Houses in my area – a rural county in SW Virginia – didn’t used to cost so much that most who live here couldn’t afford to buy one.

They do now.

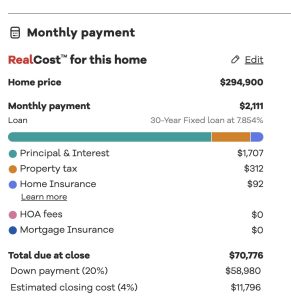

Here is an example. This small house – it is only about 1,100 square feet – just went on the market for just shy of $300,000. It would cost (according to the estimate that runs with the ad) some $2,100 per month to live in this house, assuming you could afford to put 20 percent – just shy of $60,000 – down. Plus just shy of $12,000 on top of that for closing costs – for a grand total of just over $70,000 due on the day you get the keys.

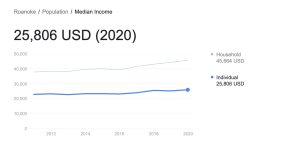

The average individual living in the area earns just shy of $26,000 annually. Family income (dual earner) is just shy of $46,000. Very few individuals or families who live here can afford such a house.

The usual lending standard defining “affordability” is the 4-1 ratio of income to home cost. Thus, a family with a $46k annual income could handle the payments (including the down payment) on a home that cost about $184,000.

There are fewer and fewer homes available for that amount of money in my area. The question arises: Who is buying these $300k-plus homes, then?

The answer seems to be twofold.

The first is people who do not live here. They are people who live in areas such as Northern Virginia – were a $300k home is usually a townhouse. A shabby townhouse. Up there, a $300k single family house such as the one for sale down here would be like getting a house for free.

Or at least, half price.

And that is why so many of them come down here to buy one.

They are mostly government employees and people whose work is with the government who live in the distorted world of government, which pays people much more than they are worth in the free market because the government can pay them irrespective of what they are worth – because it has the power to make the rest of us pay them what they think they are worth. That is nice work.

Such a person sells their $300k townhouse – or their $600k single family house – and it is no trouble at all to buy a $300k house down here. Especially if they are still being paid a Northern Virginia government worker’s income – which they can still collect by working from their new home.

But it is not just that – as even the homes for sale in Northern Virginia are no longer affordable for many who work there, including even government workers. I can speak to this personally, because I used to live there – in a small house an hour’s drive away from downtown DC, built on a slab, with single pane windows and T-111 siding on a tiny lot in a working class ’70s-era subdivision. I bought it for $150k back in the late-’90s. Adjusted for inflation, that $150k is equivalent to what about $300k would buy today.

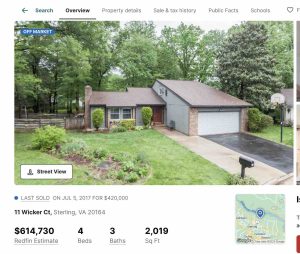

But you can’t buy my old house in Northern Virginia for that amount of money today.

According to Zillow, it would list for more than twice that – $614,730 – if it were put on the market today. That’s a hard swallow even on a government worker’s income – especially given what it now costs to finance a home. Interest rates are more than twice what they were just a year ago.

Then there is the second thing.

Speculative institutional investment. The buying up of homes for the purpose of driving up the cost of homes – and making a lot of money by selling (and renting) them.

But the fly in that soup is there must be people who can buy (and afford to rent) them – and these appear to be running out. Houses aren’t selling as swiftly all of a sudden – here or up there.

This ought not to be surprising.

In order for someone to be in a position, financially, to buy that $300k house in my area that few who live in this area can afford to buy, someone in Northern Virginia (or similar) must first sell their $600k house to someone who wants to live up there. And that’s the other fly in the soup- i.e., people are not wanting to live up there (which is why they are moving here – and to places like here) because who wants to spend $600k to live in a small, nothing-special tract house in what was a working class subdivision in Northern Virginia. where traffic is abominable and everything seems to teetering on the edge of Third World-ism, no matter how much money you have to spend.

$600k would have bought an estate home twice the size of my old house – custom built, on several acres of land in a high-end area of Northern Virginia such as Fairfax County – back when I bought my old house. Now it buys my old house, on a postage stamp-sized lot, in farther-out Loudon County.

If current trends continue, it will soon take a million to buy my old house.

This will drive most people – especially young people – out of houses by assuring very few of them (even those who work for the government) will ever be able buy one. It is not unlike the unfolding EeeeeeeeVeeeeee debacle that has pushed the average price paid for a new vehicle to $50,000.

To put that in some context, back in 1980, a Cadillac Sedan deVille – which was one of the most expensive (and largest) new luxury cars you could buy that year – listed for $13,282. That is equivalent to – here it comes! – about $50,000 today. In other words, the average price paid this year for a new car is equivalent to the cost of what people – who could afford it – were spending on a top-of-the-line Cadillac back in 1980.

Not many people were driving Cadillacs back in 1980.

How many people will be driving an EeeeeeeeeVeeeeee in 2030? Probably about as many who will be living in a single family home.

That is to say, not many.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you like items like the Safety Cult T shirt pictured below, you can find that and more at the EPautos store!

Looks like the house on Eric’s street originally mentioned in the beginning of this piece (link is to another house now) is “pending” so now under contract.

https://www.realtor.com/realestateandhomes-detail/1011-Hummingbird-Ln-SE_Copper-Hill_VA_24079_M64609-00245

It’ll be interesting to see what price it closes at, with RE and stonks still hitting all time highs as of today, 1/22/23.

1/22/24… Derp

Closed at $195K on 2/6/24. Last sold for $190K on 1/31/22. They flattened out over 2 years. Not earth shaking but definitely not going down.

Scenes from the EeeVee Bubble — Wall Street Journal dissects Rivian:

‘Rivian Automotive set out to build the ultimate electric vehicle for American consumers—a pickup truck with sports-car handling and a dizzying array of features.

‘All that comes at a cost. Rivian vehicles sell for over $80,000 on average. Yet they’re so expensive to build that in the second quarter the company lost $33,000 on every one it sold.

‘Losses have narrowed as Rivian produces more vehicles, but its cash burn continued at over $1 billion a quarter at the end of June.

‘While the R1T pickup is smaller than the Ford F-150 Lightning, its direct competitor, it weighs 685 pounds more.

‘Rivian has tasked its engineers with cutting up to $40,000 per vehicle in parts and production expenses, former employees say. Rivian would have to sell its models at an average price of $96,000 per vehicle and run its factory flat out to achieve [its targets].’

https://www.wsj.com/business/autos/rivian-ev-truck-electric-vehicle-8e8dc124

Not bad. Try to imagine this article, if it had been written by NPR’s EeeVee-driving stenographer/typist, and dedicated to Gaia, Michelle O, and Laphonza Butler. *rolls eyes*

Larry Sparks did it first but, I like the harmonies of the Harris Brothers with Darin Aldridge. Note the lyrics are pretty much about what God has blessed us with. Compare that with the Satanic visions of the WEF’ers et al. there will be a judgment and reckoning.

https://www.youtube.com/watch?v=1wgN4n-eSoE

Observations from the Peanut Gallery, the nosebleed seats.

If you watch the financial markets, equities, REIT’s have been on a decline.

CIO, City Office, a 10 dollar stock on the exchange is now 4.46 USD today. A 50 percent haircut, some kind of loss happened there.

CSR, was a 14 dollar stock with a 67 cent dividend, reverse split 10 to 1, the price is at 60 dollars these days with a dividend of 2.92 USD per share. CSR is over priced at 60 USD. From a 140 dollar stock after the split with a dividend valued at 6.70 USD per share to a 60 dollar stock with a dividend less than half than what it was in 2000.

A fall from grace there.

Lument Finance is another REIT that is two dollars, has a good dividend for the price, is doing okay for now. Seven Hills is at 11 USD and pays 1.40 USD dividend, good return if you want to invest in a REIT that is priced right.

Utility stock prices reflect the loss of business from real estate space that is not occupied, gone.

One utility had a price per share of 88 USD per share, 53 USD today. Another utility in the Midwest was 77 USD per share, at 51 USD today.

Not as much electricity is being used, people sell their shares and take the money.

On the other hand, Duke Energy has increased in price per share by a factor of 10 from the days it was in the doldrums. Consolidated Edison has the same story, they both have huge amounts of marketable product, electricity. Heavy demand for electricity in Duke Energy’s customer base. Must be true for ConEd too.

