A reader – who is also a landlord – is in the unpleasant position of having to charge his tenants more for the same thing.

Which is unpleasant, of course, because the tenants perceive this as an increase in the cost of their rent when in fact it is merely an increase in the cost of inflation – which everyone is paying, including my landlord friend.

His choice is to accept less in rent – via worth less dollars – or adjust the rent to reflect the diminishing value of those dollars. In other words, his choice is to lose money via the diminished value of the dollars he receives in rent. Or compensate for it by increasing the amount – in dollars – he charges, to make up for what he would otherwise lose.

My landlord friend is a nice guy but he cannot afford to stay in business by losing money – and his tenants should understand that if he were to go out of business as a landlord, they would no longer have a place to stay, either.

The landlord isn’t earning any more value/purchasing power via the increased rental payments. He is merely treading water. It’s true he is collecting more dollars – but these have the same purchasing power as the sum as the fewer dollars he was collecting in rent before.

The tenants aren’t paying more in actual rent, either – but they are having to earn more money (or spend less on other things) to be able to continue paying the landlord the equivalent in value of what they were paying previously. This is rougher on them, of course – unless they can figure a way to increase their income to compensate for the loss in value of their current income.

Naturally, the tenants get mad – at the wrong party.

My landlord friend lacks the power to inflate the currency and thereby decrease the purchasing power of the currency. He is not victimizing them. Indeed, he is a victim, too.

No less afflicted by inflation than his tenants in that everything he needs to buy with currency now takes more currency and – like them – he must either find a way to earn more currency or spend less of the currency he has on the things he needs.

Both – all of us – ought to focus on the source of these troubles, which is the fiat money system and those who are able to manipulate it to their advantage.

Fiat money is essentially whim money. It can be anything those with the power to force us to use it as currency say it is, according to their fiat. Pieces of paper. Digits created on a computer screen, at the touch of a keystroke. Since it can be created at whim, its quantity – and thus, its value – can also be altered at whim. In such a way as to benefit those who have the power to alter it.

It is not like hard money – gold and silver – which cannot be whimmed into existence and for that reason is much harder to manipulate the value thereof.

Gold and silver are also of intrinsic value – meaning, they are valuable in themselves. Unlike a piece of paper, which is of little value in itself. Gold and silver are also real – and rare. The latter being part of the source of their intrinsic value. Neither can be inflated – so long as no one is capable of hey, presto’ing! into existence new silver and gold. It is therefore a stable form of money. The value does increase – and decrease – but its range of value can never be as extreme (especially to the left side of the spectrum; i.e., the worthless end of the spectrum) as that of fiat currency.

But people who want to be in a position to extract value from people like fiat currency – because they can take away value (and pocket it) without resorting to the obvious method of physically taking currency, as via a tax. You keep every piece of paper you’ve got. Those pieces of paper are simply gradually – sometimes, suddenly – of less or even no value.

It’s as ingenious as it is vicious – because it turns the understandable anger of people such as my landlord’s tenants upon him rather than the people who put him in the position of having to raise his rent, so as to be able to continue being able to offer rentals. Instead of seeing him as their benefactor he is transformed into their enemy. They resent him – and he is placed in the ugly position of seeming to them to deserve it.

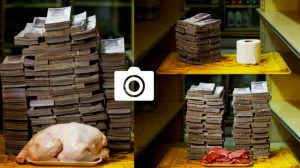

All of us ought to ask why we’re paying more for the same things. Why we have more dollars – but less wealth.

It’s not because the rent went up. Or because the supermarket is charging $12 for a couple of pork chops that cost $6 just ten months ago. The pork chops are the same – and so is the rent.

But we all have less purchasing power – because of the unseen theft of value that is inflation.

. . .

Got a question about cars, bikes, Libertarian politics – or anything else? Click on the “ask Eric” link and send ’em in! Or email me at [email protected] if the @!** “ask Eric” button doesn’t work!

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at [email protected] and I will send you a copy directly!

One of the ways I try to beat inflation, at least in the short term, is whenever I need to purchase a durable, or semi-durable good, I buy two or three. I do this with car parts I know I will need again in 6-8 years. Clothes, too. Shoes, especially. If I really like the fit and feel of a pair of shoes, I go back and buy a couple pair again. Do it for anything that can be stored. It saves some cash. I saved 18% on spark plugs for my car by buying two sets, that sort of thing.

don’t let inflation get you down. Been going on since someone invented money. Enjoy the collapse; we have a front row seat.

