The governor of Florida – Ron DeSantis – says he wants to end the most odious of all taxes, that applied as rent which a “homeowner” must pay in order to avoid being evicted from what isn’t his home – even if he paid off the mortgage – by dint of that fact.

The tax is odious for that reason alone – in that it means a person will never own their home, no matter how many decades they pay rent and no matter how much they have had to pay over those decades. The sum can easily run to what amounts to 50 percent or even more of the original purchase price of the home, which is confiscatory taxation.

The argument in defense of this is that the tax is based not upon the purchase price but rather upon the “assessed value” of the home at some point after the purchase. The “assessment” being performed by agents of the same government that will evict you from what isn’t your home if you do not pay the rent styled “property taxes” based on the “assessment.” The claim is that the value of the house has increased – but the fact is this is a hypothetical unless the house is sold. So what it amounts to is an unrealized capital gains tax, something almost as effronterous as applying income tax to income not earned. It is more effronterous than that because we are talking about people’s homes – the place where they live. The homes they bought based on what they could afford. The rent styled “property tax” makes the home unaffordable at some point, forcing the renters to sell and move – a form of expropriation.

One could avoid the income tax by not earning income subject to taxation. But that is not possible when one must pay the ever-increasing rent styled “property taxes” because of the necessity to earn income as most people do not have enough savings to pay the rent without earning the income necessary to pay it. Thus most people never stop working – in order to avoid being forced out of what isn’t really their home by the entity that is really the landlord.

DeSantis is the first prominent politician to publicly agree with the above sentiments and that is what makes him unlike all the other politicians – including the “conservative” ones, who think that it’s congruent with what they style “limited government” to impose endless rent that can and almost always is increased to pay for government. For “services” they will often say are “needed” or even “essential” – according to them. It does not matter to these “limited government conservatives” that using the government to force others to pay for these “services” makes them morally indistinguishable from the “big government” liberals they pretend to oppose.

After getting a threat letter in the mail from the government – the right-because-honest description of what an “assessment notice” is – that advises me the government has doubled the “assessed value” of my house and so I can expect to pay double in rent (oops, “property taxes) irrespective of the fact that I owe these effronterous (but cowardly) thieves anything at all, I decided to send a letter to the guy who “represents” me on the board of supervisors. As if all they did was “supervise.” Here is what I wrote:

Hi Levi –

You may have caught the news that Ron DeSantis is proposing the elimination of property taxes in Florida, pointing out – correctly – that property taxes amount to paying endless rent to the government and thus assuring a person never really owns their home since the “owner” can be evicted if he fails to pay the rent.

However much it increases. No matter how much he has paid.

I’d very much like to see Virginia do the same but if that is not politically possible, I think it’s entirely reasonable that a limit be placed on these taxes so that people can at least hope that – one day – they will no longer have to pay rent to the government just to be allowed to keep the homes they paid for.

I think that a fair limit ought to be about 20 percent of the purchase price of the home, which is more than a “fair share” as taxes are often described. It is arguably confiscatory to demand that anyone pay more than that. The 20 percent could be paid in a lump sum at time of purchase or incrementally (folded into the mortgage/escrow as is current practice) until paid off.

After which the obligation is satisfied.

I suggest this as a reasonable way to deal with what is becoming truly obnoxious taxation that is going to push many people out of their homes and even those who are able to to pay these exorbitant taxes will end up paying 30-40 percent (or even more) of the original sales price of their home in property taxes.

That is outrageous by any standard.

I understand that property taxes are based on assessed value rather than purchase price, but this is unjust because it amounts to a tax on unrealized capital gains. What one’s house is “worth” after one purchases it is an irrelevance if it is one’s home and one just wants to live there. And bought it because it was within their means at the time of purchase.

I submit that people have a right to own their homes and that there needs to be a limit on the amount of taxes they’re expected to pay in order to not be evicted from their homes.

This is just in the way of food for thought.

I’m so aggravated by these taxes I am considering speaking about them (and the above proposal) publicly, to “make the case.”

Thanks for listening!

