You have probably heard the mantra of the World Economic Forum (it sounds as if we’re all part of it, doesn’t it?) about how in the near future, you will own nothing and they will be very happy.

For all-too-many, that is already the reality. It has been for at least a couple of generations now, probably.

Debt rather than ownership has become a way of life. If you owe, they own you. How many are already owned?

How many Americans could refuse to obey what their employer – acting as the adjunct of the government – told them they had to do in order to remain employed? Knowing that if they weren’t employed, they would very quickly be unable to pay what they owe? As distinct from figuring out a way to live? The answer is obvious. Most of these owned people would do as they were told.

They did do it. They wore a “mask.” They rolled up their sleeve. They would probably have fetched a stick, too – if their employer had told them to.

And for the sake of what?

A new car?

That is one of the ways they have come to own so many people. The average price paid for a new car is now about $50,000 and while much of that cost can be blamed on the pushing of even more expensive EVs – which has pushed the cost of cars in general even higher – a lot of the blame is owned by the people whose lack of aversion to being owned has resulted in the cost of cars in general going up rather than down.

There ought to be a variety of new cars on the market priced around $10,000 or even less. Or – rather – there’s no good reason there ought not to be. The “car” is a very mature technology. It has been around for more than 120 years – like the incandescent light bulb, which was very inexpensive until it was forced off the market for exactly that reason.

With cars, it has been more subtle. The cost of the average new car is higher than ever in part because of compliance costs; i.e., the cost of designing a car to the specifications decreed by the federal government – which somehow acquired the power to issue such decrees. Readers of this column already know all about that. The other part, though, is the transformation of the car into the luxury car. Even the economy car – which doesn’t exist anymore.

It is absurd to speak of an “economy” car that has climate control air conditioning, a multi-speaker stereo, power windows and locks, a standard automatic transmission, cruise control, aluminum wheels and so on. Yet all new “economy” cars come standard with most or all of the foregoing equipment – which used to be optional in economy cars. Which is how they were kept . . . economical.

It is probably why you don’t hear about economy cars anymore. Instead, there are entry-level cars.

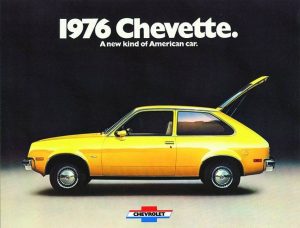

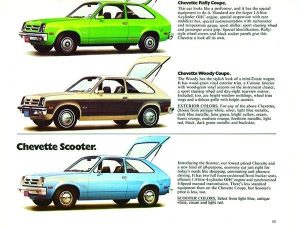

Is this generation more able to buy luxury cars? Are people richer – or poorer – today than they were in 1976, say. When it was possible to buy a new economy car for around $2,500? That was the base price of a new Chevy Chevette that year. It did not come standard with any kind of air conditioning, or power windows and locks, etc. But it was an economy car – and for that reason, it could be owned by almost anyone over the course of three years, which was the duration of the typical new car loan back then.

An economy car like the ’76 Chevette could be probably be made – today – for considerably less than $2,500 (about $13k in today’s devalued currency) because of reduced manufacturing costs and so on. But would people today want to buy a new car like the ’76 Chevette – even if they could for $10k or less, today?

Not when they can finance a $25k car that does have climate control AC, power windows and locks, cruise control, a multi-speaker stereo and an LCD touchscreen. The availability of easy debt also enables them to forget about the compliance costs they’re being forced to pay, in addition.

It’s kind of like withholding. People don’t miss what they never had. But imagine if compliance costs were line-itemed. The replacing of sturdy exposed (and chromed) metal bumpers on account of “environmental” regs that have made chrome-plating exorbitantly expensive with fragile, easily torn plastic bumper covers that are very cheap to sell at a high price – and very expensive to replace when they are torn. Back up (and now, front-up) camera systems. The cost of 4-6 air bags. The cost of replacing fuel injection with direct injection, which is only being done to comply with federal regs at a cost those who pay it do not see.

Would they buy all that if they didn’t have to?

The irony is that it is because they did buy it, they do have to buy it. Or rather, they have to finance it. Debt has made all of this luxury and compliance possible – and it would not have been possible if enough people had refused to buy into it.

If they hadn’t, not all new cars would not be luxury cars and the average priced paid for a new car would not be around $50,000. There would still be cars available that average people could own in three years’ time.

And those people wouldn’t be owned.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you like items like the Keeeeeeeeev! t shirt pictured below, you can find that and more at the EPautos store!

One of the funny things about the whole push for electric cars is that if they would take their boots off the necks of E-car manufactures, E-Cars would be a viable alternative for the “economy car”. So it begs the question, if they wanted to save the environment and were serious, why make E-cars into luxury cars at all, why not promote them as economy cars?

Why not simply dominate the short commute/City market with dirt cheap E-cars?

Not to give them any ideas, but if they continued to put all these regulations on regular cars But DIDN’T put them on E-cars, you know they would dominate the economy market in no time at all. Not to mention that a truly economical E-car would in fact be more “Green” than an E-Hummer or Tesla, etc. That makes me think it’s more about control and about keeping the finance markets intact. There is a lot of money to be made giving loans to suckers, better yet if they are suckers who feel they have no choice.

I’ve never owned a new car and have no plan to, but if I lived in the city, I’d consider buying a new cheap E-car for my wife who would probably think it’s cute. But it would have to be cheap, I’m talking under ten grand cheap with a smaller battery that wouldn’t cost a ton to replace and the rest of the car had better not be disposable, I’d still want something I could fix myself as well.

Part of the Economy of Economy cars was the ability to do a lot of the work yourself, which is something else we have lost with today’s cars that isn’t factored in. Most people can no longer fix their own cars, back in the day, if you were really broke, that’s exactly what you did, you or you and your buddies rolled up your sleeves, went to the junkyard and got it back on the road. but of course they got rid of junkyards too, another cost.

Hi Brad,

I agree completely. There is no good reason that sub-$10k EV “city” cars aren’t available. But then, if they were, people’s mobility would be enhanced and their dependency decreased.

And that’s the bad reason for all of this.

Good point on the enhanced mobility, you are right, yet another reason they don’t push them.

They’d be glorified golf carts, but if that’s what the city-driving “pube-lick” wants, WHY interfere? The discussion should NEVER be about technology, save we want a technical discussion, which is a lot of the FUN of evaluating motor vehicles. The issue at hand is FORCE. The entire thing ‘aboot’ CAFE, or crash test (dummies) “S-a-f-t-e-e-e-e-e”, or method of propulsion, is probably the greatest example of FedGov run AMOK, DRUNK with power. Would the Founders have even entertained for a second any discussion of Federal diktats with respect to choice of buckboard versus Conestoga wagons? Certainly any Congress critter seriously proposing such a preposterous notion that the Federal government had any such business, if not laughed out of DC, would have been either dealt with as was Senatorial loudmouth Charles Sumner in 1856, i.e. a sound thrashing by Preston Brooks with a Gutta-Percha cane, or tarred, feathered, and run out of town on a rail.

I fail to see why we’ve tolerated this tyranny for as long as we have. The perversion of the Commerce Clause has given us a rudderless Leviathan which runs roughshod over every aspect of our lives. Times we declare our motor vehicle self-determination as described by comedian Denis Leary in “Asshole”, desiring a 1967 Caddy El Dorado:

I’m gonna get myself a 1967 Cadillac Eldorado convertible

Hot pink, with whale skin hubcaps

And all leather cow interior

And big brown baby seal eyes for head lights (yeah)

And I’m gonna drive in that baby at 115 miles per hour

Gettin’ 1 mile per gallon

Me, I’d construct a vehicle like what “The Lord Humungus, the Warrior of the Wasteland, the Ayatollah of Rock-and-Rollah, drove, with effigies of Harris and Biden mounted on the front instead of the unfortunates from Papagallo’s group that had scouted for a semi truck. Driving that rig about town, bare-chested, with a hockey mask. Why? Because I feel a need to, Pal…

It’s all about fake global warming. Over the last 40-50 years, the automotive industry, with forced capitulation and being aided and abetted by government, has shifted the ownership prospects downward into a more exclusive club…the top 15-20%.

