When a person begins losing a lot of weight – and it’s not because they’ve been dieting – it’s what they call a clue in law enforcement that something might be wrong with that person.

Here are two such:

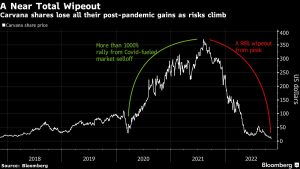

The first is Carvana – the used car chain with the glitzy towers of used cars, that sent flatbeds out to pick them up and drop them off at buyers’ houses that was supposed to wipe chains like Carmax off the map – is plunging toward the deck like Air France flight 447 back in ’09. The chain’s stock is nearly worthless. Bankruptcy appears imminent.

The second is Carmax – which appears to be coming along for the ride.

The numbers for the third quarter that ended in November are as alarming – for Carmax – as the diminishing range indicator in the gauge cluster of an EV on a cold day when you are far from home. Profits have plummeted by 86 percent, which the company attributes to “affordability challenges” and a “deteriorating used car market.”

The two are, of course, inextricably – fatally – related.

There is an “affordability challenge” because the used cars Carmax (and Carvana) are trying to sell were most of them bought at artificially high prices, which were rendered so in part by an artificially induced scarcity of new cars induced by the force-closing of new car assembly lines (and microprocessor, or “chip” production lines) during the manufactured “pandemic. Which left people who wanted new cars looking for used cars, because such were the only available cars.

This temporarily upticked demand for used cars and – there being a limited supply of them to compound the perverse incentives – the market value of used cars rose to an equivalence with the new cars that weren’t available.

People who owned a vehicle were being offered tempting sums to sell them to dealers – and outfits such as Carvana and Carmax – to be re-sold by these dealers and chain sellers for even more money. For awhile, there was a lot of money to be made this way.

And then the music stopped.

It stopped, in part, because the new car assembly lines resumed assembling cars and so there was an increase in the supply of new cars. This, in turn, lowered the artificially high market value of used cars generally but also specifically those held in inventory by used car retailers such as Carvana and Carmax, who bought high – and now find themselves in the position of being obliged to sell low.

Bad enough. Worse – for them – is that interest rates are higher now, on both new and used car loans. Which makes it harder for people to finance the purchase of any car.

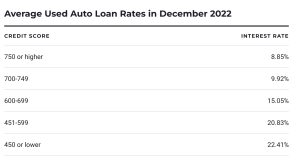

But interest rates are much higher on used car loans.

According to a recent article published by U.S. News, the cost of money (which is what interest amounts to) for a used car loan is now almost 9 percent – if you have an “excellent” credit score of 750 or higher. This is about twice the cost of money on a new car loan – which can and often does make it more costly to buy the used rather than the new car. It will, for sure, if you haven’t got “excellent” credit – in which case you might be looking at interest rates as high as 15-20-plus percent on an “investment” that is depreciating in value even more rapidly than usual precisely because of the unblocking of supply chain holdups that had temporarily limited the available supply of new cars.

Which has popped the “value balloon” of used cars.

Why pay $400/month for a used car when you could finance a new car for the same or even less?

Hence the “deteriorating used car market.”

The good news for used car buyers who don’t need to spend money on money is that the “affordability crisis” in the used car market is going to make used cars much more affordable. It will soon be as it was, prior to the “pandemic.”

That is to say, it will be a buyer’s market – for those who have the cash.

There will be fire-sales of inventory when Carvana and Carmax go the way of Blockbuster Video. And these fire sales of inventory ought to further depress the used car market, generally. People who want to sell their used car – or trade it in – will find they are no longer in the catbird seat. They will have to accept whatever the market will bear. And that will continue be less for at least as long as interest rates – the cost of money – continue to increase, which seems likely to continue for some time to come. It is a a problem compounded by the decrease in the buying power of money, itself – what is styled “inflation” but which is in fact an increase in the supply of money, which causes a dilution of the value of the money already in existence.

But, for those who have money – even if devalued – and do not need to spend money on money (i.e., interest) it is time to sit down in the catbird seat.

There will be deals to be had – for those who can still pay.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at [email protected] and I will send you a copy directly!

RIP Blockbuster Video

Hi Michael,

Yeah – I miss Blockbuster sometimes, too. Growing up, it was a kind of adventure to go to the video store to get a movie. VHS. It’s been a long time, eh?

