Financial experts will tell you that, as a general rule, you ought not to be spending more than 30 percent of what you earn on a place to live – i.e., your rent or mortgage – because if you spend more, you won’t have much left for anything else. Including whatever comes up that you didn’t expect, but always does.

Imagine spending half that 30 percent – imagine spending all of that 30 percent or even more – on a car payment.

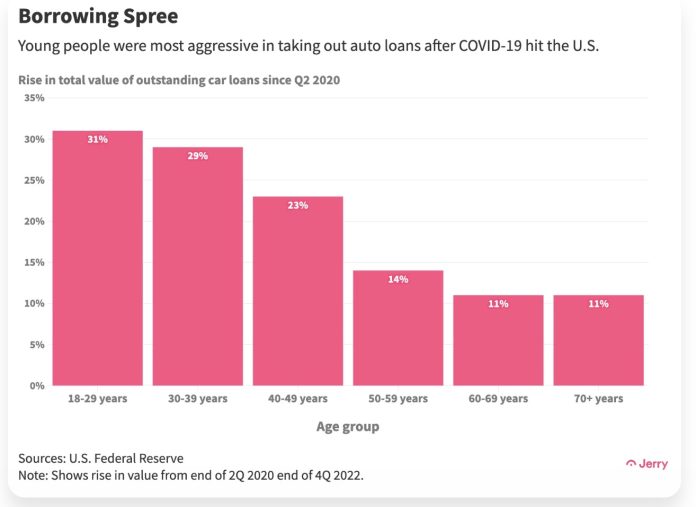

Apparently, a lot of young people did just that over the past couple of years – and now they’re broke and not keeping up on their car payments. According to Jerry, a car insurance buying app, something on the order of $20 billion in car loans is headed toward default and most of this Everest of debt presses down on the shoulders of people in the 18-39 age bracket.

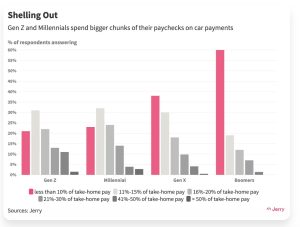

Jerry says four out of ten Gen Z car “owners” – in air fingers quotes to reflect the fact that you’re not an owner when you’re making payments on a thing that can be taken away from you if you stop making those payments – are paying 15 percent of their after-tax income on car payments.

One in five is paying more than 20 percent, or about what they ought to be spending on their rent/mortgage. Which probably accounts for why so many cannot afford their rent or mortgage. Jerry says 52 percent of Gen Z car-“owners” have had to defer a rent/mortgage payment in order to make a car payment.

It says a lot about what they’re not teaching in government schools these days.

And it says something else, which Jerry doesn’t touch on:

Why are young car buyers spending so much on cars?

The easy answer is they’re innumerate and irresponsible; see that line above about what they’re not teaching in government schools – about addition and subtraction, for instance. Also what is being taught generally; i.e., that you can “afford” a thing if you’re able to qualify for a loan on a thing.

But it’s deeper than just that.

What choice do most people in the 18-29 age bracket have?

A combination of factors – most of them set in motion long before they reached driving age – have made driving a car more expensive than it has ever been, which disproportionately affects younger drivers who, by definition, are the drivers most lacking the means to own and drive a car.

One such factor is the Obama-era Cash for Clunkers program, which encouraged the literal destruction of legions of functionally viable old cars by literally paying people to throw them away.

To have them crushed.

In the past, people would trade-in or hand-me-down their worn (but not worn-out) old cars, which resulted in there always – until now – being an abundance of cheap, serviceable beaters for teenagers and young people to drive. This Gen X writer, for instance, was able to buy a rusty old VW Beetle for a few hundred bucks when he was very young and that was all he could afford.

It did not have an LCD touchscreen. It barely had heat. But it was an operable car – and my 19-year-old self could afford to buy it without spending 15-20 percent of what I earned on a monthly payment for it.

Such cars are almost all gone now, courtesy of the crusher – and the federal government. Most of the few that remain are almost as expensive as new cars, because they are “classic” cars now.

Price an old Beetle today and see for yourself.

That leaves mostly new and late-model used cars as first cars for young buyers. And these cars have gotten much more expensive, too – because almost no car company (Mitsubishi is an exception) has made an affordable new car in about a decade. Even “economy cars” such as Corollas and Civics routinely “transact” – or sell – for more than $20,000. When you’re only making that much (or not much more) at Starbucks, it’s hard to swing a payment, especially after paying your rent.