We know the government hates gas, coal and oil as well as humanity. We are saying goodby to all. Although the use of coal worldwide increased about 3% in 2022 over 2021. So maybe the retarded reset is going so well.

What is amazing is that we have all these “new” technologies that are going to serve us well as we reverse back to the stone age. How’s that gonna work?

Fractional reserve banking is not inherently evil, if reserve ratios and interest rates are determined by the market instead of the fed. It might be 40%, or 80%, no one would know, because now it is whatever the Fed decrees.. im quite sure it would be more than 10%. Interest rates would rise and fall in response to the size if the pool of savings available. In free banking, that would be the case. Central banks create moral hazard by providing a backstop if banks make foolish bets. Bank runs are a market mechanism that causes unwise banks to fail. Some depositors, the last ones to withdraw their cash may lose their money. That was how the fed was sold to us, they were just gonna protect us. Yeah right.

In short, a central bank distorts the market signals and creates the inflation.

The Fed was given to you after multiple attempts throughout our history, Jackson, Tyler both sent them packing. You got the Fed in the midst of a conspiracy, with a mid-night gatehring of corrupt politicians, while congress wasnt in session, with the min votes, they werepoliticians bribed by Rothschild agents. Wake up man. Seriously. May I recommend you read “The Creature from Jekyll Island” and other history on who and what the bankers are and how long they been at this game in America.

@ Uncle Bob

It seems to me that Spkrman understands the situation quite well actually. You might want to reread his comments again which imo are spot on.

I agree, Spkrman –

Fractional reserve banking isn’t the problem. Fiat currency and a central banking cartel that has a legal monopoly control of the money is the problem.

If a given bank wants to practice fractional reserve banking – and lending – and the people who put their money in that bank do so freely and understanding the risks – there is no moral issue. People (bankers and depositors) have the right to assume risks for whatever benefits they consider to be worth running the risk.

But no one else ought to be forced to pay for the negative consequences – if the risks rather than the rewards “pan out.” If you lose your money by placing it in a sketchy bank, that’s between you and the bank (and the courts). It is not – it ought not to be – a public charge.

There ought to be a variety of money, used as seen fit by those who use it. If some wish to deal in paper money, let them. It is their right. But no one has the right to force anyone else to accept it.

The Fed is nothing more nor less than another taxing agency. Inflation is an extremely regressive tax, falling more heavily on those who can least afford it. For the purpose of financing the ludicrous debt the FedGov is running on. So it can keep the Military Industrial Complex fat and happy. Traveling around the world, meeting new and interesting people, and blowing their brains out.

Inflation is the very purpose of fiat currency. There is no other reason to use it.

“Money” can be printed. Wealth cannot be.

Eric, true but let’s take it a few quick steps farther. One of the largest scams on mankind is when Lucifer showed the Money Changers how to create money out of thin air to buy total control of everything for Lucifer’s evil pleasures. Let’s take Fiat Money, it’s debit based money 100% pure and simple. The 13th Amendment that was ratified in 1867 should outlaw Fiat Money because we are all locked into giving that money value by slavery and/or servitude. I could take this one step farther from my own personal observation that puts the cherry on top of the whipped cream. The CIA is the private army of the Money Changers who main job is to start wars because war insures the Money Changers debit. Even the losing side of war still pays its debit to the Money Changers through collateral of many things like natural resources as an example. The car is way too expensive but it serves to Money Changers agenda to enslave the masses in their slavery of debit. Yes sir Eric you opened up a whole lot with this week’s article/op-ed.

I think a review of the history of the US and its experiences with a first, second, and third (the Fed) central bank shows how “free banking”, and the always attendant fractional reserve banking and fiat money invariably devolves into a tyrannical amalgamation. The gov’t gets in on the money game, the bankers capture the “regulation” and the customers end up clamoring for it. It’s all too cute by half.

Technical arguments for fractional reserve banking from a “freedom” perspective without context in a vacuum lend legitimacy to it as a practice under the current system. You end up with folks attributing the US’s prosperity in the 20th century to it. Or saying you can’t have prosperity without it. And these are libertarians talking. Forget about John and Jane Matrix type.

On the issue of morality, it’s interesting how Muslims forbid loans and payment of interest as “usury”, a term which is defined much narrowly in a legal sense in the West as “excessive interest.” In its place they use a kin to kin type money transfer system known as hawala. There is definitely some kind of root of all evil vibe to this business.

I chose one of those $13,000 cars (actually $13,800 out the door) two years ago here in Mexico: a Nissan March. 1600cc, 4-speed auto trans, A/C, power windows and locks, 4 airbags, ABS, Apple CarPlay, and many other little features. Small. Inexpensive. Gets the job done. But no panache. No luxury. I’m okay with being a humble gringo.

Good stuff, Alan –

And you guys South of the Border also had new (old) Beetles available through 2000 – so they are still abundant and cheap, like they were here 30 years ago.

The way that things are headed, it would be wiser to pay more attention to the BRICS than to the WEF.

Indeed, many have figured out that it would behoove them not to conduct their business in a currency that is far from stable, and is constantly weaponized.

Exactly. The concept of living below your means by living simply and frugally is lost on most modern people. Sound money would make this possible. Fiat debt-based currency and fractional reserve banking depend on an ever-increasing supply of borrowers otherwise the whole system crashes.

Hi William,

I got into a heated discussion with my mom a few years back when she made a derisive comment about my “old truck.” Which it was – and is even more so, now. She always spent more money than my dad – a doctor – earned, with the result being that after he died, the (nice) house they lived in went into foreclosure. She drove a new (nice) car every 4 years or so when I was growing up. Three Oldsmobile 98s, one Lincoln and (lastly) a Lexus. I added this up and it came to something like $250k in total – the money spent on the cars, the insurance, the taxes and the maintenance. I pointed out to my mom that I had never spent more than $8,000 on a vehicle in my life – and always paid cash for them. My truck may be old, but it’s mine – and my house isn’t going into foreclosure because I blew all my money on new cars…

Perhaps the greatest reward for living frugally is being able to tell the government, or your employer to eff off. Once had an employer tell me he “wished I had 3 or 4 kids and a new house and car. It’s hard to deal with a good worker that has nothing, wants nothing, and otherwise doesn’t give a fuck.”

Don’t remember the source, but once heard words of wisdom, and they stuck. “He who has nothing, and wants nothing, has everything. He is richest whose pleasures are cheapest.”

Owning nothing. Back in the olden times you didn’t own your phone, you rented it from Ma Bell. If you aren’t one who’s cut the cord, you’re paying a rental fee for your cable TV set top. You might be renting your cablemodem, $5-$10/month depending on your ISPs draconian policies.

It is trivial to install your own purchased cablemodem, but it gets screwed up often enough by the ISP that many people don’t want to. But it basically pays for itself in about a year.

We might pine for the old single line wired phones that were built to withstand armageddon, but the reality is that they were extremely basic devices. All the “smarts” were at the central office. This was useful for the phone company because it gave them ultimate control over services and kept costs extremely low. The rise of the computer also led to the decentralized communications network known as the Internet. While some of the ideas were funded by DARPA the reality is networks existed before then, and some even interacted across platforms (frame relay for example).

As “transportation services” evolve we’ll see less and less innovation in the features and benefits side, and more innovation that will reduce operational expense in order to get scale. Then we’ll see “innovations” like AT&T True Voice™, which will claim to improve the service, but in fact will just slightly improve an existing product by a barely measurable amount.

5% more comfortable seat! 5%! That’s a lot of comfort! And no extra charge either! Aren’t we wonderful?

Which brings up another point: The marketing for “transportation services” will go from selling features and talking about the ride, to telling a sappy human interest story… like how grandma is able to travel to see her new baby grandkid hatched from the incubator, thanks to Ma GM. It’ll probably will win an award as everyone cries tears of joy.

‘All the “smarts” were at the central office. This was useful for the phone company because it gave them ultimate control.’ — ReadyKilowatt

And now, woke auto makers see themselves as … monopoly phone companies:

‘Under pressure of the western sanctions regime, Mercedes-Benz has cut Russian dealers off from its software, severely impacting their ability to diagnose and service vehicles. BMW has implemented its own restrictions.

