An unprecedented thing is happening – and it isn’t the attempt to inject every healthy American with “medicine” (sic) their health doesn’t require.

It is that used cars are . . . appreciating.

Normally, they depreciate – a fancier way of saying they lose value. Traditionally, almost immediately – and ongoing. As you drive, the less it’s worth.

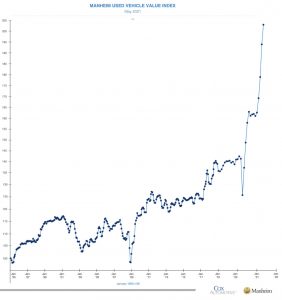

All of a sudden, used vehicles are increasing in value – or rather, cost. To a degree never seen before. The Manheim used car index – which works kind of like the consumer price index applied specifically to used vehicles – notes an almost 50 percent jump in the indexed value of the average used vehicle over the past year.

With the spike – literally, it’s almost a vertical ballistic trajectory – beginning right around the beginning of this year, interestingly enough.

Even more interestingly, the spike is general.

It is one thing for a specific make/model used car to go up in value. For example, a version of a car – or truck – that people like better than the new version of the same thing. Which is now a different and perhaps not as desirable thing.

Or a more expensive thing.

And that is precisely what’s happening now – to all used cars. They are going up in value because people increasingly don’t like – or simply can no longer afford – new cars.

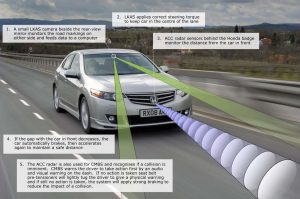

Part of the reason for the not-liking, arguably is because of the over-the-top electronic nannying that comes standard with practically all new cars. It has reached a degree of insufferability that is almost intolerable. Like having a horse fly constantly buzzing – just the right word – around your head.

Lane Keep Assist. Brake Assist. Park Assist. Blind Spot Assist. Pedestrian Detection Assist. Speed Limit Assist.

Soon – probably – Diaper Assist.

Older cars lack “advanced driver assistance” technologies. They don’t attempt to countermand your steering or apply the brakes on your behalf or automatically shut off the engine every time the car stops moving. They don’t put the transmission into park because you tried to back up with the door open – in order to use your eyes rather than a camera and beeping electronics to see where you want to go.

Some of the latest new cars won’t drive at all unless you “buckle up” for “safety” first.

The car press bow-wows these “advanced” technologies but how many car buyers actually want to buy them? It’d be interesting to find out but it’s very hard to fathom because in most cases, these features are part of the deal; you can’t not buy them without not buying the car.

Many apparently are doing precisely that.

By purchasing an older – used car – instead.

There are also related reasons for the rush to used, touched on in previous columns. Among these are leeriness of the increasing disposability of new cars due chiefly to their elaborate, vehicle-specific electronics. People are hearing about replacement costs and wanting no part of a vehicle that may be more expensive to fix than it is worth to keep once the warranty runs out.

There are also the exorbitant peripheral costs of buying and owning any new car, including the outrageous taxes applied at time of purchase and then every year thereafter – in states where an annual property tax is extracted. These are based upon the “book value” of the car. A new car can cost you more in taxes over five years than it costs to buy a decent used car, itself.

Many people are simply no longer in a position to hemorrhage say $500-plus (or more) each year just in taxes (plus the payments) for the next five years – until the value of their new car goes down and with it, the tax – due to the artificially imposed economic devastation of the past year-plus. It is not surprising they’re looking for ways to save some money, as by not buying a new car.

They also have less money.

Or rather, their money buys less – and less. On a weekly basis, it seems – and is.

Rising inflation is not unrelated to the rising values – the cost – of used cars. The same used car that sold for $8,000 six months ago now sells for $9,000 not so much because it’s worth another $1,000 but because it now takes $9,000 to buy what used to cost $8,000.

Just as a sheet of 4×8 plywood that cost $20 last year now costs three times as much. It’s not so much the item’s value that’s gone up but the purchasing power of the “money” we’re forced to use as “legal tender” having waned. Which has happened because it has no real, substantive value beyond the “full faith and credit” of the United States government – and we all know how much that’s worth.

Especially since about January of this year, when the new resident was (s)elected.

New cars are also costing more, too.

