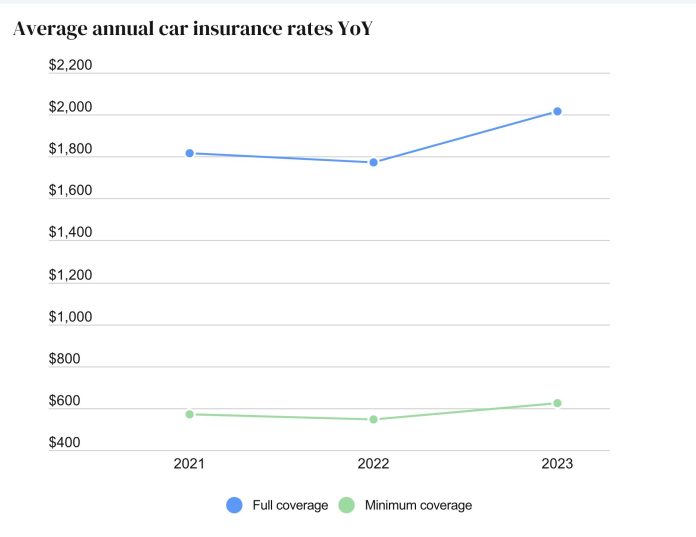

The cost of car insurance is going up – by about 14 percent, on average – chiefly because we’re not allowed to say no to it.

What do you suppose would happen to the cost of a cup of coffee if the government decreed that everyone had to buy one? It is the being able to not buy the cup of coffee that keeps the cost of a cup of coffee affordable.

Not so car (and now health) insurance. You are allowed to “shop around,” of course. But this has nowhere near the power of having the right to say no.

So it’s not surprising that the cost of car (and health) insurance is going up – for all of us. Including those of us who haven’t cost the insurance mafia a cent (but have been forced to pay it many thousands).

To be fair to the mafia – which it rarely is to those it “serves” – there are other reasons besides not being able to say no that are driving the cost of insurance upward. One of them is the cost of money. It takes more of it to pay for the same thing. This is called “inflation” – an insouciant term implying a natural unpleasantness that just has to be dealt with – rather than the deliberate result of financial machinations by the private banking mafia that owns and controls the money supply.

Anyhow, the point is that if it costs the mafia more in inflation-adjusted terms to pay claims then you will get to pay more for the coverage you’re forced to buy from them.

Another driver is the cost of cars, themselves, which is up by about $15,000 on average, if you go by what the average new car sold for last year vs. just a couple of years ago. $50,000 cars – and $70,000 trucks – are now common cars (and trucks) and even if you don’t own one yourself the fact that so many others own them is driving up the cost of the coverage you are forced to pay – because of the cost of repairing and replacing other people’s vehicles that cost so much to repair and replace.

Think of it as a “pre-existing condition.”

That you’re on the hook for.

In the relatively recent past, most people did not drive exotically priced cars, chiefly because most people could not afford to buy them. That’s still true today but a false impression of affordability has been created by making it possible for them to finance what they can’t afford – for six or seven years. Or rent – as via a lease. This has been made temporarily possible by very low interest rates on loans, but that is changing – and that will change what people think they can afford to make payments on for the next six or seven years.

But the point is that it costs twice as much to replace a totaled $50,000 vehicle as it does to replace a $25,000 vehicle and the $50,000 vehicle is also probably going to cost more to fix because it is likely to have more air bags or have a body made of aluminum and so on.

And if it is an electric car, it more likely to be replaced rather than repaired if it is involved in an accident because it is often necessary replace the battery, which may have been damaged in any accident, including minor ones. It’s not like a crumpled fender, which is obvious.

And doesn’t catch fire, either.

When an EV gets hit – or hits something – impact forces are telegraphed to the battery. It might have a hairline crack not easily found or seen. There might be damage to the inside matrix that cannot be seen.

Since lithium-ion EV batteries contain highly reactive chemicals and can (and do) sometimes spontaneously combust, this is a risk that’s too expensive to take. It is “cheaper” to total the EV and send the owner a check for a replacement.

Which you and everyone else who is forced to send the mafia money get to help pay for – because what are you going to do when you’re not allowed to refuse?

The mafia’s pay-out costs are going up – and so are yours. It does not matter that you drive an older, paid-for car that did not cost $50,000 when it was new. It does not matter that you have never filed a claim or even received a “ticket” (the blase term used to describe being handed an extortion note by an armed government worker, usually justified by some trumped-up traffic “offense” that entails the violation of an arbitrary rule that caused no harm) that can be used to portray you as being a “risky” driver.

