Why is it that the large SUVs so many Americans would love to own – because they are so much like the large sedans Americans used to routinely drive – have become so absurdly expensive?

Italicized to emphasize the fact as well as the grift.

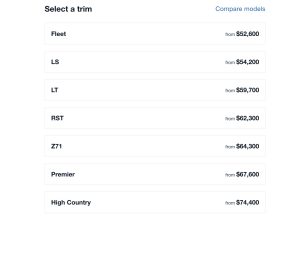

A new Chevy Tahoe stickers for $52,600 to start. This is typical for a vehicle of this type. And they routinely “transact” – that is, sell – for upwards of $60,000.

A vehicle like the Tahoe is not an elaborate or expensive to manufacture vehicle. It has a steel frame onto which the body is bolted. It is powered by a V8 that is not fundamentally different from the V8 that Chevrolet introduced in 1955. The current V8 is cast in aluminum rather than steel and it is fuel injected and has some other “modern” features. But it is still recognizably related to the V8 Chevy unveiled almost 70 years ago. Both have a single camshaft actuating two valves per cylinder via pushrods. Nothing fancy – or expensive – about it.

Nor the Tahoe’s frame. Nor its stamped steel (mostly) body panels. The wowza electronica inside the cabin – e.g., the LCD digital displays and so on – are the cheapest things about it. So why is it – the Tahoe – so expensive?

Well, it isn’t.

Unlike, say, EVs. They are money-losers, each one costing GM (and everyone else who makes them) money on each “sale.” GM CEO Mary Barra recently admitted this. And someone’s got to pay for that.

Guess who?

Correctomundo! It is the people who buy SUVs like the Tahoe who do. It ought to cost about $35,000 – perhaps even less – and that would still be enough to cover the cost to manufacture it and make enough profit selling it to make it worth manufacturing it. But it would not be enough profit to cover the losses of “selling” EVs, so the cost of the SUV goes up to cover it. And that’s how you’re paying for it.

Assuming you can still afford to.

The fact is that vehicles like the Tahoe – which were (like the similar in general layout large sedans with large engines) vehicles once upon-a-time vehicles average Americans could once commonly afford no longer are. Because average Americans don’t earn $50,000 in a year. Before taxes. Before they pay their rent/mortgage and buy the necessities of life. It does not leave room for an $800-per-month payment, which is about what it costs to finance a new Tahoe for six years. Not counting insurance costs.

This is why SUVs like the Tahoe, the Olds Vista Cruisers of our time, have become APVs – Affluent People’s Vehicles. Even more so – and even more absurdly so – the gilded lily versions of the same thing sold under different labels.

A Cadillac Escalade costs $79,295 to start. Yet it is not a fundamentally different vehicle. It is in fact essentially the same vehicle as the Tahoe, albeit with a slightly different skin and some additional features, including a larger and more powerful (6.2 liter vs. 5.3 liter) V8. But it is not a fancier V8. Nor is much else about it costly enough to justify it it costing almost $30,000 more than its sibling-under-the-skin. Including the plastic used in lieu of the chrome that plated almost everything metal on the Cadillacs of the past.

But it is even more profitable. Probably to the tune of about $20,000 per vehicle sold, which is not a bad mark-up.

The fact – if not the exact number – is not in dispute. SUVs like the Tahoe and its siblings-under-the-skin (italics to include the “GMC” iteration of the Tahoe) are the cash cows of the “car” industry. What is not as well-known is the grift. The way SUVs are being used to support the unsupportable, i.e., EVs. Without the counterbalancing profits generated by the sales of SUVs (and of the big trucks on which these big SUVs are based) it would not be financially feasible to continue “investing” in money-losing EVs.

But what happens when there are no longer profitable SUVs and trucks to support EVs? Because it is no longer feasible to sell them?

GM – and the rest – have (apparently) not thought that far ahead. Indeed, they appear to not be thinking, at all. Instead, they are “committing” to an all-EV future that depends on the continued existence and sale of the very vehicles EVs are meant to replace and which GM (and the rest) are using to bankroll this replacement.

There is a biological analog of this: The parasite that eventually kills its host. In nature, there is always a new host – and the parasite’s survival (and propagation) are assured. But that relationship may not work as well when it comes to vehicles – and the EVs that are parasitical upon them. Once not enough people to make the grift work can afford to be relieved of $60k-plus on an SUV to bankroll the manufacture of $40,000 EVs, the EV’s true cost will be known.

Of course, by then, it will be too late.

And we’ll all get to pay for it.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

Our donate button is here.

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

My eBook about car buying (new and used) is also available for your favorite price – free! Click here. If that fails, email me at [email protected] and I will send you a copy directly!