In real terms, not adjusted for inflation. The rate is not as ballistic, but it is incrementally steady. Because of the steadily, inexorably increasing cost of government, necessarily folded into the price you pay. These are the cost of compliance with all of the many federal “safety,” “emissions” and “mileage” befehls – a German word for decree, which is what they are – and which manifest in cost-adding hardware such as smaller engines with turbochargers – to make up for their being smaller, in order to comply with federal MPG mandates.

And aluminum bodywork, which costs more to manufacture and which is more easily damaged and more expensive to repair (and so, insure), costing you more, several times over.

Buyers aren’t asking for tiny turbocharged fours in place of V6s without all the peripherals – or for automatic transmissions with seven, eight, nine and in some cases ten speeds. Nor for aluminum truck bodies or direct injection rather than port fuel injection and the additional/secondary port fuel injection circuit needed to correct for the carbon-fouling problems created by direct-injecting the engine.

But they are proliferating because they are necessary to meet government approval.

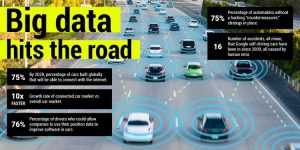

Meanwhile, the car companies are using their new cars to make money by selling you – after you buy the car. By selling data about you, mined from the car – without your knowledge or your consent.

It appears more and more potential new car buyers do not approve – and are expressing their disapproval by not buying in.

This has created a unique and unprecedented feedback loop that’s waxing seemingly with every passing day. And which may wax beyond all prior conception given the built-in supply problem with not-new cars:

They aren’t making any more of them.

. . .

Got a question about cars, Libertarian politics – or anything else? Click on the “ask Eric” link and send ’em in!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at EPeters952@yahoo.com and I will send you a copy directly!

A very dear 76-year-old friend put West got sucked into buying a 2019 Mercedes SUV. It has all the “safety software” features mentioned and more. You need at least a master’s in Computer Science just to set up the climate controls, never mind get the wipers to work when you want them to.

It’s parked. For Sale, and I’m telling her not to reduce the asking price. Meanwhile she’s driving her 2002 Explorer, which has “only” 125k on it.

Eric, It would be cool if you could do an article (and the comment thread that would follow) about if we could somehow use the best of each era of cars, and build the perfect car using only the best practices of any of the last hundred years or so.

For example, I do like today’s paint, tires, the huge horsepower numbers, the non abs parts of the brakes and the pretty good build quality. Combine that with the more reliable, not in your way and simpler electronics of the 1990s. The styling, solid feel, form and size from the 1960’s.

I guess my perfect car would look something like a Continental or Imperial from the early mid 60’s, with a hellcat hemi engine. ha ha.

My 16-year old, standard transmission car has over 200,000 mile on it, and I get offers to sell it every time I take it to the dealership for routine maintenance. Every last rental car I have driven has had all the “saaaaffety” junk on it. Which makes me want to keep mine forever. Also, I can leave the darn thing in the garage for weeks on end, and not worry about having the battery go dead the next time I go out to start it. I echo many other comments here: The Ford dealership, the Subaru/Toyota dealership lots are empty! Newer is not better. It would be nice if the powers that be figured this out.

Hi Shadow,

Indeed. I think cars are not cell phones – though they are trying to make them so. And even though some want them to be so. There is an inherent problem with that. I may dig into this at length….

Eric,

This week, David Knight has been talking about a Ford dealer located near one of the Ford facotries; the dealer normally has 1,500 new cars, but only has 30 now. I think he was quoting an article from one of the big car mags. The writer pulled in to the dealer to see if they were still open. While there, he found out that they simply cannot get any new cars, even though they’re near the factory. Anyway, it appears that the chip shortage is somewhat responsible for the new car shortage.

David also said that, when he drove to NY State to speak at Gerald Celente’s get together, how he saw car carriers carrying used cars. Instead of carrying new cars, all the car carriers he saw were loaded up with used vehicles.

Bloomberg is saying that, because of the plandemic, car makers didn’t order many chips; they didn’t think they’d be able to sell many cars in the depressed economic environment of last year, so the planned for reduced production. Since they planned for reduced production, they didn’t order as many chips. Now that demand has increased, the car makers can’t build new cars to satisfy demand because they don’t have the parts to finish them.

Oh, and Bloomberg also said that, with more people home during the plandemic, more people were ordering video games, computers, etc. SO! While the car makers are trying to get chips, companies making games and computers are buying more of them too. They said that the chip shortage wouldn’t clear up until next year, at the earliest.