The Vampire Squid are at it again. It don’t get no better. lol

BlackRock back in 1999 had a share price of 18 USD or so. BlackRock is at 923 USD per share nowadays.

First your money, then your clothes. Flip flop, it never stops.

You ain’t seen nothin yet. Back in the late 70s, a few years after Nixon closed the Gold window, unemployment AND interest rates were above 20%, and inflation was not far behind. So your money was worth nothing, no one was working, and you couldn’t borrow any money either. At one time the Prime Rate was 25%. So yes indeed it can get worse, much worse, and probably will.

It already is worse, ’cause life was still great in the 70’s and we were much more free. The numbers may not yet look as bad today…but our liberty, our culture, and trhe sanity of the majority are long gone, and the simple niceties of everyday life are long gone, and those things, whether you were rich or poor, made life as whole different ballgame.

I was speaking from an economic perspective. Although your notion that life was “great” is a bit misleading. Yes, we had more freedom, and yes we still had a somewhat viable culture, but if you were trying to support a household with no money, no job, and no ability to borrow, not so great at all.

I dunno, John- Back then, you could still support a house and a family on a single blue-collar income, with no involvement of ‘government help’- even in the NYC area……

Thing is, then that ability was available to most- just not taken advantage of by many because then, as now, most people tend to live beyond their means, and on debt, etc. But today, how many have that ability? Virtually no one, though interest rates are near 10x lower today. Numbers mean little, unless put in full context (Inflation, disproportionate cost of housing, taxes; quality of life….)

The house my uncle raised 4 kids in, with a stay-at-hom wife, 2 cars, and a horse for his daughter, on Long Island- all on a simple 9-5 blue-collar salary, is todasy occupied by a professional couple, who both work, have one kid…no horse, nor adjoining property with barn….and certainly not the home life my uncle’s fambly had, because the house is empty most of the day, and basically just a place to regroup and sleep- as opposed to the place wheresomething good was always cooking in the kitchen, and where the kids played in the yard or in the neighborhood (as opposed to some remote place in the company of strangers), and my cousins ate a big home-cooked meal around the dinner table every night……

Maybe that 20% interest was a blessing, as it caused people to concentrate more on what they had, and on what they actually did in the present, rather than living for the future and trying to buy quality of life as opposed to making it.

‘My landlord friend lacks the power to inflate the currency and thereby decrease the purchasing power of the currency.’ — eric

But a Federal Reserve bureaucrat — one Jerome Powell — DOES have that power.

And in a perfect reflection of the Biden Thing’s unerring instinct for selecting mediocre lackeys, ‘Powell’ has just been renominated. That’s his reward for driving inflation up to 6.2%, when the goal was 2.0%.

Close enough for govtard work.

As Adam Smith ruefully observed at the bottom of this thread, ‘The people [sic] running the so-called “federal reserve” are our misfortune.’

In a just world, the board of the Federal Reserve would be lined up in front of a firing squad, summarily dispatched, and bulldozed into a unmarked mass grave.

FJB.

Amen, Jim –

There’s a 1900 proof element of cruelty behind this, as well. One thing to want to get rich;another thing to use power to make others poor so you can get rich…

They aren’t just psychopaths, they are also sadists that truly enjoy destroying others and stealing their wealth.

Where is Dexter when you need him…?

Eric-“The value does increase – and decrease”. Actually it nearly always increases. The more products made, with the Gold and Silver being limited by existence, gravity and friction, the less it takes to buy that product. They might on the rare occasion outpace production in their supply. RARELY. The really interesting thing about Gold and Silver is that interest becomes unnecessary. The money you save automatically increases in value. The money you borrow will be paid back with coin that will buy more than what the borrowed money will when borrowed. You borrow a dollar, and spend it on a “thing”. A year later when you pay it back that dollar will buy more “things”. Of course the bank cartel is not too keen on that idea, so they got together in secret on that island and created a means of escape from it. The government that is always “looking out for you” went along with it.

Inflation is the PURPOSE of fiat currency. There is no other reason to use it. Nothing more nor less than a regressive tax imposed on those least able to afford it, with the revenue going to the 1%, since they’re first in line to get the newly made money and spend it BEFORE it depreciates.

absolutely. Fiat is needed #1 to conduct wars at seemingly no cost to the populace.

When there is no war, the rich benefit by being able to afford price increases, while their up & coming competition can’t.

Just like progressive tax structure, fiat is an anti-competitive measure to keep the entrenched, entrenched.