‘And then the music stopped.’ — eric

Prescient: ‘The US trade balance stunned onlookers this morning as the goods trade deficit narrowed in November to its smallest in two years after imports collapsed. The $83.3 billion deficit was massively “better” than the $96.3 billion gap expected.’

‘The shrinkage in the deficit was driven a 7.6% plunge in imports $252.2 billion, the lowest in more than a year.’ — ZH

You might think that a lower trade deficit is more sustainable. And you’d be right.

But when it’s lower because of a collapse in imports, rather a surge in exports, it means the eclownomy is gurgling down the drain into recession.

It’s not yet time for the tough to go shopping. But that blessed day — ‘Black Friday in July,’ we might project — surely is approaching, comrades.

The Fed prints up trillions, and we have economic chaos. Who would have thought. I have too much in dollars, which will steadily decline in value, and have thought about buying a nice used car, blocking it up and tarping it. But with the current crop of Psychopaths In Charge It’s not out of the realm of possibility, even likely, that by the time I need to put it in service it would be illegal.

Quit psyching yourself out. “Oh no they might do something!” If they do find a way around it to make it legal. LIVE LIFE

Wolf Richter writes about the shambles of the auto industry also, he is a wall street numbers guy and has been mocking Tesla’s inflated stock price for years. His latest on Tesla is very funny:

Tesla Joins my Imploded Stocks, -70% from Peak: Object of Religious Veneration Turns into Automaker

“The stock still has a PE ratio of 38, which is ridiculously high for a profitable automaker, but ridiculously low for an object of religious veneration, which Tesla used to be. It used to be run by Elon Musk, who used to walk on water. But walking on water turned out to be boring, and Elon is having too much fun goofing off over at Twitter for all to see, and he’s too busy tweeting goofy stuff and annoying people, including Tesla’s current or potential customers and shareholders.

So now, as people are coming out of consensual hallucination, they realize that Tesla is just an automaker, with lots of competition in the EV space, and that Musk no longer walks on water. They see that Tesla now has to do stuff that other automakers had to do for decades, like plastering big incentives on its vehicles to get them moving before year-end, talking about hiring freezes and lay-offs, and even, in a desperate move, touting possible share buybacks to try to boost its stock price. But the stock kept sinking.”

—————-

And this is right inline with today’s topic, rising rates are putting the big squeeze on the excesses:

https://wolfstreet.com/2022/12/25/the-price-of-easy-money-now-coming-due/

The era of money-printing and interest-rate repression in the United States, which started in 2008, gave rise to all kinds of stuff, and the easy money kept going and kept going, and all this money needed to find a place to go, and then money-printing went hog-wild in 2020 and 2021. And the stuff it gave rise to just got bigger and bigger, and crazier and crazier. And much of this stuff is now in the process of coming apart, I mean falling apart, or getting taken apart in a controlled manner, and some stuff has already imploded in a messy way.”

—————

So I know it sounds “extreme” but I do believe Tesla could go bankrupt, what was in favor becomes out of favor. The Left virtue signallers gobbled up Elron’s electric cars because it was inline with his agenda, but then he went over to Twitter and gutted the left wing censors. So now Elron has fallen from grace, Elron Muskrat is now a heretic, he broke the left’s monopoly on internet censorship. So that could mean, that those people who loved Tesla now hate Tesla and want to burn the heretic at the stake.

And you have all the other auto makers, with better engineers and more experienced workers, cranking out their own EeeVees. Thus Tesla stock may decline toward zero, as it loses profits, in fact it may follow Nikola all the way down to one dollar a share.

Hope I can use this opportunity to replace my well running but badly rusted ‘01 Corolla with another one about ten years newer. Hopefully will be the last car I ever buy, i.e. outlast me 😆.

Used-Car Prices Collapse The Most Since Lehman Meltdown

With soaring borrowing costs, the Federal Reserve has slammed the brakes on the once-booming used car market. The latest data on wholesale used-vehicle prices show October’s decline on a year-over-year basis was the worst since the financial crisis over a decade ago.

The Manheim Used Vehicle Value Index for October declined to 200, or about 10.6%, the worst decline since December 2008 when the global economy was melting down (and the 5th largest decline ever)…

The bad news about sliding wholesale used-vehicle prices is when they crush the retail market, there will be so many new buyers underwater in their vehicle loans.

And the used car bubble could cascade into the structured product segment of the financial market as big banks hold a lot of consumer debt.