Shortages are an excuse. Bloomberg has an interest in hiding what’s really going on with respect to inflation vis a vis the increase in the money supply. Some people make money in inflationary times, e.g, stock jobbers and related.

David Knight, when citing an article from a car mag, quoted the author’s story about how a Ford dealer near one of the Ford factories only had 30 cars on its lot vs. the customary 1,500. If anyone could get cars, you’d think it’s a dealer near the factory, right? Anyway, the author pulled in to this Ford dealer, thining it may be closed, so he went to see what’s happening. The writer said that dealer personnel told him that they couldn’t get cars, thanks to the chip shortage. While I’m skeptical of what ANY MSM outlet says, Bloomberg seems to be right about the chip shortage.

Oh, Ford is an honest counterparty. Sure. No wokey wokey there, right? That Ford dealer right near the factory, I tell ya, must’ve been tellin’ the truth! Chip shortages. Ya. Ok. But all yer China spy crap wit chips is available. What, no Russian hackers to blame? Gun control Bloomy? He’s actually from Boston, dont’cha know? Don’t you live up there in the Tri-state or adjacent?

I’m in PA, adjacent to the Tri-State Area. All I know is what David Knight discussed on air yesterday; part of that was reading the Car & Driver author’s experience at the Ford dealer that’s near the factory, which confirmed what Bloomberg Radio said. I trust David Knight, as he’s usually dead on target. Oh, and one of the posters above said something similar: the car dealer where he goes for service is out of new infentory also.

The current problems in manufacturing have nothing to do with inflation except for maybe people spending their stimulus checks on the consumer side.

I work in a manufacturing business and practically over night just about every company world wide became like Italian and French suppliers. Now if you never worked in global manufacturing that probably doesn’t mean much to you but Italy and to a lesser degree France have culture of long lead times and excuses of why your parts haven’t arrived. One supplier I dealt with made really nice gears. Prototypes? 3-4 months. Regular production orders I think eventually got to be 1 year out. This was years ago. I had similar issues with other suppliers in Italy and France every where I have worked. Now we are getting this crap globally. It’s like everyone’s workforce just went away. Night of the Comet or something.

It doesn’t even matter how much money one is willing to pay. There’s not even paying to get to the front of the queue. The queue itself is busted. All that works now is finding different suppliers, making material substitutions, building the product the parts are available today and something else tomorrow.

If not inflation, why now, not say, late 2018? Why did everyone become French or Italian overnight now? Yours is the strangest explanation I’ve seen yet.

My theory:

People are starting to go Galt.

Someone, please point me to the Gulch, I want to get off this train.

I super size with ya. But, Asian chip makers? Do they even have that cultural reference? My theory is that the “shortage” game is meant to hide the reason for higher prices, which are an unstoppable symptom of the unprecedented massive increase in the money supply. Works like this. Create artificial shortage explained by plausible but unlikely situations. Raise prices across the board really high for a short period of time for maximum effect. Hide stockpiled inventories. If that’s impossible, employ the Russian hackers/ransomware bit and pay the FeeBees some bitcrap that they repay to you at a later date, which has the added benefit to the system of associating non-gov’t money with crime. At some point medium term end either type of charade and release inventory at lower than highs but higher (in line with actual inflation) than prior to “shortages.” Due to continuing propaganda, customer “relieved” to finally pay less (but actually more and sticky at this level). Watch anything this has happened to/is happening to and the methods they employ. It’s a way to make seemingly very high inflation seem “transitory” while associating simply high inflation with a good outcome.

Eric,

I think that was the most old-lady “saaaaaafety” lamentations I’ve heard in one of your videos!

Questions I have: Where is the tipping point? Where does the momentum of Uncle’s decrees cease as the buyer will no longer buy the bastard children of those decrees? How much economic pressure must applied before the equilibrium is completely disrupted, enough of the people awaken, and the Emperor is shown to be naked?

I dunno, BaDnOn…but I’ll tell you this:

I increasingly feel like Clint Eastwood’s character in Gran Torino … a relic, standing among the ruins of what was once a great country.

Certainly seems that way. Thanks for the visual. I will add however that it depends where you are in the US. I travel a ton, and it is obvious to me that deep blue Metro areas are in bad shape, way worse than the TV shows. The burbs that surround these metro areas (that were slowly crumbling) have gotten a reprieve, probably temporary. While on the other hand, rural areas and somewhat purple or red metro areas are booming. Just my observation.