But what really matters to the mafia is that some other guy just totaled his $50,000 EV. Lots of other such guys, actually. The more of them there are in circulation, the more the rest of us will pay – so that the mafia does not. It’s a kind of rip-tide effect that imposes costs on those who try to save money by obliging them to spend money to cover the costs imposed by those who spend it.

Neat. Sweet. Petite.

And more. The mafia itself has said so. You can expect to pay more “until we get back to historical profit margins,” an Allstate capo recently told the Wall Street Journal.

Leftists love to hurl fascist! at everything – and everyone – Leftists dislike. But they have as much understanding of the term as they do of other words, such as liberal (which once-upon-a-time did not mean someone who is generous with other people’s money).

Insurance – as it exists, as it is enforced – is the very definition of fascism. Mussolini – its 20th century expositor – used the more accurate term corporatism. Which conveys the nature of the thing more directly. In any case, it is the merger of big government and big business – the latter using the power of the former to “get back to historic profit margins.”

A point will come, though, when the cost of these profit margins isn’t merely obnoxious but unpayable.

Will the parasite kill its host?

It is certainly killing driving – by rendering it increasingly unaffordable. And that may be just the point – though it begs the question: How will the mafia continue to extort “historic” profits when people finally decide, in exasperation and desperation, to stop paying for them?

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at [email protected] and I will send you a copy directly!

Live in New Hampshire. A

>Auto insurance is not required

>no seatbelt laws

>no helmet laws

>no sales tax

>no income tax

>in criminal trials defense is permitted to argue for Jury Nullification;

> etc

State Motto: “Live Free or Die” it’s on every license plate

This is bats**t crazy!

https://www.thedrive.com/news/rivian-r1t-fender-bender-turns-into-42000-repair-bill

$42,000 to fix a bumper after a minor accident.

Haha, “Illumn8”. What a crock.

I’ll be staying far away from those damn things.

Really, like is said in Eric’s article and this incident illustrates, these exorbitant EVs could be not only the demise of private car ownership, but also the auto insurance industry itself.

…I mean Christ, what if that guy backed into a fire hydrant?

There sure isn’t much people do own these days. ‘Land of the Free’ and home of the deluded. We’re really just free-range livestock treated like mushrooms…kept in the dark and fed shit from the moment we’re born; but once an individual has learned something they can never unlearn it. Much respect to Eric and others who spend their spiritual currency (time and energy) awakening new minds…they are doing the great work!

Glad I’ve never purchased health insurance. The money I saved over the past 35 years of my working life enables me to pay as I go, if need be. Plus I have a nice chunk of change in my HSA. At this point I’m not sure I trust the medical establishment for much of anything. It remains to be seen if they would even treat me, based on my deeply held convictions and lack of faith in what constitutes health care, (cut, irradiate, or poison).

As far as auto insurance goes, its such a colossal scam, how they wont just insure you as the driver. Have to have each vehicle insured. Haven’t had a wreck, ticket or any reason for them to pay out for as long as I can remember. Yet still the price continues to rise.

We have one vehicle we don’t register or insure. Last week we drove to the nearest big city (Prescott) to do some shopping. After a day of running around, I went to Golden Coral and got my grub on. Driving home, a little sleepy, coming down a hill I got tagged for 85 in a 65. I had wanted to ‘roll dirty’ with the uninsured, unregistered vehicle, yet cooler heads had prevailed. Because I was nice, and my papers were in order, the lady officeress let me off with just a warning. Heres to continuing good dumb luck.

I taught my wife how to be friendly with officers and never admit to doing anything wrong. She had previously been hostile, and almost always got a ticket. It is amazing how often one can get away with a warning with the right behavior. But a warning for 85 in a 65, unless everyone was going 85, is really good news. You must have been charming to that lady cop.

As a teenager with too many points to risk getting another ticket, I outran cops two times at two side of the road radar traps to evade a ticket. One time was versus a New York State policeman, who did not know the back roads I bicycled on as a child. Another time I passed a cop at night at 100mph in an area known for drag racing — maybe I woke him up? — he caught up with me over two miles later, but I claimed to be coming from another direction. He tried to trick me into confessing but I didn’t. It seems that I passed him going so fast he had no idea what model my car was, or even the color.

After that “event”, I formed a new Rule of Thumb in the 1970s: If there is a cop car behind me, with no lights flashing, I pull off the road and let him pass me. I don’t want any cop on the road behind me — nothing good can happen from that.