Utilities know what is in demand, electricity and water are two fungible commodities that have constant demand.

Another commodity that is in demand is steel. Gerdau, GGB, is 4.80 USD and pays a 61 cent dividend. Gerdau was a 24 dollar stock when it was going gangbusters. US Steel, X, was down to the five dollar range, US Steel is priced per share at 32.62 USD today.

It all waxes and wanes, if you are lucky, you can profit by investing in energy companies.

RIG, Transocean, was .99 USD per share when oil prices were negative, about 8.20 USD these days.

CORR energy, an oil services company, had an ATH of 46 USD, less than a dollar at 80 cents. JC Penney was well over 85 USD, fell to one dollar. You just never know.

It’s a funny ol’ ride.

Plenty of small towns out there have old homes for 15,000 dollars. There are houses on good-sized lots. You’re a long way away from nowhere, the end of the line.

BlackRock doesn’t want those, bombed out Ukraine has free land and buildings. Take your chances there.

‘Utility stock prices reflect the loss of business from real estate space that is not occupied, gone.’ — drumphish

Utility stocks are owned for income (dividends). When competing income vehicles — bonds — yield more, utilities must fall in price to increase their effective yield for new buyers.

This week, the S&P 500 utility sector (symbol XLU) was thrashed by a monstrous 7.0%. One glance at skyrocketing 10-year Treasury yields shows why:

https://tinyurl.com/bjvk6hpp

Rising labor and fuel costs also are eating utilities alive. They thrive on stable prices. The US fedgov is delivering the opposite.

It is idle to believe that utilities, with their backs to the wall, are going to rebuild the grid to serve an all-EeeVee personal vehicle fleet. Tonto, Joe!

Life In America Has Never Been More Unaffordable Than It Is Right Now

Michael came across an article about a woman that found a receipt from Burger King that was dated August 10, 1986.

At that time you could buy a Whopper for just $1.54…..Today, that same Whopper will cost you $6.79…

Inflation adjusted home prices are now 85% above their average dating back to 1900.

The average rate of interest on our credit card balances has risen from about 16 percent in February 2022 to more than 22 percent today.

As a result, an increasing number of Americans find themselves unable to keep up with their payments, and it is being reported that credit card losses are rising at the quickest rate since the last financial crisis…

Credit card companies are racking up losses at the fastest pace in almost 30 years, outside of the Great Financial Crisis, according to Goldman Sachs.

Thanks to our rapidly rising cost of living, the middle class is becoming “the impoverished class”, and the poor are increasingly being pushed out into the streets.

https://www.zerohedge.com/personal-finance/life-america-has-never-been-more-unaffordable-it-right-now

Russia produces 10.5 million barrels of oil each and every day. Russians consume 4.5 million per day, that means Russia sells 6,000,000 barrels each day. Oil is a fungible commodity, there is demand, oil sells right now. That is why there is supply, demand.

At 95 dollars for one barrel, Russia has a daily income from oil alone of 570 million dollars in one day. 570 billion dollars in less than three years.

Putin is like Jed Clampett, he’s swimming in gopher gravy.

You can buy 570,000 homes for 1,000,000 dollars each. In ten years, that is 5.7 million dwellings. Times 1000 dollars per month rent, Putin will be raking in 5.7 billion per month from hapless hopelessly poor dumb ‘muricans.

“We will bury you.” – Nikita Khrushchev

You’ll be paying rent to Vlad (Ras)Putin!

How you win the war.

IDK if Putin and all the Russian oligarchs are “bullish on Amerika”, Drumpish. But certainly those earning go SOMEWHERE. If you’re saying that FOREIGN interests are buying up USA real estate, including residential, and driving the prices beyond the affordability of Americans, I’d agree it’s likely.

Only instead of Moscow, I’d look more in the direction of….Tel Aviv.

I was a realtor in Northwest Indiana for a decade (2003-2013). My service area included Gary. Yes, that Gary. In a way, Gary shows the future if we don’t stop this madness. I will try to explain how it is likely one of the test cases of how they will separate people from owning real estate.

There are lots of rentals in Gary. A LOT of rentals! Just over half of Gary residents are renters (about double the rate of the rest of the region). But people say, but houses are cheap in Gary, so why isn’t more of the city owner occupied? Well that is the thing, they are cheap. Yes, you can buy a livable house for 50k.

But here is the catch!

You cannot get a mortgage for a small amount anymore. Most people don’t have 50k to buy that cheap house with cash. You cannot get a bank to write a mortgage for an amount under 50k for the most part. And no bank is going to write a mortgage for an amount for more than the house is worth…. So you see the problem……

So most of these houses sell (and sell fast!!) to investors with cash (and other forms of quick finance). They buy them (do whatever basic fixing that has to be done to qualify) and get section 8 renters in them. So in some ways it doesn’t really matter much if the renter is actually paying their part of the rent, since “uncle sam” guarantees (and directly pays) the rent for these people. And it doesn’t matter that the house never increases in value either, in fact its best it doesn’t to control the property taxes. They buy for the income potential, since the rent actually isn’t cheap in Gary. The only real risk is that “uncle sam’s” funny money flow comes to a stop. Because when it does, it will be abrupt for sure.

You NEVER see any housing activists talk about not being able to get small mortgages. And that is everybody and everywhere, not just people with poor or no credit in bad neighborhoods. Even if you have great credit, you aren’t going to get a 30k mortgage.

There are micro mortgages but few even know those exist. The rates are generally higher and you can’t borrow for as long either.

So at some point I see mortgages getting to the point of making it so few people can even get them, even if you have some money or the income. So you have to rent.

Operators like Blackrock will likely scoop up all (most are small time) these investors properties cheap at some point when uncle defaults on the rent payments. Because most of these “renters” aren’t paying the rent, you are!

Sigh, if only I didn’t have the ethics I do, I would likely be running a business like that.

For until the music stops its a good income for quite a few investors.

Hi Rich,

This is atrocious – and makes sense. I see it happening in my area, too. Few other than very affluent people can afford either the usually necessary 10 percent minimum cash down payment (much less 20, to avoid mortgage interest) or the mortgage itself, so they rent. It is telling that (as you say) there are effectively no less-than-$50 “first time buyer” homes that would serve as stepping stones. They don’t want people stepping up. They want to step on them.

We’re meant to rent tiny chicken-coop apartments in cities. We’re meant to walk, cycle, and ride (mass transit) to our corporate gigs. It’s all part of the plan.

Hi Myles,

Yes; and they now say so openly. Contemptuously. I think there will be pushback as awareness dawns. It has already happened with the drugs they call “vaccines” and I think will happen if they try the “masks” again. It takes awhile for people to realize they’ve been used and lied to. But I think it is beginning to happen.

“ We’re meant to rent tiny chicken-coop apartments in cities “

“ It’s all part of the plan “

Yes it is, has been for decades. 40 years ago we lived in liberal King County WA. We discussed buying some rural acreage and having a house built, the builder we talked with knew even then what was coming. “Won’t be much longer you’ll be able to consider doing this, the powers in charge want you living in some rabbit hutch in a high rise downtown, they want control and not spending money on police and services for outlying areas”. I don’t know what he was reading at the time but he was absolutely correct.

We never built, the cost and hassle too much for average income folks. Even back then the “rules” were in place to make it difficult. Urban growth boundaries, septic system rules (price out a mound system!), sensitive areas with regulated setbacks, wetland designations, you get the picture.

QE Giveth, QT Taketh Away: German Home Prices vs. ECB Balance Sheet

The chart shows Germany’s price index for existing homes (red, left scale), released today by the German statistical agency Destatis, and the ECB’s balance sheet (purple, right scale) in trillions of euros. It shows the reality of QE: it causes rampant home price inflation; and when QT kicks in, home prices decline.

from the comments….

What CBs have done is criminal in my mind. Wealthy/top 1% are enriched at the expense of others.

Essentials of life has been robbed from the working class.

Hope people wake up to this and make sure who are responsible pay the price.

https://wolfstreet.com/2023/09/22/german-home-prices-follow-ecb-balance-sheet-spiked-during-qe-swoon-now-during-qt/

the reality of QE: it causes rampant home price inflation; and when QT kicks in, home prices decline.

