Few people like taxes – excepting, of course, those who collect them (and get paid, via them). But which tax – i.e., which form of legalized theft – is the worst: The tax on income – or the tax on property?

Examination of the thing result in just one answer. The most abominable of all taxes is the one applied to property; that is, to the home you will never own on account of these taxes.

This fact encompasses the fact that you will never stop paying taxes on income, which you’ll need in order to pay the taxes on what is not your home and never truly will be. If it were your home, you wouldn’t be paying money to keep from being evicted, which is exactly what happens to renters who don’t pay and that is what you are in the sense that matters most. Which is that you can be kicked out of what you think of as your place by the landlord for failure to pay.

The consequences of this fact are considerable.

First, there is the knowledge of the fact that you can and will be kicked out of “your” place – no matter how many years ago you thought you paid for it – if you ever find yourself unable to pay the rent. This fact vitiates the security of knowing you own your place; or rather, it engenders a feeling of insecurity, because you know it will never be your place.

Then there is the fact that the landlord can raise the rent at any time and irrespective of the “homeowner’s” ability to pay it.

There are countless cases of “homeowners” who have been forced to sell what they thought was theirs because they could no longer afford to pay the rent. This happens most usually to older people who’ve stopped earning income or who are earning less, being retired and living on savings and the federal dole (i.e. Socialist Insecurity). But it can also happen top people who thought they had purchased a place in an affordable area. Not just the home – but also the taxes levied upon it. But such areas tend to be attractive to other people, who also move there for the same reason and – before you know it – the taxes go up to pay for the “services” you neither asked for nor use, such as the government schools for the children who aren’t yours.

“The children” – and the “schools” – are the oft-used guilt-trips used to justify forcing people to pay taxes to pay for them (and specifically, to pay the generous salaries and benefits of the people who run them and who have acquired the power to force you to pay them, thereby eliminating any incentive for them to do other than demand more while doing less).

Including the people who do not use “the schools” and do not approve of what is taught there.

Jefferson had something to say about the evil of compelling a man to furnish funds for the propagation of ideas he finds abhorrent, such as those propagated in government schools.

It’s also evil, arguably, to say any man is his brother’s or his brother’s kids’ keeper – at gunpoint. Which is exactly what will happen when the landlord comes to evict you from what you allowed yourself to regard as your home, if you fail to pay the rent that goes to pay for such things as “the schools” and “the children” you didn’t bring into this world.

Objecting marks you as a mean-minded person, of course. Just the same as it marked you as mean-minded to not wear a “mask.”

These things may seem unrelated but they are in fact the same things, in principle. It is not enough that you take care of yourself – and thereby impose no burden on anyone else. You must be forced to take care of others – however they define it and to whatever extent. It is why there is generally no limit on how high the rent can go. Nor a cap on how much rent you must pay.

If you live in what you thought was your home long enough, you may end up paying more in rent than you did for the home, itself. Even if not, you will still pay a lot. (This writer has already been forced to pay about $40,000 in rent on a home purchased 20 years ago; if the rent does not got up, it will be about $80,000 in another 20. That is a lot of money; almost enough to buy a new EV, even.)

The point of all of the above is that the property tax obliges you to pay income taxes in perpetuity – because it is almost impossible for most people to be able to pay the property tax/rent without earning income, in perpetuity.

Or at least, until they die.

At which point, their heirs will pay the taxes.

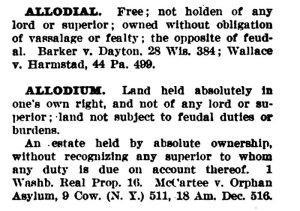

If, on the other hand, it were possible for people to actually own their homes free and clear, it would be possible to avoid income taxes by dint of not needing to earn much of even any income to be taxed. A homeowner’s expenses are (or can be) extremely modest. They encompass the unavoidable necessaries such as food (which can be raised and grown) and utilities (and the latter expense can be greatly minimized by using them less or even not at all). None of that requires generating an income sufficiently high to incur much, if any, income taxation.

That is why there are taxes on property.

It is not just about the money. It is about making sure you and I never have enough of it. That we are rendered perpetually insecure so that we are more easily controlled. The last thing controlling people want is for other people to be independent of them. For them to be able to accumulate the capital that makes people independent.

And that is why the tax on property is the most pernicious and evil form of taxation ever devised.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you like items like the Keeeeeeeeev! t shirt pictured below, you can find that and more at the EPautos store!

In case anyone has some doubt.

https://www.the-sun.com/news/8884614/evicted-300k-home-city-sold-it-3k-tax-debt/

It’s Bullshit. We had a similar law in Michigan re Tax sales. Guess what? It was held to be a “taking” by the government. Caused a lot of problems for both tax buyers and the governmental tax sellers. The governments have to upchuck the “profits” so sad. Of course the losers are all of us, the purchasers of tax deeds, the tax foreclosed and the tax screwed (all of us). Take that Richard and smoke it. You know-it-all.

There is a large campground two hours west of Phoenix that has thousands of campers from everywhere. The population waxes and wanes, 250,000 to 1.3 million is the estimate.

Winter time has more people there.

Taxes, insurance, municipal services will total some 60 thousand dollars and more after 20 years of living in your home.

You have to pay those teacher salaries of 66 or 77 grand a year up to 100,000 for principals and athletic directors. Superintendents probably receive a good 125 grand, so it does add up, even if it makes no sense.

Saw a PDF of teacher salaries of a local school district. I was taken aback at how much teachers are paid. Universities pay football coaches hundreds of thousands of dollars each year if not into the million dollar range.

You get to stand around with your hands in your pockets looking dumb and wondering how left behind you are.

Ben Franklin was right, death and taxes, no escape from either.

What gripes me about teachers is it’s only a part time job; 180 days of school required here, ~1/2 of 365. Plus all the weeks off for spring break, Christmas break, etc.

Indeed, Mike –

Also, these government school “teachers” (of obedience and dogma) get generous pensions when they retire, at our expense. I do not begrudge anyone who earns a living via the free market and the give and take of money for services rendered, etc. But I despise people who use the force of government to take their living – and then whine that they are “underpaid.”

Hi Mike,

Norm Macdonald (may he RIP) has an absolutely brilliant comic routine about teachers as “heroes”. It is just an audio, but apparently one of the “heroes” was in the audience and did not take kindly to his depiction. Norm put her in her place.

Hi RG!

Amen re Norm; he was brilliant.

PS: I thought I was the only kook up this early!

Hi Eric,

I am usually up at this time. I watch the news, drink a cup of coffee, and let the dogs out. I have some early meetings this morning, but sometimes I may go back to sleep for an hour or two…just not today. ☹️

One of your best posts yet. Absolute bulls-eye.

Had a whole ‘telligent remark thought up, but read through all the comments and don’t have much to add that hasn’t been said.

Only that — Ever think that we’re the ones who are cursed? We who can see, whose eyes are open?

Assuming that about 90% of people are mostly asleep and oblivious, and then 80% of the awake/aware are evil people and take advantage of the lies/scams/rackets.

Which leaves us 2% who know (and aren’t evil), and we’re absolutely powerless. And all we want is to be left alone. Feels like a curse…

“Ignorance is bliss”

Last month’s electric bill was 88 dollars to the penny.

57.25 USD was to have access to the electric utility’s electricity. 31.75 USD was the amount of electricity used.

Before Obamanomics, the amount for access to have electricity was 8 dollars per month. An increase in access charges has a total of 700 percent. Ripoff, nothing else there.

“Got my paycheck today

I think I’ll spend it like a crazy fool

Or I’ll give it all away

Something like the Golden Rule

Then I’ll have another drink

In a little place where I can sit and think

Ever since she went away

And left me here on my payday” – Dan Hicks, Payday Blues

Not that it matters.