“[The Tahoe] ought to cost about $35,000 – perhaps even less – and that would still be enough to cover the cost to manufacture it and make enough profit selling it to make it worth manufacturing it. But it would not be enough profit to cover the losses of ‘selling’ EVs, so the cost [price?] of the SUV goes up to cover it. And that’s how you’re paying for it.” – EP

Eric, I think that idea is what prompted Richard’s objection. What you have implied is that there is an objective way to set a price, based on the cost of the inputs plus a reasonable profit. That is essentially the Labor Theory of Value, which posits that the value of a good can be objectively measured by the labor hours required to produce it. It’s one of the pillars of Marxian economics, and it is baloney.

Value is subjective. It exists only in the mind of the consumer. While it is true (and Richard has conceded) that profits on some vehicles offset losses on others for a large manufacturer like GM, it is conjecture to say that the Tahoe “ought to cost about $35,000 – perhaps even less.” How do you know?

If they charged $35k for Tahoes, I’m sure they would be flying off the shelves. But would GM make the same or greater profit on the Tahoe as they are making now? If so, why aren’t they already doing that? It makes no sense.

Prices have to be set through voluntary exchanges where both parties believe that what they’re getting in the trade has more value than what they’re giving up.

Hi Roland,

What I was trying to convey is that sales of vehicles like the Tahoe are subsidizing EV losses. Take away these subsidies and EVs become a lot harder to “sell.”

The cost of SUVs/trucks (and profit margins) is much higher than for cars; this did not used to be so. It is so now because the popularity of SUVs (and trucks) is being leveraged to offset the losses incurred by EVs. They are what people want – and that want is artificially increased by the lack-of-want for EVs (and other loss leaders).

Richard’s position is that the two things are unrelated.

He also asserts that drugs which do not confer immunity – do not prevent the getting or the spreading of sickness – are “vaccines” if they “trigger the production of antibodies.” It’s a really oil-disingenuous framing – and he knows it.

Eric,

Mega props to you for proper usage of the word “obliged”!

“Obligated” is one of my pet peeves, and it has become all too common.

Thanks, Publius!

I value the language and do my utmost to use it correctly.

This phenomenon works for the same reason that CBS can afford to put out nothing but bullshit on “The View” and “The CBS Evening News” because they had things like “The Big Bang Theory” that kept the lights on.

Regular heckler here:

Auto manufacturers do NOT raise the prices of ICE trucks and large SUVs to offset losses on electric vehicles, or losses on any other vehicles.

Raising prices results in fewer sales — it is not a free lunch. Higher prices reduce demand.

If it was possible to raise ICE prices without reducing ICE sales and profits, then manufacturers would just do that immediately.

The reason that ICE pickup trucks and SUVs are so profitable is people want to buy them — strong demand.

Before I retired from Ford product development in January 2005, the F-series pickup truck profits literally supported the entire company, along with full size body on frame SUVs, the Crown Victoria, Grand Marquis and Lincoln Town Car. They accounted for all the fully accounted profits, with the high volume F-Series leading the way.

When you have a high volume vehicle that customers want to buy, you can make big profits. The price is determined by the competition, and profitability analyses by the bean counters. Charge too little, or too much, and net profits decline.

It is a basic misunderstanding of economics to think that a company can raise prices without losing sales.

The real problem coming soon is government rules that penalize or prevent sales of the popular ice vehicles — forcing electric vehicles on customers that few people want to buy.

Free markets work best because they reward people and companies who produce the goods and services people most want to buy. Not what the government wants them to buy.

The big problem is the manufacturers can NOT bail out EV losses by raising prices on ICEs, because doing so will cost them sales and profits from ICEs.

If you compare a Ford F150 for 2023 model, with a Ford F150 for let’s say 2018 model, you will find more standard equipment included in the 2023 MSRP. That will raise the MSRP, and cost some sales. But the Ford bean counters and product planners must have thought Ford customers were willing to pay for more F-150 features when interest rates on auto loans were very low.

The auto market is not a free market.

Hi Richard,

What you say is true circa 2013 or even 2003, but not in 2023. As a business owner we are raising prices because 1) everything costs more and 2) we don’t have the manpower to handle current demand. The auto manufacturers/dealers raised prices during COVID because they did not have the supply or peoplepower to fulfill the demand. What does a business do? You raise prices knowing that not everyone will want your service or product and hoping that those who do are willing to pay substantially more for it, so your bottom line doesn’t suffer, but your workload reduces.

Lawyers have done this for years. How bad do you need their service? Is the $500/hour worth it?

The Baby Boomers are retiring in droves, Gen Zers want to work remotely, which leaves Gen X and Millennials to hold the water. Not enough hands are on deck to keep this ship straight.

We are in a fundamental shift. The old days are gone and we either learn to swim or drown in the process.

re: Raider Girl June 12, 2023 At 1:00 pm

Prices can only go up when everyone is under the same pressures and those pressures are large enough nobody can take the hit. That’s the case you’re describing. Otherwise it’s a constant battle to keep shelf prices the same in the face of inflation from central banks because the condition that Richard describes for the first one to raise prices. These regular small steps and pressures mean the competition may or may not be faced by the competition and nobody wants to lose sales by being the first to raise prices. The competition may have costs low enough to still sell for less.