The Fed, meanwhile, is reducing its balance sheet by $95 billion a month via QT, allowing up to $60 billion of Treasuries and $35 billion of mortgage-backed securities to roll off.

https://www.reuters.com/markets/rates-bonds/us-debt-ceiling-saga-softens-feds-qt-mcgeever-2023-01-19/

The Fed, meanwhile, is reducing its balance sheet by $95 billion a month via QT,

buy RE during QT….fight the fed…haha….that always works…..

Re: the fed raising interest rates….

All the central banks are controlled by the BIS…just like the WEF running the governments…..

The BIS…bank of international settlements….the central bank of central banks…the banksters….

https://odysee.com/@G.I.U.R.E.H.:3/Filming-Bank-of-International-Settlements-the-B.I.S.-,-Swiss-Inquisition,-Ashes’-Square—Trois-Rois:0

You believe in the Fed. Raising interest rates will lower asset (home) prices and “cure” inflation, right? You know you believe that. I don’t. I don’t believe in the Fed.

the reality of QE: it causes rampant home price inflation; and when QT kicks in, home prices decline.

learn what QE and QT is…….education helps….lol

From that Reuters link you posted:

The TGA is a liability on the Fed’s balance sheet. This means that when the TGA goes down, reserves go up, effectively administering an injection of liquidity into the system.

But he notes that Fed liquidity is actually up almost 1% so far this year, thanks to falls in the TGA and reverse repurchase facility – another liability on the Fed’s balance sheet – which have more than offset the decline in the Fed’s bond holdings.

Mark Cabana, head of U.S. rates strategy at Bank of America, calculates that since the Fed’s QT program got underway last May, the Fed’s balance sheet has shrunk by $406 billion and the TGA has dropped $422 billion.

“Fed QT to date has been largely absorbed by lower TGA,” he and his team wrote in a recent note.

—

A shell game. Phony ass ledgermain. That’s it. Maybe read your links before you post them, professor.

FDS: I’m trying to get my head wrapped around this TGA point you raise. How do the Fed’s reserves go up just because it has less liability? How does it equal an injection of liquidity into the system?

Is this because a lowering of the TGA implies that the Fed paid that amount of money to the government, which then spends it into the market?

I don’t pretend to be an expert on this particular aspect. It’s his link, I just read it and lo and behold, it appears the Fedsters aren’t really “tightening.” Liars lying.

In contrast, when speculation floods into shelter / housing, it fatally distorts the cost of housing non-speculators must pay. I say fatally because shelter, along with food, energy and water (the FEW resources), are essential to life. These are not discretionary things we can decide not to have. When the price of essentials soars due to speculation that only rewards the speculators at the expense of non-speculators, the fuse of social disorder is lit.

When Shelter Becomes a Speculative Asset, Society Unravels, Charles Hugh Smith

http://charleshughsmith.blogspot.com/2023/09/when-shelter-becomes-speculative-asset.html

That article could be an eye opener for some, ReadyKilowatt, IF only they wanted to see. Most don’t.

I was kind of surprised I didn’t see anyone mention the phrase, ‘crack up boom’ in the comment thread.

Ah well. …Time Marches On.

‘Metallica – For Whom the Bell Tolls (Live in Mexico City) [Orgullo, Pasión, y Gloria]’

https://www.youtube.com/watch?v=HNybmS3xNAQ

…Or, should that be, ‘Crazy Train’?

Do you believe BLS statistics? CHS seems to. Is that “wanting to see”?

Median household income has almost doubled to $75,000, roughly in line with inflation according to the Bureau of Labor Statistics. According to the BLS, the house that cost $135,000 in July 1996 would now cost $264,000 when adjusted for inflation, and the $39,000 median income would be $76,000.

—-

1996 to 2023. 27 years, including 2020 to today. All that money printing. $135K to $264K? Speculation. That’s it, huh? LOL.

Hi RK,

Here’s what I’m seeing in my area – and it’s both sad and a worry: The youth lives at home – because it cannot afford to leave home. I have several friends/people in my circle with 20-somethings living in their parents’ house and who probably will stay there unless the situation changes. The reason why has nothing to do with their being loafers; they all work. The problem is their pay is not enough to pay the rents around here – which typically cost what a monthly mortgage payment used to. So why not get a mortgage? Well, they don’t have the 10-20 percent necessary in cash and even if they did, they can’t afford the monthly payment anyhow.

So they stay home. What happens when the rising generation feels – with reason – that the system is screwing them and that there’s little point to “doing what you’re supposed to.” Ask a German who lived through the Weimar era.

While indeed many of these “kids” are struggling, how many PISS AWAY money on the latest “Sail Fawn”, or get those $5 lattes every Gott-dammed day, waiting 30 minutes in the drive-thru and wasting precious gasoline, at $5.00/gallon, at Star-Foox?

Try buying one’s first home on an O-3’s salary (thank goodness for that “housing allowance”). It CAN be done, and with THREE kids, all under the age of five, and their mother STAYING AT HOME, but it means that one has to be wise in the use of available funds.

That’s true, Douglas –

When I was just out of college, I did not buy a new car. I kept driving the POS (but I loved it) VW Super Beetle I’d bought for $700 (this was early ’90s) and I did not buy “health insurance” and I avoided spending on anything I didn’t really have to have. And that’s how I was able to save up for a down payment on my first house.

Eric the following is a joke or maybe not;

People have asked me how I was able to support a stay at home wife and take care of three children on one income.

I told them that they would have to stop 5 vices if they hoped to have some money. The five are;

1) Stop smoking cigarettes

2) Stop Gambling

3) Stop drinking alcohol

4) Stop using drugs and finally the most expensive vice

5) Stop consorting with loose women

Ka-Ching

“If you stay single your pockets will jingle”

Message to my 15 yo grandson and I use one of my biker bros as a role model, 45 years old no wife happy life!

Next up for the grandson, when he’s a bit older:

“You can always hire it done!”

At least the value of houses going up rewards those who purchased and kept their houses. If needed they can be sold at a good profit at retirement.

I owned a house in an inner city once and it lost value. Big time. Purchased at 30k, value dropped to 10k. When unoccupied the locals would break in to steal pipes and wiring which made the house worthless. At least most areas see rising values.

lyspooner spews nothing but bullshit.

Sorry ML,

Herr lyspooner is 100% on the money with his housing experience…

Been there got shafted as well…. mine was the Ferguson MO horseshit riot nonsense….Think George Floyd… 0.5!

Semper Fi

I know exactly what part of town you are talking about. When the termites(vibrant peoples) moved in, house prices dropped dramatically. In my part of town one could actually buy insurance that you re-imburse a person for that lose.

“Northwest Home Equity Assurance Program”

“The Northwest Equity Assurance Program was established over 30 years ago to insure the value of the homes of residents on the Northwest Side of Chicago in the case of a loss of value due to local factors”

https://nwheap.com/

One guess as to what that factor would be. If you know Chicago and have lived here long you will instantly know that answer. But if you don’t I will gladly answer for you.

Remember when they wanted every equity holder to leverage their “investment”, i.e. house, straight to the moon and the market collapsed? I remember it. Of course, it can never happen again. That said, I was a single parent and took a HELOC but at that point, I felt like I had no other choice because my kids deserved the best. I have evolved.

The latest real estate update from Wolf Richter:

https://wolfstreet.com/2023/09/26/the-most-splendid-housing-bubbles-in-america-september-update-spring-bounce-fades-20-city-index-0-6-from-peak-in-2022-flat-year-over-year/

lots of charts

You and Anon1 frothing over .6% down from ATHs. It’s happening! LOL.

You should invest every nickel you have, even if it’s only two, into RE. Do it tomorrow.

Here’s another abbreviation you’ve probably never hear of, GFY.

TF is ATH? No one else knows. I doubt you do either.

All time highs. It’s a pretty common abbreviation. Maybe ask somebody.

You are right….leverage yourself up to your eyeballs in RE…right now today….lol…..during QT…..really intelligent…..

All I said was .6 off ATHs was a nothingburger. But I should leverage up to my eyeballs into RE? You’re hysterical. Next month or 6 months from now we’ll see new ATHs but we won’t see you on here.