Made a one dollar addition error. So sotty.

RE: “Last month’s electric bill was 88 dollars to the penny.”

Dang, mine was $188 and odd Cents this month.

Do you use CAC?

I have CAC, but don’t use it much. During the winter months, the electricity cost pushes up to $275 or so.

OT – Heard today that Biden is thinking about reviving the whole C-19 Bs again. Evidently, they’ve got a new “variant” –‘Eris’. I’d be interested in seeing if this triggers a Diaper Report complete w/ speculation as to how it’ll go over!

Eris rhymes with Valis — the Vast Active Living Intelligence System described by Philip K Dick in his eponymous 1981 novel.

Likely ‘Eris’ stands for Emergency Restraining Intelligence System.

Our sociopathic rulers like to imagine themselves as authors of our collective destiny. They throw in these little inside jokes, just because they can.

It sees you when you’re sleeping

It knows when you’re awake

It knows if you’ve been bad or good

So get vaxxed for goodness sake!

— Coots/Gillespie, Santa Claus Is Coming To Town

Eric, I’ve debated the property tax vs income tax thing for many years. Both are intrinsically evil- I would humbly contend that the income tax is worse in that its premise is that you don’t even own yourself. Property taxes could be ethically done if they were sales taxes with, say a 20 year amortization schedule so that you could eventually actually own your property.

And for the purists, yes, taxes are stealing and referring to them as being done ethically does not compute. True, but irrelevant. Unfortunately most of humanity wants a ruler and a master. Predicating otherwise is not going to change reality.

“Old man” Peters whines about the goobermint, and them there taxes, just before chasing children off his lawn while waving his cane.

You had to pay interest on a home loan, I assume, and taxes on the home’s’ value.

Do you regret buying the home?

Was it a bad investment?

Was it better than living in an apartment?

When you add up the cost of the home, including interest, taxes and capital improvements, how do they compare with the price if you sold your home today?

Would you have been better off living in an apartment?

For most people, buying a home is the best investment they will ever make.

You complain about $2000 property taxes a year, which is very low. How does that compare with the appreciation of your home. which could be $20,000 a year or more. You forgot to mention that.

Richard,

None of anything you say is other than the usual oily deflection you specialize in.

The issue is that I “owe” nothing to finance the government schooling of other people’s kids. Neither do you. Neither does anyone. The parents of kids have that responsibility. Those that need help may need help. Their need does not entitle them to steal.

Your annoying argument is that – on balance – I am better off having bought a home. This is like saying I won a race despite some asshole letting the air out of one my car’s tires.

If my home appreciates, it is an irrelevance unless I sell it. Did it occur to you that I bought my place to live in? The property taxes make living in it much more expensive. The $40,000-plus I have been forced to pay – so far – could have paid for many things I need. Instead the needs of others come first – at my expense.

@ Eric

Stated briefly, R.G.’s case is hopeless — and I don’t mean Raider Girl (she could have picked a better team tho, Oakland?? Yuk!!). He sort of reminds me of that famous Churchill quote about mother Russia in Oct 1939 after they signed the pack with the Nazis: “a riddle wrapped in a mystery inside an enigma”. For a guy who claims to be a libertarian (Bwahaha), for a guy who claims to have credentials, for a guy who claims to have higher education (granted, a meaningless term in this day & age), and, for a guy who claims a high mantle of intellectualism his credibility seems to come up a bit short.

Now, it’s not that the guy is stupid, I think most would agree. And it’s not due to poor writing skills which is obvious. His main problem (among many) is that which is common amongst most folks, he’s intellectually dishonest. Frankly like many others have suggested, I would just let him go on bloviating about his business and leave it at that. One things for sure, he’s a professional time-waster.

p.s. sorry to bring you the bad new R.G. (cmon now you already knew that) but your comments regarding Cheeto-Man were pretty good I must say.

“Old man” Peters evades every question better than most politicians. Looks like I have to ask the questions and answer them too.

A landlord typically rents a home for 0.8% to 1.1% of its market value each month. At 1%, your home would rent for much more than $2000 a month.

Yet you complain about $2,000 A YEAR property taxes while ignoring the incredible bargain you are getting by owning your home, compared with renting that home if someone else owned it.

While the price of homes may increase 4% year, compared with 10% a year for stocks over the long run, there is a big difference. A home is a highly leveraged investment.

Home purchased $100.000

$20,000 down payment

Assume 30 year mortgage at 5% interest rate

Total mortgage payment in 30 years $154,500

$154,500 + $20,000 down payment is $174,500 investment

$100,000 home value in 30 years at 4% a year appreciation

= $324,340 in August 2053

The average home appreciation in the past 3 years was +4.6% — I used 4% a year to be conservative.

A $174,500 investment over 30 years is worth $324,340 in 30 years

And you get to live in your investment by paying annual property taxes. If those property taxes are only a very low $2000 a year, that is a very good price for 12 months of “rent”.

If you want to complain about what the property tax “rent” is used for, that is another story.

Kuwait is a wealthy Middle Eastern nation known for its tax-free policy. Like neighboring countries such as Bahrain, Oman, and Saudi Arabia, Kuwait does not impose any property tax on its residents

.

Richard,

Are you seriously this obtuse?

It is not a question of how much I anyone else is forced to pay in property taxes. It is a question of being forced to pay any. I want to own my house. I resent being forced to pay rent – in perpetuity – to avoid being evicted from the home I bought 20 years ago. I don’t have kids in “the schools” and would not send them to government schools if I did have them. I do not use or want the “services” I am forced to pay for. Remind me, again, as to why I am obliged (morally) to pay for them?

Oh, but it’s “only $2,000” or so per year!

That makes it ok.

You know what, Richard?

I could have used that $2k to pay my Internet and most of my power bill. Instead, I have less money because I must pay for those items plus the property taxes.

If I had not been forced to pay the $2k-something each year, I’d have saved it – and would have $40k-plus right now to pay for such things as a back-up solar system, an outbuilding for a small herd of cattle (and the fence work I need to be able to have cattle). Instead, I have none of those things.

Because of people such as yourself, who think it’s “only” $2k-ish a year.

Eric:

You’re not understanding how much better it is to be beaten with a small stick than it is to be beaten within an inch of your life with a log chain! It’s a deal! The price you pay for civ-ull-uz-ayyshun!

And how do today’s “pube-lick” ensure the continuation of civilization?

Perhaps Richard is one of those elite who sit on the HOA (Home Owners Association) boards. He gets to tell others how to maintain their properties and, if they refuse, he can fine them or, maybe, CONFISCATE their house! They’re worse than property tax collectors.

Mr. Peters,

Perhaps it would be more comforting if you considered the property tax more of an investment. You may not want to avail yourself of the services provided by taxes but they do make your property more value.

Consider that a piece of property that had no maintained roads, no police or fire, no schools, no power, cable, gas, water, sewer line availability. That property would be worth half or less of the current value of your property.

You could pay 50 years or more of taxes before you would see a loss compared to a similar non taxed property.

It is unpleasant to pay taxes especially for services you do not use or want. But that does not necessarily mean you are going to lose out in the long run.

Services Richard?

What costs 10x as much and offers maybe 1/4 the value in return. Half that crap you mention has little to do with GovCo. Gas and Electric infrastructure comes from those companies. They invest to make back their money, albeit sometime a public/private partnership. Roads, they suck balls out here. Maybe I just get a side by side and keep my money. And somewhere you mentioned the cost of a well. I don’t remember GovCo pitching in jack on the two wells of mine paid for out of pocket.

Face it Richard, you are a shill for the man. Your life is to soft and you are rather detached (like most of Merika) from economic reality.