I’m in a “deep blue Metro area” and CAN’T WAIT to get the hell out of here, away from the reach of all of these face-diapered imbeciles and their abysmal influence.

That you are, Eric. Great movie, BTW.

Hi Eric,

I’ll be standing with you; every time I read one of your new car reviews I go out to the driveway and kiss my ‘01 and ‘03 Corollas. They still run perfectly but the rust is starting to get to the chassis and will probably win out in a few more years. It seems there’s no part of our lives that Uncle won’t micromanage, the sad truth is we grew up in probably the best times of American history but it’s heading downward at an accelerating rate and I don’t see it turning around in my remaining lifetime.

Hi Ya Mike!

**”the sad truth is we grew up in probably the best times of American history”**

We were truly blessed to have grown up in a place and time which was an anomaly of history- a time when technology, culture and relative liberty all coincided at a practical pinnacle which made it possible for even reasonably functional people to live in near paradise!

Such a time will never exist again (Until the Kingdom comes!)- the realization of which makes me give thanks daily that I got to experience the tail-end of that time! Growing up poor, it was still just as much paradise….and today, the richest kid could never see and experience the things I got to revel in daily, much less a poor kid!

I can not imagine how much worse the present world would be if we did not have the memories of all of those good things we were so blessed to have experienced!

I read somewhere that 25% of all US$ in circulation (includes everything, digital & paper) was issued in the last 15 or so months. Simply unprecedented.

That doesn’t surprise me. The real estate market went absolutely bonkers last year.

Funny how the Austrian school is able to predict the result of central bank activity, yet it is Keynes who is in all the text books.

https://thelibertydaily.com/yes-blackrocks-home-buying-spree-should-concern-you/

Now, maybe Blackrock is up to some nefarious activity to hasten the global one party system, or maybe they’re just looking for yield in a 0% interest economy. Either way, this is a direct result of the helicopter money policies that are destroying the wealth of the citizenry.

Hi RK,

“Funny how the Austrian school is able to predict the result of central bank activity, yet it is Keynes who is in all the text books”.

Almost the entirety of the economics profession has been captured by GovCo and exists to serve their interests. Not just the Keynesians, but the supposedly free market Chicago school as well, who favor government control of at least half the economy (the production of money). Of course the monetarists and the Keynesians dominate the field, they provide value to the State, justification for its’ asinine schemes, reasons for perpetual intervention. The Austrians offer nothing, from a Statist perspective, but “stay out of the way and leave us alone”. Ironically, there is no “free market of ideas” in economics. Funding goes almost exclusively to Statist economists.

Cheers,

Jeremy

Eric,

Just sold my rebuilt title 2016 Tundra for 5k more than I paid for it three years ago. Replaced it with a 1997 Toyota T100 5 speed/4wd with 247,000 miles on it.

It has a key, you know, that cut metal device you stick in the ignition switch. Cost me 1 US Dollar to get a new one made. Replaced the CV axle in the front, did a brake job and replaced all the fluids. Everything on it works (except the cruise control and the cigarette lighter outlet).

Also bought in January a Lexus LX470 with 248,000 miles that was almost perfect for $7900. Could not believe this guy sold it that cheap, but he had several cars and wanted this one gone. I love driving that thing. The gas mileage stinks but who cares? It’s built like a tank and the inside is gorgeous.

So, I drove a rebuilt title truck for three years and 20,000 miles and turned it into two older (Toyota) vehicles with high miles but without the nanny gear. Debt free older cars are the “future,” if you will; at least for me.

Amen, Pat!

I haven’t checked lately but I bet I could sell my ’02 Frontier for in the neighborhood of $4,500 right now. I paid $7,500 for it 12 years ago. Obviously, it’s not for sale!

Of course, Eric, when figuring the TRUE inflation rate, not that CPI crap the “Gubmint” puts out to try to convince we “proles” that the Cost-of-Living is being pulled up out of reach, like a bully teasing little kids with a toy on a fishing pole, that $7,500 is more like $12,500. Still, getting about 35% of what you paid for what was then a 5 y.o. truck (therefore, by most lending standards of the time, if you financed it, a “subprime” loan, given the age of the vehicle, regardless of your personal credit), you have done well as you’ve already gotten 12 years of use out of that Nissan, which, frankly, was not projected to last that long when NEW.