Also, everything about these cars is expensive – including even basic maintenance such as oil and filter changes, brakes and tires. Have you priced a set of tires recently? $400 on the low end. That’s more than half as much as this Gen X’er paid for a ’74 Beetle in the late 1980s. And it cost less than $10 to change the Beetle’s oil, because it only took two-and-a-half quarts and there was no filter to replace (just a screen to clean) and all it took was a crescent wrench, a catch pan and five minutes to do the job – without even having to jack the car up.

Anything made within recent memory is too complex for most new/young drivers to fix, so they must pay someone else to fix it – usually for at least $75 per hour. And because they cannot fix – and cannot pay (since you cannot finance an oil change/tire change unless you put it on a credit card and pay legalized usury in the vicinity of 29 percent interest) they finance a payment.

Which, of course, they find they cannot afford to pay, either.

Another salvo that penetrates to the citadel is insurance, which is now almost as expensive as the car payment itself – in part because of the cost of the car, itself. The cost to insure a $700 ’74 Beetle back in the late ’80s was essentially nothing. Today, the cost to insure anything costs more in a year than this writer spent to buy the ’74 Beetle he drove back in the late ’80s.

It has become a vortex, a feedback loop that strengthens itself. People who can no longer afford cars are getting deeper into debt financing them, then paying more to insure them because the average car “transacts” for ever-higher-sums. Financing enables people to buy what they cannot afford, which makes everything less and less affordable, egging-on more debt-financing the less and less affordable it becomes.

Maybe it’s not deliberate but even if not, it serves the same nefarious purpose – that being enserfment, of the young especially. They are caught up in this vortex of debt that prevents the accumulation of capital by forcing them to spend more than they earn – and then the rest of us wonder why so many young people seem to hate capitalism, even though what they actually hate is socialism.

Unfortunately, many of them have no idea. And that may prove to be something we all end up paying for.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at [email protected] and I will send you a copy directly!

RE: “i.e., that you can “afford” a thing if you’re able to qualify for a loan on a thing.”

On The Housing Bubble Blog they used to call that the, “How Much A Month Club’.

Especially, in reference to strawberry pickers who made $14,000 a year “buying” $400,000 California houses back in 2004. Home ‘owers’.

Oh boy, has this Gigantic rip-off been going on for a long time.

Anyway, Eric mentions the cost to pay insurance on a Beatle back in, The Before, Before Times.

If me & my friends had to pay insurance back in the 1980’s, just about none of us would of had cars. It was hard enough keeping four tires which held air!

The Insurance companies & their friends/supporters with their requirements for insurance are just flat out Destroyers of prosperity & Liberty.

It’s plane, as day. …For those with eyes to see.

I live in the land of the blind.

For sure I drove a $400 69 Rambler and had no insurance. Before that all I had was a $500 moped. I was paying $185 mo rent. I could barely afford food so no way to pay for insurance. And back then everyone knew it so people steered clear of cars like mine!

Hi RS,

Ditto. I think many of us Gen X’ers did exactly that. Bought a cheap POS and drove it without “coverage” . . . oh, the humanity! I cannot believe how safety-obsessed this country has become. Even when no harm has been done. But it might! Even if it never does… Wear a seatbelt! Even on the drive to the mailbox. Wear a Face Diaper. Even though everyone knows they don’t “work.” Buy “coverage” – for everything – and be broke. Rather than just be healthy and responsible . .. and not broke.

When a car is just a life-support system for a chip …

‘Mercedes-Benz said on Wednesday it has teamed up with Google on navigation and will offer “super computer-like performance” in every car with automated driving sensors as it seeks to compete with Tesla and Chinese newcomers.

‘Automakers new and old are racing to match software-powered features pioneered by Tesla, which allow for vehicle performance, battery range and self-driving capabilities to be updated from a distance.

‘Drivers will also be able to watch YouTube on the cars’ entertainment system when the car is parked or in Level 3 autonomous driving mode, which allows a driver to take their eyes off the wheel on certain roads as long as they can resume control if needed.