Everyone forgets all RE is local. And based on the pump and dump the fed performed these last three years, via Blackrock, its got a looooong way to fall. I remember getting out with huge profits in Vegas around 05/06, I was still a little early. Arizona/California went up another 50% for the next few years, All while Florida, Nevada went into the crapper. Even 10% down is nothing. The sellers are still living in a fantasy, and things haven’t even rolled over yet. The places I’m looking to buy need a 50-60% hair cut before I’m making any offers.

US gov’t debt in ‘03: $3 trillion. Today $33 trillion. This isn’t about a lending orgy bubble from the mid-00’s. It’s about inflation. Expansion of the money supply, especially in the past 3+ years. I don’t understand why so many hard boiled libertarians don’t get this. Will the food price bubble pop, too?

Although I agree with your basic premise, there are things out of our lane, beyond our control that would pop every bubble in a heartbeat. That Deagle BS? If half the US population Died Suddenly, over a year or two, we would experience a massive deflation, and who knows where it would go from there.

Hi Helot,

I will likely regret one day not having just bought us a 50 acre or so parcel in the middle of nowhere, accessible only by lifted 4×4 or ATV and built a homestead off-grid cabin there. But that would require “checking out” and – effectively – retiring and disappearing. I’m not ready to do that just yet. And that means I am probably not very bright.

Would you have the means to have a modest home “on grid”, and get that 50 acres of “Paradise” and gradually build what you need (well, septic tank, cabin or whatever dwelling YOU deem appropriate) over time?

Mine is some 25 acres in “MidWest” (around Abeline or San Angelo) Texas, about 2,000 MSL, gently rolling hills…preferably on a mesa, with limited road access, so I can “see ’em coming”. Start with that well, septic tank, and a cheap, used double-wide for starters. Put up a 60 x 30 Butler building. Power? Probably have to put in a diesel generator, assuming the costs, even with rural electrification, are prohibitive. In fact, invest in a 1,000 gallon diesel tank, as the farm truck and tractor will also be diesel-powered.

A well = “Ca-Ching!” $$$

septic tank = “Ca-Ching!” $$$

25 acres = “Ca-Ching!” $$$$$$

used double-wide = “Ca-Ching!” $$$

a 60 x 30 Butler building = “Ca-Ching!” $$$

a diesel generator = “Ca-Ching!” $$

a 1,000 gallon diesel tank = “Ca-Ching!” $$

farm truck = “Ca-Ching!” $$$

and tractor = “Ca-Ching!” $$$

That’s a sheet ton of money.

This couple did it fairly on the cheap 16 years ago, nowadays, I imagine the cost is at least double, maybe even triple?:

‘OFF GRID with DOUG & STACY’

https://www.youtube.com/@OFFGRIDwithDOUGSTACY/playlists

I was listening to the A.M. radio Pro-Farmer guys talking about how farmers are really Jacking Up the price of farmland in bidding wars at auction. Unreal.

I made a chart for you all, using the FRED chart maker, I have the 1o year Treasury vs. 30 year fixed rate mortgage:

https://i.ibb.co/r3HdzCt/fredgraph.png

The top line is hovering over 7%, and soon could be above 8%. I’ve have been saying for at least a year, that when the 30 year mortgage gets past 8% it will make headlines, etc. Maybe even cause alarm in all “Pivot Cult”.

The Pivot Cult believes the Fed is God, and that this central bank god can magically make interest rates go down. But since I know the Fed follows market rates, I do not believe in the Falling of the Rates, I believe in the Ascension of the Interest Rates.

I am a Pivot Cult heretic, I do not believe in the all powerful Fed. In fact I think interest rates can zoom back to the 1980 highs, in a much shorter time span, and in fact I believe they are doing that now. And then after a short pause, as the Communist run Amerika collapses further, USA interest rates will surge to all time highs like any banana republik.

And I am old enough to remember mortgage rates around 20%, back in the early 1980’s, when the National Debt had not even exceeded 2 trillion. Well Virginia, the National Debt is now over 33 TRILLION and going up like a bat out of hell. The last trillion added only took 3 months of deficit sinning.

So I say unto you Pivot Believers, that Ascension of the Rates is nigh. Do not believe in the pivot, look to the heavens to see where rates are going.

Here is a longer view of the same chart posted above:

https://www.sportofmoney.com/wp-content/uploads/2019/04/10-Year-Treasury-Yield-vs-30-Year-Mortgage-Rate-1024×408.png

Wouldn’t it be crazy if high interest rates were concurrent with high RE prices, like now? Maybe even higher prices as rates go up and supply diminishes further? Who’s gonna trade their 4.5% in on an 8+% note?

Home builders gotta build you know. Otherwise, they’re no longer home builders.

True, but if a builder is paid to build a house, rates don’t matter. They’ll charge the market rate for supplies and labor, which have doubled, and whatever profit the market will bear. That business is always around and they also do renovations, etc. Neither really adds to “supply” because it’s owned already.

The only aspect of home building that is subject to rates is speculative building. I would argue that the high rates hurt this, too, but you’re also dealing with a doubling of costs. A lot of builders do it all on credit and clear profits when there is a lending driven buying frenzy, which there isn’t. They don’t if cost to carry via interest gets dicey. It’s always a gamble, sometimes more or less.

Fed dogma about interest rates and inflation imploding. The following headline in the link does NOT mean what you think it might.

https://www.cnbc.com/2023/10/10/housing-industry-urges-powell-and-fed-to-stop-raising-interest-rates.html

Top real estate and banking officials are calling on the Federal Reserve to stop raising interest rates as the industry suffers through surging housing costs and a “historic shortage” of available homes for sale.

The average 30-year mortgage rate is now just shy of 8%, according to Bankrate, while the average home price has climbed to $407,100, with available inventory at the equivalent of 3.3 months. NAR officials estimate that inventory would need to double to bring down prices.

The letter notes that the rate hikes have “exacerbated housing affordability and created additional disruptions for a real estate market that is already straining to adjust to a dramatic pullback in both mortgage origination and home sale volume. These market challenges occur amidst a historic shortage of attainable housing.”

—-

Rate hikes have “exacerbated housing affordability”, meaning driven prices up? Wow. That wasn’t supposed to happen. So, according to the NAR, doing the opposite, not raising rates more or, lowering them even, will improve “affordability”, meaning lower prices? Doubtful, if anything, prices get a whole lot more unaffordable-er.

Economic sophistry from the NAR, which is hooked on easy, cheap money. Having a virtual monopoly on the housing brokerage market simply isn’t enough for them. They also demand the constant influx of Fedbux. Another example of a parasite “industry” trying to live off everybody else.

Sophistry is putting it politely. Imagine what Jerome at the Fed is thinking when fielding this kind of madness. He knows what’ll happen. Rock and a hard place and I have zero sympathy.

An important distinction here, though, that the RE bears/doomers are missing is the difference between the “housing industry” and RE prices. The Fed, through its rate hikes, can deliver economic calamity to various sectors dependent on borrowing, but it cannot control the prices of the assets that are, in the main, a symptom of inflation. These prices are not the result of a lending frenzy driven bubble, rather they reflect re-pricing in nominal terms in the currency.

Another example of this would be the cost to replace a water heater I experienced last week. I put one in in ’17 for $355 plus $200 labor, total $555. Last week the same type replacement cost $750 plus $300 labor, total $1050. Is this a water heater “bubble”? Of course not. In my case at least, I paid cash so interest rates don’t factor in at all. This is inflation pure and simple. Prices for goods may fluctuate a tiny bit at the margins over time, +/- 10%, but, barring complete currency collapse and/or diversionary but ultimately counterproductive tactics like the gov’t taking a zero off, we’re never going back to 2017 prices. Not in RE, not in cars, not in food, not in anything.

Living spaces shouldn’t be investments. The only reason why they are is because of fiat currency.

The state shouldn’t own property, other than what might be necessary for the state’s business. That the Obama and Biden adminstrations are setting aside more and more western land as National Monuments speaks volumes about their intentions.

Taking land away from productive use in the middle of a massive housing bubble that is blocking millennials’ ability to buy in speaks volumes.

Malice or incompetence, the result is the same. Pull up the ladder behind you and profit from the limited supply. Can’t make money when there’s plenty.