But the REAL question should be, why contemplate selling the truck at ALL, unless one or more of the following situations is present?

1) It needs a “big ticket” repair, like an engine or transmission rebuild. Of course, even replacing an “module” can be a big “Ka-Ching!”

2) It no longer serves your needs. Which, for a forty-something guy, is ludicrous. A man and his TRUCK…it’s a beautiful thing. Only if you must have a BIGGER truck, like for tow jobs that Frontier can’t handle, or to haul a camper, and so on.

3) You have higher priority uses for other vehicles and don’t have the space, or can’t justify the insurance, taxes, and title expenses. Especially if the truck sits parked most of the time.

Else, I’d say, just drive the damn thing. The cost to REPLACE it is generally far higher, and every month you’re NOT laying down $600 to $800 (yep, that’s a more TYPICAL truck payment these days), you can sock away those payments you’re not making, let alone let the down payment work for you in other ways. As I’ve learned, the hard way, of course, I’m too damned “stoopid” to learn otherwise…

When you are poor, YOU work for your money

When you are rich, your MONEY works for you.

If KBB can be believed, my 2012 Tacoma is worth at least 2k more than I bought it for 4 years ago. Given my low interest rate on the loan I am about to pay off, I still haven’t paid nearly that much in interest. I’ve gained net worth on a used truck. That is not supposed to happen. I look back at how I balked at the price of my nearly new used truck and now think I made absolutely the right decision. It was worth the investment apparently. And no, the truck is not for sale.

If the truck served your needs well enough to justify a four-year loan on what was already a five year-old vehicle, and it still serves you now, then its performance as an “investment” is fine, but IRRELEVANT. It’s worth the EXPENSE if it serves your trucking needs. It’s good to know that at least, if you gotta “punt”, you can recover what you’ve paid for it and a wee bit more, hell, that’s damned great, but what, pray tell, will you do with the cash? Only if you don’t need ANY truck now, or the Tacoma no longer meets your needs, is that hefty resale value going to serve. Be content that the Tacoma itself will serve, and, since you’re seeing the end of the (debt) tunnel, you can sock away those payments to “pay yourself”.

‘Soon – probably – Diaper Assist.’ — EP

Remember last summer, when Dr Faust’s — errr, Fauci’s (easy to confuse, as both made a pact with the devil) — gain-of-function virus was eating the travel industry alive?

‘Hertz announced its car sales program will be paused amid bankruptcy Friday [14 Aug 2020].

‘Hertz was able to sell tens of thousands of cars after it filed for bankruptcy, which economists say is a good sign for the nationwide car rental company.’

https://tinyurl.com/2wuyr4yh

A new summer is rolling round, and the classic capacity cycle has come into play. Last year car rental companies were shedding their fleets like smugglers hurling fentanyl out the window with the fuzz on their tail. Now demand has surged back with an almighty bang, and they are caught flat-footed.

An article a few days ago (tl;dr) highlighted some dude who found it cheaper to rent a U-Haul truck than to scrounge for a scarce rental vehicle.

As ol’ Henry Hazlitt pointed out three generations ago in Economics in One Lesson, it’s tough to manage a business when Big Gov slams the brakes so hard you bang your head on the windshield, then floors it viciously enough to pin you back in your seat.

Soon enough, the next neck-snapping brake slam is coming, after the roaring auto biz ‘overheats.’

A simple thermostat could replace thousands of fedgov apparatchiks, and do a better job to boot. Robotics, comrades!

The price of everything is going up- such is hyper-inflation, caused by the printing-up of TRILLIONS of dollars of worthless fit currency.

It’s not that the average person has suddenly come to their senses and desires simpler more durable vehicles- as a good percentage of the vehicles which are appreciating in value are just as festooned with all of the crap as are brand new vehicles. Witness a local guy I know whose friend had recently bought a brand new Chevy truck….and was offered more money for it BY THE DEALER thjan what he had paid for it.

People are flush with money from all of the recent government hand-outs, and at the same time there are shortages of goods, including new cars…… But the bubble will burst, and then it will be interesting to see what happens. I was SHOCKED to see the paltry inventory of new vehicles that a dealership in the town where I go shopping had a few weeks ago- They hardly had anything- they can’t get new vehicles…and the ones they do manage to get fly off the lot.