Hi Brent,

During hard times (recessions, economic slowdowns, etc.) what Richard and you describe is true. We are dealing with a different beast right now. That is why companies are so gung ho on AI. Yes, it is cheaper once it is implemented (and as long as it doesn’t break), but there is a shortage of capable people in the job market. Everyone is turning to machines to take up the flak.

Less and less people are establishing businesses and more are retiring. In the accounting field we have lost 1/3 of all CPAs/EAs/accountants during the “COVID” years. The younger generation does not wish to go into taxes or finance. The clients from the now retired are looking for new representation and there is little to no availability. It is this way in many industries, especially anything having to do with trade (plumbing, HVAC, electrical, carpentry, etc.). This is affecting doctors, dentists, psychologists, and even teachers. The whole damn productivity sector is a mess.

It is strange though because people are looking for work, but managers and owners don’t have time to train. My sister has been out of the job market for four years raising babies and she wants to jump back in, but nobody will grant her an interview. She is too demanding, she wants flex time, a certain amount of pay, etc. I love my sister dearly, but she is dreaming. Employers don’t have time for that shit. Myself, included.

I am speaking of physical products. That physical reality doesn’t change. Everyone is still fighting the fed.

There’s been a decades long war on the productive. Why does anyone want to be productive? The pejoratives used on productive people, the dehumanization. Why be productive? It’s hard work and then society hates you. Taxes you. Enslaves you.

What is rewarded there is more of, what is punished there is less of.

Amen, Brent –

I continue to work only because I enjoy it. Even though it makes me a tax goose to be plucked. I sometimes fantasize about living in some really remote area, in an Aistream or similar – and just flipping the bird to the system.

Hi Brent,

Respectfully, I disagree with your views on productivity. Yes, it is hard work, but it is also freedom (or as free as one can get in today’s society). The more productive I am the more money I make. Many may disagree with me, but money is freedom. Money makes my life easier. It allows me to delegate tasks I do not have time for, it allows me to purchase quality items that last a life time, it allows my family and I to enjoy quality time making memories, etc.

As for society hating me…why should I care? Honestly, who are these people? Do they truly affect our lives? Should any of us care what someone who has never met us, talked to us, or know anything about us think about what we say or do? If we are trying to please the world we are in for a miserable life.

Yes, the more money that one makes the more taxes they pay. What the Asses say about the rich not paying their fair share is complete bologna. Do I like taxes? No. But I will use any legal means and loopholes I can to save myself a few bucks. The way that I assess it is if I make $200K per year (after deductions) I will pay about $44K in federal and $11500 in state taxes which equates to about 27.75% in taxes. That leaves me with $144,500 to do as I please. I could choose to make $40K a year (after deductions) and pay about $6800 a year leaving me with $33,200 to spend. That is a difference of $111,300. That is the difference of being able to buy healthier food, take a vacation, have a larger yard, donate to causes that I want, etc.

Making more money is not enslavement, but allows people to purchase assets which creates more wealth that enables them to live a more comfortable life and to provide their family with the support that they need.

I will explain the economics in more detail:

What is a price increase?

A price increase means the price increased more than potential customers purchasing power increased.

Due to inflation and productivity improvements, average incomes gradually increase over time.

If the purchasing power after taxes of potential customers went up +3% in one year, and the price of a vehicle went up +6% in one year, that would be a +3% price increase. The price increase could include more standard equipment the customer may, or may not, want to buy

EP would have us believe auto manufacturers can increase ICE prices to compensate for EV losses with no consequences. That is false.

If that were true, auto manufacturers could arbitrarily double prices of ICE vehicles with no consequences. Of course that can’t happen.

Would an arbitrary ICE price increase of +20% have no consequences? How about an arbitrary ICE price increase of +10%?

If auto manufacturers could raise ICE prices (relative to incomes) with no consequences, then they would be money making machines. But they are not money making machines. In fact, they get into financial trouble with every recession.

And I think they will be in financial trouble again with the 2026 EV lineup to meet the EPA 48mpg regulation. They can’t bail themselves out by raising ICE prices with no consequences.

Ford customers do not know or care about what a F150 pickup truck costs Ford to make when they decide how much they are willing to pay for an F150. They compare F150 prices with competitors and consider how much money they have to spend.

Economics is easier to understand if you exaggerate claims to see if they still make sense. If auto manufacturers could raise ICE prices without hurting profits, then why not double ICE prices, and double ICE profits? The theory falls apart when taken to the extreme.

If a business raises prices (versus incomes) without reducing their profits, then they were underpriced before the price hike, and less profitable than they could have been.

The belief that corporations set prices by counting up their costs and then adding an arbitrary profit margin is false.

Ford has sold small vehicles at a loss to meet CAF requirements, and made some profits later on financing them, and spare parts sales.

Sorry my Ford data are from 2004, but inside data from 2004 arebetter than no data from 2023.

My contacts with Ford engineers ended in December 2022 when the last one retired. He and his fellow EV engineers did not see how Ford can survive selling mainly EVs, unless there are large government EV subsidies.