‘All vehicles on Mercedes’ upcoming modular architecture platform will also have so-called hyperscreens extending across the cockpit of the car, the company said on Wednesday.’

https://www.msn.com/en-us/money/companies/mercedes-benz-cars-to-have-supercomputers-unveils-google-partnership/ar-AA17QfII

Got a computer at home, Jack. And I don’t suffer from Tesla envy.

Those who succumb to this sleazy pitch are gonna be watching P0rnHub on their hyperscreen, not YouTube … as the kill switch cuts in to ruin their buzz.

…or were they taught by the government that the very same government will bail you out??……..and don’t be surprised if they do bail them out via the new “Auto Loan Forgiveness Program.”

I just saw an ad for a new KIA UBER-SUV of some sort. A young couple on vacation at a snowy mountain resort stands at the door with their 3-6 mo. old baby. The wife asks about the baby’s “favorite binky”, to which the emasculated simp-husband responds by zooming down the snow-covered mountainside, offroad of course, to dive all the way home to get a pacifier.

This, folks, is the answer to Eric’s question, “why”. The latest generation of “men” are no longer just that, men. They have become simpering, emasculated, effeminate, virtue-signalling slaves, to everything; women, advertising, and pretty much every other aspect of the “wokeness” and “obedience” to “culture”.

My response in that situation would be (and as a no-nonsense parent literally has been) the child is too old for that, and if you disagree, stick your tit in her mouth, but I’ll be damned if I’m running anywhere to fetch a fucking pacifier!

I’d be willing to bet Mr Limp-Dick in the ad is probably not even the child’s father, for obvious reasons.

Well thats pretty harsh but i have to say im seeing a lot of these young men up close for the first time in our new large office building and i have to agree with your assessment. These males i would call beta males are young kids who are kind of on the shorter side, thin, no muscle tone wearing skinny pants and walking around the building perpetually staring down into their phones. Like zombies. They seem to have hardly any testosterone. As a women seeing guys like this is very unsettling. They give the impression of incapability and someone who does not think for themself. I figure they’re probably good at anything related to computers but they exude a childlike and passive quality.

Indeed, RS –

These are the types who stand around and do nothing when a weaker person is attacked. And when attacked themselves, curl up into a ball and beg not to be hurt.

Whilst workers will usually resist a reduction of money-wages, it is not their practice to withdraw their labor whenever there is a rise in the price of wage-goods. It is sometimes said that it would be illogical for labor to resist a reduction of money-wages but not to resist a reduction of real wages.

-Keynes, John Maynard. The General Theory of Employment, Interest and Money (p. 7). Signalman Publishing. Kindle Edition.

Remember back in the Obama administration? Coming out of the Great Recession, Occupy Wall Street and Bernie bros demanded an increase in minmum wage, and the state was happy to oblige. This had a ripple effect across the workforce, increasing the wage scale across the board. I remember getting a 15% wage alignment one day, almost a doubling of on-call pay and an increase to three hour minimium call out pay. Then two months later another merit increase. Good times…

Of course it couldn’t last. COVID just exacerbated the fundemental problem. Productivity hasn’t increased to meet the increase in labor cost. So costs go up. Meanwhile the Chinese supply chain is likely permanently damaged, so that’s the end of that deflationary mechanism too.

I have bought my last three cars and probably buying another one soon with an auto loan. But I do things a bit differently than a lot of people… apparently. I put enough down so that the monthly payment doesn’t make me have to “give up” any else (including fun) ***AND*** that, if worse came to terrible, I have enough in the bank to cash out the loan TODAY.

I did that with my ’02 A6 Avant about eight years ago. I did that with my 2014 A8 and I did that with my 2015 A4 Allroad. All of them, I paid *more* than the monthly payment for a while and then just paid them off well before the loan term expired. Thereby paying little interest and hedging my bets as well as possible while leaving a chunk of change in the bank.

All of them I paid off in full in about (or less) than 2 years time on the loan. I get nervous being “long” on a debt. And now, not only do I have enough to put half down on the prospective new vehicle but that’s before selling the vehicle it will replace (the A4 Allroad).

If you count on just eeking by, stretched to the limit, you’re putting on a huge amount of financial risk that is likely to bite you in ass, real hard!

Dropping like dead flies:

‘Guidance from electric vehicle start-up Lucid fell well short of expectations and Wall Street has some concerns. The stock is diving 18% in midday Thursday trading.