I’ll let you know whether he did. And whether he plans to try to do anything to follow DeSantis’ example. If not, I intend to get involved – because it may be the only way to end this evil business of taxing people on unrealized gains and of making us all renters-in-perpetuity, even if we’ve paid for what can never truly be our homes thanks to that.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

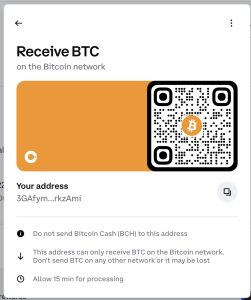

Our donate button is here. We also accept crypto (see below).

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you like items like the Baaaaaa! baseball cap pictured below, you can find that and more at the EPautos store!

The bitcoin code is: 3GAfymoqSUbaFvY8ztpSoDKJWCPLrkzAmi if you’re unable to scan the QR code above!

[…] Guest Post by Eric Peters […]

In North Dakota, there is a homestead credit and a homeowners credit if you are over the age of 65. It amounts to 1,500 dollar credit, which is really a return of money stolen for 40 years of paying property taxes, and insurance adds even more to the cost of owning and maintaining a home.

Basically, the elderly need a serious break from all of the taxation. Paid enough over the years.

All that happened was the powers in the state bought votes to keep property taxes intact, and are double what they were in 2000.

Property taxes and insurance cost you a fortune.

Even if property taxes weren’t onerous and didn’t constitute slavery, the idea of having to pay more or less depending on “the value” of one’s property is just as preposterous of every other aspect of taxation. So, some former childhood neighbors of mine who had 11 kids and lived in a decrepit small house, paid practically nothing in property taxes, and got to have their brood supported by and educated by everyone else. Meanwhile, the hardworking couple next door with no kids and a nice house, and the recently retired guy around the corner also with a nice house he worked hard for all of his life, paid many times more in property taxes.

This is just one thing that led me to the realization when I was still just a teen, that we are nothing but slaves, and America is a communist country, since we practice the redistribution of wealth -which is what all of these various taxes are- after the politicians and their contributors, friends, relatives and favored businesses take a nice cut.

Trump brought the idea up of revoking the property tax & having tariffs pay for everything. Just the way the FEDGOV used to operate, before the dictator (((Lincoln))) destroyed the USA. Will it happen? Orange Man is the man on a roll with the EO’s so here’s to hoping!!!

In the meantime, look for any kinds of respite from taxation wherever possible, such a “disability” diagnosis that inhibits your ability to earn money, as a way to get relief.

Check with a tax advisor/account/lawyer as needed!!

The money you save will be yours!!!!

So yr better cuz ya pay more?

Snob shit

Those people who had a bunch of kids and lived like paupers in a run down house are the bad guys? Or ar they making huge sacrifices for something more important than a bankroll? While I absolutely sympathize with the retiree being robbed by property taxes, and somewhat with the DINK couple also being robbed, the issue isn’t some people winning and losing, the problem is the corruption house running the system.

Hi Ernie,

I see this as another example of pitting us against each other. A person who wants kids – even a lot of them – ought to have them and I agree that having kids is necessary and even noble in that without them there’s no future and kids raised well help improve the odds of a better future. But no one ought to be forced to help raise/feed/educate someone else’s children. That is effronterous. The childless couple has every right to not have kids and save the money and spend it on themselves. Maybe it is selfish. But it is their right because it’s their money. Ergo, they owe no one else a cent of it.

And this business of taxing people out of their homes is simply criminal.

The problem is indeed people being robbed.

I have no issue with people having as many kids aas they want, and living whatever way they have to or care to.The problem I have is with this communal system, in which those people are subsidized by others.

In the example of the people with 11 kids, the father was an alcoholic who didn’t have to pay income taxes (I think the tax stops when you have 9 kids), and the family received entitlements galore (Several thousnad dollars a month in food stamps alone), while the people who had no or few kids had to subsidize them. Or in other words the other people aren’t allowed to keep what is theirs; what they rightfully earned, and what they rightfully owned. Essentially, one is punished for being responsible; for maintaining their property; for living within their means, while others are rewarded for doiung the opposite, because of the redistribution of wealth scheme imposed upon us by government, which decrees that what you legitimately earn, own or produce is NOT yours, but is theirs to do with as THEY see fit, and to just leave you with a portion (which they get to determine).

“…with no kids…”

So who is paying into their social security ponzi scheme? The neighbor’s 11 kids?