Indeed, Norman –

Richard is comfortably retired (he has said so) and living on a pension and probably SS in addition. He does not mind paying for the “services” he wants – and so, neither should you.

> Richard is comfortably retired (he has said so) and living on a pension and probably SS in addition.

Perhaps the proper response to his nonsense is a simple “OK, Boomer,” as that’s no doubt what he is with his smug attitude of entitlement.

Hi Easy,

“Perhaps it would be more comforting if you considered the property tax more of an investment. You may not want to avail yourself of the services provided by taxes but they do make your property more value.”

Perhaps – but is this a good thing? If my home increases in assessed value, the taxes levied upon me increase, eh?

And the core point remains: We lose when we are forced to pay. I located to where I am now to try to pay less – where the “services” are fewer. But then new people move and demand these “services” – and I get to “help” pay for them.

The worst thing, though, is the assault upon the very concept of home ownership – which becomes impossible when there is a perpetual (and always increasing) tax on the property. This is, in my view, a despicability.

This is the argument that I don’t get. Why would one care if your property goes up in value if you’re going to live in that house for the rest of your life.

Exactly, William –

It’s another one of those pernicious things about our times that a home is no longer a place to live but an “investment.”

A forced investment. The devil always was in the details…..and if you do not invest, the state (or borough/county) seizes your home and land from you….

Indeed, Shadow –

And there’s never an end to these “investments.” I have considered showing up at a county supervisors meeting to ask just how much I “owe” to “help” finance the government schooling of other people’s kids. Is it $40,000? I’ve already paid that so far. How about $80,000? Is it enough when I have paid a sum equivalent to half the purchase price of my place? At what point do I no longer “owe” these people money?

The answer, of course, is never.

“Old Man” Peters decides to form his own nation on an island off the US coast: Peter’s Paradise.

There will be no taxes.

Also no government

No public schools for children of poor families, unlike 191

of 195 nations in the world

No roads and sidewalks

No snow plowing

No water and sewer pipes

No garbage pickup

No police, courts and jails

No firemen

No zoning laws

No laws at all, without any government to enforce them

‘Survival of the fittest — fight off criminals with your own gun. You are also the judge and jury.

But no taxes

That is the dream of the Peters Paradise Island

Predicted population: one

Richard,

You bring out all the tired old arguments…

If a service is desirable, there is demand for it. People will pay for desirable services, freely. I do not require nor desire the “services” of armed government workers to enforce laws involving no harms done to others; I do not regard it as my obligation to provide funds for the government schooling of other people’s kids (and I resent what these kids are being taught in those schools, as any half-bright person ought to).

I live in a county that has no zoning laws – thank God. Do you know what that means, Dick? It means I can largely do with my property as I like, without having to beg the government for permission to do it.

And they ask me why I drink….

All these services can be provided privately. On a voluntary basis, probably a lot cheaper. And you only have to pay if you WANT the service.

Never mind that, John –

Richard and people like him are the arbiters of which “services” “we” need. That is to say, Richard and people like him will tell us which “services” they think “we” need – and force us to pay for them.

At gunpoint.

I listed government services EP is getting for only $2000 a year while forgetting $20,000 a year appreciation of his home’s value. And avoiding way over $2000 a month rent for a similar home. In fact, if his home is worth $500,000, it might rent for $4000 to $5000 EVERY MONTH == a payment he avoids by owning his home.

Did i ever say I approved of public schools and their current leftist indoctrination? No.

I would prefer school vouchers to be used for any public or private school rather than a public school monopoly.

I do not have children, but if I did, i would never send them to the leftist indoctrination camps known as the public schools. On the other hand I do not want children in poor families to never attend school, and have to work full time as children. Compulsory education was

191 nations of 195 nations have public schools. Compulsory school These laws were put in place not only to improve literacy rates but also to discourage the widespread child labor practices of the 19th and early 20th centuries. Attendance or compulsory schooling means that parents are obliged to send their children to a school. All countries except Bhutan, Papua New Guinea, Solomon Islands, and Vatican City have compulsory education.

Looks like the majority rules here.

There are free public schools for families that could not afford private schools.

The subject of what is taught in those schools could be a problem for half the people in America.

But there is no demand for the family of every student to pay the full price of the student’s education, while childless families pay nothing.

There are five US states with reduced or eliminated school taxes for residents over age 65.

Dick,

“I listed government services EP is getting for only $2000 a year …”

You are exasperating.

I do not want nor use nor approve of these “services.”

Life is tough — you do not always get what you want.

People with no children, or having no children of school age, finance public schools all around the world.

In 191 of 195 nations, the majority decided that if only parents of children in school had to pay for their education, many children would not get an education.

The usual decision was for all property owners to share the cost, whether they had children in school, or not. In 191 of 195 nations, but not in Peter’s Paradise.

Richard writes:

“Life is tough — you do not always get what you want.”

That is not an argument. It is a non sequitur.

“In 191 of 195 nations, the majority decided that if only parents of children in school had to pay for their education, many children would not get an education.”

So? This is the majoritarian argument. At one time, a majority favored chattel slavery.

Why not expect parents to be responsible for the children they produce? Is it too much to expect them to not have sex without using birth control if they cannot afford to raise children?

“The usual decision was for all property owners to share the cost, whether they had children in school, or not. In 191 of 195 nations, but not in Peter’s Paradise.”

No one is “sharing” – they are being forced. Oily people like you play words games to avoid discussing the truth.

“Peters’ Paradise,” as you call it, would be a place free of the collectivism and violence people like you seem to like – when it benefits people like you.

Richard continues to make arguments with his slave mind. Way to go, buddy. You’d be the first one to run with the bloodhounds to catch Mazza’s runaways, huh?

“Predicted population: one”

Speaking for myself, your prediction is at least 100% off. You aren’t doing climate predictions on the side are you?

Richard Greene employs the fallacy of Relative Privation (also known as the “not as bad” comparison) to somehow make the point that property taxes on one’s home are justified.

Richard must have forgotten to take his meds today. Without them his narcissistic tendency to be the center of attention compels him to put out a troll post. The tell tale signs are styling himself as “heckler” or preceding with some sort of jab, like “Old Man Peters.”

Man, you guys are always getting me scrolling back up to the top of thread & reading back down.

It just blows me away the extent & contortions some people go through to defend the tax racket of their overlords.

… Is that another way of saying, “They’re boot licking ass kissers”?

The usual character attacks, rather than a debate on the subject of property taxes and what we, and our community gains, in return for paying them.

Richard writes:

“…a debate on the subject of property taxes and what we, and our community gains, in return for paying them.”

Who’s “we,” Dick? You mean you – and those who share your views. If I (and others) do not share them, what does that matter – when people like you can use government to force us to submit to you and yours?

Of course, people like you are poltroons who lack the courage to actually do the taking-by-force of other people’s things. I know you would never personally go over to your neighbor and demand money for “the schools” – or whatever you think “needs” to be funded. But you’ll vote to have others do it on your behalf. And you’ll rationalize and euphemize what they do, as per the above quoted statement.

You are also not bright enough, apparently, to understand that once the principle is accepted that it’s legitimate to force people to pay “x” in property taxes, you have agreed to more and higher such taxes. Invariably, they increase to the point of insufferability – often driving people out of the homes they long-ago paid for.

Any authority given to tax is authority given to take it all.

“Old Man” Peters opposes all government by opposing all taxes. He wants anarchy.

No free public education for poor children — they couldn’t afford to live in his neighborhood anyway. So who cares about them?

.. And if you don’t pay taxes to build them, then don’t use the roads — taxes sent to the government paid for them. If you don’t pay taxes, yet use, or benefit from, government services, then you are a freeloader.

Richard writes:

“No free public education for poor children — they couldn’t afford to live in his neighborhood anyway. So who cares about them?”