“This time, it’s different” (i.e. the idea that the inflated prices are here to stay forever), has been the sentiment of the last two housing bubbles (late 1980s and mid 2000s) and I imagine that’s the sentiment now. That’s been proven wrong, of course. The current bubble will burst at some point. In a way, this is good, but of course, just like the last housing bubble that burst, the elite will find a way to not be hurt yet the middle class will suffer

The Most Splendid Housing Bubbles in America, September Update: Spring Bounce Fades. 20-City Index -0.6% from Peak in 2022, Flat Year-over-Year

https://wolfstreet.com/2023/09/26/the-most-splendid-housing-bubbles-in-america-september-update-spring-bounce-fades-20-city-index-0-6-from-peak-in-2022-flat-year-over-year/

Housing Demand “Vaporized” After Rates Hit 7%

When rates finally reached and surpassed 7% in October (by which time monthly payments were up a nauseating 47%), inventory began to decline more steeply.

https://www.zerohedge.com/news/2022-11-30/housing-demand-vaporized-after-rates-hit-7

Many folks “stay put” when they realize that they’ve missed the boat, real estate wise. Tends to INHIBIT economic growth, which the Phony POTUS and those like him would just tax away.

Wow, a whole .06 off ATHs from ‘22. The sound of bubbles bursting! LOL.

Housing is in an epic bubble, and the bust could be Biblical level wipeout. If you want some charts to back that claim up, there is this young man on Youtube who has a handle on real estate, and presents his argument with a plethora of data and charts:

Reventure Consulting

434K subscribers

https://www.youtube.com/watch?v=2gQo1qxY4fI

Basically, the argument to load up on real is estate is because if the USGov is running huge deficits, the Federal Reserve has been monetizing that debt, and creating a huge increase in the money supply, thus inflation is permanent and you need to buy real estate to get rich quick as the value of the dollar goes to hell.

The game is to leveraged in debt, because the idea is that if Uncle Sam is 33 trillion in debt, and is going to skate out of that obligation by inflation, you should also be in debt, leveraged with a home loan. That way when the USGov runs permanent inflation to get out of their debt, you will get rich.

People are in a panic to get out of cash and get into real estate to protect the value of their wealth. With interest rates at the lowest level in human history, and with no-money down loans, house prices exploded. And the bubble feeds on itself into a blowoff top, which has just happened.

The result of this fear of inflation, low rates, is a huge real estate bubble dwarfing the 2006 top. Now we are in an even bigger bubble, called the everything bubble, because stocks and bonds also went to record highs.

People believe in this bubble, even with interest rates shooting up, they are having a big problem selling at what they perceive to be the peak value, which has passed – as the tide turns, as it always does, panic buying is now becoming panic selling. And that is just starting.

Furthermore, this central bank entity, is causing huge instabilities in the economy, blowing bubbles which become crashes. Easy credit has created a big mess and now there is hell to pay.

I like to use the example of buying a Geo Metro with cash or credit. A 30 year old Geo is worth from zero to about $3000. But with credit, if the metro was a house, it would be selling for $20,000. A geo is not worth 20k, likewise the 350K home in his area is also overinflated because of credit.

If you put 60K down and the Virginian home market tanks, you can kiss that 60K goodbye. And that reality is going to drive panic selling, which is starting right now.

In the Great Depression many homes fell over 90%, and the bubble this time is 2 magnitudes bigger. Thus the bust could be on a Biblical scale. And if you think the Fed can stop it, you are wrong, the Fed is bankrupt, and the Fed does not control interest rates, they follow them.

“the Fed does not control interest rates, they follow them”

Here is the proof of that statement, look at the first 6 charts, follow the links when you open each chart to read the article:

https://duckduckgo.com/?q=fed+follows+interest+rates+elliot+wave+chart&t=ffab&atb=v387-1&iar=images&iax=images&ia=images

Why home prices could collapse argument. Interest rates are shooting up. The mortgage rate on a home is based on 10 year US Treasuries – which has been moving up aggressively, thus mortgage rates, which are set off the treasury rate, will soon, maybe this week, be over 8%.

This chart lags by a week: https://fred.stlouisfed.org/series/MORTGAGE30US

Rising mortgages rates are the hammer to home prices. And home consumers, who do not believe rates could go higher, are caught with their pants down.

No pivot suckers. Everyone expected the Fed to pivot, but what happens if rates keep going up? PANIC. CRASH. A whole lot of people will soon learn the evil of debt and mortgage.

It’s the dollar that’s going to crash, with debt levels as high as they are now. This isn’t 1980s when the Fed was able to raise rates and put an end to inflation. Raising rates now will put a quick end to the dollar and the whole financial system. Look at the US fed gov’s interest payments, they are shooting to the moon.

https://fred.stlouisfed.org/series/A091RC1Q027SBEA

This will happen either as hyperinflation, chaos and collapse of society, or a controlled demolition of the dollar, when the whole system is just shut down one day. How the powers-that-be do this, only they know. In the latter option, they may blame the computer virus from North Korea or Russia for this, or war as an excuse. What happens to RE after this point is anybody’s guess, but an important point to realize is that even if it’s real, it isn’t yours, since you pay taxes on it. If they raise taxes, owning RE will be pointless. And raise taxes they will, since they’ll need money, under a new financial system that will be in place after the current one. The only thing that will maintain its value is physical precious metals.

You can be sure the banksters behind the Fed know what they are doing and this is exactly what they want to happen. The collapse of the US has been planned long ago, from the very beginning of the country’s creation actually. All the US founding fathers were masons. They founded the US for their own purposes, which was to take over the world. This has now been accomplished, and they no longer need the US now. So the it will be demolished soon, or rather reorganized as a corporation that it is. People will be fired, and their paychecks reduced. The planned headcount after this is 100 million. They’ve been preparing this a long time now, shifting production to China and other countries. And they state this openly, too (see Manly P. Hall, Deagel, WEF). It’s not like they are doing things in secret. You’ve gotta give them credit for being open about it. You have to be blind not to see it. (They pulled their population projection plans from the Deagel site sometime in 2021 though, bastards, but the web archive remembers everything).

https://archive.org/details/the-secret-destiny-of-america

https://www.weforum.org/agenda/2016/11/america-s-dominance-is-over/

https://web.archive.org/web/20200412132200/http://www.deagel.com/country/forecast.aspx

We are living in perestroika again, comrades, but this time it’s in the US, not the Soviet Union, although the result for the US will be the same.

Very well stated.

The Costco Gold Indicator

To gauge the average American citizen’s trust in our fiscal and monetary policy, look no further than what’s going on at Costco.

The retail giant has recently been selling 1 oz. bars of authentic 24-karat gold from South African mining company Rand Refinery and Swiss precious metal supplier PAMP Suisse on their website for $1,949.99 and $1,979.99, respectively, according to Insider.

…..they are selling out quickly….And if you think that’s crazy now, wait until we hit a period of volatility. So far, markets have been pretty orderly, but it’s a mathematical certainty that this won’t continue to be the case.

Just think about this for a moment: people are buying gold from Costco. This tells us that the average American has grown so weary of our government’s reckless spending and the Fed’s irresponsible monetary policy that they literally want to fill their shopping cart — online or in person — with something they know is real money

central banking policies are being called into question publicly a little bit more than they have in the past. For example, in Congress days ago, Matt Gaetz made the following joke:

“We are devaluing American money so rapidly that in America today, you can’t even bribe Democrat senators with cash alone. You need to bring gold bars to get the job done, just so the bribes hold value.”

Putting aside what you think about him or the Republican party, the soundness of our money is an infrequently discussed topic in the halls of Congress. The issue has also been brought up repeatedly by presidential candidate Vivek Ramaswamy, who is running on a platform of reducing the amount of power granted to the Federal Reserve.

https://quoththeraven.substack.com/p/the-costco-gold-indicator

leftist crooks…..

Sen. Bob Menendez (D-NJ) and his wife Nadine have been indicted in New York for allegedly accepting bribes in relation to a corrupt relationship they had with three businessmen from their home state. The indictment also charges three businessmen, Wael Hana, Jose Uribe and Fred Daibes.

“Those bribes included cash, gold, payments toward a home mortgage, compensation for a low-or-no-show job, a luxury vehicle, and other things of value,” reads the indictment.

Daibes, a developer and former bank chairman, allegedly gave Menendez gold bars valued at approximately $400,000, in exchange for assistance in a case in which he faced federal bank charges.

https://www.zerohedge.com/political/democrat-sen-bob-menendez-indicted-over-gold-bar-bribery-scheme

In the great depression, the printing press wasn’t functional yet. Housing crash won’t happen.

