwillingly” actually were neither. The roads and car culture are the result of the need to connect all the fantastic varieties of cultures, goods, services and natural wealth and wonder of this nation. It was, for the most part, accomplished through the natural system of our free-market economy. It has recently been abused and spoiled by the PTB, in large part due to the events of 9/11/2001. However, this does not erase the fact that without individual free will, determination, and hard work, we would still be in economic and social chaos like most of Europe and Asia, or in poverty like most of South America and Africa. In the 20th Century, the govt. mostly (though not always) stuck to it’s Constitutional responsibilities of providing national defense and an environment of national economic prosperity. It has been the rise of the Utopian Globalization Con, aided by bullshit like Political Correctness,”the war on drugs”, Global Warming, and all other manner of bogus cons and distractions, that is ruining our prior cultural and family values. Globalization is about “human farming” and “we the people” are the “terra cotta army” being shaped, glazed, and fired in the “kiln” to serve the present Dynasty of PTB, and their progeny.

In short, your naive and even somewhat childish notion that a wholly agrarian economy could effectively ensure the insolubility of a nation that spans an entire continent, died in a little conflict we had from 1861-1865.

The Constitution is about human farming…and none else.

Congress shall have power to lay and collect taxes.

Translation: It’s okay for us to steal your stuff. Your stuff is our stuff. YOU are ours.

Your argument about the current situation being the “need to connect” and something being accomplished through a “free-market economy” is equally fanciful.

It’s not my argument. These are facts, a code of order set down by men far better than you have any place to judge. The govt does have responsibilities, and does need revenue to fulfill those responsibilities. I suppose you would prefer to return to feudalism, European style? Or perhaps you should volunteer to defend your country in the armed services, or maybe build your own roads? I know, go join the Amish or Mennonites, wait, no, they pay taxes too, just not social security (which I do agree is a scam). But I’m not going to give you a history lesson, because you don’t have any understanding or appreciation for any of what got you, and the rest of us, here. You just want to cry about how criminal ALL taxes are, which is untrue. The fact that other greedy selfish bastards choose to corrupt the system is not proof of a bad system, merely evidence of corrupt people. When you develop a system impervious to corruption, you let the world know. If you believe the Constitution is so bad, perhaps you would care to present another? Have you not read the Bill of Rights, or maybe you simply don’t understand their significance? Your lack of understanding is your shortcoming, not mine.

And again, it is not MY argument that the current economic situation is representative of the free market economy, far from it. Your twisting and subversion of the statements I have made here only makes you part of the problem we struggle with today, not part of any intellectual solution. Perhaps you should run for public office, I wouldn’t want you doing anything important for society when you can’t even distinguish fact from opinion.

Jim, it wasn’t lost on me, especially when I 20 was being built that highways were literally running through people’s yards, old homesteads that were very rural and off the beaten path have access roads bordering their front yard. Most people gave up, as would I, and moved to other parts.

But fuel taxes and oil taxes have always been a windfall in Texas, so much so, the roads get very little of it now. We could have silver and turquoise roads if the “road fund” wasn’t completely robbed by every two-bit stupid ass program you can imagine, sorta like Lady Bird’s “Highway Beautification Program”. Her one claim to fame that simply costs hell out of the state and about the only difference is we don’t get to see what cars in the salvage lots when driving, something I always perused since there were jewels out there in the carnage.

But truckers never get mulcted enough so the Feds have a Federal Highway Use Tax. Other states require you to pay a fee to cross or either buy “X” amount of fuel. And then you have to buy their stamp for your “Bingo card” as we always called it.

You know that you are in hell when you live in a police state and are not allowed to say it.

Utopia: Where you can do anything you want, as long as it is what they want you to do.

“In principle, the tax – the user fee – added onto the price of motor fuels is as Libertarian a thing as can be imagined. It is non-coercive”

Ummm … no. The governments involved are not “asking” the sellers of gasoline and diesel to send them money, any more then they are “asking” the sellers of any other product to fork over money … or else.

What happens if the gas seller doesn’t collect the tax and send it in? Do the governments say “darn it, I guess there’s nothing we can do about that” — or do they send people with guns to … remedy … this non-compliance with theft?

It is a less obnoxious form of theft, IF the money collected goes toward road building or maintenance, than some other taxes, but a tax and theft it nonetheless is.

Hi Jim,

Yes, that’s why I prefaced it with “in principle.” Yes, you’re right the tax as it is involves coercion. But in principle, it’s a user fee – and could be, in fact. I have no issue with the idea of paying for things I use.I do object to being made to pay for things I don’t!

The trouble with the arguments that privately-financed and constructed roads would perform better, serve the motorists needs, and are morally superior fall flat for one simple reason: the “pube-lick” roads are ALREADY THERE. Sure, in a few instances, a private venture (which typically is more a government-granted monopoly, as was done in SoCal with SR 133) can be constructed to make a toll road that turns a profit for its investors, but these are the exception, not the rule.