It is not that I don’t “care” about them – as you and people like you oilily put it. It is that I deny their “need” imposes an obligation enforceable at gunpoint on me. And: Has it ever occurred to you that by subsidizing irresponsible people – e.g., people who produce kids they cannot afford to raise – more of the same is incentivized? And that responsible people are discouraged from having kids they could afford to raise, were it not for all the “help” they were forced to provide?

As far as “the roads” – oy vey – I pay for them every time I drive. Via the motor fuels taxes I freely choose to pay. I have no\ problem paying for the things I want and use.

Your problem is that I object to paying for the things you want and use.

But Eric, Richard is never wrong, and he will argue that point all day long.

“Yet you complain about $2,000 A YEAR property taxes while ignoring the incredible bargain you are getting by owning your home, compared with renting that home if someone else owned it.”

Okay, either you’re a rich snob, or you’re dumb as hell (or both). “Only” $2,000/year to MAYBE not get booted from what you THOUGHT was your own home. What a load! Just wait until we have to start paying annual taxes for the clothes on our backs! Oh, but don’t worry! It’ll “only” be $250/year! You should move here to Doitey-Joisey, if you’re not already a resident. Fuhrer Murphy and his family need more boot-lickers to fund their Bermuda vacation next year, so don’t disappoint! lol

Hi Blue,

Dicks’ despicable argument is, essentially: He can afford it, so you should not complain about having to pay it. This is the same basic argument often given by EV people who dismiss the coercion (and cost) associated with EVs. The most egregious example being Pete Buttigieg, who told people feeling pressure about the cost of gas to go out and buy a $40,000 EV.

Dick’s argument is also the “conservative” argument. And it is why Leftist always wins and advances, “conservatives” having agreed in principle with everything the Left argues.

You can live in your own home, rent a home or apartment or live on the street.

You made a choice and then complain about the cost of living in a home, while ignoring the price appreciation, and ignoring the much more expensive alternative of paying rent for a similar home.

If you live in a $500,000 home, and pay $2,000 a year in property taxes, then you are getting a bargain. Would your home be worth $500,000 with no government in the area?

Dick likes to blame the victim. He writes:

“You made a choice and then complain about the cost of living in a home, while ignoring the price appreciation, and ignoring the much more expensive alternative of paying rent for a similar home.”

I have never objected to the “cost” – as you oilily (per usual) put it. I object to the theft. I pay my bills. I resent being made to pay other people’s bills.

The “price appreciation” is meaningless unless I sell. If I don’t all it means is I will pay more to live there.

None of these points above are contestable.

You can argue that it’s right to force other people to pay for “services” they neither use nor want and may consider immoral.But that would force you to deal with the violence people like you always oilily avoid openly talking about.

Ye gods, I wish we lived in a country in which people like you were just annoying busybodies who could be ignored and avoided.

Already Cali(porn)ia is strongly considering a milage tax, on top of the already exorbitant fuel taxes and registration fees we already pay. This will in effect make all public thoroughfares in the once “Golden” State TOLL roads. WHY? Aside from “feeding the beast”? Three reasons are men. The first is to pay for highway infrastructure “rebuild”. Gee, it was my understanding that’s why the fuel taxes were raised. Second, with the CA “bullet train” stalled, the ding dings in Sacramento are trying to make up the BILLIONS of funding shortfall. Lastly, it’s claimed that fuel tax revenues are DOWN due to EVs. All the Tesla and Prius owners griped at the “impact” fees, so now the “pain” falls on ALL CA motorists. It should be self-evident that most of those rolling up the miles, via long commutes or in BUSINESS, didn’t vote for Governor “Pretty Boy”.

And some want him in the White House. Sheesh.

>Lastly, it’s claimed that fuel tax revenues are DOWN due to EVs.

How about we require the EV drivers to pay their “fair share” of highway construction and maintenance costs by taxing the electricity they use to charge their expensive “virtue signaling devices?”

Paying property taxes on your house means you never really own it. You merely rent it from the state you live in, or the county. Try not paying the property taxes, and see just how much you own the place.

Richard – your home appreciation argument is immoral. Appreciating homes is because huge government debts are being monetized by the Fed, which causes inflation, which causes society impoverishment for all, but the homeowner gets a break from this debt inflation scam, because the home owner is also in debt, like the government.

Government debt inflation has caused the biggest real estate bubble in history, because everyone knows the government will continue to inflate (as a way out of their debt) so they to leverage themselves to the hilt with as many properties as they can. The cumulative result is massive societal speculation in real estate to beat inflation. That creates a highly unstable real estate bubble which could unwind from rising rates.

Inflation of home prices is nothing to crow about, it is actually the debasement of currency, and only some people enjoy the inflation because of their debt leverage. The renters get screwed by such a process, rents go up with home prices, yet wages do not follow in lockstep, and the result is the current rent crisis.

Then you have the immoral situation where kids coming of age can NOT afford highly inflated real estate values – and the government’s response to this huge crisis that they themselves have created – is to kill them off with a death jab or push communism, or herd the young ones off to 15 minute gulag cities.

Your whole argument Richard is immoral, because, of course, so are you.

Brilliantly stated, Jack!

Especially the point about how inflated property values have excluded young people from buying a home. Here’s a specific example I can speak to personally. The little fixer-upper house I bought in Northern Virginia back in the mid-’90s for $150k would have cost $306k in today’s inflated currency (per CPI). Houses like it in my old neighborhood are selling for $500k-plus. Mind, these are little tract houses originally built for working class people when they were new back in the ’70s. T-111 siding, single pane windows – on a concrete slab. When I bought my place, it was a “starter” house. It is now the same house but a rich person’s house. Half a million bucks to live in a 1,400 square foot ’70s house on a slab, sitting on an 1/8th acre lot in a not-great part of Loudoun County.

You need to go back to Skool, in the purest sense buying a house to live in is only an “Investment” in a place to live. Most any so called gains are purely in inflated dollars. Then you have the pleasure of paying more taxes when your so called investment appreciates.

Unless you just happen to get lucky and buy in a location that becomes desirable in the future, your gain is a mirage.

I agree with this one, Peter: “Most any so called gains are purely in inflated dollars.”

I disagree. A home, is a depreciating liability.

Not, an investment.

An “investment” creates a return,… independent of fiat Dollar creation.

Keyword: ‘creates’.

Owning a home provides appreciation and you do not have to pay rent. Renting a home may cost 1% of the home’s value EACH month. In the long run owning a home, even after mortgage payments, and property tax “rent”, is a much better use of your money than paying rent for 15 or 30 years.

EP may be getting $20,000 appreciation of his home’s value each year, while complaining about unusually low annual property taxes of $2,000. He could not rent a home like the one he has for close to $2000 a MONTH. He would prefer no government and anarchy. That is an extreme minority position that few others agree with. That’s why anarchy does not exist.

Richard,

You are making the typical Leftist argument; e.g., he can afford it.

And then you trot out the justification: He prefers anarchy!

No. I resent being made to pay for “services” I neither use nor desire to fund. I have stated this very carefully and clearly on several occasions. Are you dense? Or is it something else?

I also pay $2000 a year for school taxes even though I have no children. I actually pay $3000 and get a $1000 rebate for being old and lower income. So my $2000 gets nothing in return and this is only a $250,000 home.

I live in the smallest home in a wealthy neighborhood where most people can afford a private school for their children, and many do pay for private school. Way more than $2000 a year for each student.

We all knew we would have to pay school taxes before we bought our homes, and we decided they were still a good investment versus renting a home or apartment.

Richard,

You continue to evade dealing with the issue. No one “owes” anyone else a cent unless they have contracted with them or damaged them in some tangible way. The fact that other people have kids does not impose an obligation on others to “help” them. That people like you think there is such an obligation – or do not object – is why this country slides toward authoritarian communism, having embraced most of its basic tenets.