One time since the 1970s I pulled over and the cop behind me got suspicious. He parked on the side of the road and waited until I eventually passed him at a legal speed. Then he followed me and pulled me over “on suspicion” (suspicion of what I don’t know). I tried hard to be friendly and did not get a ticket.

I have never had a good encounter with a policeman, other than just getting a warning many times, but maybe others have.

Concerning auto insurance:

I had Allstate insurance most of 2022 and then switched to State Farm. Both companies lost money in 2022, so I can’t claim they are ripping me off with high insurance premiums (Michigan is really high). Insurance is mandatory because people without insurance cause damage to other people and their vehicles, but can’t pay the costs.

Richard writes:

“Insurance is mandatory because people without insurance cause damage to other people and their vehicles, but can’t pay the costs.”

You realize, I hope, that you just contradicted yourself?

As with “gun control” – which does nothing to prevent criminals from getting or using guns – mandating insurance does nothing to prevent people from driving without it. Especially the ones who are most likely to leave you holding the bag for damages they cause.

All it does is make insurance more expensive – especially for the people who aren’t the problem.

And that’s why I object to it. Because I object to being made to pay for harms I have no caused. To help offset the costs imposed by others.

What would be preferable?

How about holding people fully responsible for any harms they cause – but leaving the rest of us alone?

Insurance is (in essence) a bet that you are guaranteed to lose.

It is supposed to be a means of transferring risk, to buffer against potential catastrophic losses. In exchange for the company taking on the risk of incurring a large loss, you pay slightly more than the expected value of losses incurred, in bite-sized chunks, over time. It’s all a numbers/statistics game, and the house always wins. It’s just gambling, but without the flashing lights & showgirls.

Society at large has essentially forgotten this, if it ever did really understand it at all.

Indeed, Publius –

One of the worst such bets is homeowner’s insurance. Assuming you live where tornadoes, hurricanes or other natural disasters are remote risks, it’s idiotic – financially – to buy such insurance. How likely is it you will ever file a claim for more than say $40,000 dollars?

You’ll pay that much in premiums in as little as 20 years ($2,000 per annum) and have nothing – nothing! – to show for it at the end of that time.

I’d rather have the $40k, myself – and they keep the “coverage.”

Hi Eric,

Homeowner’s insurance is not a requirement if one owns their own home. Also, I would suggest that most individuals look at their coverage policy on their autos and homeowner’s insurances. I usually keep my deductibles pretty high on both, which results in lower premiums. My homeowner’s insurance is for catastrophe only. I would never file a claim under $5K and would just pay it out of pocket. Wind damage or a fire is really the only time I would use it. The same with my car. If a rock hits my windshield I have an auto glass company that will usually install a new one for about $400. Why deal with the insurance company?

Insurance is one of the easiest things to get around in regard to not having it. Save the premiums and if a disaster hits one should have the assets to cover it.

Which ain’t that easy, since the Psychopaths In Charge are doing their best to confiscate those assets, which makes it harder to pay insurance premiums too. It appears one of their many evil goals is to make life as difficult as possible.

Hi, Eric,

>One of the worst such bets is homeowner’s insurance. Assuming you live where tornadoes, hurricanes or other natural disasters are remote risks, it’s idiotic – financially – to buy such insurance.

Well, you pays your money (or not) and you takes your chances). The real question, to me, is, “How much can you afford to lose?” versus how much will it cost to insure against that peril? Strictly a cost vs. benefit calculation, IOW.

Where I live, in SoCal (seismic zone 5, the highest risk), companies which sell you standard homeowners’ policies are *required* to offer earthquake insurance, but very few people buy it, because a) it is expensive, and b) deductibles are always high (10% is typical). From an engineering standpoint, single story and even two story wood frame structures which are constructed to modern codes tend to perform very well in seismic events, because they can absorb large amounts of energy without failure. My own home (built in 1956) has weathered 3 major earthquakes (Northridge, Whittier, and Landers) without incident during my 42 year tenure so far, and I anticipate it will continue to do so. So, no thank you, no EQ insurance for me. Tip of the hat to Raider Girl’s observation about managing your deductible to whatever is comfortable for you.

That said…

(and please bear with me, because I intend to ramble a bit)

My youngest brother spent most of his working life as a claims specialist for State Farm, and he traveled the country as part of their National Disaster Team. Hurricanes in Florida and the Gulf Coast (including Katrina), tornados and hailstones the size of baseballs in the Midwest, wildfires in Northern California, were all part of his work experience.

So, *I* think if you live in Oklahoma, you would be a damned fool to not insure your house, AND your car, against hail damage. But, different strokes for different folks.

One more anecdote, and I will shut up, for now..