‘bought a brand new Chevy truck … and was offered more money for it BY THE DEALER than what he had paid for it.’ — Nunzio

What do you want to bet that some of those 100,000 reservations for Ford’s F-150 Lightning are speculators planning on a quick flip?

It’s the same technique as the guys who post the ‘I buy houses for cash’ signs: get it under contact; then sell it on to someone else before it closes.

Free money, free beer, free love: Biden’s bottomless well of Yellenschrift has induced a giddy Weimar saturnalia, in which invisible sculptures sell for wheelbarrows full of Scheiße Papier … and flapper girls on ecstasy dance till the purple dawn.

Sherry buys a paper and a cold 6-pack of beer

The headlines read that Sonny is goin’ to the chair

She pulls back onto Main Street in her new Mercedes Benz

The road goes on forever and the party never ends

— Robert Earl Keen, The Road Goes on Forever

Absolutely spot on Eric, its not the items value going up, or rising demand, or even constrained supply, (except maybe for used cars). It is the flood of digital ‘shitcoin’ otherwise known as federal reserve notes which is responsible for rising prices. Also a fake pandemic which amounts to a bail out of the big Pharma sector. All that extra “money” sloshing around has to go somewhere.

Over the last few years I bought and resold a couple of used trucks. Both times I made a nice little profit after driving it for a few months. I watch the price of used cars on Craigs list in our area and this rising tide is a real thing. Its weird how for a while the price of used low mile luxury cars (Mercedes, BMW, Audi) say eight to ten years old was cheap. Nice shape, well kept, low mile, one owner types. To me they all look mostly the same. maybe that is why they were so cheap.

I just might start looking for something a little older that I can buy and hold while driving and enjoying. On a side note a week after your article on the little red express one came up for sale on CL it had low miles and looked pretty well taken care of. They wanted I think, 18 K. Seemed like a deal. Iv’e also noticed a lot of old T birds for sale as well. Real cheap for a 65 as compared to a 65 Mustang. I was always partial to those T-birds.

The excess TRILLIONS of $$ being fed into the money supply is inflating everything. Of course, all the readers here know that. Now with the Libs/Greenies in power in DC, they are going after/restricting anything natural-resource related. So anything that utilizes natural resources (steel, lumber, agriculture, oil and gas, – and to some degree electronics) So, this will put pressure on the supply chain. One might think that tech/software/services would then still be cheap, since they do not use these things. But the natural resources that serve as the basis for everyday goods that people need TO LIVE are putting all this pricing pressure on things.

So two-fold: Increased funny munny, and governmental pressure restricting the supply/delivery of natural resources.

Looks like I timed it right (again). Bought a 20 Ram a few months into the corona when they were giving them away. I then learned that this truck could easily replace my sedan/F150 split I do in another location. So I queried a dealer I like and he was slobbering over my two late model/low mile 300 and F150 stripper. Told me he would sell them in days for a small profit. First time in a long time I didn’t even have to think about it, as the trade prices were probably 10K over what I expected. Ordered the 2nd Ram a few months ago when they were still in good supply, wrote a small check and off we go. Dealer even gave me a little more 8 weeks later cause my two trades appreciated in the two months.

People are forgetting the “cash for clunkers” program which destroyed hundreds of thousands if not millions of perfectly good used cars and trucks.

That’s true! I know a guy I used to work with got rid of a perfectly good Ford Windstar minivan during cash for clunkers, so he could get a Mini. He said that, if not for the program, he couldn’t get the Mini he wanted. I was thinking how this one, simple act took a perfectly good, albeit used, minvan off the road; it would’ve been perfect for a young family just starting out. It was worth, $3k-$4k at the time, so it would’ve been an affordable alternative for a young, growing family. What a WASTE that was!

Also, I heard elsewhere that, while we were doing Cash for Clunkers over here, that Britain had a similar program going on over there at the same time. I found that curious. Maybe it was part of the plan to get private vehicles out of the hands of the Proles? I don’t know…

OT:

Badged swine rams, flips car of pregnant woman clocked for speeding:

https://www.usatoday.com/story/news/nation/2021/06/10/arkansas-police-rammed-pregnant-womans-suv-traffic-stop-lawsuit/7645474002/

A very large chunk of the population has been working from home for the last 12 months. So they weren’t driving the 30 miles round trip to work and back every weekday. That car has been sitting for a year, not adding 7200 miles. And with everything else closed, the only trips were to the grocery store and back. Another hundred or so miles per week not driven. No need to replace it if you’re not using it. No new car means no trade-in and no used car inventory.