“So who is paying into their social security ponzi scheme? The neighbor’s 11 kids?”

And who is going to pay into the neighbor’s kids Socialist Security fund? Do the math on that….. But hey, I’m sure that the victims will be giving thanks when their money is shunted into that Ponzi scheme, instead of letting them keep it to invest and grow, and be given to their own heirs if they never make it to retirement. Have to make sure Grandma has her Friskies for dinner, so to hell with the robbery victims….

The tax burden is onerous. Yet people still prattle on about Govco’s “services”. There is a significant percentage of the population that willingly licks the hand that regularly smites them.

Testing

One-two-three

Excellent idea in pointing out that property taxes are a tax on unrealized gains. In just the past four years I’ve paid out more than the purchase price of this house – $33k in 1974. If I added up the cumulative total of my ‘rent’ over the past fifty years I’d probably have a stroke, or more likely go postal. Have been retired for about twelve years now and the property taxes are our single biggest expense, I have a decent pension and an IRA but the pension is the same as it was when I retired so definitely falling behind inflation. What galls me the most is that a large portion of my ‘rent’ is going to pay for the gold plated pensions of the cops, firefighters, and teachers here.

The teacher’s summer vacations aren’t going to pay for themselves you know.

Yes, property taxes need to end, period. But something needs to be done about the rising cost of government mandated vehicle insurance, too, just got my bill and it went up another $100/6 months to over $1,000! And I’m trapped with Farm Bureau since my house is old and has fuses (yes, an electrician looked at it and said it is fine and he wouldn’t change a thing), no other insurance company will even look at it. Sure, I could just switch my vehicles to some other mafia company, but losing the so-called multi policy “discount” would make it a wash. Gonna go drop it down to bare minimum liability, and maybe drop my barn/tractor off the farm policy, too.

Hi Gary,

My Spider Sense tells me we’re very close to reaching a point – if we’ve not already passed it – when responsible people come to understand there is no longer any point in playing by the rules – and we just stop doing that. Screw insurance. If they catch me, so be it. Make myself a pauper on paper so they can’t get anything out of me. If millions of us did this, forcing insurance on us would become untenable. Disobedience is the last resort before revolution.

Yr gettin closer. . .

Probably what will happen is already visible in places like Mexico, there is rapidly coming a time when you just pay la mordidas to the cop who checks your papers, since he can make your life hell if you don’t and the communist government is so disconnected from reality and sanity that it will be ignored unless there is a cop in your face. Please note that this is far different from free people in a free country, but it is far better than democracy/communism.

‘After getting a threat letter in the mail from the government’ — eric

Here’s another ugly threat letter from Big Gov, that decent people are resisting:

‘The AAPS (American Association of Physicians and Surgeons) challenge of mandatory “Beneficial Ownership Information” (BOI) reporting to the Financial Crimes Enforcement Network (FinCEN) took another important step forward today, following last week’s announcement of a new March 21 filing deadline.

‘In the U.S. District Court for the Northern District of Texas, AAPS filed a renewed expedited motion for a preliminary injunction against FinCEN requirements to file personal information or face the potential of a felony conviction.

“Many Americans were unaware of this new federal criminal law, which carries a penalty of two years in prison for non-compliance,” explains AAPS General Counsel Andrew Schlafly.

‘Although Congress appears willing to delay the reporting by another year, complete repeal is needed. Please ask Members of Congress to support two bills that will end the FinCEN BOI reporting requirement, H.R. 425 & S. 100.’ — email received this morning

So — as in the case of filing income taxes — you can go to prison for not submitting useless paperwork to FinCEN. Big companies, by the way, are exempt. BOI is to punish and harass the butcher, the baker and the hairdresser, and to eat out their substance. Its sponsor the Financial Crimes Enforcement Network assumes you’re guilty until you prove yourself innocent.

This is how we got Prop 13 in CA which limits the tax to 1% of the assessed value and caps annual increases at 2%. You make a good point. If someone buys a home based on what they can afford and the home value sharply escalates, they should not have to move out because their property tax increased. The services provided by the government that are the basis and justification of the tax have not increased in cost proportionate to the increase in property value. The home is reassessed to market value when it sells so the government will get more property tax over time anyway due to property sales.