I once knew an architect who cancelled the homeowners’ policy on his house in Rimforest, CA soon after he paid off the VA mortgage. The next rainy winter, the hillside failed, and the house ended up at the bottom of the hill, a total loss, and totally uninsured. I do not know if Ken ever rebuilt, but I doubt it.

All excellent points, Adi.

I have homeowner’s and auto insurance by choice. To me paying a thousand or two a year is worth my peace of mind. I don’t share the same contempt that some do in regards to the insurance industry. We all work to make a profit. I don’t despise State Farm for trying to stay in business. The health insurance industry I choose not to participate in, but if I get cancer or break a leg it is my obligation to come up with the funds, not the general public. It is the risk that I assume.

Unfortunately, like many things in life we are all drawing from one pot. It would be nice if services were more personalized to number of claims filed, credit scores, good driving, etc. but most of the services that we in society partake in don’t offer this. When we get on a plane are we weighed to determine our “baggage load”? No. When we buy software are we charged by how much we use it? Usually, no. The price is the same if we don’t touch it all month or use it 16 hours a day. The insurance industry is ruled by risk. As you stated above, how comfortable with that is up to each of us as an individual.

Hi RG!

To be clear, I don’t have contempt for insurance – as such. My contempt is for the making it mandatory. This has made it a scam; another form of rent-seeking. If it were simply a service offered for those who wanted it, the cost would be much lower – at least, for the responsible. As for the irresponsible: I resent the Hell out of being made responsible for them…

Hi, Eric,

>My contempt is for the making it mandatory.

I agree with you to the extent that the peril insured against has no possibility of causing either physical or financial harm to anyone but yourself.

So, for example, if you take up skydiving, and decide there is no point in buying insurance which will help cover your medical bills in case of injury, that is your privilege. Just be prepared to pay your own medical bills in case you land wrong and sustain a spiral fracture to one of your femurs. (seen it – the guy was in a cast up to his hip for quite awhile, but was in amazingly good spirits).

It is unacceptable to force me, a non-skydiver, to pay an “insurance premium” which would cover your medical bills due to *your* skydiving accident. (When I played HS football; we were offered an inexpensive medical policy which would cover expenses *only* for football injuries. Our non football playing classmates were not taxed to pay for risks which we players had willingly assumed, and were therefore solely responsible.)

You’ve been quite vocal in your contempt for people whose ill health is largely due to their own lifestyle choices. I agree with you there as well, and see no reason why those of us who have chosen to take better care of our physical selves should be taxed to pay for the self inflicted ills of those who have not.

That said….

I believe that auto insurance is a qualitatively different situation, because one person’s actions can put the well being of others at risk, however unlikely that may be, based on the operator’s past behaviour.

For one thing, there are always the forces of nature to contend with, and those are at least somewhat beyond your control.

For example, suppose you hit a patch of black ice which causes you to lose control of your vehicle and skid into someone else’s auto, causing significant property damage and/or personal injury, even death.

Guess what. It will not be you who determines who is “at fault,” and therefore gets to pay the bills. It will be none other than a member of your favorite fraternity, an AGW, whose interest manifestly does not include any concern for the well being of either motorist.

If you choose to “go naked in the world” with respect to auto insurance, I sincerely hope you have taken the precaution of engaging the services of an attorney who specializes in asset protection, in the interest of preserving your own financial well being. Just sayin”…

Hi Adi,

In re:

“I believe that auto insurance is a qualitatively different situation, because one person’s actions can put the well being of others at risk, however unlikely that may be, based on the operator’s past behaviour.”

Yes, but that argument can be used to justify requiring people to buy insurance for practically anything conceivable that might “put the well being of others at risk.” For example, carrying a gun. And the bastards are trying to require that people who do buy “coverage” for that – so as to add a huge financial burden, so as to discourage carrying a gun.

At the end of the day, a person either has – or has not – caused harm to some other person. If he hasn’t, then I maintain he has a right to be let alone and that includes financially. I understand this makes some people nervous. But it makes me more nervous to contemplate a system in which the possibility that someone might “put the well being of others at risk” becomes a de facto equivalent of actually having caused harm – and being held “accountable” for it.

To me, it is inarguable that someone who has caused harm is responsible for the harm he has caused. And it is equally inarguable, as I see it, that if he has not caused harm then it is wrong to “hold him accountable” for not having caused it – because he might have.

You tatally miss Erics point. It is the mandatory part of being forced to buy coverage at the point of a gun. If yo choose to place a bet bet with your bookie, that’s on you.