“… it is foolish and misleading to concentrate our attention merely on some special point—to examine, for example, merely what happens in one industry without considering what happens in all. But it is precisely from the persistent and lazy habit of thinking only of some particular industry or process in isolation that the major fallacies of economics stem. ” …

https://fee.org/resources/economics-in-one-lesson/#calibre_link-0

That’s assuming Ford management has a collective IQ above room temperature, which they most certainly are not demonstrating, or they would not be bothering with EVs that few can afford , and even fewer want. There are no market forces in play according to them. Never the less they will sail off into the sunset on their golden parachute “retirement” plan.

It is sad that US auto company management now takes orders from the government without fighting back on behalf of their customers. That seems to have started at least 20 years ago, and is worse than ever now.

Government to Ford: “We say jump”

Ford: “How high?”

Hi Richard,

You’re always talking about ‘before you retired from Ford, circa 2005,’ What happened after that? The bailout of all the money grubbing TBTfs. The big three have no teether to economic reality left. How could they? They made horrible decisions and payed no price. They had privatized gain at the expense of taxpayer losses. All so they could bail out their pensions. Had they been allowed to fail the point you make about free markets, rising prices, supply and demand would hold some validity. As it stands now its all voodoo economics built on the back of fractional reserve banking.

The Ford engineers do not have access to the financial data I could access in 2004, but the F-150 today is still the major money maker for Ford. Along with full sized SUVs. That has been true for over 50 years.

The Federal Reserve Bank has been mismanaging the US currency since 1913, with the purchasing power of a 1913 US dollar down 97% as of 2023.

$1 in 1913 is equivalent in purchasing power to about $30.64 today. The dollar had an average inflation rate of 3.16% per year between 1913 and today, producing a cumulative price increase of 2,964.27%.

The car manufacturers will charge whatever the market will bear. They maximize (units * profit), so it’s ok to lose sales if the profit goes up enough.

The government mandates a bunch of expensive stuff related to safety and fuel efficiency, which are at odds with each other, so that drives up the price.

However, I think a bigger factor is that cars are all racing to be some kind of luxury machines. Cars are moving upmarket, and there is precious little available in terms of cheap, simple transportation. Modern Tahoes, F150’s, whatever, are incredibly complicated with all kinds of electronics that rich people cars didn’t have ten or fifteen years ago, and all kinds of mechanical magic too; like automatically locking differentials, instead of locking hubs which you had to lock yourself.

For those of us unwilling to pay these premiums, and who have some wrenching ability, the best cars now are used cars, so long as the interior plastics haven’t rotted away.

Re: Richard Greene June 12, 2023 At 12:40 pm

The auto market is not a free market. As such the costs of BEVs are being foisted on all the automakers through government. Even if an automaker chooses not to make BEVs they have to buy credits from those who do to keep selling in various places.

This in the end means BEV costs are buried in every new ICE passenger car or truck sold. Did anyone deliberately raise prices for a BEV fee? No. The baseline costs of doing business increased. This baseline goes into every product and prices were increased.

BEV costs are not buried anywhere. BEV losses are offset by ICE profits. ICE profits would decline if ICE prices were raised in a failing attempt to offset BEV losses.

If product A’s profits are supporting product B’s development product A’s price isn’t increased. Product A’s price increases because costs go on to product A. This happens when product A can’t be sold unless credits are purchased or because the overhead costs applied have increased when such expenses are taken as a whole and shared. It simply depends on how the manufacturing company does the accounting. At some point project specific expenses break down and now they are just expenses.

Hi Brent,

Richard is our new resident troll. He quibbles, parses. Examples include this one. That the profits made selling SUVs aren’t directly subsidizing the manufacture of EVs. As in, literally. A direct transfer of one to the other. Of course that is beside the point as the point is that the profits earned via the sale of SUVs do offset the losses incurred by the “sale” EVs. If all that GM or Ford “sold” were EVs they’d be bankrupt in six months’ time.

Richard also likes to insist that the drugs recently being pushed on people were – are – vaccines. Notwithstanding these drugs did not confer immunity; did not prevent the getting or the spreading of the sickness putatively “vaccinated” against. He says: But these drugs cause antibodies to be produced and therefore qualify as “vaccines.”

That’s the sort of Talmudic parsing he excels at.

Talmudic parsing?

I’m an atheist.

Still wrong on ICEs:

ICE prices are NOT deliberately raised to bail out EV losses. That implies ICEs are money making machines. Their profits do keep auto manufacturers in business, but they can’t increase ICE net profits by arbitrarily raising ICE prices.

I have investigated the history of vaccines, and the lack of effectiveness of the so called Covid vaccines. At best it appears the Covid vaccines could reduce Covid symptoms for a few months, offset by the worst adverse side effects in vaccine history. Although called ‘leaky vaccines’ by authorities, the traditional definition of a vaccine is a drug that creates strong antibodies — so effective that infections are defeated with no symptoms, which is called immunity. Covid vaccines do NOT meet the traditional definition of a vaccine. Even the current influenza vaccines stretch the definition of vaccines — the antibodies they create are short term, and typically miss half the flu strains that will show up in the flu season = 50% effective for a few months.