And yet, 47 years hence, when Howard Jarvis, that crusty old “Jack” Mormon, got Prop 13 passed, the libtards and Dummycrats pissed and moaned ever since. First election that I ever voted in (I was 19 then) and I voted in favor of it, simply because the property tax for my Grandmother’s home, her having bought it some nine years prior, was already about half as much as her mortgage. She being a recently retired state employee feared losing her home if she could no longer afford it. When it was my turn, sure, that 1.08 percent on, say, $417K was still, but at least I knew what it’d be!

One way or another the services from GovCo must be paid for. That said it’s high time the powers that be realize that the tax payer is not an overflowing piggy bank that can be pulled out of without issue.

Funny thing is we keep electing people that insist on spending our money and when we the people don’t have enough they float a bond to spend more. In the end we all have to live within our means. Perhaps it’s high time that GovCo tries it.

How does an entity $37T in debt shamelessly promise $5k per household bribes ?

Who voted for this?

Hi Rain. No one voted for this; this is just the new way of saying”Look; Squirrel”. Hopefully it doesn’t fool any one. If they actually hand it out I recommend spending it on some precious metals and long term food, if it works out in the end and you don’t need that stuff great but better to have it and not need it than need it and not have it.

VA can keep sending me property tax letters, one day I’ll show them their magic appraisal isn’t worth the paper it’s written on, and scrap the truck if need be to get them off my ass.

Let’s see for three years we’ve been telling him it’s worth 2 grand, and he up and sold it to the junk yard for $400. Does that mean we get the $400 owed on it being worth 2 grand? I think not.

Hey, Eric,

Does Virginia have ballot initiative process?

If so, perhaps you should consider becoming the Howard Jarvis of Virginia.

https://en.wikipedia.org/wiki/1978_California_Proposition_13

>Proposition 13 declared property taxes were to be assessed their 1976 value and restricted annual increases of the tax to an inflation factor, not to exceed 2% per year. A reassessment of the property tax can be made only when a) the property ownership changes or b) there is construction done.

Ballot Initiatives in Virginia…

Good luck, the idiot that writes those is bought and paid for by the democrats.

Always a waste of paper. Always something that if the legislatures head weren’t up it’s own ass would see it’s either clearly a good idea or not, and never giving the voter a meaningful role in self determination.

Yes we have ballot initiatives, and they’d never in a million years let us put it to a vote.

Over here in VA-04 my rep just sent me a newsletter about how she’s hanging out with “we don’t know what they got on us” Maxine Waters and pushing Project 2025 is the reason for the “Musk-Trump-Vance” admin.

The votes are rigged, and the politicians suck, and they’d never allow us to vote on that.

Please for the love of god mandate paper ballots and you’ll never see VA blue again. If they Un-gerrymandered everything it would never be purple again.

I live on property I bought in 1981 for $67,000.

My current property taxes are $1661 per year.

Based on inflation (CPI) the current value of $67,000 in 1981 dollars would be ~$228,000.

I estimate current market value to be: $600,000<value<$700,000

A purchaser @$630,000 would be assessed a basic rate of $6300 per year.

There are other "garbage assessments" (mosquito control, etc.) which push the effective tax rate to ~1.25%, so realistically, the new owner would be looking at ~$7875 per year.

If I were forced to pay property taxes based on current market value, it would result in a severe financial burden, since I am retired and living on a fixed income.

My advice 2U?

Quicher bitchen and take action.

As you yourself put it: Strike hard, strike now.

If you can't run with the big dogs, then stay on the porch and howl.

Thanks for pursuing this – tax relief needed, on property

and income. Recently paid my unfair share.

Hi liberty,

Absolutely! I’m getting involved, locally – because I consider this tax to be the most evil and obnoxious of all taxes. A man who can never truly own his home is a serf – and that’s a fact.

Hopefully what DeSantis does is cause the first domino to fall so to speak and this spreads to other states. Hopefully mine (OK) will do the same. I’m with you in that this is the worst tax of all imo. How and why this stupid tax got accepted by people is something I will never understand.