Hi Raider:

I don’t either. After I graduated school in 1986, I moved to Texas. At the time, there was no law that required you to carry insurance. Today there isn’t either except that you have to prove that you are financially responsible or carry insurance in order to get your car registred in the state.

From that time on, I made the choice to carry automobile insurance. The only time I wouldn’t have is if i bacame unemployed. Its been a long time, but I think I dropped it for a couple of months. You can’t do that now as they have ALPRs to rat you out.

Hi, RG,

>It would be nice if services were more personalized to number of claims filed, credit scores, good driving, etc.

Well, that *does* happen, at least to some extent. As it happens, I have not had an auto claim for quite some time, so State Farm discounts my auto premium significantly, based on recent claims experience.

>worth my peace of mind

Now, you’ve put your finger on it, RG.

And only *you* can place a value on your own peace of mind.

>The health insurance industry I choose not to participate in, but if I get cancer or break a leg it is my obligation to come up with the funds,

Likewise, here.

>When we buy software are we charged by how much we use it?

Don’t give them any ideas. 🙂

The perfect solution to the fake insurance conundrum that Richard Greene speaks about is that if you are concerned about an uninsured driver hitting you and causing damage, is that you can just buy uninsured motorist coverage. There’s simply no need to mandate that every single car have an insurance policy, unless of course, you’re in the business of selling as many insurance policies as possible.

Except this completely contradicts Eric’s point of people taking responsibility for their actions. Why must someone else have to take out an uninsured motorist policy because someone else does not want to be liable? Responsibility is not an evil word. Personally, I am sick and tired of paying someone else’ way through life. If I hit someone’s fence I have two options: 1) file it through insurance (that I have chosen, but not mandated to have) or 2) show up with my tools, some nails, fencing board and put my ass to work.

We should not be able to shrug our shoulders and walk away from our actions.

RG: I do not argue that the wrongdoer should be immune from responsibility for causing damage. Rather, if one does not want to “take the risk” of having an uninsured driver cause damage for which he cannot pay, the option to guaranty against that would be to get an under/uninsured motorist policy. This would be in addition to one’s right to compel recovery via say a lawsuit.

This would be in contrast to the current situation where everybody is compelled to have “coverage” for other’s property (reminds me of the BS “your” mask and vaccine are not for you, they’re required to protect others).

@ ML,

Well, yeah, but the more people who *do* assume financial responsibility for their own actions, the lower UM premiums should be.

I am in favor of mandatory auto insurance for that reason, but I do believe that, at least here in CA, the statutory minimums are far too low, and have not kept up with price increases, either for BI or PD.

If you are driving a $90,000 luxury vehicle which gets totaled by someone who carries only $30,000 PD, you get stuck with the difference. The nightmare gets much worse if it involves any contact with the Medical Industrial Complex.

>Why must someone else have to take out an uninsured motorist policy

Because, unfortunately, there are scofflaws and outright criminals in this world who do not believe the laws apply to them. You might as well ask, “Why didn’t John Dillinger earn an honest living?”

Pedro, who is in the country illegally, is unlikely to stick around following a collision (even if he is, otherwise, basically a decent guy) because he lives in fear of deportation, and probably believes that if La Policia show up, La Migra will not be far behind.

He might be right. 🙂

Hey Eric!

“How about holding people fully responsible for any harms they cause – but leaving the rest of us alone?”

I’ve oft thought that maybe this problem of mandatory liability insurance could be replaced with the advent of accident loan companies. I.e. if a wreck was your fault and a judge ordered you to pay damages, you could get a (probably high interest) loan to pay off the people to whom you’ve caused damage.

This may sate all of the people with $50,000 vehicles. That supposed impetus for mandatory liability insurance would be lost, and those of us who never cause any damage would never have to pay a dime. And even if you do get in a wreck or two, you might pay less during your lifetime than you do now.

Then, I do wonder if somehow we’d be replacing one demon with another…

Morning, BaDnOn!

I don’t see why the same principle that applies to me not being obliged to buy “Fist Insurance” – on the basis of the possibility that my fists could be used to punch out a Clover – does not apply generally. My position is that no one ought to be compelled to pay, a priori, for harms he didn’t cause because others worry he might. I maintain that this notion is behind a great deal of the evils that beset is. For example, the “masking” thing. People were presumed sickness spreaders. It didn’t matter that they hadn’t – or even that they couldn’t (not being sick, themselves).

The bottom line – for me – is that if someone has not caused harm then they have a right to be left unmolested until they do. I mean this even in extremis – as in the hackneyed example always trotted out that if there were no enforceable speed limits, people would drive 100 MPH in school zones. Yes, a few criminally reckless people might do just that. However, most would not. And they would not have to worry about the precedent set by any speed limit being expanded – as these things always are – such that we get to where we are and people are regularly cited for “speeding” for driving 54 in a 45 and other such nonsense.