“In some cases, the lack of access to online systems will increase repair times,” the company said, as mechanics will have to rely on their “accumulated experience and knowledge.” In addition to thwarting maintenance and repairs, the software cut-off will also leave Russian drivers unable to update programming on their vehicles.

“Given the way things are clearly developing, it won’t be long before your ability to access automative services is as subject to deplatforming as your ability to upload YouTube videos or make posts on social media,” writes Vox Day.

https://tinyurl.com/3ady5jsc

There you have it, folks — spelled out in black and white. And this is three years before all new vehicles are fitted with impaired driving monitors that can shut you down and park your sorry ass beside the road — by edict of the United Snakes Clowngress.

Really, at this point, the collaborationist auto industry is such a disgrace that it ought to be shut down and liquidated. It’s become an enemy of the people, just begging to have its factories ‘liberated,’ then torched.

Gardens of nocturne, forbidden delights

Reins of steel, and it’s alright

My heart is black, and my lips are cold

Cities on flame with rock and roll

— Blue Oyster Cult, Cities on Flame With Rock and Roll

The old phones were indeed built to LAST. Good ol’ Western Electric, built in ‘MURICA.

The cost of leasing the phone was simply built into the phone bill before “Ma Bell” was broken up, it’s not as if there was a CHOICE. Well, by the time I could place a phone call, there BEGAN to be: remember that wall-mounted phone that had the 12-foot coiled cord to the receiver and the dial? They always came in black, or “off-white”, but by the 1960s, you could get (WOW!) COLORS…yellows, reds, blue, avocado green, pink, brown…as they were marketed to the “little woman” who wanted to color-coordinate her kitchen. Now, if the family was prosperous, and they had a slew of teenagers, or one spoiled bratty princess, there was the “teenage line”, so the kid’s friends knew which one to call. And that led to the “trimline”, which usually was in pink, ivory, red, matching the little darling’s room décor. Or, starting about 1965, there was the “Ericafon”. THAT was considered “progress”!

Desk phones were still usually the “basic black”, as the concept of “frills” was considered something only a homosexual would worry about. Of course, many offices had multiple lines, so you’d see the flashing lights on a given phone. A busy, large office often had a dedicated PBX with a “trained” operator.

The deregulation that de-coupled AT&T from the provision of phones at least led to not only a greater variety, but also the answering machine, and with that, the ability to SCREEN calls. Then came things like “call waiting”, “call forwarding”, and then, “Star-69”. Soon, phones “tattled” by telling WHAT NUMBER was calling.

Cellular phones have been the big “game-changer” of telephony, by not only enabling each individual to have at least his/her own personal line, wherever (s)he goes, but, coupled with the so-called “SmartPhone”, or, as Eric puts it, the “Sailfawn”, enabling so many DUMB things to be done, we have the proverbial electronic “Swiss Army Knife”. Or at least it SHOULD be. Too bad for so many it’s nothing more than entertainment or frivolity on the go.

“As “transportation services” evolve”

Or are they devolving? There product surely is. Per FedGov diktat.

When I first saw that WEF slogan, I thought it was either a joke or some kind of publicity stunt. I thought to myself “Who the hell would be happy owning nothing?!”. Then “covid” came and kind-of went, and I suddenly realized that the average dildo not only wants to be owned by the state, but will fight tooth and nail against anyone who “dares” to even question it. Apparently, free will is too “labor intensive”.

Good morning, Blue!

I had the same initial reaction. It also alarms me that so many people don’t ask the obvious question: If we are to own nothing, who will own everything?

Another thing that is not considered: If everyone is sharing everything, and no one owns anything, then why should I take of something that is equally shared by everyone else around me? There is no pride in ownership, and therefore, no reason to treat whatever you are sharing as anything less than just a dirty napkin. Also, Eric, I noticed that at the bottom, the option to have follow-up comments sent to my e-mail has been eliminated. Is this a change you made? I was just curious, as I like following the comment thread.

Why, those that presume to be the “Lord of the Manor”, of course!

Hence more reason to go OFF THE GRID. Get a vintage VW Bug or a ’65 Plymouth Valiant with plenty of spare parts, including, perhaps, a surplus rebuilt engine and/or gearbox. Make it so the ONLY way that thing is kept off the road is if the “coppers” come with a TOW TRUCK and packing plenty of heat, which they’d BETTER if they expect to take it away.

I would like to know the average price of a car excluding leases. I think leases skew the numbers. Then break that out for EV vs ICE

Translates to another 900 grand available for circulation.

If I deposit one million dollars into my money market account, it means that 900 K is available to be expended for more economic activity at 10 times the amount.

At a loan rate of 5 percent, 9 million dollars, 450K more to be loaned to the next loan 10 applicants. Another 4.5 million dollars available for loan approvals. Rehypothecation is the result.

Next thing you know, you’re a commercial bank headquartered in New York City.

Build a merchant marine and have a port for fisheries. What else is new?

All of a sudden, Michael Bloomberg is the greatest farmer ever to exist on the face of the earth.

Bill Gates is a distant second.

The world is in an industrialized permanent state. Oil and coal are here to stay, everything industrial and automated is here to stay. Everything digital is here to stay. Electricity is here to stay.

Just ask the Amish.

Nobody cares about the Jews. That’s why they’re called Wandering Jews, just like the plant. har

‘If I deposit one million dollars into my money market account, it means that 900 K is available to be expended for more economic activity at 10 times the amount.’ — drumphish

This math is based on a nominal 10 percent reserve ratio, featured in banking and finance texts throughout the 20th century.

But that’s all over. First, Alan Greenspan invented the talmudic subterfuge of ‘overnight sweeps,’ allowing deposit accounts (which needed reserves) to be magically transformed at sunset into savings accounts (which didn’t).

‘Not enough!‘ hissed the envious banksters. Then, under the guise of a pan-respiratory crisis, this happened:

‘As announced on March 15, 2020, the Board reduced reserve requirement ratios to zero percent effective March 26, 2020. This action eliminated reserve requirements for all depository institutions.’ — Federal Reserve Board

https://tinyurl.com/mu42pxte

Infinite leverage, comrades: we don’t need no stinkin’ reserves! 🙂

Interesting thread on my local Nextdoor feed, about the emissions testing program known as E-Check in Ohio. I like to call it Naz-E-Check, as it is a warrantless search of property contrary to the Fourth Amendment. Sadly, most of the Nextdoor commenters were in favor of it, as “it’s for environment”, “for cleaner air”, and if your car doesn’t pass, “just fix it or buy a new one.”

Never mind that cars made since the 1980s are much less polluting that the older cars were. And never mind that some people can’t afford the cost of repairs, let alone the cost of a new car.

But I’m sure that underlying this “Let them eat cake” mentality is the oft-repeated slogan that driving isn’t a right, it’s a privilege. Why? Because Teacher in government school said so, apparently.

Maybe the Nextdoor commenters are mainly leftists. If this is actually representative of the general population, the concept of freedom is dead.

I was on nextdoor for about a week. Deleted it a long while ago. Total waste of time just like FB. I don’t care about all the shit you do. I care about important things. To much chafe and bullshit which hides the real things.

It’s mostly lost pets

I also hope the Nextdoor commenters are mainly leftists.

From what you’ve written, that website does seem to be a window into the thoughts of those around you.

That kind of information can be useful, imho.

Right. That’s why I monitor it and FB. To see what the enemy is thinking.

Hello from Dayton. Because teacher in government school said so is all I needed to hear in high school in the late 1970s to want to break off a heavy table leg & dent statist heads. Even before I ever drove. Argh.

Hi Rust,

Yup. From an early age I can remember being annoyed by “just because” and “do as we say.” No. I need to know why I ought to. If there’s a good reason to, ok. But if it’s “just because” then IO’m got resent and resist – because I’m not a dog and I don’t “sit” on command.