“How and why this stupid tax got accepted by people…”

Government skools produce sheeple. Forced to pay

and forced to attend (slaves). It ain’t pretty…

If Ron DeSantis goes through with ending property taxes in Florida, it’s liable to spread to other states, even BLUE states who treat their citizens like they have an endless supply of money.

There are rumors that the state of Oregon wants to enact state property taxes, which, if passed, will likely be in ADDITION to whatever property taxes local government has. I’m sick of this attitude from so many governments that people are little more than a piggy bank to be endlessly fleeced for more and more taxes. Corrupt politicians & bureaucrats always seem to want MORE taxes, and they almost invariably frame it as “Making the wealthy pay their fair share!” or “It will ONLY affect the wealthy!” However, they used the same arguments for income taxes in 1913, which, over the next 100+ years, eventually affected EVERYONE who earns income.

The idea of this spreading is fake news. Many entrenched interests will stand in the way. These interests could be overcome, as the tide is shifting and the mood in the country is beginning to take a turn. However, as you know first hand, elections in their current state always resound to the house. Its a uni-party system and we aren’t in it. for things to really improve we need to do away with mail ins, counts that continue for days, and polling places that don’t require GovCo issued ID. Until that happens, I’m afraid we are all just pissing in the wind. Or, we could move to the next Box available to us per our founding fathers. Soap box and ballot box will probably only get us so far.

Governor of North Dakota tried this last year and it was voted down . I suspect a voting error.

Hi Ant,

That property tax bill in North Dakota may have also went down because there was a lot of fear mongering over what getting rid of property taxes would result in. Claims like “Granny will die!”, “Your kids won’t get an education!”, “Fire & police departments won’t be able to respond to emergencies!”, etc.

Hmmm, I thought: read this bit, then re-read your comment:

‘”Give Us Back Our Fu*#ing Money.” How Washington Stole Everything.’

“Every person in your family or community living on nuts and bolts and berries has had his life stolen by the bureaucratic blob.

And, we are going to get it all back.”

https://elizabethnickson.substack.com/p/give-us-back-our-fuing-money-how

I wonder if there is a U.S.A.I.D. equivalent on a State level, or if it’s all just trickle-down?

I wonder if there’s any difference between the net worth & salaries on the caption in that article, vs. those in State .gov?

>“Fire & police departments won’t be able to respond to emergencies!”

The hose monkeys might not get paid to shop for groceries, cook dinner, and sleep at the fire house. let alone “retire” and start drawing a pension @ age 50.

The horror. The horror.

Morning, Adi!

If my house burns down that is my problem. It is not my neighbor’s obligation. If either of us wish to pay for fire services we will almost certainly never need, then that is of course our right. As far as police: If they actually were that – rather than speed trap manners and mulcters of peaceful people causing no harm to anyone else – I would not object to contributing a modest/reasonable sum toward the general fun.

Fire service ‘protection’ serves the insurance mafia, not the home owner.

Hi, Eric,

>It is not my neighbor’s obligation.

Neither should your fire become your neighbor’s problem.

One main function of the FD is to prevent fires from spreading to nearby properties.

Your house may already be a total loss by the time FD gets there, but if they can prevent it spreading to your neighbor’s house, they will have done their job. Fact is, embers from your burning roof *will* be borne on the wind, likely beyond the confines of your property, and *you* would be the cause of any resulting fires on other people’s property.

Yes, Adi –

That could happen, But it does not mean it will. Much less that it did. As you know, I oppose the idea that people ought to be made to pay for “what ifs” rather than for what is. I understand there are people who are not “comfortable” with risk. But those feelings are not my problem. The only thing that ought to be is harms I actually cause.

Just pay em when they perform their “service”. You don’t pay Jiffy Lube yearly, you pay when you use their service. If you call the popo or the fire dept. when they show up to remedy the problem, they can leave you an invoice.

Hi John,

I am hoping those bleats lose their potency – as “wearing is caring” did in re “masks.” I say it is immoral to force anyone to subsidize the schooling of other people’s children. I say, further, that it would be better if parents home-schooled their kids or hired their own tutors, paid for the schools and teacher they approve of and have the ability to fire if they do not do their jobs.