Fiat currency always fails. ALWAYS!! In fact the fiat dollar has had an unusually long run. Per one of our American Prophets, I forget which, “The American economy thrives IN SPITE of government, not because of it”.

Fiat currency does not, in fact, fail to do what it is designed to do; namely, transfer the wealth of an entire people, or nation, to the privileged few. In that respect, fiat currency always succeeds.

In a sense, all money eventually fails, because money is a mere representation of wealth for convenience sake. People are easily fooled into believing that money has intrinsic value, through repetitive use and through further disconnecting of wealth from money through the use of paper currency.

Wealth is the raw material from which useful things are created. Money is a fictional concept used to facilitate transfer of wealth, that is all money ever has been. Money is not a real “thing”, it has utility only in its use as a form of accounting. Somewhere along the way, the average person, and many of the elite, forget that money is a mere representation of wealth, not wealth itself.

Without people willing to make food, cut timber, and do all the millions of chores needed to sustain a modern industrial civilization, all the money in the world won’t make a lick of difference. One cannot eat gold or silver. The real sinister destruction of wealth comes not only in the form of price inflation, but also in the steady destruction of the work ethic. Work for its own sake becomes a farce, as more wealth accumulates in the hands of bankers, politicians, and their favored friends.

The fact that we, all of us, have allowed this systemic theft to continue for over a century is all the proof we need of our degraded sense of liberty. We truly are slaves; the genius of the American system is in never allowing the slaves to realize it.

I have a feeling that the current round of inflation is designed to put the squeeze on small players. The big change in this round of housing bubble is large companies and REITs buying up property, even large numbers of single family homes in a metro area. They are turning them into rentals, with common management offices. This allows for scale, reduced overall cost and greater efficiency. All good, but also makes it harder for new entrants and smaller entrepreneurs to enter the market. Less competition means the big players can compete on their terms, only being slightly better (in specific, marketable ways) than their competitors. And it makes it easier to cut corners to keep prices within the acceptable range of the housing authority.

And of course the housing authority will seek guidance from the loudest company for what matters to renters.

In a decade or so people will forget how things used to be, or only think about the benefits of scale that the landlord company chooses to highlight, and it will be “Eastasia has always been at war with Oceania.”

What I call the last stage of conspiracy theory: “It has always been this way”.

I’ve read that Wall Street bankster firm Black Rock has been the major buyer of single family homes. All part of the “you’ll own nothing…” plot to crush the middle/productive class. I definitely won’t “be happy”.

‘The big change in this round of housing bubble is large companies and REITs buying up property.’ — RK

Unlike the previous 2006 housing bubble, driven by individuals using no-doc mortgages as ‘free money’ for their nothing-down speculative housing purchases, this one features individual and institutional punters working in tandem to ramp prices.

A classic NYT article article about the Austin housing bubble captures the zeitgeist:

https://www.nytimes.com/2021/11/12/magazine/real-estate-pandemic.html

When I visited over Thanksgiving, friends and relatives couldn’t stop talking about Elon coming to town — echoing the NYT’s wide-eyed scribblers.

Every bubble has a good concept and a good story behind it. Then in the cold, gray light of dawn, the misguided, exaggerated story — amplified by unlimited free financing during bubble times — is seen to have been a chimera.

In 2006, a lady in Las Vegas managed to accumulate nineteen (19) mortgage-financed condos — and ended up losing them all as prices collapsed 50 percent in 2008-9.

Your turn, Austin. The eyes of Texas are upon you. 🙂

There are in a number of metro areas in the US where whole single family subdivisions are being built from the ground up not to be sold to individual homeowners, but to be used as a rental complex. Some cases run like a regular apartment complex. Mostly in the sun belt, but I am sure it will spread to other places too.

Granted some communities will oppose such all rental subdivisions (like they do with large apartment complexes), but its likely the investors won’t ask for “permission” beforehand. They will just build it like they were going to “sell” them, and just not sell them and start renting them out as they are finished.

I know if i was building such a thing in my area, I wouldn’t tell any town officials that they were going to be rentals. I think many towns are going to find themselves in that situation where they get a rental community they didn’t know was coming. It could be built out before its discovered.

Another thing not noted often, is the lack of newly built two flat houses. It’s a path to homeownership (especially in expensive metros) if you can get a place where you can use rent from a single tenant to pay your mortgage. Most newly built duplexes are too expensive to do that way, plus they are the same size (works better with a family sized house with a smaller rental).