‘Wednesday evening, Lucid said it was planning to make 10,000 to 14,000 vehicles in 2023. Wall Street was expecting closer to 20,000. What’s more, vehicle reservations came in at 28,000 units as of Feb. 21, down from 34,000 reported on Nov. 8.

‘Management also said it isn’t going to give reservation figures going forward.’

https://www.barrons.com/articles/lucid-motors-stock-price-cash-6a103783?mod=hp_DAY_Theme_1_2

Great strategy: when business turns south, clam up and stick your head in a hole.

Another one bites the dust

Another one bites the dust

And another one gone, and another one gone

Another one bites the dust!

— Queen, Another Ones Bites the Dust

‘The average car “transacts” for ever-higher-sums.’ — eric

And EeeVee pickups cost even more … till they turn into costly door stops:

‘Lordstown Motors stock fell over 10% on Thursday after the electric-vehicle maker issued a recall for the 19 Endurance electric-pickup trucks in use and halted production and deliveries of future EVs.

‘The Endurance recall means to “address a specific electrical connection issue that could result in a loss of propulsion while driving,” Lordstown said.

‘The company also said it’s dealing with performance and quality issues with some Endurance components that have led it to temporarily stop production and customer deliveries since its last production update in January.

‘The 19 vehicles affected are either in the hands of customers or being used internally by the company. Vehicles waiting for shipment will be retrofitted, Lordstown said.’

https://tinyurl.com/5yrrxjwa

‘Teething troubles,’ as the Brits say. But this minor malady could prove fatal for baby EeeVee maker Lordstown.

Nineteen (19) units produced is a pathetic joke. Die already, Lordstown!

With property taxes, no one actually owns a vehicle.

You will own nothing and be happy. Here comes Fentanyl.

If you pay 25 thousand for a new car or next-to-new, you’ll pay the insurance to prevent catastrophic loss.

Gotta make money, though. If the bank loans you some dough, you qualify for the loan. Have to be a go-getter. somewhat hard-headed and right-minded about earning a living.

It still can all go wrong, have troubles and problems.

After 65 years of age, the bank won’t insure the loan.

Once you are old and in the way, not wanted in the workplace for obvious reasons, you then receive a pension and/or SS payment of some sort.

The gov secretly wants you to die sooner than later after you retire. Another useless eater that generates nothing to the economy.

A cruel assessment, but the truth.

The FED knows how to count. Especially in the negative number territory. Minus 31,500.000.000.000 dollars will take some time to count back to zero.

If you pay back at a rate of 500,000,000,000 dollars per year, it will take 63 years to pay it all.

Going to be a lot of dead people after 63 years, pay back one trillion dollars per year, 31.5 years of paying down the debt, just about everybody might get to see the debt at zero.

Not going to happen, ever.

If you were a commercial banker that loans the US gov money and then the gov pays interest to the bank maybe 350,000,000,000 dollars each year, you’d be a banker ready to provide some money to lend to dot gov. You end up loaning the money that the gov pays back back to them again.

Thinking taxes will ever go away is just plain nonsense.

Jefferson wrote that a good and frugal government will make sure the people are happy and free.

“A wise and frugal government, which shall restrain men from injuring one another, shall leave them otherwise free to regulate their own pursuits of industry and improvement, and shall not take from the mouth of labor the bread it has earned.” – Thomas Jefferson

Nothing close to that. Nice try, but not quite.

Get Nazis shooting at those crazy Russians, all kinds of money to make that happen.

Looks a bit suspicious. Maybe somebody wants it that way.

Julian Assange said that the goal is to have forever wars to wash money from the hands of the people in Western Europe and the United States.

Okay, whatever says Putin, going to cost plenty now.

The banking car loan bidness must be doing the same.

The gov secretly wants you to die sooner than later after you retire. Another useless eater that generates nothing to the economy.

A cruel assessment, but the truth.- Drumpish

Even as a youngin I never considered or thought old folks on SS useless eaters… When I saw an old woman buying some food with her meager SS I felt good that the country took care of it’s elderly. That’s history.

What gets me is while many citizens is the US call US SS pensioners useless eaters the US is supporting the Ukraine Pension system in the billions of dollars and most don’t even know. Kind of funny…

Hi Ken,

The real tragedy of SS is that many of those forced to “contribute” all their working lives could probably have retired – in the sense of not having to work – well before SS retirement age and not been dependent upon SS in their retirement.