I will still argue that people refusing to wear masks — which is true of most people these days — will not solve all the problems (or any problems) in the world, as EP implies.

Yes, Richard –

SUVs – not “ICEs” – are the major profit source for new car manufacturers; the fact is not in dispute. These profits enable the manufacturers to “sell” vehicles that lose money. EVs being the biggest money losers. Facts.

“ICE prices are NOT deliberately raised to bail out EV losses. That implies ICEs are money making machines. Their profits do keep auto manufacturers in business, but they can’t increase ICE net profits by arbitrarily raising ICE prices.”

Of course, they can. All businesses do this. Grocery stores do this on a weekly basis. They are called loss leaders. They know they are losing money on these items so they jack up the prices on other items to compensate for it. The auto manufacturers are doing the same thing. They know they are losing their butts on EVs so they are building in a cushion on the ICE vehicles to ease some of the pressure. Does this cover the loss? No, but it decreases the burden of it. It is a difference of Ford losing $3 billion vs losing $4 billion.

Any successful business owner knows that every item produced or serviced is not going to be profitable so we build in slack in other areas to profit. In my business I barely break even on handling payroll reports for clients. A client is only going to pay so much and it is a field where there is quite a bit of competition (e.g. Paychex, Intuit, ADP) so I can’t charge 2x or 3x more than they are. I make it up in areas where the competition is scarce (bookkeeping or DCAA compliancy).

If Ford isn’t doing this then they are fools. Look at Musk he is taking the profits off of Space X (and sometimes Tesla) to prop up Tweeter. Sometimes you have to do this to cover for ST losses. If the product or service continues to bleed funds then you shutter this section or department, cut your losses, and move on. Ford and GM are more than aware of this. Do you think the Ford F150 didn’t cover the losses on the Ford Festiva?

Twitter, not Tweeter….you can tell I don’t use the platform.

“It is a basic misunderstanding of economics to think that a company can raise prices without losing sales.”

Spot-on.

This misunderstanding is similar to when people complain that oil companies “jack up” the price of gas just because they want to generate more profit. If it were possible to do that with no loss of sales, then why didn’t they start charging more a long time ago? Why do prices ever go back down?

“The auto market is not a free market” is not a relevant argument here, as regulatory capture and bailouts do not alter the fact that demand curves slope downward. Raise the price, and some consumers will either do without or substitute something else.

I wrote the for-profit economics newsletter ECONOMIC LOGIC for 43 years, and I have to say that you know economics, and explain yourself well.

Thanks. I suppose I run the risk of being named Special Assistant to the Regular Heckler. 😉

Btw, thanks for linking to your Honest Climate Science and Energy Blog. I check it daily for the latest on climate lunacy.

RE: ““The auto market is not a free market” is not a relevant argument here […] demand curves slope downward.”

…”Market exchanges are not equal exchanges. They are unequal exchanges, from which both parties expect to gain.

So trade is productive of value. In a market economy goods are constantly moving from those who place a lower value on them to those who place a higher value on them. This is a fact of economic life that is not taken into consideration by mathematical economists. They seem to think that economic goods have a certain fixed value, usually based on the cost of production. They calculate this value as an unchanging fact, not realizing that when a good shifts from one person or place to another its value has been increased. The physical goods have greater value when they are owned by people for whom they can provide greater satisfaction.

It is the unequalness of the use and exchange values of different people that leads to exchange. These differences cannot be measured, only compared. They are in the mind. They are psychic. It is always a matter of greater or less. If the value of what you expect to receive is not greater for you than the value of what you will have to give up, then there is no trade. The differing use and exchange values of different individuals result in the emergence of prices — market prices. There are no other kinds of prices, only market prices.” …

https://mises.org/library/how-prices-are-determined

Yes, helot, that is the miracle of voluntary exchange: After a trade, more value exists than existed before the trade, even though the things that were traded have not changed.

Only slightly off-topic:

A taste of what is to come in dystopian technocracy:

Amazon accuses customer of ‘racism’ and shuts down their ‘Smart Home’ and their ability to purchase on Amazon:

https://youtu.be/NfiIXooD77s

This is the “social credit” system in operation….and will no doubt be extended to EVs as well…..

Yesterday a 1952 Chevy pickup was parked next to me at the gas station store. Its dash looked like this:

https://tinyurl.com/y297nht9

I envied the brute simplicity: two round gauges; half a dozen knobs; three pedals; one gearshift lever.

In old pickups equipped with a straight six, you can actually stand between the engine block and the wheel well to work on it. From today’s standpoint, that’s wasted space — every cubic inch under the hood is densely crammed with components, making maintenance a headache.