“whole single family subdivisions are being built from the ground up not to be sold to individual homeowners, but to be used as a rental complex”

That’s been going on for at least 30 years. Once upon a time, when I was still able to be a plumber, the largest contractor we worked for was doing exactly that thing. It’s just expanded now, beyond high housing demand areas, to those less so.

BlackRock is paying 20%-30% ABOVE asking price! Not only are they snapping up homes; they’re pricing buyers out of the market.

Eric,

While gold and silver are better than mere paper money, they’re NOT foolproof! They’re not immune from being debauched; only the method is different, not the end result.

How can gold and silver be debauched? Simply by reducing the gold and silver content in the coins, which achieves the same thing; the money is worth less than it was. Rather than print up more paper money, they just reduce the gold and silver in the coins; that means you need more coins to buy the same thing as you did before with the “pure” coins.

History teaches us that this can be done. Ancient Rome did it. They found themselves in the position of having to pay for all their foreign adventurism and largesse. Sound familiar? So, they reduced the metal content in their coins; they cut the copper content of their money, the As, in half, thus doubling the Roman money supply overnight. SO! If we were to use gold and silver, per the COTUS, the same could be done with our coins-even though they’re supposedly “honest money”…

It’s not that one form of money is more honest than another; it’s whether those administering the money supply are honest-or not. Even if we had gold and silver for our money today, the same thing would be happening, because we’d still have the same cretins in charge.

But with the metal content trick people notice. Then they hoard the older coins. The older coins are not traded at face value. If you want say a 1960 quarter you can expect to pay in excess of $4 for it.

When I was still of single digit age I learned what coins were 90% silver. I have looked for them in the change I get ever since. How many have I gotten that way? Zero. Exactly zero in decades. I still get 1965 coins in change. In the 1980s I got them frequently. Never a 1964 or before. Why? People pulled them out of circulation years prior.

The only real money I get in change are pre 1982 pennies. They aren’t worth enough for most people to hoard. At times of high copper prices they are worth two cents. Yeah, it’s double, but only oddballs like me bother to separate them. And of course nickles, which still have their traditional composition. But I never got a 40% silver war nickle in change either.

The “cheapest” currency is used for circulation. Anything more valuable is hoarded.

I occasionally find pre 1965 nickels in my change; I got one the other day. I’ve never gotten anything else though.

That’s because, unlike dimes, quarters, etc., look a lot different than a pre 1965 nickel; they’re easily spotted via the strip of copper in the middle. With a nickel, you have to look at it up close, sometimes under a mangifying glass, to verify the date. That wasn’t what I had in mind though.

What I had in mind was, say a 50% reduction in precious metal content; what I had in mind would be in line with what Ancient Rome did when they cut the copper content of the As in half. It still had copper, but only half of what it had before. Ergo, I submit to you that, if a similar trick were pulled with gold and silver coins, that it wouldn’t be so easy to discern.

In any case, precious metals aren’t foolproof; like their paper counterparts, they can be debauched and debased. Only the method of doing so has changed. For once, let’s-gasp-LEARN from history!

You’ll find old nickels up to a point because the design hasn’t changed since the Buffalo head was retired and neither has the composition.

It was easily detected in ancient times. People hoarded the older coins. I’ve read that from many sources. It would be easily detected now if govt violated the law and made a change without telling people.

Often the difference between a full copper 1982 penny and a zinc copper coated 1982 penny is obvious. Other times less so. There’s probably an easy way to do it, but I can make a reasonable guess by eye and feel alone. That said I still put all 1982 pennies in a container all their own.

I looked it up, as expected, the difference is simple weight:

https://www.thesprucecrafts.com/penny-solid-copper-or-plated-768853

Addendum there are ways to make a fake gold coins. It is done. but the process is going to be too expensive for circulating coins. Also once detected good night nurse for the govt that did it. Good for making fake collectables or gold bars but production coins for official circulation not so much.

Oh, and was it good night for our Federal gov’t when they debased our coins in 1965? Was it good night when they took us off the gold standard in 1971?

Of course it was easily detected in ancient times, because the edges were reduced. Even so, precious metals aren’t foolproof. The Ancient Romans showed how to do it, so a gov’t could do the same today. Gold and silver aren’t any more honest than paper money; they too can be debauched. All that changes is HOW…

A stack of gold coins is the same weight of gold after the govt changes the weight gold to their currency unit.

A stack of fiat paper money changes its value as govt changes the value of the newly printed money.

Gold and silver is clearly more honest because it is a form that govt can’t change unless it first takes it from you or you voluntarily turn it in to them.