Let me sum up Immoral Richard’s argument:

But, but, but, Eric. I’m getting fucked harder by the government than you are so you have no right to complain. Also both you and I knew that we were going to get fucked by the government before we bought houses, so we have no right complaint that we’re getting fucked.

Good grief Immoral Richard, STFU. Whether buying a home is a good relative investment has nothing to do with it.

Thanks, Mister –

Dealing with people such as Richard can be infuriating. Not so much because they are immoral – but because they are evasive. Richard has posted multiple times about how I’m getting more out of my house than the taxes I am forced to pay in order to not be evicted from my house. Despite my several times pointing out to him that it is not a question of whether I am getting value out of my house but rather a question of whether people have any right to any of that.

And they ask me why I drink…

From reading Mr. Greene’s post I don’t see that he is trying to make the case that property taxes are moral, just that perhaps they are not as bad financially as has been asserted. It is entirely likely that an immoral situation may be favorable in one manner or another. This doesn’t make it moral of course.

Some immoral acts may lead to desirable or favorable outcomes. It is a mistake to insist that because an action is immoral it will lead to bad results just because it is immoral.

And of course in this situation it is all academic as there is no choice on the paying of property taxes.

Hi Easy,

What Greene is attempting to do is to minimize the concept of the property tax, which renders home ownership in any meaningful sense an absurdity. He pretends it’s just a minor thing to be constantly presented with demands for more money by the local government, to pay for “services” one neither wants nor uses. Money that the person who earned it has a right to keep and use for his own purposes, whatever those may be.

He trivializes being obliged to pay (in my case) “only” $2,000 or so annually. It’s not trivial over time. I have pointed out that – so far – I have been relieved of well over $40,000 over the course of 20 years. Not counting the money I might have made by using that money for some productive purpose. If I stay here another 20 years – and assuming the tax does not go up (which is silly; of course it will go up) I will have been relieved of something on the order of nearly $90,000 by then.

Trivial, eh?

Ask Richard if he knows why California’s passed Proposition 13 back in ’78. First election I voted in. All I knew was Grandma’s property taxes on her home, bought party with proceeds of sale of the family farm, exceeded her mortgage. As she’d recently retired from the State, at age 67 (at the time), she was on a fixed income and faced the prospect of not being able to afford the rising property taxes. Many of the elderly were in a similar situation, often with homes long otherwise paid for. And for 45 years the Dummycrats have had the NERVE to bitch that it ONLY helped “rich” people.

Taxation on somebody’s dwelling, food and other of life’s necessities is particularly reprehensible.

“unusually low annual property taxes of $2,000”

Well if they’re so “unusually low”, how about you pay them for him? Apparently YOU can easily afford to.

A home does not appreciate. They are a liability. They require constant repair and maintenance. Any gains are simply a product of inflation. Or governments in other areas driving people to the market where you live. As in high property taxes.

If the price of a home merely kept up with inflation, owning a home would still avoid the much higher cost of renting a similar size home.

Rent is usually 1% of a home’s value each month and the rent increases as the home’s value increases.

If the home price and rent never changed, 30 years of “1%” monthly rent payments on a $100,000 home would add up to $360,000.

It’s your choice to buy a $100,000 home or pay $360,000 to rent a $100,000 home over 30 years.

It becomes a choice of simply leasing the property and letting the owner assume the risks and maint, or renting the purchase price. It’d be nice if folks could routinely pay “cadh” for their primary residence, but that’s seldom. But thanks to property taxes, NO ONE truly “owns” their real estate, mortgaged or not.

There are many advantages to the owning of property. You mentioned the gains will be in inflated dollars. However so will be the taxes. The value of the property over time is almost always more then the rate of inflation. Typically much more. Therefore your original investment grows much more then it would have if for example put in a savings account.

Also the equity built up in the home is an asset that can be used to provide additional advantages.

It has been said that owning a home is the best investment a working man can make. Off-times the monthly cost of a home mortgage is less then a monthly rent payment. It may not be for everyone but it certainly can be a good deal.

Well, hum. I’ve been a home owner since April 1977. Please keep track of your maintenance dollars and also consider your financial exposure to the budget busting costs of a new roof, new furnace, new heat pump, plumbing failures, appliances that die and can’t be repaired (looking at you $1200 LG fridge internal coolant leak at year 2 ). Driveways don’t last forever, concrete cracks and spalls, asphalt alligators into little chunks and the cost of replacement – wowser. Here in central WA your landscape requires irrigation if you want civilization instead of sagebrush. Come Fall the drain and purge by a truck hauled giant compressor mandatory to avoid catastrophic freeze damage over the Winter. Money, money, money baby!

I am handy at spinning wrenches to keep it all functioning but roofing, jackhammering failed driveways, pouring concrete ain’t happening at 68.

Another joy when you sell your home in WA, the real estate excise tax (REET) now graduated rates but figure on about 1.78 to 3.50 % based on transaction value, combined state and local. Oh and it’s not a gain/loss tax, it’s gross sale amount tax. So, when the economy tanks and you sell your $600,000 hovel for $450,000 that’ll be 1.78% on $450k. Wounded financially then the State drives the knife in even deeper. Never mind the property taxes all those years.

A $600,000 home could cost $6000 a month to rent. You completely forgot all the $6000 a month rent payments you will not have to pay because you bought your home.

The possibility of a $600,000 home losing 25% of its value in a recession is slim, unless you bought at the top price and sold at the bottom price. And no one would be forcing you to sell at the bottom price.

How much did house prices fall in 2009?

The bursting of the housing bubble has brought the steepest and swiftest decline in house values in recorded US history. The national median house price fell from its peak in July 2006 to January 2009 by 29 percent. There was also a value loss of 27 percent over a four year period (1929-1933).

Richard,

In order to not haver to pay that putative $6k per month, the homeowner had to pay off the house. And regardless, he is still forced to pay the government. You dismiss this as trivial in relation to the home’s appreciation in value (uncertain and even if so, it is an irrelevance unless the person sells the home or takes out a loan) and you still miss the point at issue – which is not the amount the person if forced to pay but rather the fact that he is forced to pay it.

And the amount is never trivial.

Never mind that another serious proposal from both the Korrupt Kenyan Kandidate and FJB is to deemed the difference between Richard’s hypothetical rent payment and what you actually shell out in mortgage payments as imputed income, therefore, TAXABLE. I shite you not.

You may not believe this Richard, but damn few people pay $6000 per month rent, nor live in a $600,000 home. Not many more at half that amount or less.

Hi Easy,

Yes, all true. But the issue here is not a subjective utilitarian one (Richard’s argument). It is, simply: Is it morally an affront that people can never truly own their home given the property tax? And – more broadly – is it morally defensible to compel people to pay for “services” they do not use and oppose funding?

I think everyone in this conversation agrees that forcing people to pay for services they don’t want or use is immoral. One may counter that argument by saying you choose to live in that place knowing that you would be forced to pay those taxes. However that does not make it moral and anyway there are few (none) places where you could avoid a property tax.

You do generally get a lot for the taxes though. If it was a free market for services, some of which you would purchase, the cost may be much higher as the economy of scale of everyone in the same system probably would reduce prices for those services.

It may be the best option money wise and from an organization standpoint the simplest. But it is still taxation.

Hi Easy,

in re: “You do generally get a lot for the taxes though.”

That’s a subjective value judgment. I place negative value on such “services” as those dispensed by armed government workers and government “teachers.” It is bad enough being robbed. It is much worse to have things you loath financed by the money stolen from you.

I have never understand the logic of forcing “services” on people in that this proves these “services” aren’t wanted or considered necessary by those forced to pay for them. The fact that others may want them and consider them necessary is as beside the point as the wants of a common street thug. Even if the thug “donates” your money to an orphanage.