As Ben Franklin (and others) reputedly said, “If I’d had more time, I would have written you a shorter letter.” Simplicity is elegant. But it’s not on offer anymore, at any price.

I’m surprised most new car stealerships can even keep their lights on. Every time I drive by, I never see anyone there. The cost for new prices so many out, and now interest costs rising. But lo and behold I’m sure To Woke To Fail will trickle down. Certainly the money created by fedzilla to bail out the big three will be shared with their dealer network. Also who even wants new when the roads are falling into turd world like conditions.

n 2022, profits reached an estimated $6.5 million per location for dealerships owned by public auto retailers, more than triple of pre-pandemic levels, according to the report from Haig Partners, a buy-sell advisory firm to auto dealers. “We’ve polled owners of hundreds of dealerships over the past few weeks, and most expect profits will decline 10%-15% in 2023,” said Alan Haig, president of the firm. But dealers still expect profits to remain over twice as high as 2019, powering demand for acquisitions in the drive to expand, the report said.

Car dealerships generally make more money on the sale of accessories and warranties than they do on new vehicles.

New car sales.

Financing, accessories, warranties.

Used cars.

Service department.

Just throw it on the list, along with the pension fund, the generous management stock option performance bonus, the facist health care plan, the local property taxes, and just about anything else that “big business” just pays out without protest.

Benjamin Franklin said “Watch the pennies and the dollars will take care of themselves.” Today’s executive ignores the penny and is obsessed with dollars. The really big dollars, because a really big number gets everyone’s attention. Back when GM mattered, Ralph Nader published Unsafe at Any Speed: The Designed-In Dangers of the American Automobile. In the book he claimed that GM purposefully skimped on a $0.35 suspension part that could have “prevented” Corvair’s different handling, along with many other so-called corners cut. Ever since then the goal has been control costs, not cut them.

Because engineering is expensive and design is relatively cheap, the first thing was to consolidate and eliminate engineers. Make one engine for everyone. Then comes body work. Make the core of the thing as bland as a Walmart sheet cake then send it over to design for gingerbread and icing roses. Might not be as profitable for Chevy, but Cadillac makes up for it. Net-net is all that matters, even more so when you convince governement to hobble every corporation equally. Makes that first rung on the ladder extra high for the new guys.

I’m reading Nader’s book right now. I don’t take anything that guy says as truth. I Don’t believe that for a second that Nader was interested in anything but shutting down 1/6th of the United States economy (back then, it was the auto, not the heaf care industry that was 1/6th).

Reading the book forces several questions, though. Why did the the fatal accident rate seem to increase during the 1960’s as the much safer interstate highways were being built? Was Nader actually correct that the car manufacturers were stalling some safety advances that oculd have been made? How could automotive safety been improved without creating the second worst agency in Washington, the National Highway Traffic Safety Administration? Same goes for the chapter on auto pollution (The power to Pollute) and the Engineers… How could we have reduced tailpipe emissions (CO, NOX HC) to reduce photochemical smog without having the EPA in our lives daily.

I frankly could give two shits about either tbh since it seems to be coming at the cost of an entire industry and the mobility of the American public. I don’t think that and of the advancements over the last 60 years have been worth it if it leads to the end of mass motorized transport. Not a damned bit of them.

When arguing the whole issue, I will dispute the entire premise of the argument. I will not argue on safety or environmental grounds at all since everything that has taken place has forced me not to give a crap. They have to prove to me that auto safety was a real problem in the 1960’s first. Or car pollution. I doubt that the average activist could tell the difference between Carbon Dioxide and Tetraethyl lead

Hi Swamp!

I can speak to the Corvair “issue” as I owned a first-generation (1964) Monza coupe. The first “issue” was that some owners did not read/heed the tire pressure recommendations – hugely important. The second was that – unlike the very similar in general layout VW Beetle, the ‘Vair was fairly powerful and many people bought them as “poor man’s Porsches” – without really having the skill to deal safely with a rear-engined car of this type, prone to lift-throttle oversteer.

Driven with the right front-rear tire pressure and knowing how to drive it, the car was arguably safer than the typical American cars of the period, which had terrible brakes and primitive suspensions. The ‘Vair was agile and responsive; it drove like a car from the ’80s rather than the ’60s…

“without really having the skill to deal safely with a rear-engined car of this type, prone to lift-throttle oversteer.”

Curious that Porsches had the same problem, but were not assaulted by Herr Nader.

Three rich high school friends had the following cars in 1971:

Pontiac Trans Am

Jaguar XKE 12 cylinder

Porsche 914 rear engine

The 914 required the most driving skill. The better handling Trans Am went over a cliff and killed the drunk driver. The Jaguar hit a tree, split in half, and killed the drunk driver and my good friend.

The pollution was a real issue and real safety is not crashing. I remember the 1970s and I have old photos. Things are much cleaner now.

Pollution would have never been a problem if it wasn’t for the courts’ “prove harm” rulings rather than property rights. Under property rights there would need to be at the very least efforts that were possible to prevent pollution and deliberate dumping would not be allowed.