The hyperinflation in car prices is really the bankruptcy of the United States, which a few days ago had it’s debt downgraded. Now Fitch is also downgrading the major US banks:

CNBC – “A Fitch Ratings analyst warned that the U.S. banking industry has inched closer to another source of turbulence — the risk of sweeping rating downgrades on dozens of U.S. banks that could even include the likes of JPMorgan Chase.

The ratings agency cut its assessment of the industry’s health in June, a move that analyst Chris Wolfe said went largely unnoticed because it didn’t trigger downgrades on banks.”

But another one-notch downgrade of the industry’s score, to A+ from AA-, would force Fitch to reevaluate ratings on each of the more than 70 U.S. banks it covers, ”

The big joke is these major US Banks also write insurance on US Treasury debt. As if JP Morgan or Goldman Sachs could actually pay if the US Treasury were to default.

So the banks that insure US Treasury debt are being downgraded at the same time US debt is being downgraded. This means the premium of the Credit Default Swap would have to be increased – which means the US Treasuries will have to yield more in order to sell them. A vicious self reinforcing feedback loop.

These debt downgrades are also coincidental with US political persecution of Donald Trump, who is being indicted with 90 some charges over election fraud when in fact it was the Demoncraps who stole his presidency. This is leading to political instability exactly when Fitch is downgrading banks and government debt.

Anyone can see that the current regime is making cars and homes inaccessible to the average working Joe. Everyone knows the ban on gas engines and gas stoves is poltical and climate change is a hoax. How much more of this bullshit is the electorate willing to put up with?

If a populist revolt occurs, then surely the Dictocrats will respond with draconian force and make the debt situation worse – and the whole world will be watching the dissolution of the United States and NOT want to buy our debts – which is going up exponentially shooting past a trillion a pop in a few months.

Do you all remember when Arizona threatened to leave the union if the national debt exceeded 2 trillion back in the early 1980’s? Well how long until the states decide that their state would be better off without the Fed albatross around it’s neck?

The shit is starting to hit the fan, and the credit markets are the canary in the coal mine.

Wall Streeters know how to put lipstick on a plethora of pigs so those ugly pigs look like the shapely curvaceous beach beauties with ample mammary glands that count the most of all, starts with 38-24-34 5’8″, can be seen at the beaches in Rio de Janeiro.

On Wall Street, one pig after another is just drop dead gorgeous.

Sow the wind, reap a whirlwind of whirling dervishes.

What do you own?

You don’t own your house…you have fee simple title only…the government says they have the allodial title, and you rent it through property tax, don’t pay the tax (rent)…lose the house.

if you own a tent…you own it….the homeless are on to something….

When you register your paid for car…you don’t own it….

When you deposit money in the bank it is now the bank’s money…you loaned it to them….you will probably get it back if you ask for it…today at least…tomorrow??…check out bailins legislation….

If you have cash, you own it….but…. it is a form of debt…a promise to pay…but it is still accepted for gas and groceries…for now….until CBDC comes…then it is all virtual…

If you have gold or silver you own it…..

If you have cash, the Coppers can SEIZE it from you, on the legally flimsy argument that the cash is “guilty” of the civil offense of being the fruit of alleged illicit activity. No crime need actually be charged. Therefore, it’s “yours” until some AGW sez it ain’t.

Eric, I rarely disagree with your POV, but I do here. The cost of cars increased due to two things: 1) inflation and 2) demand exceeding supply. Neither one of these was mentioned in your article. There hasn’t been a $10K vehicle (new) for about 20 years. They are not coming back. Inflation was caused by out of control government spending during COVID (under both Trump and Biden) and the demand for higher wages and more benefits by employees.

Car financing was created by both Ford (1928)and GM (1919) at the beginning of the 20th century. In the mid 2010’s the average car price was $30K with an average finance term of 68 months. The inflation rate was around 1.26%.

I am not a big fan of debt, but the onslaught of EVs did not make IC more unaffordable. A government shutting down their manufacturing factories and retail stores did. A government subsidizing stimulus payments, PPP and EIDL loans, and advance child tax credits did. A workplace where 1/3 of all participants left between the years 2020 and 2023 did. A workplace that is only running at 66% of capability, short staffed and over worked did. An American public that still demanded their good and services be met with a lot less hands on deck did.

I don’t blame people for asking for more money. When you are putting in 10 or 12 hours day you should be compensated for taking on more work with far less help, but the downside is that everything else increases as well. The prices in supplies increase, the transportation and fuel costs increase, etc. The only way prices decrease is when supply exceeds demand.

We need to get our heads out of the sand and stop pretending it is 1986 or 2012. We can’t buy a candy bar for a nickel or even a dollar. No business is going to succeed by taking a loss and no employee is going to show up to work if the guy down the street is making $10 more per hour for doing the same job.

Stop it! Too much logic is causing me a headache……

Taking the risk of disagreeing with the smart raider Girl and agreeing with Eric:

Of course inflation raised car prices and it was already mentioned that a Chevette would be over $13,000 in 2023 dollars.

So why are there no $13,000 Chevettes in 2023?

The first explanation is the current mandated safety and fuel economy standards have raised the prices of all vehicles.

The second explanation is few buyers want a car with no AC , manual windows. manual door locks and hub caps instead of aluminum wheels.

Add the mandated safety items, and the options that most people want, and you can still buy a cheap car, but just not for $13,000.

Cheapest New Cars

1. 2023 Mitsubishi Mirage ES: $17,650

2. 2023 Kia Rio LX: $17,875

3. 2023 Nissan Versa S: $18,595

4. 2023 Kia Forte LX: $20,815

5. 2023 Hyundai Venue SE: $20,985

6. 2023 Nissan Sentra S: $21,145

7. 2023 Kia Soul LX: $21,215

8. 2024 Chevrolet Trax LS: $21,495

9. 2023 Hyundai Elantra SE: $22,065

10. 2023 Subaru Impreza: $22,115

SOURCE OF LIST:

https://www.cars.com/articles/here-are-the-10-cheapest-new-cars-you-can-buy-right-now-421309/

DEMAND VERSUS SUPPLY

I see no evidence that demand for automobiles, in general, exceeds the supply of automobiles for sale. That is not reflected in days of new vehicle inventory on dealer lots. New-vehicle inventory is stabilizing at around 1.95 million units and days’ supply in the mid-50s, which is normal. Electric vehicles have twice the days’ supply as all new vehicles.

Jul 13, 2023

And since most of those are foreign made there must be some shipping costs involved in the pricing. Imagine if they were made here and did not have that cost? Even cheaper.

LOL. Yes, because Craftsman tools was very successful in keeping costs down in the US. Jobs are shipped overseas because labor is the largest expense of any business. Americans love cheap. Show them a $18 hammer made in the USA and another for $9 made in China. Nine times out of ten they will buy the Chinese version.

Except the Pentagram, where they will buy a $700 hammer 😆 wouldn’t be surprised if that’s made in China as well; maybe a subsidiary of General Dynamics.

Now extrapolate that out to whats really happening. Bags and bags of hammers destined for the Ukroid. Joe and Co. will get their 10% rebate in the form of campaign cash for everyone to see, while the republicans sit around with their thumbs up their asses

Exports are subsidized by the state. Japan, by forcing the Yen to trade far below market value, keeps exports cheap at the expense of screwing their savers.

China is a little more blatant. China Post picks up the tab for exports. I’ve bought a few electronics devices direct that were DOA. The sellers were always happy to send another, but absolutely did not want the bad product back, because they’d have to pick up the shipping tab.

Hi Richard,

What changes in mandated fuel and safety standards over the last four years caused an increase in price? My 1996 Ford 250 has electric door locks and windows. It also comes with aluminum wheels and A/C. This have been standard in new cars for the last 20 years. This is not causing the price uptick of 15, 20, or 25% from four years ago.

Let’s look at the Chevy Tahoe. In 2019, you could buy one for $47,685 (out the door around $50K). In 2023 a 2022 USED Chevy Tahoe with mileage under 10K is going for $69,550 (out the door $72K). You want a new 2023 or 2024 Chevy Tahoe add another $5K and wait 3-4 months for it to be manufactured. Tell me where I can get a brand new 2023 Chevy Tahoe for the 2019 price and I will be there tomorrow. What has caused an increase of $25K over four years if not inflation and demand?