And another large chunk of the population has taken an earlier than expected retirement. Just read something the other day about how for the first time since the 1980s the 55+ working age group fell slightly last year. That’s people either laid off or coloring up to cash out. They aren’t going to be buying new vehicles either.

I went to a ford dealer to talk to a friend 2 weeks ago and i was astonished to see how few new cars they had on the lot. Every time i have gone almost every spot in the dealership had a new car in it. This time it looked like to me what a dealership would do if all the cars were being moved so that the lot could be re-paved. My friend told me that they can’t get inventory from ford because of the chip shortage. Almost everything they have available is used. He said the Chevy dealer down the block was even in worse shape since they were down to 12 new cars period. I think this supposed chip shortage is having an effect because the dealers are doing everything they can to keep people in their 2 & 3 year old leases beyond the lease end date so that they don’t jump to kia or hyundai. Apparently the korean manufacturers have their own supply of chips and are not effected by the chip shortage like all american, european a japanese builders are.

Hyundai has it’s own chip manufacturing company:

https://en.wikipedia.org/wiki/SK_Hynix

SK hynix Inc. (KRX: 000660) is a South Korean memory semiconductor supplier of dynamic random-access memory (DRAM) chips and flash memory chips. Hynix is the world’s second-largest memory chipmaker (after Samsung Electronics)[2] and the world’s 3rd-largest semiconductor company.[3] Founded as Hyundai Electronic Industrial Co., Ltd. in 1983[4] and known as Hyundai Electronics, the company has manufacturing sites in Korea, the United States, China[5] and Taiwan. In 2012, when SK Telecom became its major shareholder, Hynix merged to SK Group[4] (the third largest conglomerate in South Korea).

You can bet that every manufacturer is looking at companies that own their own fabs and make their own chips and trying to see if there’s a case for in-house production. Apple has a toe in the water because they outsource production to TSMC but I’m sure someone has a Keynote (powerpoint) pitch deck for a fab ready to go. There are already tons of application specific integrated circuits (ASICs) in everything but they’re fairly simple devices. As the transistor density gets cheaper it makes more sense to add more integration and functions directly to the silicon instead of using up machine cycles.

What happens next is going to be interesting. We might see a true break from standard systems, and along with that, increased balkanization. That’s how it was back in the early days of networking, where Cisco dominated because they figured out how to translate protocols. The nice thing is that it will probably delay automation since most of these systems are going to depend on machine to machine communication for much of their benefit. The downside is that we’ll lose even more control of our devices and less choice.

Agweb

Social media started buzzing this weekend after a marketing analyst made a comment about where prices could go in 2023. The analyst painted a scenario and stated corn prices could hit $18 to $19 per bushel, soybeans $30 and wheat $42 to $45 per bushel in the year 2023.

Soybeans are $15.50 today, wheat is $6.63 and corn is $8.80. 150 bushel per acre for corn in Iowa, in Mississippi corn can yield 300 bushel. 8.80 x 150 = 1320 USD per bushel gross income. 300 bushel will have a per acre income of 2640 USD. 150 acres will gross 198,000 USD.

A new combine is 750 grand, a new four wheel drive tractor is 540 grand. A used combine is 225 thousand.

Custom plant and custom harvest, you won’t have to do that much to clear about 600 per acre gross. You can stay on vacation, have a good computer with drones reporting the progress of the crop.

A rainstorm dumped 1.6 inches of rain on my little farm this morning, rained cats and dogs. Rained like a cow pissin’ on a flat rock. Out of the woods, the drought came to an end just like that.

The value of the farm property has probably tripled in the last ten years. Not going anywhere.

The song birds keep singing from morning to night, can’t beat that.

Hi drumpish,

“The value of the farm property has probably tripled in the past ten years”. It will only get worse, just read that Bill Gates is now the largest owner of farm property in the country. Just wondering if he plans to sell for a huge profit or more inclined to control The food supply, I’m betting it’s the latter.

New cars might sell better if they didn’t all look alike. I can’t tell a Honda from a Toyota unless I can see the badge, nor whether its a 2018 or a 2021. The front grilles are getting pretty outrageous in an effort to make them different, but even more expensive to repair. Buying new has never made fiscal sense. Why buy a car that depreciates $5,000 when you drive it off the lot? Just so you have more paint options? 90+% of us have declined in our economic condition. We can no longer afford $5,000 to select the color we want. Which even in a used car you MIGHT get a chance to select.