The best thing would be to confine revenues from fuel “taxes” (re: fees) tolls, and vehicle registrations to the streets, highways, bridges, and tunnels, and restrict state and federal financing strictly to REVENUE bonds, which put the risk on the investors, as opposed to GENERAL OBLIGATION bonds, which the taxpayers ability to pony up taxes is what’s at risk. And if a state’s highway “trust” fund (with some form of independent citizen and investor oversight) does actually accrue sufficient excess funds, then a dividend can be declared, either in the form of tax abatement or even outright refunds to the various motorists (like a reduction in the vehicle registration fees, which BTW, for my now five year-old Ford Focus have always INCREASED each year, which seemingly ought to go the other way, but not in “Calipornia”, I guess!)

Great points Eric.

They should just rename all taxes and fees for what they will overwhelmingly be supporting in the very near future:

Local, state, and federal pension contributions. Oh – I almost forgot: Local, state, and federal “heath care” coverage after retirement. And yes – I’m including Social Security and Medicare in here as well.

There will be no more room for funding anything outside these things in our lifetimes (at least those of us around 50ish like me). Nothing.

Guess what the pensions have been investing in since “interest rates” above zero have become considered immoral since 2008: Higher risk investments.

The pensions are already underfunded, even with criminally negligent assumptions of things like 7% ROR compounded now and forever into the future with no recessions ever. They are actually much worse when you make anywhere near realistic assumptions on rates of return.

California and Illinois are just the Canaries I the coal mine with respect to unfunded state liabilities (pensions).

The only legitimate taxes are those that are not collected by force – sales taxes and user fees.

Also: Many states, including Ohio and Florida, don’t have a sales tax on food – no need to head for the woods

to eat.

Sales tax IS collected by force, or have you not ever owned a business? Try retailing virtually anything in any State, every one has a tax on something sold, and some even tax labor. If a business owner refuses to serve as pro-bono “tax collector” you think state he lives in won’t come after his ass? Think again. The FEDS are trying to legislate force national sales tax on any and ALL on-line business, regardless of sales tax being State jurisdiction. Is YOUR county or town on the “water-runoff” taxes bandwagon yet? That’s right, by FEDERAL mandate you WILL be tax for the fucking rain that fall on YOUR property. You think it will stop there? When, or IF Solar collectors become easily affordable for everyone, and energy costs plummet, they WILL tax you for the sunshine you collect based on square footage and wattage….you wait and see! Don’t EVER underestimate the greed and capacity for violence of fat-ass, lazy-fuck bureaucrats!

No disagreement.

Those living off taxes are in “business” of devising any way possible to collect more. And with the, current, worthless fiat currency it will not end well – high inflation (another tax) has arrived.

Hi Liberty,

There is no such thing as a legitimate tax. User fees are legitimate. But the sales tax is a tax – because it’s collected by force and is (effectively) impossible to avoid – either collecting or paying – since literally everything that is bought or sold (unless “under the table”) is taxable and taxed, even including sales between private parties such as me buying a car from someone else.

Eric,

Got it… 🙂

We don’t pay any sales taxes in Montana.

as it should be everywhere since you’re already paying a gas tax.

Which is partly the reason I got a “Speeding Ticket” in a State with no posted speed limit, in 1997, lol! That, and the fact that I had a front license plate (Virginia). I believe that got rescinded in 98 or 99 when a Montana resident fought his citation in court and won on the basis of the lack of Due Process (no posted speed limit).

The issue with taxes on fuels comes to how they are structured and used.

For instance in Illinois there are numerous taxes on fuel that go to the general funds of various government entities. Some of these taxes are applied before calculating the other taxes. That is a tax on tax. This means a sales tax on the fuel excise tax in IL.

And the higher the cost of fuel the higher the sales tax gets too, since its a percentage (I believe 6.3%)of the entire bill. Sale tax which is applied after all other taxes have been added. Why people aren’t outraged by that I don’t know. I think many don’t even know.

https://www.sj-r.com/x1638738591/-Tax-on-tax-keeps-Illinois-gas-prices-among-nations-highest

Of course my state (Indiana) is adding a 10 cent increase every year for the next ten years, so an entire dollar of added tax will be the result at the end. And this was designed by Republicans not Democrats in this case.

It wouldn’t be so bad if all the fed money collected went to maintain the roads, but in most places in the US, urban transit will get more then the roads. It’s been like that since the Clinton regime, it was dialed back a bit during Bush 2, but of course reversed by Barry. Don’t think Trumpster has changed it much.

Never mind that only 1% of trips taken are by transit, and only 5% of Americans have ever set foot on a transit system. Even if you never gave transit a dime of it it still benefits since buses drive on roads.

Brent, the very reason I refuse to pay road use tax. The ungodly registration costs plus the huge amount of tax I pay on fuel and then the various state fees I pay just for a single load to that state. And then truckers are “legally” stopped and inspected which fairly much means what might easily amount to thousands of dollars in fines for not being in compliance on the vehicle itself not to mention a vast amount of paperwork you must carry and with certain loads, carry in a specified location. When DOT comes calling for a Level 2 inspection it’s just another way of raising even more revenue since you’ll be fined for things only the occifer thinks aren’t in compliance.