Meanwhile, shares of Carvana crashed 24% Monday after the company missed Wall Street’s top- and bottom-line expectations for the third quarter as the demand for used cars plummeted.

Last month, the largest US chain of car dealerships, AutoNation, whose CEO, Mike Manley, warned the used car market showed signs of imploding.

Separately, Hertz Global Holdings reported its third-quarter earnings that showed depreciation costs were rising due to its used car prices at auction fetching lower values.

https://www.zerohedge.com/markets/manheim-used-car-prices-crash-most-lehman-meltdown

A Flood Of Repossessed Vehicles Poised To Hit The Used-Car Market

best job right now…..repo man…they can’t find enough of them…

Short supply combined with literally 0% rates caused many people to start buying any car that could “fit into their budget”. Why responsibly buy a 30k car, when you can finance a sick 100k truck at 84 months with 0% rate? I mean it’s free money after all. (this is a 7 year loan btw).

The key issue that caused this is how Auto Loans are issued. Currently, Americans owe more than $1.2 Trillion on auto loans (the highest in US history and a 75% increase from 2009). Given the fact that more than 85% of cars are financed, we are looking at a massive problem.

This was possible because dealerships successfully lobbied to have less oversight – meaning that there is no federal oversight with auto loans unlike Mortgages, student loans, and credit cards. Reduced oversight allowed them to lend money without proper background checks.

An investigation in late 2021 found that up to 50% of the loans were given to customers who might not be able to afford them. The income and employment verification only happened 4 percent of the time. All of this means that more and more customers are starting to default.

Doug DeMuro……….dropping prices seem to especially be affecting “gas guzzlers” like big SUVs (Land Cruisers, modded Jeeps, etc). No real surprise given gas prices, but worth a mention: your 100-Series probably isn’t worth what it was in August 2021.

Same with real estate. People still listing for what they could have expected 6 months ago and properties are just sitting without offers for weeks where they would have bought in 24 hours sight unseen last year.

https://www.zerohedge.com/personal-finance/flood-repossessed-vehicles-poised-hit-used-car-market

An investigation in late 2021 found that up to 50% of the loans were given to customers who might not be able to afford them. The income and employment verification only happened 4 percent of the time.

when I sold cars in the 1990’s 25% of my deals were refused because of bad credit….they actually verified income, etc., ….

then from about 2011 to 2022 (I was no longer selling cars…should have been), they would finance anybody…the same with real estate…lots of liar loans, faked income numbers…lots of fraud…mortgages based on bs and lies….

Why responsibly buy a 30k car, when you can finance a sick 100k truck at 84 months with 0% rate? I mean it’s free money after all.

with a 0% interest loan and real inflation of maybe 17% that is a negative rate of -17%…like being paid to borrow….

or with real inflation rate of maybe 17% and getting 3% in a savings account that is a negative rate of -14%

10% down from ATH isn’t much, even if it’s the most since “Lehman.”

I think all car prices are ridiculous, and who has the cash to buy a typical $30,000 and up vehicle, they do not, they are able to get credit. And these F-150 prices are looney tunes. The cost of steel, rubber, labor is basically a flat line, so why are prices so damn high? Cheap credit. Zero interest rates. And a giddy public high on inflated real estate and stock market values.

But that could all change and here is the evidence. The Fed increased M1 by a huge amount:

https://fred.stlouisfed.org/series/M1SL

The curve doubled it’s slope in 2008, then shot straight up in 2020 and the result was what the money printers wanted, inflation. This inflation is now lit, it is like a bat out of hell, and now the Fed says it must fight inflation by raising rates.

Well raising rates after a period of ZIRP ought to be a bubble buster of historic proportions.

https://cms.qz.com/wp-content/uploads/2015/12/us_fed_funds_rate__fed_funds_rate_chartbuilder-1.gif?w=450&h=274&crop=1&strip=all&quality=75

https://fred.stlouisfed.org/series/DAUPSA

Notice how the definition of M1 was changed in May 2020? These guys…

Yes, they constantly change how they add things up to get the answer they want, a good example is the inflation rate, which constantly changes to make it appear to look lower. If the official CPI is lower then all those getting COLA increases is lower. And when that won’t cut the bleeding they scream Covid and vaxx you to death, or put you on a one way trip to nirvana on a ventilator, lol.

the truth is that the way the inflation rate is calculated has been changed more than two dozen times since 1980.

if inflation was still calculated the way that it was back in 1980, the official rate of inflation would have been 15 percent in 2021

https://thewashingtonstandard.com/is-the-real-rate-of-inflation-more-than-twice-as-high-as-the-number-we-were-just-given/

Based on Third-Quarter 2022 CPI-W inflation, the 2022 Social Security Cost of Living Adjustment (COLA) headline increase is 8.7% for payments beginning January 2023;

per the ShadowStats alternate estimate, it would have been 17.0%, had the CPI-W calculations not been redefined following the CPI Inflation and COLA spikes of 1980/ 1981.