Hi Eric,

We shall see, though many Democrat politicians still use narratives like “Republicans want people to starve!”, “Republicans want to take away your _______!”, “Republicans want to take away your money & give it to billionaires!”, etc., and there are still propagandized people out there who buy it hook, line, and sinker. The Democratic Party used such tactics to try to get people to vote for an empty vessel of a presidential candidate last year instead of Trump, but their tactics failed. But now, with Elon Musk and other big tech types in the Trump 2.0 administration, I’m concerned that we’ll be seeing not fascism coming to this country but technocracy.

Are your kids getting an education now? In Oregon private schools provide education. Public daycare makes green hair.

The property tax elimination was an initiated measure, petitions were circulated and signatures gathered, enough to make it to the ballot. Then the vote, which was more or less rigged by the state collectivists.

The governor didn’t take part.

Incredible to see this.

https://rumble.com/v6oqxol-ron-desantis-pushes-to-end-property-taxes-in-florida.html

Levi. SMH, LMMFAO. Maybe you pay Levi a visit at the council chambers and ask him how he feels about MadMaxineWaters notion that you can, ‘get in their face?’

All these local officials need way more fear in their diet than they currently consume. It took a while but your ideas on the onerous nature of property tax has found some purchase. kudos on that.

Good on Ron D. Santis. The first state that figures out how to do this successfully wins the free state project. It would be a no brainer in my state AZ, if we hadn’t been taken over by locusts from California. The fact is, our Governor isn’t even fit for making cat turd sandwiches. Yet she bravely fronts for team Bolshevik, vetoing the will of heritage Arizonans on a regular basis. Lifetime limits on property tax is the least they can do. Its an idea thats time has come. But if its ever going to happen wide spread, we first need election serious reform.

I sure hope this could come to Arizona, Norman. But you’re right about the governor. She sucks, and I’m sure she’d veto such a thing because of “muh publik skools”.

She needs to go. Even with her meddling, our states voucher system still stands head and shoulders above anything muhpublikskools offers. I know a fair number of people whose kids have benefited, and are finally getting a [relatively] decent education

Good. Public schools are TERRIBLE. I know because my woman is a teacher. She describes the horrors of the publik edukashun sistum all the time. All of it needs a complete overhaul. I really hope the “Department of Education” gets abolished for good.

And yes, I hope we can get rid of Hobbles soon. Next election is next year and we need to give her the boot. The abolition of property taxes would be absolutely sublime. Perhaps we can get back to owner/builder laws, too. Keep the vampires off our property and out of our lives.

Hi, BaDnOn,

I am myself the product of what was, at the time, a very excellent public school system (Albuquerque, NM Public Schools, 1960s).

OTOH, my best friend taught at Gabrielino HS in San Gabriel, CA

https://gabrielino.sgusd.k12.ca.us

for 10 years before he packed it in because he was tired of looking over his own shoulder. My friend is an original thinker, and that made him dangerous.

Hey Adi,

Yeah, some schools are better than others.

What I’ve seen generally, however, is that it seems people were better educated before the “Department of Education”. You likely received a better education than 90% of the kids today.

Also, yes, thinking for yourself is often discouraged in this day and age, especially in public schools.

My first grade teacher went nuts in the classroom during a simple first grade test.

She demanded all students to stop erasing incorrect answers, all tere was to it, the teacher went ballistic. The teacher went around the room and pulled every eraser from the tops of every students’ pencil in the room.

Lost in space. There she, was gone.

The teacher never returned to the classroom, a substitute was there to fill the void for the remainder of the class year.

Not everybody is able to cope.

There she was, gone.

I will never forget her using her teeth to bite every eraser from the pencils each student had in the classroom.

Just nuts.

Yep, Drumph, some people snap in such a position. Being a teacher isn’t easy, but comes with perks the rest of us don’t enjoy, mostly being all the vacation time.

I went to private religious schools for eight years and then four years of public high school. This was back in the 50’s, 60’s. I was taught some reading, writing and math plus some history, biology, chemistry, physics, algebra, geometry etc, in high school. The teachers were okay. This was enough that I qualified for every army job, finance, computers, electronics etc.

Is the problem teachers or students or both? Our changing demographics leads me to believe that demographics is destiny and if the USA does not change course we will be headed into Idiocracy.

BTW White people are only about 56% of the USA population and dropping. White school age children are already in the minority.