You see no evidence of a demand in vehicles? Do you have any new Toyota Sequoias in Michigan? Are they under $75K? New vehicles (EVs) are sitting on lots for 3-4 months. I don’t see this with IC new cars unless they are pick up trucks or Dodge Chargers. Need a 2023 fleet of Dodge Ram 1500s in plain white? I can buy them all day long. Need a Chevy Suburban or a Toyota (any model). You will pay the piper. Used car prices are more than new car prices from four years ago. My husband’s Dodge Ram 2500 sold for $1K more than what we bought it for back in 2017.

The US dollar is worthless add that to the demand for higher labor wages and we can very easily determine why things cost more. Has is your grocery bill, Richard? Are you paying the same price that you were in 2019? Is it because of new government regulations?

I’m breaking my Rule of Thumb to never argue with a woman because there is nothing to be gained. Twice in one day. And a smart woman too, who knows all about auto depreciation for businesses.

The prices of a specific model in the past four years is not the subject of the article. The example in the article was the 1979 Chevette, not a 2019 Tahoe.

The article did a good job explaining why there is no equivalent 13,000 vehicle today ($2500 Chevette in 2023 dollars)

Look at that photo of a Chevette and you see bumpers that would not be legal today. And standard equipment that would not be wanted today, such as hubcaps. Then there are many hidden features not visible in the photo such as the body structure required for crashes and multiple airbags. That’s why a $13,000 car is not available today. I previously listed some relatively cheap cars with the required 2023 safety features and options most people won’t live without in 2023.

Now lets consider the price hikes from 2019 to mid-2023:

A 2019 US dollar had the same purchasing power as $1.20 now — 20% inflation.

I have no idea why the price of a Tahoe increased so much in four years. I know GM will sell fewer Tahoe’s after such a large increase relative to the consumer price inflation rate.

The CPI, in fact, attempts to adjust auto prices for additional features to create their CPI for automobiles. Their adjustments fully support Eric’s claim that more standard features have had a big effect. A chart at the link below compared the ACTUAL retail MSRP for a Ford F140 and Toyota Camry with the CPI for automobiles after adjustments for added auto features. The adjusted CPI uses a hedonic quality adjustment method to remove any price differential attributed to a change in quality by adding or subtracting the estimated value of that change from the price of the old item.

I know these CPI data are from the government, and almost no one trusts the government, even if the data support Eric. I find it interesting that leftists, in contrast, don’t trust a source that is NOT a government.

Here is that chart from the original source:

https://wolfstreet.com/cpi-hedonic-quality-adjustments-for-new-used-vehicles-consumer-electronics-other-products/

Concerning my grocery bill:

Not relevant for auto prices, but I AM paying less in 2023 than in 2019 by shopping at low cost Aldis. And the store I had shopped at until a few months ago (Meijers) was already about 20% cheaper than a local Kroger supermarket. Some Aldi’s items do not meet my quality standards but at least 90% do. Many years ago, we visited an Aldis for the first time. bought some private brand losers, and never went back. That was a mistake. Today, their private brand 40 ounce peanut butter, for one example, costs 3.89, versus 7.39 for 40 ounces of Jif peanut butter at Meijers. I am very particular about my peanut butter, but can barely tell the difference, except the huge price difference. On the other hand, Aldis pizzas are awful.

Finally, ya made me laugh & kinda agree with ya, Richard Greene:

“I’m breaking my Rule of Thumb to never argue with a woman because there is nothing to be gained. Twice in one day. And a smart woman too,”

…She is, isn’t she?

Anyway, your bit about Aldi pizza… whoa… are you buying the ones made in Italy which are almost never in stock?

Those things are Da Bomb! I’d rate them as better than 3/4 of the pizzas from pizza joints in the Midwest.

I consider pizza, hamburgers and salami to be the three basic food group in my personal “food pyramid” … Aldis frozen pizzas were awful. Their fresh pizzas we bought were very large, but mediocre. I’ll look for Aldis pizza from Italy on Sunday. Thanks for the tip. … Aldis also has a flavored sparking water for 55 cents compared with 89 cents at Meijers. … My first fight with my first Michigan girlfriend in 1977 was over the quality of Detroit deep dish pizza versus thin crust NYC pizza. But she showed me. She married me, and we are still married.

Demand exceeding supply is not even an economic concept that makes any sense. Demand is a curve. Supply is a curve. Yes, there can be an increase in demand that can increase prices. and there can be a decrease in supply that increase prices.

Hey Eric – the “follow comments by email” seems to have disappeared, any chance of getting it back?

I noticed that as well, Mike, and said something to Eric in a post above…

Wow, I had no idea this was happening in Canada, did you? While reading I had to scroll back up to make sure it wasn’t something written in the year 2020:

…”Everyone is required to wear filthy masks. […]

“There is talk that Christmas gatherings may be canceled. Every source of solace or happiness is being shut down. […]

Montreal residents won’t be allowed to visit friends or family at home for most of October or eat out at their favorite restaurant as the provincial government struggles to slow the surge of new coronavirus cases. All bars, casinos, and restaurants are closed (takeout only). Libraries, museums, cinemas, and theatres will also be closed. Being less than two meters apart will be prohibited. Masks will be mandatory during demonstrations. Houses of worship and venues for events, such as funerals and weddings, will have a 25-person limit. Hair salons, hotels, and other such businesses will stay open. Schools will remain open.” […]

students have reported their classmates for violating quarantine and wandering outside.” […]

The plan is to dehumanize us in advance of full-blown tyranny. The scary part is that the masses still think the “authorities” have their best interests at heart.”…

https://www.lewrockwell.com/2023/08/no_author/becoming-pod-people/

A quote in the same article about 1,889 ‘cases’ at U of Alabama in Tuscaloosa is from an August 15, 2020 NYT article.

Why is the author Klark Barnes posting three-year-old stuff as if it’s contemporary?

I’ll shove that mask right down his throat.

Hi Jim,

I can’t tell whether this article is describing what’s going on in Canada now – or 2-3 years ago. If it’s 2-3 years ago, it’s pretty shabby to not make that clear.

RE: “I can’t tell whether this article is describing what’s going on in Canada now – or 2-3 years ago.”

Me either.

I’ll be very happy if I made an early morning mistake & passed on bad info.

“Trust, but verify” …I didn’t do the verify part.

There are colleges & universities in America that are STILL requiring students to be vaxxed to attend classes in person. Some of them even require students to have a booster jab. I can’t help but wonder if these “schools of higher learning” are getting money from Pharma and/ or the Biden regime to cling to COVID jab mandates.

At the end of the ‘linked’ article is another link to a book they are selling.

“The Home Doctor” and at the end of that, about 20 page downs, the price of $37.

It was recently reported that the overall debt of Americans exceeded $1 TRILLION. The Biden Thing consistently touts how Bidenomics is “working for the average American”. It’s working all right…..Americans are having to use credit cards more and/ or dip into retirement & savings accounts just to pay ordinary expenses while climate change grifters, Big Pharma, the military-industrial complex, and likely others are making BILLIONS.

A bit of perspective from a comment at USA Watchdog’s, ‘New BRICS Currency Bad for Dollar – John Rubino’

…”In 1956, I bought enough groceries to feed a family of 6 for a week for $5.”…

helot,

More perspective, in 1956 silver dollars were in circulation. They were worth a dollar.

$1 in 1956 had the same purchasing power as $11.24 today

SOURCE:

https://www.in2013dollars.com/us/inflation/1956

That means $5 is equivalent to $56 today.

Could a family of six be fed for $5 a week in 1956?

Maybe if they only ate white rice, white bread beans and water.

In my opinion, that $5 a week claim to feed a family of six is extremely hard to believe.

RE: “In my opinion, that $5 a week claim to feed a family of six is extremely hard to believe.”

That’s just shy of calling Marie Joy a liar.

I dunno. I wasn’t alive at that time.

John,

Meanwhile FedGov is 32 trillion in debt, which makes the rest of us look downright frugal.