There is nothing that is foolproof, except death, but exactly how would the Psychopaths In Charge inflate gold and silver coin to the 2500% or so level they have the fiat dollar since the Federal Reserve Act? You know, back when an ounce of silver was worth a dollar, and now its worth $25?

Uh, they’d do what the Ancient Romans did; they’d reduce the metal content. If they reduced the metal content by half, they instantly double the money supply. In terms of end results, how is that any different from printing money? At the end of the day, don’t you have more dollars chasing the same goods and services?

And the 2500% is achieved exactly how? My point being shaving or diluting MIGHT get you one or two hundred percent. Paper is unlimited.

Hi, Brent. I personally save all pennies and nickels, I believe I will see hyperinflation before I die (and I’m surprised and nonplused that it hasn’t already happened because it will be an even bigger wreck because of the manipulations that have delayed it).

My reasoning is that even debased copper washed zinc pennies are worth more than face value (around 1.3 cents depending on markets), and cupro-nickel nickels are worth a substantial portion of face value. It is a very cheap speculation and a very painless savings plan. Plus plastic quart jars of pennies and nickels lining shelves are a very cool thing to look at!

Some years ago nickels were 7-9 cents melt value. I haven’t spent a nickel since.

Don’t forget about the 40% silver halves, issued from 1965 to 1969.

Yes, indeed. Since I have been a coin collector since my youth, I have always daydreamed, “Hey, what I wouldn’t give to have been around in 1964, to hoard up all that silver!” Well, guess what: It *IS* 1964 as far as regular nickels are concerned. (Without checking) I’d say the melt value of a nickel is pushing past 4 cents. Once it gets reversed, the metallic composition of the 5cent piece will become debased, such that its melt value becomes way below 5 cents. There was a while that I was getting nickel rolls from banks… I have about 3 coffee cans full of nickels for my coin collection. I’ve heard some posts on bulletin board of people hoarding nickels by the 55-gal barrel. I have *seen* posts of 55-gal barrels full of pennies, just waiting for the law to be rescinded that makes meltdown of coinage illegal in the US. It is also unlawful to export the coins for meltdown too, so GOVCO knows full well about debasing currency!

Such as is the case with the penny, which is copper plated zinc. (Hey, maybe swallow one as a vitamin!) As such, when the Mint rolls in raw material, labor wages and bennies, capital equipment, and distribution costs, the cost to produce and distribute todays penny is north of 1.3 cents! Hence the calls to get rid of them.

I’ve occasionally drilled a hole in a penny or a nickel to make a washer, which costs 10-20 cents or so at the store. Especially if I needed one urgently and was not AT the store.

Just FYI, I know you are being glib, but do NOT swallow a zinc penny. The electrolytic reaction is dangerous and can cause ulceration. Kids used to be safe if they swallowed a copper penny- you just had to wait for it to pass through and become filthy lucre… Now it can be a life threatening event.

You don’t have to melt the coins they will trade per their metal value as they are. “junk silver” has done so for decades. Sacks of war nickels, dimes, quarters, etc.

Stack 25 dollars in quarters, 100 quarters. The price of silver is 22.64 USD today, but it has been more. For ease of ciphering, 100 nickelcuprosteel quarters buys you one troy ounce of silver.

Since six 90 percent silver quarters will be approximately one troy ounce, the value of clad quarters will be 1/16th of a US minted silver quarter dollar coin.

16 times more copper clad quarters, 96 of them, will be required to equal one troy ounce of silver. Plenty of room for chicanery in finance and banking.

Six 90 percent silver US minted quarter dollar coins equals 96 clad quarters today. In the words of the Mogambo Guru, it’s not the same.

The same for pennies, any penny 1981 and older will be 95 percent copper. Copper is over four dollars per pound, 151 copper US minted pennies equals one pound. Pennies are worth three cents each and probably more.

Gold at 1800 dollars translates to 180,000 pennies to buy a troy ounce of gold.

In 1920, 2000 pennies equaled one double-eagle, a twenty dollar gold piece. 90 times more.

What you call hyperinflation.

“Simply by reducing the gold and silver content in the coins” At which time it becomes fiat money with some Gold or Silver in it.

THAT was my point! The Ancient Romans did something similar; they reduced the copper content of the As. Copper was a precious metal in Roman times. If it was done once, why can’t it be done again? After all, as the preacher says in Ecclesiastes, there is NO new thing under the sun…

Right you are. That is why any reputable mint’s coins should be able to be used as money.

an ounce of gold is an ounce of gold.