Based on Third-Quarter 2022 CPI-W inflation

http://www.shadowstats.com

per the ShadowStats alternate estimate, it would have been 17.0%, …..robbing old people….

The half ton truck has been an expression of manhood since the Dodge Ram redesign in the 90s. The prices of the F150 reflect that.

Roscoe,

I would say more a replacement for manhood, or a facade of manhood. But otherwise you are right. Once upon a time, trucks were CHEAPER than cars. Then came the urban cowboy goat ropers, who never carry a load in their truck.

It’s performative manhood, which is a symptom of living in a gynocentric society.

It’s time for the used car industry to return to the more sustainable small business model. CarMax and Carvana (and big new car dealer groups for that matter) just have too much expensive (and unnecessary) overhead. It drives prices too high (and that “no haggle” pricing nonsense).

Granted some of those local small time used car lots can be shady as h***. However they are far easy to run out of business than a large single shady monopoly operator. Though these days the shady business practices are more in the financial end of it rather than a dealer unloading a turkey on somebody that should know better.

But to be honest overall (not just the used car biz), for the average consumer, buying from small businesses rather than big or international 500 firms are generally going to be better in the long run. The few advantages that global trade have given average people have come at a cost that is far greater than we often think.

I’m not usually a reader of scandal sheets like The Daily Mail, but I came across a link and clicked. Other stories along the side included a Paris Hilton cheesecake Christmas shot, and I clicked, cause what the heck, ’tis the season. The woman is 41 years old and still never did a thing other than be a celebrity, but that’s not the point. The point is, are some people stuck in a time loop from the 1990s? I don’t understand how it is possible for Ms Hilton to be relevant at this point.

Carvana is much like Paris, in that I don’t get it, and I never got it. Sure, looks interesting on the surface but no practical value at all. And it isn’t like there aren’t plenty of pretty girls or car dealers around. But stock brokers continue playing the 1990s dot-com bubble over and over again. Like the Daily Mail, pump up the latest unicorn or disrupter or new normal, and ignore that there’s nothing there but photoshop and hype.

It is so rare that a true game changer comes along and even more rare that anyone can see it early on.

@ RK

So true. But of course when you consider the big picture Carvana is small potatoes. There are now so many phony & useless pretend business entities floating around teetering on bankruptcy that it would even take my breath away. These artificially goosed Frankenstein monsters need to go bye bye and they would were it not for being propped up govt subsidies, cheap credit, and idiotic investors desperately seeking profits & income.

OK class, now in order to get a passing grade today you need to correctly answer the following question:

Do you think the Fed’s printing presses have really been ordered to stand down as reported?

a. Yes it has

b. Who is the FED?

c. No it hasn’t

d. Do they really have a printing press?

e. All of the above

SORRY, but you failed

The correct answer here is (f.) you’ve got to be kidding!

Can’t say I feel all that sorry for these used-car “stealerships”. When the “Rona” hit, with its artificially-induced shortages, they leveraged their way to buying up inventory, and they could reasonably do it, as the interest rates for their respective lines of credit were low and manageable. Outfits like Carvana and CarMax exacerbated the unreasonable run-up in used car prices with their ability to outbid small “mouse house” used car lots, and, of course, flippers and folks simply trying to sell their rides themselves (for reasons I won’t elaborate on, just DON’T DO IT, and don’t buy on a private sale unless you know who you’re buying from, there’s way too much risk involved these days). They were hoping to cash in, big time, on the innate demand for cars that even in the worst of times will exist, simply due to old rides being retired and wrecks. The combination of used car prices easing off and the big jump in interest rates means they’re paying a lot more to carry inventory that now they’re likely “under water” on! So what to do? Simple…wait until they go under, and a lot of inventory is dumped by the banksters that have seized the unwanted cars in a bankruptcy liquidation and are anxious to unload them for whatever they can get. You might not be able to get the ride you want directly from such an auction, as typically that’s done by wholesalers, but, the inevitable downward pressure on used car prices may just make what you want that more affordable. Who knows? You might even be able to pay CASH, which in these inflationary times will likely get you an even better deal, as a fistful of dead Presidents will give a hungry dealer options he doesn’t have with a customary financing transaction.