John,

The typical politician will say little more than “Raise taxes on billionaires!” as a way of “Paying off the Fed’s MASSIVE debt”. Will they also call for raising taxes on credit card companies as a way of “Paying off Americans’ credit card debt”?

And where did that debt originate?

Was there some investor who loaned his earned assets to other people for a fair return?

No, it wasn’t.

The origin was a law created by a group of private bankers in 1912 and passed by the con-gress that was bought by private bankers in order to get the Federal Reserve Act passed.

That law gave private banking the legal right to create credit, create money, from nothing more than that law. 90% of all loans to private companies and people are credit created from nothing. The private banking cartel that owns the Federal Reserve Bank receives interest on all those loans that were created from nothing, and then when so many loans can’t be paid, the banking cartel receives bail outs from government – which are also loans created from nothing and the taxpayers ultimately must pay the interest on those loans. In every case the banking cartel benefits and individual people are robbed.

The entire thing is effectively a Ponzi scheme. Unless more and more credit (debt) is created, there will not be enough money in the economy to pay off the previous loans because the only way that money is created is through debt that in turn creates more interest to be paid and therefore must require that more money must be created (via debt) to pay the interest.

The system must collapse and we are now seeing the results.

Collapse is inevitable and the elites are desperate to disarm and corral all their debt slaves before that happens.

If we don’t act soon it will be too late.

Freedom isn’t free.

Indeed! What a racket. Create “money” out of thin air and loan it out at interest.

1913 was the final nail in the coffin of the Republic. The Federal Reserve Act, the Income tax, and the 17th Amendment taking the selection of Senators out of the hands of State houses and turning it into a popularity contest just like the House of Representatives, leaving the States with no say in the matter.

Yup! Tell a “home owner” that and clock how fast their eyes glaze over. Milliseconds usually.

How bout the lemmings that claim to “Own their Home”! When I mention taxes,,,, that’s the end of the conversation. The house I occupy has been paid off over twenty years. But each year I get billed by the State, County, City, and worse the School district for permission to live in it. They’re all bad but the school taxes are even worse, I have no children in their schools but even if I did look at the numbers. The kids can barely chew bubble gum upon ‘graduation’.

Even after the schools closed for the non existent virus they still torture kids. They now require the clot shots to attend school. And people that claim they are parents line little johnny and Jenny up for who knows what. Now little kids are having strokes and heart attacks and dozens of other debilitating diseases.

Reply to John Galt

Your analysis is correct. I would quibble about it being a problem of banks loaning out more then they have. That’s a basic feature of money lending and when done properly works. The creation of capital is the miracle of capitalism. You can make the argument a modern economy would not exist without an expanding supply of money. The real problem is that the FedGov backs the banks if they overextend and put the taxpayer on the hook for it. Now some people make the case that it’s in the best interests of the people to have a financial system that doesn’t collapse, and thus make an excuse for government interference.

Also I feel your take on this issue is a classic one and I think the times have changed. The system has figured out a way to monetize debt. Debt has become a bankable asset in it’s own right so the old concepts of debt have to be revised. It still seems like it should lead to collapse. But it hasn’t. And it sure should’ve by now.

Krustyklown says: “I would quibble about it being a problem of banks loaning out more then they have. That’s a basic feature of money lending and when done properly works.”

Nope! That’s a basic feature of fractional reserve banking. Sure, it’s considered a “lawful” practice, but it’s still fraudulent. How can a bank both (a) promise to pay all of a depositor’s money on demand AND lend 90% of that deposited money to a borrower?

Krustyklown also says: “You can make the argument a modern economy would not exist without an expanding supply of money.”

Not exactly sure what you mean by a “modern economy,” but if it means the US economy that we currently have, you’re correct. We would not have the state of this economy without the expanded money supply. But that’s just a tautological point. A healthy economy would not be built one built on an expanding money supply (which would include fractional reserve banking). Expanding the money supply is no different from debasing coins, only worse because the dollars stashed in the mattress also get “debased” without ever having to being touched by the debaser.

https://en.wikipedia.org/wiki/Methods_of_coin_debasement

Fractional reserve banking is the only way a large economy can work. A bank can loan out more then it has on hand because the money they use is invested and can be liquidated later if needed. When you sign a contract with the bank to hold your money they will tell you that you will have to wait a certain time to have access to all your money (if it is a significant amount). In return they pay you some interest on your savings. If you want all of your money back immediately you may have to wait as agreed upon in the contract. There is nothing wrong with doing business this way. Goldsmiths during the Middle Ages issued demand receipts for gold on hand that exceeded the amount of physical gold they had under custody, knowing that on any given day, only a tiny fraction of that gold would be demanded.

“A healthy economy would not be built one built on an expanding money supply (which would include fractional reserve banking). Expanding the money supply is no different from debasing coins”

That is not correct. You can only have an expanding economy with fractional banking. Fractional res. banking is not expanding the money supply. You are mixing that up with the actions of the Federal Reserve.

Fractional reserve banking is intimately related to the expansion of the money supply and the Fed. Startpage “the Mandrake Mechanism”, a term coined by G. Edward Griffin and you will learn how. Needless to say, it takes more than a few paragraphs to explain because it is purposefully complicated.

Fractional reserve banking is something that a bank does, it doesn’t have anything specifically to do with the Fed. The issue with the Federal Reserve is that it was made the “National Bank” and therefore responsible for all actions related to banks including fractional reserve banking as it set the policy for it. I agree the Fed has been a disaster but it was formed to prevent financial panics and collapses by controlling the policy of the member banks which had been doing a shitty job of controlling themselves.

So you agree that, under our current system, fractional reserve banking and the Fed, as the Central Bank, are related and that both are involved in expanding the money supply.

As for why the Fed was created and what it really does, I recommend you read the entire “Creature From Jekyll Island” by G. E. Griffin. I think you’ll be surprised at how the history and reality differs from your understanding.

Lending money you do not have, fractional reserve banking. I am not very smart so I need to keep things simple. “Something that a Bank does” In other areas it is called “Fraud”. Put that in your pipe and smoke it.

You do not understand the meaning of the word FRAUD. It is not FRAUD if the customer is told that his money on deposit will be used by the bank while they hold it, and in exchange they will pay him a fee (interest).

No one has been defrauded in that situation. The customer is increasing the value of his savings and the bank is able to pay him by investing the money. This is pure capitalism, and not in any way a violation of libertarian principles.

Smoke that.

The fraud is the bank misrepresenting that it is a demand deposit (i.e. the RIGHT to withdraw it upon demand), but then lending the money out.

It is not fraud if the depositor’s access is prevented during the

. . .during the term of the loan.

NO bank account guarantees you the right to take out your money on demand, there will always be a disclaimer that withdrawal is subject to some condition, usually an amount of time. Read your bank contract.

Krusty, you’re deluding yourself. You can transfer it via wire immediately. It is only where the bank fails that you can’t have your money, and even in that instance, the FDIC guarantees that you can get it up to $250k per depositor, per bank. Where does the FDIC get the money?

Ten depositors each put $100k into savings accounts, which equals $1 million, The bank then lends 90% of that (and keeping a 10% “fractional” reserve) to 10 borrowers ($900k). Magically 1.9 million now dollars exists. That’s fractional reserve money expansion and it’s legalized fraud. This is not fraudulent only if access to the deposits is restricted to the extent of the terms of the loans.

A true expanding economy results from employing the factors of production (land, labor and capital) to create value. Money expansion is not necessary.

No new money is created in that example. The bank may invest the money on hand and make more money but they are still on the hook for a million dollars. The 90% that they loan out is not “new” money, it’s the money they are holding for the depositors.

What happens if the depositors come in and demand their $1 million in deposits?

Also, RE: “The 90% that they loan out is not “new” money, it’s the money they are holding for the depositors.”

That’s called, fraud.

If they are holding it for investors & they loan it out… you don’t see anything wrong with that chain of thought?

RE: “Fractional reserve banking is the only way a large economy can work.”

I don’t think you’re a libertarian of any stripe. Or, you’re very confused?

I suspect you’re a Marxist.