From 2006 to 2010, housing crashed hard, despite the Federal Reserve slashing Fed Funds to zero by Nov 2008, and then purchasing $600 billion of mortgage-backed securities (QE printing press) in an effort to stop the slide. But with the usual lag effect, housing didn’t bottom out till 2010.

It could happen again. The conventional wisdom in 2005 was “housing never goes down.” Then it dropped 50% in several cities. Some have forgotten this lesson, while others were too young in 2008 to remember it. 🙁

Exactly, housing can go down, but the bulls, those long on housing, will not admit it – ESPECIALLY REALTORS.

A realtor has a vested interest in SELLING homes. Thus to get you to buy a home, especially an overpriced one, the realtor must convince you that the market will keep going up.

If a realtor knew the truth (they don’t) and told you the truth (they won’t) then you sure as hell would not buy a home now – unless you are Zelensky getting billions of free money from Biden.

Thus all realtors are biased, and in the long wave they have been right – until the whole system goes bust, like it did in the Great Depression – then their advice is catastrophic.

Or – you are leveraged in debt – and Biden forgives all debt when the market crashes. That could happen also.

The great thing about real estate is that it is, well, real. You can see it, walk around it, touch it. And it always has some value. It still fluctuates, but it always has value.

Much like precious metals, classic cars, art, wine, guitars, and other sorts of things rich people convert their money into. These are meant to be kept until needed or sold.

It’s real except that it isn’t yours, really, since you pay taxes on it.

Yes it costs money to maintain it.

As does everything else (some things more so than others).

The tax bit is an artificial cost.

Excellent analysis Eric.

My reaction here is not one of: ah shit, look at those insane prices for houses in my town!, but one of: this is what you can expect when “those people” print money by the trillions. And frankly it was easy to predict this would be the case for real estate prices, along with prices in practically every other market in the economy.

We all know when govts print money they cause economic distortions, and when insane govts print money you get insane economic distortions. These distortions are so obvious now that you’d think the average wealth-producing working stiff would be marching in the streets screaming to throw the bums out. But once again all we hear is crickets. Apparently people are now so propagandized that they’ve become completely numb to almost any atrocity or transgression. Tragically, and most unfortunately for us, this sends a most dangerous signal to the crooks & criminals that it’s now possible to get away with almost anything. Oh Houston. . . we’ve got a problem. We’re getting damn close to a lawless free-for-all society in which anything goes.

And once again, why do I feel we’re in a similar situation to that which occurred in 1930’s Germany. A replay of the Reichstag fire should be right around the corner anytime now.

That happened a while ago. We call it Nahnnaleven.

I’m sure the NOVA homes are affordable if you have 4 – 10 families living in the same house. That’s what the southern invaders do, and because they keep coming, the demand for housing will not go down, and the speculators will win as usual, the rich get richer, the poor get poorer. Us natives will be forced to adjust by reducing our standard of living even further, in order to live.

I truly sold my old house in the nick of time, and I’ll never regret it. Everyday I wake up in the serene juniper forest and only possibilities abound. I can walk around wearing nothing but boots and pop off 9mm rounds at random objects if I want, and no one is going to do anything to stop me. It’s wunderbar, and it’s only getting better as time progresses.

It’s certainly not easy, though. Being off-grid takes loads of physical and mental labor, at very least initially. Not many of those DC vampires would have the gumption for this sort of life. May they fester in the hell they have created for themselves.

Thats my hope. That they fester in the hell hole they’ve created for themselves. As time passes, I’m beginning to question if I put enough distance between the state of Maricopa and myself. Hopefully the residents of that place wait for someone to come save them. By the time they realize no ones coming, it will be to late to leave.

I have a city (less than 10k population) house I bought 2 1/2 years ago, I need to sell. Problem is, the wife likes it and feels safe. I keep telling her she’s already salty enough, she’s useless to me as a pillar of salt. Kudos for getting yourself off grid. The only part of my country spot thats off grid is the well. Still, Aqua de vida. So there is that.

Hey Norman,

Water is important. Eventually it will be all water collection for us, but for now we have to haul water. It’s STILL less expensive per month than it was in the city, though, and not a heavy burden.

The feeling of safety is an illusion, but we feel much safer here than we ever did in what you call the “State of Maricopa”. I wish it were its own state; that would make much sense, and be better for the rest of us. But here, we don’t have to worry about casual passers-by liberating our personal property from us, and if someone were to become too much of a nuisance, well, I have plenty of firearms and a backhoe.

Nice. Don’t forget some 60 pound bags of lime.

It’s as much a housing “bubble” as it is a food price “bubble.” Ultimately, we are experiencing inflation. We are learning that higher interest rates can’t cure it, as they create unintended consequences such as greatly diminishing the supply of real estate. I read somewhere that, since ‘19, M2 has increased something like 46%, which reflects like a mirror in both home and auto prices over the same time period. The nominal units of account have lost value that will not be regained even if the economy collapses.

Inflation is caused by expansion of the money supply, and that happens by new money being spent into the economy, and there’s one primary way where this is happening today – federal deficit spending. They directly spend money which didn’t exist before.

All this ZIRP and Quantitative Easing nonsense was a bailout of the banks, but not as inflationary as what we have today, because with QE, the Fed created virtual $trillions, gave it to the banks, and they deposited it back at the fed, and got $billions in interest on it, but those $trillions didn’t enter the economy.

Today, $trillions are being spent into existence, creating significant inflation (5% of GDP is deficit spending!), while the Fed tries to fight inflation on the other side. It’s not going to work, it’s making smaller banks insolvent (maybe that’s the point, nationalize them), and the cost of the US gov’t debt is growing really fast. Something is going to have to give. We either go back to ZIRP and inflation accelerates, or the government stops spending deficits (haha, right), or the dollar breaks.

When the government prints tens of trillions of dollars over decades, only two economic sectors are big enough to soak up that amount of money; equities and real estate. We have the largest bubble that we have ever seen in both areas. Young people who have entered the workforce since 2008 have never seen a stock market that goes down, nor a world where housing prices keep pace with income.

Those who earn a lot buy a house, price be damned, to get their foot in the real estate door as fast as possibly, and those who don’t, give up on the idea of ever owning one.

Locally, it can be even worse, because some places, like Silly Con Valley, where I live, have industries which make some people very rich (tech, bio-tech), coupled with idiotic politicians who prevent new housing development, so you have a shortage. For example, here is an $1.3M house, not as nice as the one Eric linked, and the lot is 5700 sq ft, vs Eric’s 2 acre listing. (https://www.realtor.com/realestateandhomes-detail/1678-Latham-St_Mountain-View_CA_94041_M12115-17246).

Around here, we have AI-driven real estate investment funds run by wealthy people who think the market will go down, but that housing will only ever go up. We have foreign investors, particularly from China, buying out houses for cash offers to park it somewhere outside of China. Meanwhile, we have shops closing up, the people who provide goods and services are being priced out of the area, so all we’re left with is multi-million dollar houses, fentanyl addicts on the streets who have given up on life, and nobody around to work in the restaurants or grocery stores, or to cut your hair. A burger costs $25 in local restaurants, a two-burrito, two-margarita lunch with a friend recently cost us $80 at a random restaurant, and a basic haircut for what’s left of my hair is $40 and takes less than 10 minutes.

When we came to this country, as refugees from the Soviets in the 1980’s, the so called American Dream was still attainable. Today, our entire economic and political system is as twisted to help the rich and powerful as the USSR was twisted to enable the party members to live well at the cost of all others. The US at this point is more corrupt than the USSR, at least in my eyes. The US has been far more effective at propaganda, because people still recite the mantra that we live in a free country, and no matter how much things turn into the totalitarian direction, somehow it’s ok if their preferred party makes those changes.

Well said. This is the most corrput nation on earth. Others are bad, and more in your face, but we have at least three layers of government doing the bidding of the courrupt elites. Federal, state county and “local”. There is actually nothing local about local. Anymore than your local wal mart or local home depot. Thery are about as local as Fed Ex is federal. Add in the corrupt court system and federal reserve banking system and there is no way that even a group of average individuals can make effective change withing this system.

If I was younger, could tolerate the cold and could learn a new language, I might try Russia. It’s corrupt too, but at least the government isn’t actively looking to destroy the people like it is here. At least it’s not as apparent to me.