John, biggest issue i see on why someone would buy new vs say 3 year old car.

Taking the truck i was just looking at as an example, new Tacoma sr5 approx $38,000, 3 yr old version of the same truck at a dealer is currently going for the outrageous price of around 34 to 35k for anything under 40,000 miles.

New car -60 month loan with 2k down and 7% sales tax is 644 a month with 0 apr since most new cars have 0 apr as an option. The same 3 year old truck at 35k with an approx 4.4% rate which is the average bank rate for a 60 month used car loan is $664 a month. Also with new cars many people can spread the payments out to 84 months if they want, most used cars don’t have that option as 60 months is the max.

Some people don’t have mortgages at 600 a month. This is also why i didn’t bother using a bank or dealer for financing and had alternative means available to me.

Yeah, I keep forgetting how the ability to use debt influences things, since I’ve had none since I was about 40, 27 years ago. Now I can’t use it because I have no credit rating, which suits me fine. It the latter part of my working life when submitting a resume, I had to note on the resume that I had no credit rating, and why. Because employers do check such things, and simply not finding one would likely confuse them.

I thought about your article while reading this bit, especially these parts:

U.S. farmer Rob Arkfeld was vacationing on a sandy beach in Mexico’s Riviera Maya when he won an online auction to rent 535 acres of cropland back home in Iowa by bidding nearly double the local average for each acre.

…the 48-year-old agreed to pay an annual rent of $417.50 per acre for the next two years for the ground in Mills County. That amount is big enough not just to rent, but to buy land in some parts of the United States.

..In Mills County, the average rent for farmland is $229 per acre, according to Iowa State University, about half of what Arkfeld paid. Arkfeld says he can guarantee a profit this year by booking corn and soy sales ahead of time for the autumn harvest.

“I never even looked at the farm to tell you the truth, until after I rented it,” he said. …

Buyers are worried about availability of the augers – which cost up to $14,000 and are normally sold around harvest time – and are paying for them in advance…

For now, high crop prices are lifting North America’s demand for large farm machines to the highest level since 2012-13,…

At Lindeman Tractor in Atlantic, Iowa, an hour’s drive northeast from Malvern, sales of new New Holland tractors made by CNH Industrial (CNHI.MI) started rising in November 2020, salesman Lonn Schlueter said. They are now up threefold from a year ago and the strongest in about nine years, he said. …

Prices are up 20% year-on-year for large used tractors and 50% for small tractors, while supplies in North America are at an 18-year low, according to Jefferies Equity Research.

https://www.reuters.com/business/energy/surging-us-crop-prices-reverse-fortunes-rural-iowa-2021-04-29/

Agweb

Social media started buzzing this weekend after a marketing analyst made a comment about where prices could go in 2023. The analyst painted a scenario and stated corn prices could hit $18 to $19 per bushel, soybeans $30 and wheat $42 to $45 per bushel in the year 2023.

Soybeans are $15.50 today, wheat is $6.63 and corn is $8.80. 150 bushel per acre for corn in Iowa, in Mississippi corn can yield 300 bushel. 8.80 x 150 = 1320 USD per bushel gross income. 300 bushel will have a per acre income of 2640 USD. 150 acres will gross 198,000 USD.

A new combine is 750 grand, a new four wheel drive tractor is 540 grand. A used combine is 225 thousand.

Custom plant and custom harvest, you won’t have to do that much to clear about 600 per acre gross. You can stay on vacation, have a good computer with drones reporting the progress of the crop.

A rainstorm dumped 1.6 inches of rain on my little farm this morning, rained cats and dogs. Rained like a cow pissin’ on a flat rock. Out of the woods, the drought came to an end just like that.

The value of the farm property has probably tripled in the last ten years. Not going anywhere.

The song birds keep singing from morning to night, can’t beat that.

Oops, tried to make a correction, double entry.

While reading this article I was reminded of the old cars of Cuba which I’ve seen on the TeeVee and wondered about the similarities of how things got to be the way they are in both countries and if that’s where we’ll wind up eventually, for a time, or, for forever?

It also reminded me about all the stacks and piles of used and old lumber I saw fetch what I considered to be crazy high prices at the lawn & garden auction this past Spring.