Agreed Eric

Too bad we could not have just saved the money they took. The problem of that, in my case, is any savings from the 70s would be devalued 70%,,, (80s 60%),,, (90s 50%) or more by now. I suffered losses from the market crashes in 87,,, 00,,, 09. Stuck on SS.

Hard to win a rigged casino….

OT:

Academics advocate WWII-style rationing of food, fuel, travel to combat “climate change”

https://www.foxnews.com/politics/wwii-style-rationing-food-fuel-combat-climate-change-academics-claim-new-paper

“…rejection of markets, and a commitment to fair shares, is a key part of the value of rationing, and precisely what made rationing attractive to the public in the 1940s.”

They openly want literal communism now…

My grandfather worked in a Pennsylvania steel mill in a small town during the 40s. At that time, gas, rubber for tires, and food items like tinfoil meat and butter were being rationed. He walked to the steel mill every day from the one room downtown rental he and my grandmother lived in. He bought a very nice used car that a gentleman could no longer afford to drive and saved his gas coupons. Every few months he would take his boys and wife out for a picnic in some scenic area, taking long drives on the turnpikes, which were empty of traffic since no one else had any gas to drive. They were able to afford to put one boy thru college and the other joined the army and later became a policeman. They both settled in sunny CA where they started families, grew their wealth travelled far and wide in their great cars and bought property which appreciated to levels they could only have dreamed of. I feel like we have come full circle since going back to rationing and small woke apartments in 15 minute cities will likely be our fate in the not so distant future.

It amazes me that the average new car costs more than I paid for our house – $33k in 1974. Thanks Federal Reserve for debasing our purchasing power over the years; probably going to get a lot worse going forward as anyone who shops for groceries can plainly see.

I feel bad for young people today. They’ve been helicopter parented, propagandized, masked & scared of their own shadow, indoctrinated, and a stripped of their individuality. Boys turned into pussies bc of ‘toxic masculinity’. Girls turned into brainwashed viscious bitches. Everything is stacked against them.

The way this country is (few people, large geographic area) and the way it is set up (might move around for work quite a lot especially in your 20s—even into your 30s and beyond) personal transportation is pretty much a necessity.

I didn’t have a car (because I wrecked mine) in college & the first part of grad school. I managed, but it was hard sometimes. Now it would be a great deal harder, and visiting relatives would be nigh impossible.

The contradiction will resolve itself, eventually. Perhaps even soonish. But it will not occur without an enormous amount of pain.

Cash for Clunkers 2.0 is coming for the ~ 20 year old pickups that are still functional *work* vehicles for someone. It would have happened already except Elon is late with the Cybertruck, and the Farley family is busy filming a less funny, more tragic “Tommy Boy” sequel at Ford.

Roscoe. I agree that is the plan. However all the people I know that use work trucks will cling to their non EV’s. They will have to do it at gunpoint. They do not have enough guns. It’s a loser.

“Unfortunately, many of them have no idea”

Wouldn’t matter if they did. They aren’t given a choice. Courtesy of FedGov and the FED. Why are cars so expensive? Because FedGov made them so to “save” the “climate”. Why are they assuming excessive debt to buy one? Because the FED rewards debt and punishes savings. Even the elder among us pay these costs, but we are nominally in a better place to pay them. Nominally. Until the next poo poo hits the whimwam. When no one may be able to.

I think we are heading for an early 1900s standard of living. Before there were cars. When life expectancy was about 45. When most people spent most of their time getting food, if they could.

‘The Obama-era Cash for Clunkers program … encouraged the literal destruction of legions of functionally viable old cars by literally paying people to throw them away.’ — eric

Who benefited? Corporate-grifter auto makers like GM and Ford.

Who lost? Ordinary Americans who needed cheap transportation to work.

Who did this to them? The elitist Obamas, who ride in chaufeured limousines and now own four houses, collectively valued at over $20 million.

The saintly Obamas echo the Soviet-era nomenklatura, who shopped at the dollar-only GUM department store on Red Square, then carted their haul in their long black ZiL sedans (unobtainable by lowly cadres) through Moscow’s shabby gray streets to their weekend dachas in the forest.

Oh, the contempt! Do they know how much they are hated? If a pack of jackals were to rip them to pieces, most onlookers would be snickering in glee as they whipped out their phones to video the bloody slaughter and share it on TikTok.

That’s entertainment, folks! 🙂