“If it was a free market for services, some of which you would purchase, the cost may be much higher”, but more likely much lower, given market forces, and the more efficiency in a free market for such services where there is competition among providers. Private schools typically cost less per student than public schools, how much depending on location. Because there is competition. Your taxes are fed into mandated monopoly. You are given no choice in the matter.

I think there is no way to predict that a free market will be cheaper in providing services. It would depend greatly on many factors. For example a rural area might only be able to provide enough revenue for one private police department which would then be free to charge any price they wish. At least theoretically you have some control over the local municipality police cost through voting on council members and millages.

Hi Easy,

The free market provides services at a price the free market will bear. That price is necessarily in line with what the market will bear. The real issue here is whether people can be free when they are forced to pay for “services” they don’t use or want, because others want them.

Here’s a good example: I live in a rural county. Of what use are armed government workers to me? If a thug attempts to violate my home, it will be up to ME to deal with it. Because the armed government workers are more than likely nowhere in the vicinity and it will take them anywhere from 15-30 minutes or longer to be on scene, by which time the situation will be over. What “service” am I getting? All I’m getting is fleeced – potentially – by these same guys running a radar trap and – actually – by the taxes I am forced to pay that pay their salaries.

I think you underestimate the work that the police do. It would be rare for you to face an armed conflict. However if your house was burglarized or a car stolen you would need the services they supply in investigation and hopefully recovery. If you had a dispute with a neighbor, an accident, property violation, other emergency, they will be needed. Most of the work they do in apprehending criminals goes unseen but is important to maintain a decent environment.

Oh dear. Easynow, have you ever reported a crime? How’d that work out for you?

When has any cop actually helped you?

Hi Easy,

What do most cops spend most of their time doing? Enforcing laws that illegalize actions that involve no harm to others. In any case, when you say, “I think you underestimate the work that the police do,” you are making a personal/subjective value judgment. If my home is burglarized, it is unlikely in the extreme that cops will recover my stuff.

Here is what maintains a decent environment in my neck of the woods: Distance and diffusion. People don’t rub against one another constantly, as in the city.

Also, everyone here is armed to the teeth. Unlike the ‘burbs (and the cities) breaking into a home around here is a good way to find yourself disappeared.

Holy shit, “Dick” is attempting to master his perverse and obviously, unhinged parlor game and now he’s sucked Easynow into his matrix.

James N

August 22, 2023 At 12:03 pm

Holy shit, “Dick” is attempting to master his perverse and obviously, unhinged parlor game and now he’s sucked Easynow into his matrix.

Haha! Take the “Greene” pill and be sucked into the “unhinged” matrix!

“… as the economy of scale of everyone in the same system probably would reduce prices for those services.”

Reduce prices??? When the government runs it there is no “reduce prices”!!!

Apologies in advance if it’s already been stated within the 117 comments.

Property tax is the most asinine and heinous tax.

A guy like myself pays for compulsory schooling though property tax, when I have home educated both my children into adulthood. I not only don’t use the services, I don’t approve of a huge majority of what is happening even in the “red state” I live in.

Compulsory tax funded schooling puts everyone in the same box. The dumbest are dragged along and the smartest are impeded from actually learning and thriving. All the while your children are away for the tune of 8 hours a day having who knows what jammed into their impressionable minds. Psychopaths playing the long game know this. Which is why they HATE people having control of their own child’s learning.

The fact that property tax can be used to push whoever cannot afford to maintain the payments off their land is serfdom in a softer modernized sense.

In some allegedly backwards parts of the planet there is a saying: “Plomo O Plata.” Translation = Lead or Silver. Give or Take the bribe / OR / you get the lead (Bullet). Their hands are right there waiting to be greased, not hidden in plain sight behind their back while they wait for your decision.

ALL Taxes are immoral to those who actually try to live Moral lives. We have been living in a Banana republic for as long as I can remember. I received most of my knowledge from the school of hard knocks. Thank you Eric for this, I have been saying such for years to many with deaf ears.

Bingo! Great post Eric.

I have been bitchin’ about property taxes for the past 30 years, especially school property taxes. If…and that is a big If…property taxes must be levied to pay for parts of society, then the tax should be based on the property itself and NOT what is built on the property.

Where I live in rural Upstate NY, our property taxes are 3.5%-4% of the assessed value of the property. My house is assessed at $105,000. My property taxes each year are:

$2,000 – County/Town taxes

$2,100 – Schoool taxes

$4,100 a year property taxes I pay. My house is paid off, so I pay $341 a month rent to the government.

If the property taxes were based on the property itself (.50 acres) and NOT my home value, my taxes would be a little over $100 a year. THAT would be doable. Plus it would allow home owners to upgrade their properties without worrying about being reassessed and having their taxes go up.

That is my dream anyway.

I hate paying for school taxes seeing as I have no kids, and the public schools around where I live are woke hell holes. I have voted NO in a couple of school budget votes and of course the school budget always passes (its a miracle, always the vote is 400-35) giving a 2% increase – every year. I stopped voting at school budget votes.

If I was governor of NY here is what I would attempt to do on day one:

1. Base all property taxes on property value only (residential at first)

2. Remove NYS inspection requirement for all vehicles

3. Remove eye test requirement for driver’s license

4. Have only one NYS driver’s license (right now I believe NY has 3 types)

5. Remove the tolls from the NYS Thruway

Just little things to give New Yorker’s a few dollars back into their pockets.

Oh well, never going to happen.

In Missouri, funding increases for schools are always voted on in April. Given the low turn out, most of the voters are those with a vested interest, as in teachers and administrators who are going to vote in favor.

I watched the video and here are my comments and what I did to beat the system. You mention the fact that if you owned your home and property, then you wouldn’t need much income to live, just enough to pay the land tax and food. That is very true, and I have lived that way for many years – because I was conscious of the ripoff and proceeded to make myself free.

To beat the system of taxation (which is really slavery to the state) I moved to a highly conservative state with low taxes and low power rates and small government. I found a county that had nearly zero building fees, and I paid for a lot with cash and built a house for cash. I did this twice in two areas of Idaho.

I bought bulk food for the winter, I hunted for game and fished, and all my heating needs were with wood. I built a hot water heater hooked to my wood stove, it took me a few tries, but finally I met an old boy who showed me how it is done. (you have to get a cast iron heater that sits in the back of the stove – it is then plumbed to a hot water tank that is above the stove so it naturally thermosiphons with no pump).

https://i.pinimg.com/originals/07/db/e3/07dbe350d4e3b4efb24bef85018f24ef.png

My electric bill averaged around $5 a month for lights, my heat was essentially free from the wood I cut in the woods, most of my meat was elk and deer. I learned how to be a mechanic, and never had an auto bill, I learned how to buy and service used vehicles.

So I did what you are speculating, and you have so much free time that I was always at the local coffee swill and shooting the shit with my equally free friends, and we went hunting all of the time, helped each other get the elk or deer out of the woods and dressed.

I did have to work hard shoveling snow until I got smart and bought a good John Deere snowblower. Most of my friends had trucks with plows. When the snow slid off the roof we adults would run outside and count the kids, making sure one didn’t get buried.

So I can tell you first hand, if you want to live free, that is one way to do it. And no I did NOT beat all the taxes, but I did minimize them. And I can tell you something else, many, many people live this way in Idaho and other rural areas, and some even home school and raise their own beef (which is way smarter than trying to kill some skinny deer).

I grew up back east in Amish country, and was always a bit envious that they had a community and they all lived the way I am describing. They raise barns and houses for cash, they have milk cows, they make delicious cheese and breads, their lawns are neatly mowed without a powered mower, their clothes are simple and put out neatly to dry because they do not have dryers (nor refrigerators some of them).