Focusing on crash safety makes people more reckless if they don’t care about their about their car and many people don’t. Focus should have been on performance with secondary on crash safety. Today crash safety creates blind spots and such reducing safety.

Need to go read the ZH article, “Ford Pulls An Apple, Cuts Chargers From New Mustang Mach-E Purchases” especially the comments. And especially propagandized commenter Basket911 that thinks IC cars are still polluting like the 40s through 80s and has bought the whole EV line of BS.

https://www.zerohedge.com/markets/ford-pulls-apple-cuts-chargers-new-mustang-mach-e-purchases

That’s the deception the control freaks use. They keep acting like pollution hasn’t been reduced 99% or more. That’s why everything is put out as ‘reducing pollution by 50%’. 50% of the 1% or less that’s left. Very expensive and makes no practical difference.

The days of $35k Tahoes will not return. So we have two choices…pay the price or go without. I am about to pay the price. I am going to wait a few months hoping prices will come down a bit, but they will not be dropping $40 or $50k. Not only is the subsidizing of the EV factored in the price, but the increase in labor and materials. The dwindling dollar doesn’t help either.

Do we believe we will ever see a new ranch home for $140k again? The median home price in the USSA is $407k. That is more than twice what I paid for mine 25 years ago and five times more than my parents paid 50 years ago. Those numbers will not return and neither will a $15k Honda Accord or $.99 for grass fed butter.

This is the world we live in. It is a vicious cycle, but until the system breaks and the dollar crashes inflation will continue to wreck havoc on our economy and make small and large purchases difficult for those trying to get by.

Hi RG –

Yup. And – as regards home prices: The little ’70s house I bought in Sterling (Sugarland Run) back in the mid-’90s for $159k is currently a $500k house. The neighborhood was – when these houses were built, in the ’70s – working class. But they were single family homes that working class people could afford. That I – a young guy, just starting out – was able to afford back in the mid ’90s. Today that same house is for affluent people only – and they are “poor” by Northern Va. standards. $500k buying you a 50-year-old ’70s tract house in that area…

‘house I bought in the mid-’90s for $159k is currently a $500k house.’ — eric

Calculate the annual compounded return: (500/159) ^ (1/28) -1 = 4.2%

That’s gross return. Subtract property taxes, maintenance, insurance, commission on sale, and the net annualized return likely would be around 3 percent.

Today’s big six-figure sales prices sound astronomical. But the dirty little secret of real estate ownership is that most owners haven’t even kept up with stock and bond returns over the same period.

Leveraging up can raise those returns … but also can wipe out equity in a downturn.

Hi Jim,

Very true. But, one big difference now vs. then is even managing the initial purchase. I had saved up the 10 percent of the $159k to put as a down payment. How about 10 percent of $500k? Who can manage that? Very few, I suspect.

Hi Eric,

Baby Boomers said the same thing in 1995. Why would someone pay $159K for a house? Who is going to be able to afford a down payment of $16K? That was 50% of our total home cost in 1975! 😉

Admit it…we have become our parents. Everything is too damn expensive and that is not the way we did it. Sound familiar? 🙂

No. According to the Case Schiller Home Price index, homes are about 2x or more adjusted for inflation. More in some areas less in others. Inflation is a fairly accurate gauge, however, it also doesn’t take job security and other factors into account. So, no. Homes cost a lot more. It has nothing to do with old people. With active market interference enabled by the ballooning of the money supply and corporate capital privelege, home prices have skyrocketed. By any measure.

So have wages, swamprat. When my husband and I brought our house we were making $12-15/hour. My parents were making $3/hr. in 1972 when they bought theirs. My nephew, who just graduated, with zero skills, is making $30.00/hour.

My house was $200K in 2000. My nephew is making double of what I was making so yes, his house is the equivalent of $400K.

My point to Eric was as we get older we remember when prices were lower and the absurd amount that things cost.

The states and unions are demanding that people receive higher pay, more benefits, etc. For employers to pay those higher wages they need to increase costs. That means everything goes up along with it from food to transportation to housing.

Add a swarm of illegal migrants crossing the border and the demand for housing increases. No doubt inflation is affecting the dollar and making it less valuable, but the demand is also there which is keeping the prices high.

RE: “but the demand is also there which is keeping the prices high.”

Ah-hem:

http://housingbubble.blog/

Seems like, you’re stuck on, “This time, it’s different”?

Click the link.

Open eyes.

Your choice.

RE: “higher pay”

Consider this, from March:

“… , that continued nominal income growth that does exist is not keeping up with price inflation. The result has been 22 months in a row of negative real wage growth, and that will translate to falling demand. ” …

https://mises.org/wire/real-estate-markets-are-addicted-easy-money

And, you’re buying a new vehicle with these headwinds & what you’ve written about your industry?

Hope ya know what you’re doing.

Thank you, helot, but I am more than capable of handling my own money and deciding when I can purchase a vehicle.