I like things objective and clear cut. If someone caused harm, the fact is undeniable and holding him accountable is indisputably just. But it is a bizarre thing, indeed, to hold anyone “accountable” when they have not caused any harm – however much someone else may not like whatever it was the person was doing.

Well said, Eric.

Most families have no saving or a tiny amount of savings with which to pay for damages they cause. Insurance that covers uninsured drivers causing damage does that.

Anyone who wants to save money on car insurance can skip the collision and comprehensive coverages. In the long run the savings will most likely exceed the cost of repairs out of pocket. It’s you choice to gamble, or not

Auto insurance has nothing to do with gun control.

It’s unfortunate the safe drivers subsidize the reckless drivers. I drove for over 50 years without one insurance claim.

Richard,

You really cannot grasp that the concept of requiring people to buy car insurance as a condition of being allowed to legally drive a car could easily be applied to gun ownership? And – on the same obnoxious you-might-cause-harm basis – to many other things besides?

Like what is called “health care,” for instance.

Are you truly that dense? Cannot connect the dots? Do you think the government could have “mandated” that people buy health insurance in the absence of a precedent that required people to buy car insurance?

Do you know why safe drivers subsidize the reckless ones? It is because they are forced to.

Imagine – if you can – not having to.

Eric,

in RE: your comment below,

>Yes, but that argument can be used to justify requiring people to buy insurance for practically anything conceivable that might “put the well being of others at risk.”

Point taken.

>And the bastards are trying to require that people who do buy “coverage” for that – so as to add a huge financial burden, so as to discourage carrying a gun.

Again, I take your point. Another egregious example of attempting to “regulate” out of existence something which certain interests have not been able to legally ban.

I don’t care.

>It’s you choice to gamble, or not

I believe that is Eric’s main point, Richard.

You pays your money (or not) and you takes your chances.

The consequences are ALL ON YOU should you lose the bet.

>It’s unfortunate the safe drivers subsidize the reckless drivers.

Not “unfortunate.” Unacceptable.

Unfortunately, as Raider Girl pointed out, insurance companies may very well not divide the risk pool finely enough. Every male here was once young, and no doubt remembers auto insurance being outrageously expensive (if he could even buy it), because insurance companies classified *all* young, unmarried males as “high risk.” Some would give you a discount if your school grades were good. I suppose the rationale was that you were likely to be studying rather than partying, thus reducing their exposure.

>I drove for over 50 years without one insurance claim.

Well, good for you. I believe Eric has stated something similar for himself. BOL to everyone. May you live long and prosper. My observation is there are a) forces of nature (including human nature) beyond your control, and b) nasty and dangerous creatures in the swamp which *WILL* eat you financially if given the chance.

Bottom line: you had better make sure your ass is covered, one way or another, so that you do not risk losing everything you have ever worked for to some worthless scumbag who is looking for a free ride at your expense. Their enablers tend to favor splashy billboard advertising. Just sayin’…

I don’t care.

Car insurance, home insurance, rural property insurance, adds up in a year of coverage to 4 to 5 grand. Ten years later, you have spent 40/50 grand to protect the value of the property. Then the taxes over 35 years total more than 40 grand also. You have paid insurance premiums and taxes some 80-90 grand, maybe more.

Depends upon where you live. A cardboard box will have lower costs than a penthouse with a view overlooking Central Park.

Looks like you are losing and are not gaining. If you file a claim, it’ll be adjusted, investigated, an amount paid out to satisfy the claim.

If your house burns to the ground, the insurance company will investigate the cause first, then consider the claim.

There is always insurance fraud, somebody shorts an airline big time and the next day, two commercial jets fly into two 102 story buildings. Stranger than fiction, but it’s true and surreal both.

There will be nothing but lies and deception after that episode of destruction.

Insurance companies don’t want to bother to find out who did it, won’t do any good. Could surface a few inconvenient truths.

Russia is considering declaring war on the US, so insurance costs for Washington, DC real estate will rise automatically.

Health insurance is another total. Pain, that is.

Living seems to be getting more dangerous by the hour.

>If your house burns to the ground, the insurance company will investigate the cause

Actually, based on my experience, it is the local fire inspector who will investigate, and they are generally well trained to, among other things, recognize arson. Whether PD will succeed in catching the perp, or whether an insurance company cares about the cause of the fire, are two different, and two separate, questions.