That would keep the govt mint honest.

Inflation is so evil, combined with capital gains taxes. The official inflation rate is around 2% long term, while true rate is closer to 5%. Let’s split the difference and call it 3.5% average, long term price inflation.

Let’s say you put away $10,000 for retirement when you’re 30 years old. At 65, 35 years later, it has lost 71% of its purchasing power, so now it’s worth $2,873. The government took 71% from you.

Ok, ok, nobody puts their money in a mattress, so let’s say you found an investment that doubled inflation, returning 7% over 35 years. Your $10,000 has grown to $100,000. So, when you cash it in, you owe long term capital gains on it, leaving you with $80,000. Discount this by the inflation factor and you now have $22,990 purchasing power. Great! Your investment doubled in real value over 35 years. You took all the risk, though, as doubling inflation reliably is difficult, and for your effort, and risk, you got $12k in “real dollars”. The government got far more than that. Now, when you spend this money, you pay property taxes, sales taxes, all that kind of stuff.

I wonder if anyone has ever done the math trying to compute all-in, lifetime taxation for a person in the US. I’m suspecting that the vast majority of all wealth you ever generate goes to the government.

Most people are lazy and stupid (really all people, we just break out on occasions) and most believe that their investments will compound and they will retire rich. It is easy and tantalizing to believe this- but it simply isn’t true. The majority simply cannot beat the house.

Many people have done the math on tax and you are correct. 7/8 of everything is tax. The good lord demands a tithe- 10 percent. Government puts itself above God. Moderns who believe themselves more prosperous than their great grandparents are usually looking at the wrong measurements.

We just increased the wholesale prices of our products by about 12% to 15% because of price increases over the past 3 years (when we set the previous prices.)

We haven’t increased our retail prices yet, but that may happen in the next 12 months, too.

We are a small manufacturer of tube audio amplifiers for home stereo enthusiasts. Our USA made products are comparable in audio quality to others selling for 3 to 5 times the prices, and we want to keep the retail prices in that ‘value’ niche.

“No State shall enter into any Treaty, Alliance, or Confederation; grant Letters of Marque and Reprisal; coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts; pass any Bill of Attainder, ex post facto Law, or Law impairing the Obligation of Contracts, or grant any Title of Nobility.” US Constitution Article 1 Section 10

The most egregious excesses of the various governments are all rooted in and enabled by the willful ignoring of this fundamental law. The USA has not been a free country in over 200 years. I have always contended that all “licenses” including the “driver’s license” are in fact illegal Titles of Nobility. The tyrannically useful, nay vital, issue of fiat currency has enabled a world wide company town with absolute control over the lives of God’s children.

Look up the “missing thirteenth amendment”. This amendment was changed illegally into a civil-rights” amendment.

The original thirteenth amendment prohibited anyone with a “title of nobility” from serving in any government position such as lawyers, etc.

Look it up…

That applies to states,,, not the federale’s. In the time the constitution was ratified most states had their own money systems as they were sovereign. The coup that imposed the Constitution and tossed the Aritcles of Confederation also tossed the States sovereignty.

That applies to states, which means the State cannot legally collect taxes, nor pay its debts with other than Gold and Silver.

Ken, the Federal republic is supposed to be a creature of the several states. The federal republic was implicitly and explicitly understood to be a voluntary union up until the abuses of the yankee bankers in the northeast compelled the southern states to try to declare independence and withdraw from a tyrannical and despotic regime. The good guys lost. World history is replete with the good guys losing- it has never made them wrong, and we can always try again.

But to the point, “No STATE shall… coin Money; emit Bills of Credit; make any Thing but gold and silver Coin a Tender in Payment of Debts” implies many things.

If gold and silver coin is the only legal form of tender, and the states cannot coin money, what then does the federal republic have to do, logically, to provide circulating legal tender?

Good morning Eric,

“All of us ought to ask why we’re paying more for the same things. Why we have more dollars – but less wealth.”

I would guess that most of your readers understand this dynamic pretty well.

Unfortunately, most Americans are too busy, misinformed and in some cases too stupid to understand the nature of coin and credit. Too many think rising prices are a sign of progress and that it’s natural that things cost more in the future. They truly don’t understand fiat currency and how toxic it is to society. It’s also unfortunate that someone like your landlord friend may anger his renters by “raising” the rent, when he is really doing no such thing. As you say, their method of theft is ingenious. Too bad it’s evil.

The people running the so called “federal reserve” are our misfortune.

☮