Not long ago on a 4 foot long ticket there was a pitman arm out of adjustment, even though it was brand new and just installed. There was the charge of no DOT number on the truck even though the numbers were of the correct size plus being big black numbers on a red truck.

And there were the worn out brakes on the tractor that were less than 2 months old with every part of the entire system being new.

Don’t get me started on those mandatory insurance costs that are never less than $6,000 every 6 months and often much more.

Trucking is a business that government works to make it so the small players are harassed out of business just like any other where government is involved.

As to the amount paid to operate trucks on the public roadways, it’s not nearly enough to cover the wear and tear and building the roads to handle the trucks. Trucking is ultimately subsidized by the users of smaller vehicles.

It could be argued that smaller vehicles aren’t necessarily subsidizing trucks. The weight of the trucks are spread out over more axles and several more tires. The trucks are also getting no better than 6.5 mpg’s and are paying fuel taxes on every gallon burned. They pay additionally for any overweight/oversize loads. Many trucks carrying loads are hauling product to……build more roads.

The studies have been done over and over again and truck just does a great deal more damage to the roads. From an engineering standpoint a road designed to last decades of heavy truck travel wouldn’t even notice a passenger car. It’s like when steel is loaded under a certain stress. The fatigue life becomes infinite.

I don’t disagree that trucks do far more damage to roads than cars. That’s a given.

My only contention is that it could be argued that smaller cars aren’t necessarily subsidizing trucks. Have there been studies done on the damage accounting for the extra taxes paid, trip prrmits, oversize and overweight, and other factors?

Also, many states tax diesel at a higher rate. Many at more than 8 cents per gallon extra.

Yes. Trucking is subsidized. Trucking companies have lobbies. As much as the regulations come down they have enough to pull to make sure private personal travel subsidizes trucking. Individual motorists have the NMA which is canceled out by AAA.

That depends on the truck and the tyoe of ‘trucking’ you’re speaking of.

I own side dumps, dump trucks and two heavy equipment transport trailers. I’m a member of no lobby. The extra 8 cents per gallon that I pay, plus the exorbitant fees and other taxes levied on my trucks coupled with the random inspections, weighing and its associated fines should cover the “damage” I’m doing to the roads.

Trucking–in general–is totally different than a guy with a couple trucks.

Even with all that said, I’m not solidly convinced that the truck hauling whiskey from Kentucky to Montana is putting more wear vs. what it’s paid to travel that distance than grandpa clover driving his Camry the same route. The truck is paying much, much more fuel tax per gallon for that trip while getting 5.5 mpg’s at best.

The problem is that it’s damn near impossible to know the real cost of anything because government subsidizes, manipulates and steals from every aspect of the market. Who knows what the real cost of the kings roads are and who’s subsidizing who and how much?

I do know when I get a $250 ticket for “improperly securing a load” because the chain wasn’t “right”–after paying $100 in fuel tax to get there–I don’t feel like uncle Camry driver subsidized me.

The government claims fuel taxes are going for roads. I myself do not quite believe it all does. For example, I-81 here in Virginia is being prepared to become a toll road. The state government claims it needs the funds to improve it. My question is where was all the fuel tax revenue going for all these years

? To implement the toll, toll booths have to be built, purchase more traffic cameras, hire more people to man it all. I suspect after all that , the state will claim fees need to go up so they will have funds to do actual road building. Once funds build up . funds will be used for NoVA or misspent elsewhere. You can call me a pessimist but to trust the government is to be asking for abuse.

Correct, especially here in the “Commonwealth” of VA, where revenue is robbed from any and all available resources, and spent in accordance to the will and wishes of the General Assembly in Richmond. Since the major VA Office Campaign contributors are those with the most “expendable” income, the “common” wealth almost always flows North towards Alexandria, etc.

Back in 73 when I bought my first 18 wheeler I got an education how lucky I was to be a Texan.

I already knew New Mexico roads sucked as did La. and Arkansas. I didn’t realize prior to that the further away from Texas you went the worse roads were.

Back then fuel tax actually went to the Highway fund with a little being robbed for edumacation. Of course it was a tiny percentage of what it is now.

The Fed’s have been stealing Texas taxes for decades now to make up for 17 states who evidently don’t pay any tax to the feds or very little.

If we had all the fuel tax going into the state fund building roads we’d have the smoothest, 4 to 10 lane highways over the entire state with possibly east Texas and its waterhead inhabitants not wanting or needing them as They see it. That part of Texas was full of crackheads before crack came along. Some small communities apparently passed around the same set of dentures. Don’t know if it was a lottery or some other way.

I was always amazed that the back roads (FM) in Texas were better or at least as good as the main highways in other states.

Out in the extreme NW Panhandle, roads between virtually every small town are 4 lane and divided.

I always figured it was the oil taxes that funded it ???

I noticed the sticker here in houston at a shell pump, $.40 for feds, $.40 for the state, per gallon. so about 40% of the cost of a gallon is tax.

I thougth it was 18.4 cents for the feds, 20 cents for Texas. That hasn’t changed since 1993. I don’t object to that either. Every penny you give to the feds emboldens them. I prefer to keep them in a cage.