“consumption that is not supported by production i.e. the dilution of the pool of real wealth.”…

https://mises.org/wire/fractional-reserve-banking-and-money-creation

And I don’t think you are a libertarian. I suspect you are an old fashioned conservative. In a FREE society someone can start up a bank and offer terms to customers of what ever they please. It is not FRAUD if the customer is told that his money on deposit will be used by the bank while they hold it, and in exchange they will pay him a fee (interest).

No one has been defrauded in that situation. The customer is increasing the value of his savings and the bank is able to pay him by investing the money. This is pure capitalism, and not in any way a violation of libertarian principles.

If the reserve requirement is 10%, the deposit multiplier means that banks must keep 10% of all deposits in reserve, but they can create money and stimulate economic activity by lending out the other 90%. So, if someone deposits $100, the bank must keep $10 in reserve but can lend out $90 which is spend and flows into various banks.

The banking system can then lend 90% of the $90 dollars.

And then 90% of $81 dollars.

The Money Multiplier:

With a 10% reserve requirement, the banking system as a whole can lend $10 for each $1 of reserves.

Before you criticize this banking system, please recall that it allowed the US to become the top world economy. in the 20th century.

I’ll need some actual proof of causation that fractional reserve banking was responsible for allowing “the US to become the top world economy. in the 20th century.” How do you know it wasn’t despite fractional reserve banking?

This site attracts the strangest “libertarians” I’ve ever come across. Two separate defenses, if not celebrations, of fractional reserve banking on one thread. Doodoodoo… welcome to the twilight zone…

There is nothing inherently evil about fractional reserve banking. If banks were all privatized in a completely free economy they would do exactly that. That is how a bank makes money. I think your argument is against the Federal Reserve system which is a National Bank with monopoly powers.

A libertarian should fully support the freedom of a bank to do business as they see fit.

RE: “A libertarian should fully support the freedom of a bank to do business as they see fit.””

Sure, they get to take all brides before the wedding.

As long as the aggrieved husband gets his REVENGE.

Hi Krusty,

Two issues here, as I see it. The first is the “Fed” – which is a system, of private banks that have acquired monopoly power over the money supply, which they thus control and use to legally create “money” (fiat currency) out of nothing and loan it – at interest – to the government, thus creating false debt (which is then used to make us pay taxes to pay the interest).

People are forced to operate within this system, which defrauds them via inflation.

Then there is fractional reserve banking. The problem here is also fraud in that it enables the bank to loan money it does not possess. This creates the obvious problem for depositors.

When money was not fiat – and when it was gold or silver or directly convertible – it was much more difficult to “inflate” its value (artificially). Its buying power would go up – and down – but that is not the same thing.

Fiat currency and fractional reserve banking creates artificial (debt-based) prosperity that always results in most people becoming the opposite of prosperous, while a relative few become extremely prosperous.

When the dollar was still convertible to metals, it had real and enduring value. Now it is just a piece of paper – literally. And the entire financial system is an intricate scam designed to screw the average person while enriching those who run and control the scam.

The United States had a free market in currency and banking for a long time. All the problems you mentioned were a part of that free market. The Fed was created to bring some stability to the process which it did for a while then the same problems came back. I would prefer a free banking system as it is the moral choice. But it’s still a mess.

krustyklown:

C’mon, buddy. Get a grip. You’re giving us the high school history explanation of the Fed. That’s the propaganda on the Fed’s website. Try too look at its existence with a more critical eye, please.

I’ve mentioned it before, but it’s worth repeating: Ready Whitley Strieber’s 1984 WWIII novel, “Warday”, about a fictional 1988 “limited” nuclear war between the USA and the then-USSR that lasts but 36 minutes…but the devastation from the EMP weapons (exaggerated, but the points the book makes are not) more or less “burns down the electronic village”, so all that “funny money”, in but a few thousandths of a second, goes “poof”, and with it, the instant economic collapse of not only the USA, but fairly much most of the world. Canada, though not directly attacked, did suffer somewhat from what they term “The ‘Electro’ “, and close their borders to the USA, especially refugees from the northern plains, badly hit with fallout from all the ICBM silos taken out in Montana, the Dakotas, Wyoming, Kansas, and Missouri. As if the war itself, though “limited” in terms of a single round of nuclear salvos, is terrible, killing about eight million Americans in the first hour or so, the REAL horrors are unleashed by the loss of deliveries of just about EVERYTHING, and loss of power in many areas and nationwide telecommunications and most broadcasting. What few working radios are left are highly prized, and it takes years for Japanese and European manufacturers to set up TV plants in the USA. There are few imported goods anymore, as few Americans have any money to BUY them, and the USA has become in effect a colony of Japan and the UK. Many US service personnel in Europe have managed to remain as “illegal aliens”, though the locals are usually hostile to them and if tolerated at all, exploit them terribly. And the fate of many “third world” countries are, well, awful, as most are in a state of civil war, pandemics, and de-population, with tinpot dictators everywhere. The Soviet Union also collapses, much as it did in the early 90s OTL, with even several “hermit” kingdoms or sheikdoms of the old Soviet “republics”. The situation is made worse by various Russian or Asian warloads with nuclear weapons.

However, the situation isn’t entirely grim. Most Americans that survived the war itself, or the various pandemics and/or famines that ravaged the country (down to an overall population by 1990 of about 170 million) more or less operate on a cash and/or barter economy. Such things as credit cards and car loans are but a memory, and the old mortgages and other debts from before the war are in a state of moratorium, which, in the book’s setting, is about five years postwar, and all but permanent. Real estate prices in most metros have completely collapsed, with homes, many with decay from neglect, being bought for the price of filing a claim and a title for ten “paper” dollars…in decent areas with a semblance of government and services, the typical price of a home in the DFW “metroplex” is 7,000 “paper” dollars, or 70 “Gold” dollars…but gold certificates are precious and FEW. There is even a resurgent auto industry out of the Midwest, but cars are of poor quality and lack amenities. Even so, there’s a long waiting list for them, as companies and state and/or municipal agencies have priority to replace all those fleet vehicles rendered “brain dead” in the war. Needless to say, very old vintage vehicles that had ordinary “points” distributors” and carburetors are HIGHLY prized, and often, if privately owned, are locked away in a garage with the owner standing armed guard over them. There is an industry to install new computers and components for newer cares, but most of them are unfixable due to decay, or being stripped for parts, especially tires.

I did not say the fractional reserve system was responsible for our economic growth to become the top world economy. I said it “allowed” that to happen. In plain English, the fractional reserve system did not PREVENT the economic growth of the US.

I’m not sure if I understand the point you make then. That’s not much of a claim.

If I inject heroin into my veins for ten years and do not die, I can then claim that heroin “allowed” me to live? I mean, after all, it did not PREVENT prevent me from living, right?

Ah-hem, Richard Greene, ya got it bass-ackwards:

“consumption that is not supported by production i.e. the dilution of the pool of real wealth.”…

https://mises.org/wire/fractional-reserve-banking-and-money-creation

-After 43 years of writing a for=profit economics newsletter, ECONOMIC LOGIC, one subject I do not get backwards is economics.

The Fed creates bank reserves out of thin air, and the banking system multiplies that initial credit creation by a large amount.

That has been true since 1913.

The system can be abused with excessive credit creation by the Fed, as in 2020 and 2021, to fund the huge federal deficits signed off by Trump and Republicans controlling the Seante while Trump was still President.

High consumer price inflation in 2021 and 2022 was the result. Biden had no responsibility for the high consumer price inflation rate in 2021 and 2022.

The Fed has mismanaged a 97% loss of the US dollar’s purchasing power since 1913. That is not the fault of fractional reserve banking. It is the fault of the Fed.

Bank loans are used to finance businesses, homes, cars, etc. If the loans are not repaid in full, the bank’s owners lose money.

If the Fed allows the money supply to expand faster than the supply of goods and services (GDP), then price inflation results.

Price inflation hurts many people. but helps others. Example: The price of your food goes up, but the value of your home goes up a lot more.

Biden had no responsibility for the high consumer price inflation rate in 2021 and 2022. He was a Senator and VP for decades. Trust me, he is and was part of the problem.