No no no no, don’t try Russia, I am very familiar with it today. The US being corrupt doesn’t make that a good place to live. All you own can be taken away at the whim of a local politician and there is nothing you can do about it. You can be conscripted into the army even if you’re fairly old, and all your money and communications are monitored.

Pick some place with good affordable health care, where the dollar is accepted, and the corruption is democratized; meaning it’s endemic and affordable to everyone to buy a politician. Perhaps something like Costa Rica, or Puerto Rico if you want a sweet tax haven.

Thanks, Opposite. That is good to know. I speak a little Spanish, enough to order chiccherones at the Mexian meat market. That’s about all.

‘people still recite the mantra that we live in a free country’ — OppositeLock

In Nabokov’s classic novel published in 1955, Lolita sasses ol’ Humbert when he tries to discipline her: ‘It’s a free country!‘

It was a commonplace expression when we were kids, especially to taunt parents. But I have not heard it even once in the past ten years. Since 11 Sep 2001, it is not even true, except in a highly circumscribed sense. 🙁

Relevant in general to the thread:

We completed the paperwork on a sale today. “Highly desireable” neighborhood where typical sales over the last 5 or 6 years took place in 7 to 10 days. We bouight it in 2017 the day it was listed and there was a line of prospects. It took 240 days this time. Sold at 13% less than the comps indicated based on December 2022 sales.

As to the “free country”:

We have made 7 purchases/sales prior to this one. I believe the first one entailed signing on one or two pages, including mortgage documents. Today, we signed 9 pages for a cash transaction. One, to assure everyone that we were not terrorists and having to prove it with government approved

documents. Title on that sheet was Patriot Act Compliance Form.

Here in Central WA similar situation. The “tech bros & broettes” from Seattle are buying here and the expected result sky high prices. Also trending is the mostly vacant second home, catered to by developers making sanitized country living (Suncadia development and more coming) for the newly well heeled from western WA, now about a million $ a pop.

So, the help can’t afford to live here restaurants and retailers constantly trying to get workers. The places we like to eat are cutting back on hours plus only open 4 days a week some cases.

Also, the contractors, remodelers, elec plumbing and HVAC are not available for the average not so well heeled homeowner. Neighbor was quoted a two year wait for exterior painting. Plus the added insult of the FU pricing. Don’t like the price, basically “FU”. They’re all making bank on the million dollar properties can’t be bothered with the middle class homeowner looking for a reasonable deal.

Hi Sparkey,

The town of Floyd – the actual town that is the county seat – used to be a sleep little one-stoplight place with very little going on that was “hip” or flashy. Far from it. But that is exactly why the people who live here love it. Now, the people who live here avoid the town – because it’s full of new arrivals from Northern Virginia and similar who have “boutiqued” the place up such that a lunch for two at the “country store” is now a $40 deal. And that’s considered a deal.

Floydfest – which I wrote about some time back – has brought in thousands of new people, which isn’t the problem, per se. The problem is what these people bring with them. They want to bring Northern Va – and so on here. Like locusts, they destroy everything in their path and then move on.

We get the double whammy now, the tech / trust fund money moving in and literally van loads of illegals arriving. Yea I know many of the illegals work hard, problem is, it’s the conduit of crime that comes along with the invasion.

We were a hay growing and ranch community, now the apple growers discovered our south of the valley ridge is ideal for Honeycrisp. So, apples equal lots of pickers and their families and their cousins peddling drugs. My kids house in town the alley facing garage has been tagged several times with gang symbols.

Daughter has bugged me for several years “we’ll sell both places and buy a large acreage compound in Idaho!” Ha ha I’ve said, I’m not laughing any longer it’s sounding better every year.

You’re right about that EP.

I increasingly want to cash it all out and find acreage away from yuppie beatniks.

And then they have the GALL to bitch about how Floyd, VA, doesn’t have a “decent” delicatessen, like their favorite place back on the LOWER EAST SIDE (of “New Yawk”), or, “you can’t get good “Chinese Food”). Sneering at the very place that their predatory lifestyles are RUINING.

ep,

Though not a native of the Wynwood section of Miami (artsy fartsy Kool) The place formerly known for warehouses painted by street Rembrandts …

is now being overrun by ghastly hi rise condo’s !

Crap, you should see the volume of concrete being poured!!

RIP The Miami Art District.. 🙁

Hi Expat,

Sorry to hear that; it seems to be happening everywhere. I am comforted by the fact that there are still some deep woods and hollers not far from where I am now; place that are hard to get to and in which one could probably just fade away and no one would ever know…

My family tried to flee to central/western Wyoming just prior to the vax man-dates which destroyed our jobs.

We put several offers on properties in Lander and Casper which are in the middle of freaking nowhere…..These were not vacation destinations but end of the road old skool Western towns with no muzzles. Every single time we were outbid by some “agent” who would buy the property sight-unseen for 20-40k over asking with no contingencies.

There’s serious fuckery afoot. The Realtors we dealt with were all local folks and said they had never seen anything like it….

I’m thinking it’s another investment plan driven by financial advisors for the benefit of their somewhat wealthy clients. Friends brother is a surgeon in Seattle his thing was farmland investments coached by the money planner. “Wow I own a farm now, hee hee hee.”

Or, money laundering foreigners? Hey congress how about getting the playing field benefitting us taxpayers not some deep pockets foreigners. I’m not a fan of mega regulation but congress working to our benefit fits the “general welfare” clause of the constitution as far as I’m concerned.

The so called “general welfare clause” is nothing more than an apology for the taxing clause.

Article one section eight: “Congress shall have Power To lay and collect Taxes, Duties, Imposts and Excises, to pay the Debts and provide for the common Defence and general Welfare of the United States”

The 4 to 1 ratio of cost to income was 3 to 1 back in the 70’s when we bought this house, and the banks wouldn’t count my wife’s income in that formula. Really frosted me because there was a house we could have afforded in pristine condition (the house we did buy was a fixer-upper) but we didn’t “qualify” for a mortgage under those terms. Imagine how pissed we were seeing anyone with a pulse “qualify” to buy a McMansion during the prior housing bubble. Worked out well though, great bones in this old house, plus the house we didn’t get has even higher property taxes than ours.

Also how do you come up with 20% down on a million dollar house? That’s $200,000!

No wonder most kids are figuratively “living in their parents basement”.

Hi Mike,

How does a person come up with even 10 percent of $300,000? That’s $30k in cash. Imagine being 26 or so and trying to buy that first house…

With a salary in the $<7/hr range, I managed to save up $10k to put down on a $54k house at age 29 in 1978. That required some modest living. What it takes is setting your goals and putting your nose to the grindstone instead of crying about how impossible it is.

How? I’m reminded of one of the frequently overlooked Bill Murray quotes in “Ghostbusters”: “Everybody has three mortgages nowadays.”

Seriously, though, that’s the way it is done to buy the $1 million house on a two professional income in a hot market. Everything works as long as house prices and the stock market do not decline significantly.

We have that situation. son is an electrician with plenty of overtime, but even renting anything you would want is now $1500+. Doesn’t leave a whole lot after food & bills to stash away.

My formula was to buy a house that was easily affordable, pay it off quick as possible, never borrow another dollar, and save as much as you can.

That isn’t as easily do-able today.

Hi Dan,

There are still some options for young people but they are unconventional. These include living in an RV or van to eliminate rent/mortgage for a period of years, so that you can afford a mortgage after a few years. A midway solution is to buy a little land – no house – and park the RV on it and live in it. In my area, it is still feasible to buy an acre or so for around $10,000 and an decent little RV one could live in for around $15k. This can be finagled – financially – by most people who have a job and it’s what I’d do if I were 22 again.

There are a lot of districts that will only allow you to stay on your property for two weeks if that property does not have sewer/septic, etc facilities. There was a story a while ago where a veteran was chased off his property in Costilla County, Colorado. The Vet’s place did not meet county regulations.

You can buy a used sailboat for a small amount of money….(sailboat so you can move around without buying much fuel)…….there is some free ones….but they require a lot of reconditioning/maintenance…..

anchor it…..no rent and no property tax…..

even in a marina…..$600.00/month moorage fee….all in is better then $3000/month rent in some big cities….

the real sailors say marina users are the trailer trash of sailors….just anchor it….

advantages over an RV….no compulsory insurance…if anchored….., no parking or speeding tickets, larger, less restricted area to move around in, fewer enforcement nazis…(tax collectors)…., free food…(fish and seaweed)….you can actually own the boat…..etc…..

living rent free…..