Later in life I became a Libertarian and promoted the Free State Project and found out the government really hates it. So what I also learned Eric is that humans are a domesticated slave specie (created by the “gods”) on a prison planet, which in many ways is a kind of hell.

Hi Jack,

Yup! I have done similar, though not as well and not to the extent you have. I probably did not move far enough out into the Woods (a difficulty for me if I wish to continue reviewing new cars). But, far enough to avoid a lot of the worst. So far. I still need to figure out how to add solar for basic power needs and to rig up a water heater such as the one you have. My utility bill is not huge, but it’s still one of my major monthly expenses. Also, the high-speed WiFi, another unavoidable (I think) cost. But, things are hugely better here than where I was, when I lived in Northern Virginia!

“But, things are hugely better here than where I was, when I lived in Northern Virginia!”

I figured that, you are to close to the District of Criminals, and your local county officials are learnin’ the ways of the Potomac Parasites.

Solar is expensive for how many watt hours you get, I have run the numbers many times, grid electricity is dirt cheap. What you want to do is change how you use it, unless you have gas, 90% of your light bill is not for lights, it is for heating water (huge) and space heat (huge). Defeat those two and you win.

A good experiment is get a used analog house meter and rig it up and measure everything in your home. Measure the fridge, the water heater, measure the toaster, etc. You need a meter base and a meter and wire it up like an extension cord.

Another way – just turn everything off except what you want to measure – then go outside and see how much power is being used on the house meter.

You can also read the labels on what they are rated at, then estimate it. Your bill lists the Kwh rate, nation wide it is about 8 cents per kilowatt-hour. Convert everything to that unit.

I can tell you this, your water heater is using 90% of your power.

Dude,

If you think April or May in FL is bad, you should try July-YIKES! One year, when my company shut down for a week in July, I visited my brother down there. I used his motorcycle to get around. Even without wearing a jacket (I wore sneakers/shoes, long pants, t-shirt, and helmet), I was still SWEATING MY ASS OFF! No, you can keep the FL summers, TYVM.

The ignorance found in many people seems to have been expressed perfectly by Coldcash below.

It has been said that it’s never too late to correct such ignorance in adults. Who knows?

Without any government in place, “..Eugene Hollon writes that the western frontier “was a far more civilized, more peaceful and safer place than American society today” (1974, x). Terry Anderson and P. J. Hill affirm that although “[t]he West . . . is perceived as a place of great chaos, with little respect for property or life,” their research “indicates that this was not the case; property rights were protected and civil order prevailed. Private agencies provided the necessary basis for an orderly society in which property was protected and conflicts were resolved” (1979, 10).

https://www.lewrockwell.com/2010/09/thomas-dilorenzo/was-there-a-culture-of-violence-in-the-old-west/

This was a good one, too:

“..Although the early West was not completely anarchistic, we believe that government as a legitimate agency of coercion was absent for a long enough period to provide insights into the operation and viability of property rights in the absence of a formal state. The nature of contracts for the provision of “public goods” and the evolution of western “laws” for the period from 1830 to 1900 will provide the data for this case study.”…

https://mises.org/library/not-so-wild-wild-west

For a more in-depth bit about liberty in our times without government, Murray N. Rothbard summed it up well here:

‘Society Without a State’

“…The idea that the state is needed to make law is as much a myth as that the state is needed to supply postal or police services.

Enough has been said here, I believe, to indicate that an anarchist system for settling disputes would be both viable and self-subsistent: that once adopted, it could work and continue indefinitely. How to arrive at that system is of course a very different problem, but certainly at the very least it will not likely come about unless people are convinced of its workability, are convinced, in short, that the state is not a necessary evil.”

https://www.lewrockwell.com/1970/01/murray-n-rothbard/how-anarchism-can-work/

However; reading is hard. For some people.

Let alone, thinking.

No matter what the “wild west” was like, we have nothing like that world today. And Rothbard lived 50 years ago, his writings even older. If you think we live in the 1940’s USA you are delusional. And none of those examples were of life without government. It was a little government because it involved few people and a lot of land. They still had Marshall’s, sheriff’s, land offices, federal troops, and local government. They would have loved to have a fire department. You can’t argue for this old tyme government in the modern world.

Cold Cashy: What is it about the “modern” world that requires big government? Do tell.

Coldcash Bot –

It is the principle that’s at issue; the practice is incidental. But I doubt your algorithm can process that.

Sigh,…Some people (er, bot?) ya just can’t help.

Willful ignorance in People -is- just like programming.

One other crucial difference. In the Old West, it was never “DARK in the afternoon”.

That’s why I enjoy reruns of Jack Webb’s “Dragnet”. Los Angeles when it was mostly WHITE. It’s like looking at a FOREIGN country now.

You weirdo anarcho-libs are at it again. No taxes, this time for “property” taxes, and the main complaint is about schools. Not surprising coming from a group no one wants to mate with so you have no offspring to consider.

Think about a world without schools. Feral youths traveling the country side, looking for a way to kill time. Mom (no dad) couldn’t afford school so education comes from the other kids on the street. That’s your idea of a good society?

No property taxes? Then not only schools go away. You don’t get sewer. You don’t get water lines, you don’t get electricity, you don’t get cable. House catch fire, put it out yourself. Gang of kids try to rip you off, no cops to call. Enjoy the dirt roads, no one’s building one for you. Traffic control-forget about it-you don’t like ‘em anyway. Complain to the local reps, nope no local government.

That’s the utopia you are begging for. It’s not communism or fascism for people to form government. It’s the way humans have lived since civilization started. Stop whining.

That reminds me of Monty Python’s Life of Brian:

What Have The Romans Done For Us?

https://www.youtube.com/watch?v=Qc7HmhrgTuQ

Joe Biden, the sick perv is like the Roman Emporer – who lacks the self inspection to know how everyone outside his inner ass kissing yes-man click, views him:

Biggus Dickus – Monthy Python, Life of Brian Best Scenes

https://www.youtube.com/watch?v=yzgS61zgPEg

Let’s hope Eric doesn’t get “thrown him to the floor” treatment, lol. You never want the attention of the biggest dickhead in charge.

I know you and commonsense are not well acquainted but the “What have the Roman’s done for us?” skit is support for big government. Thank you for pointing that out as you all rage about the evils of taxes from your comfortable air conditioned homes on paved streets, protected by firemen and cops in a peaceful neighborhood. What has government done for me you ask.

Protected by firemen and cops LOL. They’ll scoop up the ashes or your body maybe.

Didn’t realize this was a troll thread. Oh well. By the way I spit on our miltary’s “service” Mr Cash.

Hello, Cashbot!

I see you’ve changed your IP and email again:

[email protected]

174.245.2.14

[email protected]

154.6.94.21

[email protected]

149.57.16.184

As far as my “peaceful street”:

It’s peaceful because everyone around here is armed – and everyone knows it. The armed government workers you venerate are 15-30 minutes away when seconds count. Also, I am not a quivering cunt that wraps myself around the leg of other men to protect me. I take care of myself.

You always avoid dealing with the foundational thing here, which is that if these “services” are so desirable, why is it necessary to force people to pay for them?

And: I use my real name. Not a faggy made-up name like “Coldercash.”

Coldcash, you have the intelligence and insight of somebody that was taught by the government schools. You’re giving us the “Somalia” argument -“feral youths. . .”

It wouldn’t be “a world without schools.” Schools would be run by the private sector that would be accountable to the students and their parents. They wouldn’t be the government indoctrination centers that they are.

Explain how private residential communities, malls or theme parks (think Disney) are built with paved roads and traffic controls?