I took my late wife’s Kia Sportage to the dealer. Dealing with them was wonderful. Dealing with Kia finance was nightmarish.

Anyhow, the dealer gave me the payoff value for it, which is about the same as the blue book value. I was just happy to be rid of it. He said they needed inventory and maybe if they’re lucky, make $1000 and $1500 on it.

I said that didn’t seem like it was worth the effort and the dealer manager said they needed used to get people in to look at new.

If you accept the increase in the money supply definition of inflation, which I do, I don’t understand why folks think used car prices would go down that much. Maybe 10-20% of extreme bubble froth will come off. That’s because the intrinsic value of the metals, plastics, rubber, computers, steel, etc. has gone up in nominal terms. Interest rates cannot correct this adjustment in of value in dollar terms Just like real estate, I expect the market for cars, all cars really, to be basically frozen for a time only to relent in a few weeks or months into generally much higher prices (though not peak highs) across the board perpetually going forward. Of course though, cash buyers will have an advantage, as they do in almost every situation except maybe the frothiest bubble 0% financing bubble conditions. Even in such situations with say multiple bidders, a cat buyer is seen as a strong buyer for a number of reasons. Loan buyers will pay the high price and the vig or go without.

Funk Doctor Spidock:

Spot on. Inflation is the increase in the money supply (in our case federal reserve notes), which devalues those federal reserve notes. This, in turn, causes the price of goods and services to increase to account for the devaluation of those notes. This is no different than clipping gold coins. It devalues the coins, which in turn cause the sellers of goods and/or services to demand more of the clipped coins to account for their devaluation. Thus, inflation is the increase in money supply (inflated money supply). Price increases are not inflation, but rather the inevitable result of the inflation (i.e. increased money supply).

There is another aspect to discuss here though as it relates to used cars. At the same time the money supply increased, the world was “locked down” which cause two things: (a) consumers re-allocation of their spending (shifting things like travel and entertainment expenses to the purchase of goods such as cars) and (b) a reduction of the production of goods (such as cars and their component parts). These two phenomena, along with near zero interest rates, caused even more federal reserve notes to be aimed at the purchase of cars (i.e. a further increase in demand) at the same time there was a reduction of supply. The confluence of all of the factors caused prices to skyrocket. Money was devalued while demand was up and supply was down.

While the money supply does not appear to have decreased, the re-allocation of purchases seems to have reverted back to what it was pre-“lock down,” interest rates have soared, and auto production has ramped back up. Additionally, working from home seems to be a lot more accepted now than pre-2020, thereby decreasing the need for daily commutes to an office (further decreasing car demand). All of this, in turn, has caused significant downward pricing of cars.

In the short term, the price of used cars could really plummet. However, unless the money supply is decreased, I really don’t see cars going back to pre-2020 prices in the long term.

This whole notion of credit and rates vis a vis inflation is sort of funny when you think about food. Everyone pays cash for food (I think, anyway). Yet we’re seeing 10-20% real yoy moves up in prices. Why? The money’s worth less because there is so much more of it in circulation. What are rising rates gonna do to that?

For financed purchases, interest rates are very important because the buyer buys what he can afford on a monthly payment basis. The higher the interest rate, the less buying power his monthly payment will have.

The volatility of the used car market in itself is a “warning sign”. That the value of a designated product can fluctuate so wildly means the “money” isn’t working. As all fiat currency has always done, this too shall pass. The very purpose of fiat currency is inflation. There is no other reason to use it. In real money, prices go down, while quality and availability go up. Savings are rewarded, and debt is not. A direct opposite of what fiat currency produces.

With real money (gold standard) in the 1800’s there was deflation, things got cheaper, which is good….but they have demonized deflation, saying it is bad….

they are debt pigs…the government…they want inflation to erode their debts and increase the value of assets the .0001% elites own…it all benefits the elites…

We bought all of these used cars for top dollar, now nobody can afford to buy them. Damn!

Not many want to consider paying too much for an over-priced car. Going to be the last thing on their minds for a while now.

My BIL sold his like-new Ford F-150 for 2000 dollars more than he payed. Back in June, somewhere in that time frame.