I doubt an insurance company would care whodunnit. It is a documented loss; time to pay the claim, up to policy limit, provided it is an insured peril.

Berkshire previously said it expected Geico to return to operating profitability in 2023, after securing premium rate increases. Still, Geico remains an issue for Berkshire, with top line growth in the quarter of less than 1% that “significantly lags peers,” CFRA analyst Cathy Seifert said.

“Get used to making less,” Munger said.

https://www.zerohedge.com/markets/buffett-turns-gloomy-incredible-period-us-economy-coming-end

“How will the mafia continue to extort “historic” profits when people finally decide, in exasperation and desperation, to stop paying for them?”

Piece of cake. (for the parasites)

First the ‘courts’ find you guilty of driving without insurance,,, involved in an accident. Since you were not supposed to be driving in the first place and shouldn’t have been out there,,, you will be held responsible for the accident.

You will be fined accordingly for driving w/o insurance (with possible jail time, see below)

You will have to pay the repair costs of the other car and possible medical costs/lost wages etc of the other person.

You will have to pay any court costs. (funny that 🙂 taxpayers (you) paid to build the courthouse and pay the Judges salary)

You will have to pay for your ‘room and board’ in jail.

How will they do this? CBDC. Rest assured… You will pay. Easy Peezy

Auto insurance price should be decreasing over time, as driving gets safer. Yet it doesn’t. Oh sure the cost of a car increases, but if the safety features are doing their job the odds of being in an accident should be decreasing. Yet they don’t. Just poking around the Internet I see that miles driven are basically flat not counting COVID years, the number of fatal accidents has gone down drastically since 1990, yet we all still pay more for insurance.

It can’t all be attributed to the high price of cars.

Back in the old days if you dented a bumper in the parking lot, well, that sucks. Maybe you could pull it out, or maybe find one at the junk yard. Now there’s no dent, the whole plastic cover cracks and falls off. Big bucks to replace that. And any that you find at the automotive repurposing center are rotten due to UV exposure and will likely break when trying to remove them.

I remember my college roommate had a Saturn SC. One of the selling points was that the body panels were flexible and deformable plastic. And like the old Fiero, body panels weren’t structural and easily removed so you could theoretically take them off and drive around “naked.” He told me it was one of the cheapest vehicles to insure because of that. Compare that to the occasional spotting of an F150 flair side that has a piece of the rear quarterpanel missing where someone backed into a post or hit it with something at the jobsite. Or a missing bumper on a Kia, exposing the thin rusty (actual) bumper underneath.

Repairable ≠ profitable.

While it may “go without saying”, I always like to remind people that insurance avoids paying out with super-human ability. Somehow, it was more *your* fault, even it wasn’t. You should have this or that or know something different or better.

And besides, look at your car. It didn’t just roll off the lot yesterday. They think it is worth quite a chunk of money less than you’re gonna have to spend to replace it. Doesn’t matter what they’re selling for on Car Gurus or even Kelly Blue Book.

Their idea of “fair value” is never anyone else’s. You always get fucked by insurance of any kind, almost by definition. And then, since you dared actual use what you’re been forced to pay for… well… they’re gonna make you wish you hadn’t.

Lastly, insurance in health care, along with Rockefeller’s Big Pharma, is precisely why we have more disease and lower quality of life. Talk about corporatism.

Corporations, in league with the government, have stolen our livelihoods and our health. Heck, they’ve literally taken countless lives and tell us how bad we are and how good they are. Endlessly. Breathlessly.

Hey, you’re the one who took your car out of the original packaging.

Geez, I bet you’ll expect a payout from us because your mom tossed out all your old beat up comic books!

(mimicking Jimmy Stewart) Besides, the money’s not here! It’s in CALPERS accounts, that pension fund your 105 year old mother still gets a check from, and your S&P 500 indexed 401(k). If we start cutting checks everyone will sell our stock. Our hands are tied you see.

Finally, the board approved the budget and the executive compensation plan, so if you have a beef, take it up with the board.

Besides, no one forced you to exist. We’re doing you a favor.

-The insurance’s advocate

True XM, they have quite the profitable business model: take in regular premiums but fight like hell to never pay out any claims. I’ve had personally experienced that with homeowners insurance. We had one claim in the 48 years we’ve been in this house which they paid after sending out an “adjuster” to check it out. Paid out less than I’d paid in premiums up to that point, and then proceeded to cancel our policy. Was able to get a new policy from my agent and briefly considered just going without, since the house is paid off. Decided to get a new policy for the liability coverage, with all the lawyer advertisements on tv I don’t want to roll the dice on some idiot tripping on the sidewalk (which is city property btw) and suing me out of the house.