To my knowledge, electricity is not provided by the government and neither is cable

When was the last time you saw government firemen stop a fire? I witnessed the fire department watch a house nearly burn down in my neighborhood while they took their sweet time unrolling hoses and assessing the situation. They got on the ladder truck, chain-sawed holes in the roof and flooded it with water. The net result was a completely destroyed home.

When was the last time you saw a cop stop or be actually helpful to the victims of a crime? Me neither. Instead, we get pulled over and ticketed by them. Gosh, I’d really hate to lose that service.

Government schools, utilities, police and firefighters are a relatively recent thing in human history, but they didn’t teach you that in gubmint school, now did they?

If the government didn’t tax the hell out of everybody and declare a monopoly over all of these things, they would be provided by private firms that are accountable to their customers.

I missed two:

“Complain to the local reps, nope no local government.” That’s about all they’re good for. You can complain but nothing will result. Besides, the only reason people complain is because some government policy is screwing them and they seek relief from it through their “local representative.”

“You don’t get water lines. . .” You mean the ones that deliver water that I have to filter because it contains it stinks, tastes like shit and contains all sorts of contaminants like heavy metals, chlorine and toxic waste known as fluoride?

Coldcash: Your arguments suck!

Disney world? You mean the place built by the taxpayers of Florida? I’m sure you’re a big fan of Disney because you too live in a fairyland, one where all fireman and cops are bums.

But like most libertards you fall back on some ridiculous idea that those services could be provided privately.

And your water stinks (from lines you didn’t build) and your electricity comes from lines you did not pay to install. Streetlights, parks, animal control, courts, all useless according to you. Admit it, you’re just a cheapskate that uses services and doesn’t want to pay your share.

Ok Cold-Cashy: If the private sector can’t seem to figure these things out, tell me how government magically does?

Sorry, the nearby streetlights, water lines and park were all built and paid for by the developer, from which this “cheapskate” bought the house. I do see shitty government parks with drug addicts in them and government streets without lights though. Probably because the citizens just haven’t been taxed enough, right?

Animal control? That’s the best you’ve got? Don’t tell me, without them there’d be rabid feral dogs running the streets along with all the feral youths.

What “share” should I and others pay for the streetlights, schools, cops, firemen, etc. that you find so important? Why do you need others to subsidize these things for you, cheapskate?

What a bunch of lame-o, loser arguments, Cold-Cashy. Speaking of fairytales, what else did they tell you in your government high school civics class?

You go on and on about how bad all the services you receive are. That’s not even remotely true in most places. I imagine a cheapskate, hate your neighbor, guy like you lives in a shitty place. That’s why they’re shitty. Shitty people.

Most people get clean water, dependable electricity, trash pickup, road maintenance, police service, and fire protection. Maybe move someplace where all the services don’t suck so much and at least get your money’s worth.

Cold-Cashy: You’re a mind slave spewing the regime’s talking points. You’re shitty made-up arguments just suck!

If government were as good as you claim, it wouldn’t have to finance itself through armed robbery, aka taxes. People would fund it voluntarily. It isn’t, so we don’t.

There is no way cheap shits like you would finance government if it wasn’t required. You’d complain that the services weren’t any good like that Mister Liberty clown, try to dodge the responsibility by claiming some moral high ground foolishness like Peters, or make up a conspiracy like a lot of the others.

Hello coldercashbot,

We are “cheap” for not wanting to finance what you want.

And – again: I see you are fine with using this service – which you’ve not paid for.

You’re the freeloader.

You’re also a disgusting little coward who hides behind anonymity.

Your regime invective is tiring and without merit. You’re the cheap shit that wants everybody to be forced at gunpoint to pay for things they don’t want. You add nothing to the conversation that we don’t already get on a daily basis by the regime media. Now go fuck off.

Coldcash,

It is not about the “services you receive.” It is about not wanting these “services” – and being forced to pay for them anyhow.

PS: We know you’re a bot. AI isn’t as intelligent as it thinks.

Coldbot –

All armed government workers – i.e., “cops” – and non-volunteer firemen – may not be bums, but they are receivers of stolen goods. They use the state to force people to pay for their “services.” How about I threaten to kick you out of your home (well, I know this isn’t possible as you’re a bot) if you fail to “help” me provide the “service” you’re using right now? That is to say, my site?

The fact is you’re the freeloading cheapskate. Not I. Not others here.

You’re the free loader. Did you pay anything for the water lines to your property. No? Receiving stolen goods! Did you pay to put up the poles and lines that bring the electricity to your property? No? Receiving stolen goods! Did you pay for the road in front of your house you use everyday? No? Receiving stolen goods! You’re worse then a cop who only receives stolen goods for his salary, you receive the benefit of millions of dollars of infrastructure!

Hello Cashbot –

Did I pay for the water at my place? Yes, absolutely. I am on a well, you see. And I paid for every cent it cost to dig it and plumb it.

I pay for the electricity I use. This includes my share of the cost of getting it here; it is part of the bill, you see. I pay for the roads (via motor fuels taxes).

You’ll need to bring more than a rubber knife to this gunfight, you AI Twerpbot.

If you have a well then you aren’t “taxed” for water. You may pay for electricity but that doesn’t cover the cost of all the infrastructure needed to build it, same with the roads. You only have those things because millions before you paid their taxes so that there would be roads and poles. Not to mention all the other services a large nation requires. Your whole life is in debt to a collective that has made whatever living you have managed possible. You act as if you are have not benefitted from it, which you have immensely. And for some reason you think after all the years of raking in the benefits of society you should be able to be free of the responsibility. And you have the nerve to say that is the moral choice!

Cashbot,

The cost of building/maintaining the power lines is factored into the bill you pay. The roads are pay-as-you-go, via motor fuels taxes.

You’re just not very bright, are you?

Like Obama – probably a hero of yours – you say (essentially): You didn’t build that. But it is parasites such as yourself who take what others build and make them pay for what you want (and they don’t).

No wonder little worms such as you hide behind anonymity online.

My bet is you are either (a) a college kid (b) a person being paid to heckle sites such as this one or (b) a government “worker” of some kind.

Well, if you weren’t a not particularly bright chatbot.

Eric and others: Cold cash is a Troll sounds a lot like MB or Cashy. Do not respond. Waste of time. Delete it and block it. Boy Eric you are getting coverage. I will send another check. The slimes are worried.

Nobody’s worried about dingbats like you. It’s just hard not to comment on such ridiculous things like abolishing taxes which will clearly make life worse.

Yes Cold-Cashy, you moron. Taxes are good. Just as war is peace, freedom is slavery and ignorance is strength.

Coldcash,

How would not forcing people to hand over a large (or even any) portion of their money “make life worse”? I can assure that my life would be a whole lot better if I even just had the money that has been stolen from me over the past 30-plus years in Socialist Insecurity “contributions” in my pocket rather than extracted from me via threats of murderous violence.

PS: We know you’re a bot.

Morning, Ugg!

Yup – and thanks!

CashBot is just that. It uses the same odd (and changing) Gmail address. It is interesting in that it is just facile enough to be almost believable. God help us when we can’t tell the AI from the real people.

Cashy say “Think about a world without schools.”

Let me lay a flash on ya slick. We have that now. Feral youths roaming the cities, allowed to steal, rape, and beat people at will. Copfucks that don’t really do shit about it, so whats your point? All evidence that we don’t really need schools, or at the very least they should be voluntary. Some types were meant to learn and achieve and some were just meant to be warehoused. Spare me your vapors about roads and sewers, we have fuel tax for that.

Imagine how much worse it would be if they weren’t warehoused like they are now. Remember those people vote. Some education gives a few of them the chance to learn a little about the world. You may not want to admit it but you have to share your world with those people and the better off they are the better off you are. Think a little bit about the future instead of complaining about having to pay for a better tomorrow today.