Demographics is indeed the “problem”, Rather the change in demographics is the problem.

The East Detroit Public School system used to be one of the top-performing school districts in the state of Michigan.

The city of East Detroit changed its name to Eastpointe to get away from the negative connotation that being associated with the city of Detroit entailed. Property values shot up considerably almost immediately. The school system never changed its name, remaining East Detroit Public Schools.

Anyway, the changing demographics of the population of Eastpointe resulted in the school system deteriorating rapidly. It is now one of the worst school systems in the state. From top scores in subject material to present-day school shootings and violence almost on a daily basis, it is the demographics that is the problem. If declaring this change is “racist”, I wear my “racism” as a badge of honor.

By the way, I, being white was “ethnically cleansed” out of Detroit many decades ago. I stand by my statements.

Hey Europeasant,

There are many places to lay the blame, but I’d start with leadership and current paradigm of “testing-testing-testing” to receive government funds. Disconnecting from that system would do wonders.

Also, kids are kids, and where the blame lies with students is really with parents. Some parents are frankly trash, no matter their color. Where my wife teaches, the kids are mostly white, with a hispanic minority. But we are talking “white trash” to be honest. It’s just some bad culture. Not everyone to be sure, but I think it’s a fairly accurate generalization.

Many parents, these days, just treat public school as a subsidized daycare and food program. That’s what it has become, and this needs to end.

Take care of your own kids, people.

BaDnOn,

She might try teaching at one of the for profit charter schools. They’re springing up everywhere. One of the people from our Saturday afternoon poker games was a retired public school teacher. Has lots of stories about how horrible it was in public schools, even in rural Idaho where he’s from. He recently came out of retirement to teach at a local charter school, and he loves it. Always telling us stories how the disruptive students are given one chance, if they continue to cause problems they’re out. No BS, or mealy mouth 2nd, 3rd, or 4th chances. Just, ‘Theres the door, don’t let it hit you on the way out.’ And the administration has the teachers backs which is a new thing for him. Just saying, if she has to drive some distance to get to work now, I’m sure she could find a decent for profit school where she might actually find some decent kids, and supportive Admin.

As for Slobs, she cant be dispatched soon enough. The damage she’s done/doing to the state is Bidenesque. I look at her, and listen to her voice and think, this must be some great punishment unleashed on us from the gods.

Hey Norman,

She’d be happy to teach in such a school if she were to find one anywhere near here. Right now, she’s looking at getting her Master’s in Child Psychology, because they pay the big bucks to such people just to test kids, and there is a deficit of those with proper training.

But one thing she’s considered is to create a “microschool” for our area. There is some protocol for doing so, and it would be highly valued here, being as there is only one truly nearby school. And she’d get to kick out any recalcitrant brats as necessary.

As far as Gov. Blobbs goes, I don’t think the gods would be that cruel. Likely she’s there due to sheer human stupidity or perhaps shenanigans. She won after hardly running or making any substantive statements about her policy positions, so that was a little questionable.

DeSantis wants his wife to succeed him as Florida Governor in two years, and Trump endorsed another Republican last week.

‘I decided to send a letter to the guy who “represents” me on the board of supervisors.’ — eric

Have you ever met him? In a county of relatively small population, it shouldn’t be difficult to schedule a personal meeting.

Two weeks ago I met with our district’s county supervisor to talk about some projects our non-profit is working on. Called his secretary on a Thursday and got a meeting the following Wednesday.

Sit down with these folks and get to know them. My county supervisor has a red-and-white 1957 Ford hardtop with a mechanism that stows the top in the trunk. He loves to take it to car shows.

I cannot emphasize this enough. I’ve been a small town councilman and mayor for close to 30 years, and it’s lonely because the only ones heard from are the ones that want to steal and spend someone else’s money. They always have a well rehearsed and heartfelt sob story, and he people being robbed and screwed over never bother to show up or participate, instead staying home or muttering in the bar about how bad they have it.

“Freedom isnt free” has very little to do with military running around the world and enforcing for the oligarchs. It has a lot more to do with paying attention and speaking up against all the well meaning bull$#it and making the sacrifice of serving in some position where you can gum up and plug up the schemes of the democrats/communists.