Back during the height of COVID jab mania, there were people who compared unvaxxed drivers to drunk drivers, and probably advocated charging the unvaxxed MORE for car insurance accordingly. Shockingly, the Biden Thing never tried to implement such a nonsensical policy, considering practically everything else the regime has supported or implemented the past 2+ years was either nonsensical or bent on DESTROYING this country.

And with this new rule from the Biden Thing effectively punishing home owners who have good credit to subsidize home mortgages for people with bad credit, they may pursue similar rules that would punish people who drive gas powered vehicles to subsize people who drive EVs.

They even went so far as to say that unvaxxed people should be denied any health insurance benefits. Not that unvaxxed could therefore not be forced to have health insurance. Nope. You still must buy it but they somehow pieced together that you can’t use it for its intended (and mandated) purpose. While that wasn’t fully implemented to the degree that the psychopaths “calling” for it wanted, it actually was implemented to various degrees informally.

“Unvaxxed, long-haired freaky people, need not apply” — we don’t serve your kind here, not even for the shit you are forced to pay for!!

It’s mind boggling.

OBTW… in case you hadn’t heard or noticed… the “emergency” will be “over” this Thursday.

XM,

A DEMOCRAT legislator in Rhode Island supported an extra tax for parents in the state who wouldn’t get their children vaxxed, while California had all sorts of draconian COVID related bills last year that their legislature wanted passed until massive public pushback resulted in most of them being dropped for consideration.

The Biden Thing also dropped their vaxx mandates for international travelers and employees at Head Start and medical offices that accept Medicare/ Medicaid. The COVID “Public Health Emergency” may end this week, though the Biden Thing and other governments have gotten DRUNK with power the past few years, and will likely try to declare a BRAND NEW EMERGENCY; perhaps a CLIMATE EMERGENCY & enact draconian measures similar to what we saw at the height of COVID hysteria. They may try CLIMATE LOCKDOWNS or decree that only people who have an EV may be “Allowed” to drive.

John B,

“they may pursue similar rules that would punish people who drive gas powered vehicles to subsize people who drive EVs.”

*They* the government already do this via the tax *credit* scheme when you purchase an EV. It would be one thing (and wrong enough) to incentivize purchase of an EV to provide for a tax deduction against earned income. However, the government provides a tax credit, which is putting other people’s money (or printed out of thin air via the Fed) into the buyer’s account because they bought an EV.

We all lose.

Oops, here comes a claim right now … ‘Oakland apeshit’ in Commiefornia, yo!

https://twitter.com/ppv_tahoe/status/1654983449701220352

‘The cost of car insurance is going up.’ — eric

As Uncle Warren Buffett deduced back when he was a boy in short pants, there’s a lag between receiving premiums and paying out claims. Insurers can invest their reserves for a profit, even while incurring underwriting losses.

Naturally, insurers gravitate toward fixed income investments, such as bonds and mortgages. Currently, this puts insurers in the same boat as regional banks, which have experienced unrealized losses on their bond portfolios (since interest rates went up) and commercial real estate loans (since ‘work from home’ emptied downtown office buildings).

Thanks to their political clout, insurers are regulated by the fifty states. There’s no FDIC behind them. If a stressed insurer goes down, it’s up to its state of domicile to sort it out.

One suspects this somewhat antiquated industry structure will be put to the test in coming months and years.

Property/casualty (P/C) insurer cash and invested assets were $2.2 trillion in 2021. In 2021, P/C insurers invested 30 percent of their assets in stocks, and 53 percent in bonds.

https://www.iii.org/publications/a-firm-foundation-how-insurance-supports-the-economy/investing-in-capital-markets/property-casualty-industry-investments

I don’t care.

I care about data and facts

You may have other interests

Like the fact that – until about two years ago – a vaccine was defined as conferring immunity on the person who received it? Who could no longer spread it?

Until it was redefined – as something that “reduces the severity of symptoms” (you know, like aspirin).

Without the death-risk, of course.

I simply don’t care what you have to say Richard, period.

Some government data and facts you accept, and some you don’t, and I see no rhyme or reason in your determination, other than what pleases you. Certainly not logic.

A market you are forced to pay into is not a market at all. It’s no different than any other “tax”. As has been aptly demonstrated by the Military Industrial Complex, and the “new and improved” Medical Industrial complex, state guaranteed income spikes prices. Because there are no market forces among them to hold prices down. Just the same with car insurance. That denial of the ability to say no is a rather strong component of rape. Keep the KY handy, and if you drop your soap in the shower, do not bend over to pick it up.