There is a 2 mile long stretch of road by the water in california that is lined with old RV’s, vans and camper trucks..(a lot of them are not registered/insured)….the city leaves them alone, lets them live there….other cities will harass/fine them daily if they sleep overnight for just 1 night……they are forced out….

the city leaves them alone, lets them live there……how does a low wage service worker pay $3000 month rent…..they can’t……

in some areas people are getting $7000 per month renting their house as a STVR/airbnb rental…..

rent out your house, live in a van…save/make a lot of money………..

‘The 4 to 1 ratio of cost to income was 3 to 1 back in the 70’s when we bought this house.’ — Mike in Boston

You are correct. A 3 to 1 ratio applied when mortgage interest rates were in high single digits.

Then 15 years of ZIRP (zero interest rate policy) brought mortgage interest rates down to 3 to 4 percent — and the guideline changed to 4 to 1.

Well, mortgages back over 7 percent now. Soon enough, the old 3 to 1 guideline will return, after banks get burned. Hey, that rhymes! 🙂

There was a time when a banker would be greeted by a young, dual-income couple, wanting to buy their first home, and the reason? The young “wifey” obviously had one in the “oven”! Hence why COMMON SENSE dictated that either she’d be leaving the workforce, at least for several years, OR, if they “contracted out” the daily grind of motherhood to a “day care provider”, that didn’t come for FREE. At least there was COMMON SENSE that, in practicality, the young mother ALREADY HAD a “Job”, just one that, while it didn’t come with a paycheck, if done right, it pays HUGE DIVIDENDS to the family and society.

Buy a house. Rent it to those that get gov housing paid for, EBT and the gauntlet of other ‘assistance’.

Anything the cartel gets involved in,,, no matter what,,, prices increase as everyone wants a piece of the action. Check out the price of what they pass off as education today.

A neighbor decided to get in on the cartel scam. Fixed up the older house,,, what many call a 60s house. Rented it for $1500 p/m where the cartel picked up most of it. The ‘renters’ destroyed the home as they didn’t have any skin in it. He is devastated and broke.

Back in the day, when the overwhelming majority respected other peoples property, (a completely unknown feature today), People left the house unlocked with a note saying it was for rent for $$$ and their phone number. Today it would be quickly filled with bums and anything of value stolen. I have seen the wiring ripped out of walls to sell for the metal at salvage yards. The destruction of property is so common today the News rarely reports it.

in some areas people are getting $7000 per month as a STVR/airbnb rental..the owner can zap the renters like a rental car company does….nobody wants long term tenants anymore….way less rent, can’t get rid of them, can’t collect for damage…other then the deposit…..

Here is another point to be considered. People who have lived in and paid off their homes years ago are about to walloped when the next real estate estimates occur. They will be hit with increased tax bills that will eventually become unaffordable and be forced to sell or have the homes sold off by the local jurisdictions to recover the delinquent taxes. You will no longer be able to stay in your paid off house.

Happening here in free Florida where many escaping their home states tyranny are moving to.

Happening to me now, property taxes of $12k on a house we bought for $33k in 1974. Funny how the taxes are on a ratchet, only go one way – up. Few more years we’ll be living in a van.

Teachers union: ‘Thank you for your sacrifice, Mike.’

p.s. ‘What have you done for us lately?’

But “It is for the children!” Very few ask “For whose children?” Or “Why are there more administration desks than teacher’s desks?” Or “Can I see the curricula and a book list?”

I see Newsance is bragging that he signed a bill prohibiting book banning. Does that mean Little Black Sambo, or Huckleberry Finn, or even Little House on the Prairie will reappear in the school libraries?

Texas passed a property tax “reform” during the latest session of the Legislature which, if approved by voters in November, will artificially suppress the millage rates for two years, kicking the can of the irresponsible spending on the local levels for another two years and using the state’s current $17 billion surplus to pay for the party.

The fun will end when the 2026 trim notices go out, but that will be the problem of the Legislature when it convenes in 2027.

That will keep property prices at the already artificially high levels as people shop payment for their mortgages.

In North Austin/Round Rock, the decreased property taxes next year will be offset by increased homeowners insurance costs after Sunday night’s storm.

I already had my policy backdoor cancelled once in the last year due to the carrier desiring to get out of Texas and electing not to overlook a mortgage company mistake with the escrow payment.

RE: “Who is buying these $300k-plus homes, then?”

Indeed.

“For two years, the Turkish property investor thought he had purchased a renovated rowhome in the Park Heights area that had tenants who were paying rent. He’d received 20 months of such payments. Then, five months ago, the money stopped. Property Invest USA, the Miami-based company that facilitated the transaction — along with nearly 300 others across Baltimore to buyers in Turkey and Central America — was being evasive under questioning, he said. So the 34-year-old investor, a commercial airline pilot, decided on a recent layover in Washington to make the trek to Baltimore and take a look at the property for the first time since he bought it in June 2021. ‘Yeah, here we are,’ he said, standing on the sidewalk looking at a front lawn that hadn’t been mowed in ages. ‘It’s obvious there’s no tenant.’”

“He says he did not know that on the day of his closing, Property Invest USA paid $53,000 to acquire the property, and would sell it to him for twice the amount in what’s called a ‘double closing.’ Now it was time for the pilot to see what he paid for. A local Realtor he had contacted prior to arrival, Nick Pfisterer, led the way up to the front door. ‘I’ve seen some bad houses, and this looks like it hasn’t been touched in years,’ said Pfisterer. ‘Even if it was renovated, pardon my language, it’s a shit job.’ Standing on the porch of his home waiting for a locksmith that never arrived, the pilot wondered if he’d been naïve to invest in property 5,000 miles from home. A group of other pilots had recommended it. ‘This is United States. If something bad happens, I can go to court. The United States works efficiently. I thought that,’ he said.”

http://housingbubble.blog/?p=7835

Hi Helot,

Yup… And: There’s a house about 1 mile down the road from me that sold more than a year ago… and hasn’t been occupied by anyone since it sold. Who owns this house? Clearly, it is someone with no interest in living in or renting it.

What, then?

Its a coroporation sitting on an infinite supply of cash. It s a number on thier balance sheet. These companies are literally and “legally” stealing from us as we are being force out of our homes.

Ghost cities in China, so why not do it in America too?

We sold our mother’s home after she died. 4500sq feet w/ several out buildings, on 13 acres in a very nice area. Sold for more than we ever thought we would get. It has been vacant, not maintained for 2 and a half years now. I can’t imagine what our winters have done to the interior, (hot water baseboard heat). Who does that!

Buying real estate, SIGHT UNSEEN. Still the biggest dumb-assed financial move one can make.

TURKIST Pilot, huh? That convinces me to NEVER fly Turkish Airlines if ever I’ve a need to go to Istanbul or Ankara. Someone with that lack of common sense being trust with an Airbus A320? I don’t think so.

I wonder if investment management companies such as BlackRock & VanGuard are buying up all these homes for sale that most people can’t afford to buy and turning them into rentals. The Klaus Schwabs of the world are trying to turn everything into a “service that we rent” instead of actually owning them, from houses to cars. Why, it has even become obvious that they wish to eliminate natural immunity and alternative medicines in favor of “immunity as a service” via expensive ‘drugs’ & ‘vaccines’ made by the pharmaceutical industry.

You nailed it John,

I regularly get letters from various LLC’s offering to buy my house “as is, for cash, no closing costs, yada yada yada”. I’m sure the ones they aquire get some fresh paint slapped on and then rented out to whatever sucker they find.

Hi Mike,

The whole thing is a combination of depressing and infuriating. I love my place – in part because I’ve put 20 years of my work into it. I’ve fixed/rebuilt so many things I can’t remember them all. The thing is, I did all that on the assumption this would be where we’d live the rest of our lives. I now worry we may have to start all over again, somewhere else. But where can anyone go to get away from what’s happening? That seems to be the question, eh?

Maybe Farley (Chris, not the Ford CEO) was right about the van down by the river….https://www.youtube.com/watch?v=Xv2VIEY9-A8

1) Actual insurrection

2) Secession