Price inflation is a silly concept. MONEY gets inflated, which reduces its purchasing power, which causes one to have to give more money for goods and services. The value of a good and service does not necessarily increase with inflation. It’s just that the purchasing power of the money decreases.

Please show me US GDP figures before and after 1913 and write that credibly.

1Q 2023 US household net worth was $149 trillion

1Q 2023 US household debt of $17 trillion

$149 trillion of net worth versus 17 trillion of debt is not a problem.

ECONOMIC COLLAPSE IS NOT INEVITABLE, although with Biden in charge anything is possible.

These data are from the Federal Reserve Bank summary of their 1Q quarterly Z1 report:

https://www.federalreserve.gov/releases/z1/20230608/html/recent_developments.htm

Sure,,, The Federal Reserve and the Government it owns would never lie or fudge numbers around.

Yup,,, everything is absolute gospel truth!

The Federal Reserve is owned by its member banks.

Have you investigated home prices recently? Jome account for a lot of private net worth.

Here we go again, Richard, with your blind faith in Caesar’s “data.” You’re one of those guys that says Fed is privately owned and not a government agency, huh?

The Fed is a creation of and is controlled by Caesar:

https://www.federalreserve.gov/faqs/about_14986.htm

I find it high comedy that many conservatives never trust data from governments. and most liberals only trust data from governments.

You can not debate any subject using government data with many conservatives, or any subject NOT using government data with most liberals.

The result is a lack of meaningful debate.

Almost everyone prefers to “take sides” — either you are with us, or you are against us. The classic False Dilemma (aka Either-Or) Logical Fallacy.

Most people have beliefs that can not be falsified with facts, data and logic.

Modern life is like a bizarro world.

Nope. Government data may actually contain truth, but it should always be viewed with caution. Remember all of the government data on the “cases?” It has become obvious to even the least intelligent that this “data” was absolute bullshit.

My point is that you seem to just assume its veracity because it’s “data.”

I do my best to differentiate between government data that are reasonable, and government data that are not. I am not a 100% anti-government data or 100% pro-government data person. but too many people are, IMHO.

The problem being, Government always has an agenda that does not care about truth. And how does one draw the line between factual data and agenda data?

It’s not a matter of the “data” being “reasonable.” The only question is whether the data is accurate and true. It can be difficult to discern this, but one should also consider the source, and government is known serial liar.

Huh, a timely article on LRC, Richard:

https://www.lewrockwell.com/2023/08/no_author/why-you-cant-trust-the-us-government-data/

Steve Kirsch sometimes has good articles that I recommend on my blog. That one was not one of them. I could only see the short Rockwell version because the full Kirsh version was paywalled. The prior Kirsch article about one nursing home also did not meet my standards. Kirsch claimed a Covid epidemic that happened after the Covid shots were caused by the Covid shots. He used correlation to attribute causation. I don’t accept that as valid evidence.

I agree with you about Kirsh (he can be a mixed bag), but he has been helpful to cast doubt on a lot of doubtful things.

It’s actually owned by a consortium of PRIVATE International banks, Richard. Where’d you get this idea thar the member banks own ANY of the Fed?

While the Fed Board of Governors is an independent government agency, the Federal Reserve Banks are set up like private corporations. Member banks hold stock in the Federal Reserve Banks and earn dividends. Holding this stock does not carry with it the control and financial interest given to holders of common stock in for-profit organizations. The stock may not be sold or pledged as collateral for loans. Member banks also elect six of the nine members of each Bank’s board of directors.

Who owns the 12 banks of the Federal Reserve?

Federal Reserve Banks’ stock is owned by banks, never by individuals. Federal law requires national banks to be members of the Federal Reserve System and to own a specified amount of the stock of the Reserve Bank in the Federal Reserve district where they are located.

Who owns most of the Federal Reserve?

According to the board of governors of the Federal Reserve, “It is not ‘owned’ by anyone and is ‘not a private, profit-making institution’.

Commercial banks that are members of the Federal Reserve System hold stock in their District’s. Reserve Bank and elect six of the Reserve Bank’s directors;

RE: “…the Federal Reserve, “It is not ‘owned’ by anyone and is ‘not a private, profit-making institution’.”

Go ahead and think that.

It’s owned by the mafia. A.k.a. The Power Elite.

Haven’t you seen, ‘The Godfather’ series?

Or, read much history?:

“If you ever wanted to know the backstory of how elites came to dominate America’s political economy and foreign policy, here is your preliminary guide.”…

https://www.lewrockwell.com/lrc-blog/establishment-studies-and-power-elite-analysis/

Net worth is a false equivalent. Net worth only has value as an accounting gimmick. Net worth is not a tangible asset. Net worth only has tangible value in that net worth can be used to create debt. Realization of net worth into real wealth, i.e. tangible assets, is not a given. My girlfriend in Los Angeles says she is doing fine, her home is worth over half a million, if she had to she could sell it for that amount, she believes. No. Your home is only worth what it actually can sell for. Period. Over 800 thousand full time jobs were shut down in July. Perod. Just July. What is the population of people who can finance a half million dollars for a home purchase right now? A lot smaller than a year ago. Much much smaller than 4 years ago. Net worth is an interesting measure of wealth, yes, and it may even be useful. But $149 Trillion? Are you seriously saying all that net worth could be converted simultaneously into tangible liquid currency? Of course not. Just like a 50% share holder in a large corporation would not recoup the exact net worth of that stock once they started unloading it.

This U.S. economy has been debt based for decades. Using pre-central banking wealth accumulation as the foundation for trillions upon trillions in debt creation. Its an old story; denominate every in an official currency, devalue the currency while borrowing beyond the ability to pay back, the favored few snap up devalued assets, pump and dump again, again, and again. Been there. Done that. Except now, in the U.S., the scheme has run up against reality, as they all do. And the pain is only beginning.

If you truly believe the U.S. economy is fine, look at the US Bank Freight Index. Then be afraid. Be very afraid

‘Debt has made all of this luxury and compliance possible.’ — eric

Businesses incur debt, expecting to make a return on a capital asset to service, then pay it off.

Households can regard debt in the same way. A house doesn’t earn a return. But if owning is cheaper than renting, then a necessary shelter cost is converted into a capital asset whose mortgage debt will be paid off, eventually.

Cars depreciate faster than houses. Buying a car with debt is a poor [double entendre] idea, unless the car buyer needs it to commute to work and thus earn a wage to service the auto loan.

But … what the hell am I on about? My granny used to talk like this. Today, it’s YOLO: You Only Live Once. Indulge yourself, before the next Great Inflation and Depression II strike. It was fun, fun, fun, till ‘Biden’ took the T-bird awayyyyy …

I bought a 2005 Camry using debt at only a 1% interest rate, even though I had enough cash to pay for the car.

For my 2016 Camry, Toyota wanted 6% for a car loan, so i paid cash.

You said in your comment that “Cars depreciate faster than houses”

In fact, home prices rarely go down over time while car prices almost always do. Using debt to finance a home has been an excellent investment for about two thirds of Americans.

House Price Index YoY in the United States averaged +4.58 percent from 1992 until 2023, reaching an all time high of +19.20 percent in July of 2021 and a record low of (-10.60) percent in November of 2008.

This page at the link below includes a chart historical data for the United States FHFA House Price Index YoY.

https://tradingeconomics.com/united-states/house-price-index-yoy

Two reasons why houses don’t depreciate. First is supply is restrained by zoning laws and regulations. Second is because cash is not an asset. So you have to dump your money somewhere, and you need a place to live, so houses make some sense. Really though, the only real estate investment that makes sense is rental property or maybe a REIT.

Hi RK,

Also, cars are not disposable in the way that cars generally. Few cars are still around after 30 years. Most homes are. They tend to be maintained and even improved such that the second or third owner gets a better home than the original. Most cars are decrepit beaters by the time they get to their third owner…

Even if the home is a ramshackle shed, it’s the LAND that appreciates. Where by actual demand (population increase and economic growth) or by inflation, more money chasing fixed acreage.

RE: “Even if the home is a ramshackle shed, it’s the LAND that appreciates.”

They had this graph on TheHousingBubbleBlog once, it showed house prices (land) from the 1500’s up to around the year 2000.