A local trading website, sells just about everything, has sellers trying to find buyers for 40 grand for a used late model pick up truck. Number 1, you probably don’t need one that bad, #2, the price is too high, #3, after another 125999 miles, you’ve spent a lot of money to drive to the next gas station.

Plenty of early warnings when the bogus vaccines were distributed far and wide. Nobody wanted to pay attention, too busy being in it together.

https://www.earlywarningreport.com/“>Early Warning Report by Richard Maybury

Carmax had relatively small losses in the past two quarters

https://finance.yahoo.com/quote/KMX/financials?p=KMX

Carvana shares last traded at $4,06 and the company lost $4.18 in the trailing twelve months. The financials look like a money burning machine. Their business model does not work.

https://finance.yahoo.com/quote/CVNA/financials?p=CVNA

Earlier this year Carvana offered me too much money for a 2005 Toyota Camry with 210,000 miles, over the phone. I found out later they did that to get people to drive their used cas in for an inspection — you would never get their first offer over the phone.

I would have done that but the battery was dead, when jump started it would stall in 5 seconds, and I couldn’t find the title, so it never got to Carvana.

My wife placed an ad for the car.

An employee from a Toyota dealer showed up in one day with over $1000 cash, said he’d get the car home somehow, and it was sold by the wife in one day!

Needed a paint job = no big deal.

Big dent in the back fascia and broken taillight, by the wife = no big deal.

CD player did not work = no big deal.

Keys too worn out to open the driver’s door = no big deal.

Driver’s seat power lumbar support didn’t work = no big deal.

Front wheel bearings were noisy = no big deal.

Used cars were HOT last Spring.

I was going to give the car to charity, and then the wife sold it in one day,

and spent the money on herself, with the usual female rationale: “You were going to give the car away for nothing, so why should you get any of the cash?”

Hmmmmm. My ’07 Escape is closing in on 220K miles, and the rust is consuming it. A “fire sale” in the used market sounds pretty good to me. A ’15 to ’17 econobox would be my sweet spot, and I’m a cash buyer. [Mr. Burns voice, rubbing hands together] “Exsscellent!”

As tempting as it is to buy a new/newer auto (p/u truck) in my case, I’m taking the most prudent route and saying no. I’m reminded that Fedzilla has just authorized ANOTHER 1.7 trillion in reckless spending and that will devalue the dollar in my pocket even further. If you think the basics are expensive now, wait until a year from now! I look for many new car dealers to go under because of inventory just sitting because of higher interest rates (that will go even higher), ever increasing MSRP’s, and the fact many people will not have the income to buy. The government is hell-bent on decimating the middleclass and imposing a two-class society; overlords and peasants.

‘It is a problem compounded by the decrease in the buying power of money, itself.’ — eric

An entire cottage industry has developed on the internet. This modern-day cargo cult awaits the prophesied ‘Fed pivot,’ when Chairman Powell finally relents and sends interest rates plunging back to zero, as they were during the good old days of yore.

Saw an image yesterday of a distraught woman in her psychiatrist’s office. “This pivot — is it in the room with us now?” the shrink asks her. 🙂

With Big Gov having entered the tertiary stage of every fiat-currency Ponzi scheme, where it must print currency just to pay the interest on its own $31 trillion debt, free money may be gone forever. Very disturbing, I know.

Any short-lived pivot will happen after something breaks with an awful bang. No read to read the WSJ — everyone will be talking about it: some bank or fund or corporation or government, suddenly insolvent, and of course asking the 535 innumerate dwarves of Clowngress to bail it out.

Used cars will be the least of our problems. But when the Lügenpresse finally capitulates and cries doom in the face of hopeless crises, that will the time for the tough to go shopping.

Don’t be angry, don’t be sad

Don’t sit cryin’ over good times you’ve had

There’s a car right next to you

And it’s just waitin’ for something to do

And there’s a rose in a fisted glove

And the eagle flies with the dove

And if you can’t find the one you love, honey

Drive the one you’re with

— Stephen Stills, Love the One You’re With

It is the job of the entrepreneur to predict what the customer will want. Those who are successful are rewarded, those who are not go bankrupt.

I wonder if the actions of these used car giants helped push prices higher than they otherwise would have been across the market. If so, then part of the price drop is the return to a more normalized status.

Markets – like nature – desire equilibrium. But there are many other forces at play here, so Carmax & Carvana seem to have failed to plan for the next stage. Someone else will fill the void.