Ah, truly, pardon me if I rubbed you the wrong way.

I didn’t intend to suggest you’re not your own helmsman.

Just pointing some facts out in relation to what I’ve read in the past… & today.

I should care, less. I guess.

…It’s finally raining. A little.

But, the drought is not over.

Also, I hope you have good air to breathe:

https://forum.ericpetersautos.com/forums/topic/is-there-more-to-the-smoke-from-the-canadian-wildfires-drifting-here/

I mean that in a, i hope you have a good night, kind of way.

“Gentlemen, place your bets” comes to mind as well.

…I got nothing else.

Hi Helot,

I’m glad you’ve found and are using the Forum! I had hopes it might become what Twitter isn’t. But it seems most people prefer to Tweet – like little birdies…

Hi RG,

Well, maybe! Ok, some! But, just for fun, I looked up what the $159k I paid for my first house back in the mid-1990s would be in Biden Bucks, today: It’s about twice that ($315k). But the house – my old house – would list for around $500k today. So the increase seems pretty real- and big. Also, the property tax on a $500k (or $315k) house would probably be twice as much (or more) as well. My last year in Sterling, the bill was something like $3,500 annually. I bet today it’s close to $6k.

What’s worse is when the area your house is in doesn’t appreciate or appreciates much slower but where you want to go or need to go has. That has happened to many people too, leaving them stuck. Can’t move to where there are better jobs because those jobs don’t pay enough for the houses there and selling your place won’t yield enough either.

As to downpayments step in new government assistance programs on every level for those who qualify. Government makes the problem and then offers assistance to deal with it.

Indeed, Brent –

I’m fortunate in this respect, for two reasons. First, I’m happy where I am – so moving would only be an issue if the area becomes everything I moved here to get away from. So far, it’s still not like that. Two, if it does become like that, I will probably be able to sell my place for more than enough money to bug out for somewhere better, because the value of my land would rise in accordance with the development of this area and the turning of it into a replica of Northern Va.

Real estate is local. Ski towns in Colorado have seen many properties increase 200% or more over the last 5 years. Now the vast majority of these properties are true investments, either one percenters parking their money or AirBNB real estate tycoons, but it has pretty much priced out anyone who might actually want to live in their purchase.

Now true, it’s always been like that, at least in the city core and slope side, but the difference this time is that the buyers are paying way over list for no apparent reason, other than vacation real estate is the least bad investment option. There are even property management companies that will clean your AirBNB, just like any other short term rental or hotel.

Man, reading about the take so many of you have on real estate, is…

http://housingbubble.blog/

Hi Helot,

As recently as pre-“pandemic,” one could buy a nice little house on 2-3 acres of land in my area for $150k or less. Today, single wides on an acre are going for $200k.

My 80s girfriend’s parents’ stucco 3/2 1400 sq ft house in the Tampa suburbs which they bought in 1987 with 13% mortgage paper for $90k was a $500k sale last summer before interest rates went crazy.

People feel “rich” because of the mid-six figure values of their houses, and, until that changes, the car manufacturers and dealers are going to continue to take advantage.

That’s just a reflection of dollars having less purchasing power as a result of the Fed’s inflation of the money supply. Even when one knows this, it can still be deceiving.

Well, yeah. But there is never a direct relationship without market changes or interference. Consumer prices for instance, have not always been in line with increases in the money supply. The securities market’s, for instance, absorbed a lot of the asset inflation that would have happened from say, 1981 to 2001. That, and the free trade labor arbitrage economy. When the dot bubble occurred, the money from the markets went into the real estate market. After the 2009 crash, it found its way back to securities by 2013 or so. And real estate. Except it wasn’t a supply demand thing for real estate. It was external market interference from companies like Black Rock and others who make trillions of profits on the sale of assets and god knows what other derivative financial instruments they are using. It stems from the fed, but active market interference is how this real esatate situation is unfolding. It comes from virtually zero interest loans from the fed and likely from back door channels to it’s virtually unlimited supply of money. –

Hi swamp:

I would disagree. 1/2 of virtually every transaction (at least in the US) includes federal reserve notes. Money, like any other traded good or service is subject to the law of supply and demand. All things being equal (and this is important), the more supply of something will cause downward pressure on its value. More money supply will necessarily lower its purchasing power. However, this pressure always takes a little bit of time, as it requires the new money to circulate throughout the economy from the points of where it was injected as well as changes in the behavior of buyers and sellers, which has a sort of inertia unto itself. Also, things almost never remain equal. For example, there could be a simultaneous drop in demand for a certain good occurring at the time of the increase in money supply, which may cancel out a price increase. Nonetheless, in that case, without the increase in money supply the price of the good would have otherwise dropped. It’s almost impossible to tell with specificity what the cause of a price change is, as there are so many variables and human action is at play which can change those variables midstream.

Also, assumed in your argument is that the newly printed dollars can somehow be sopped up by a certain asset class such that they will not affect the prices of another. This is a pretty common myth, but that’s not what happens. If you exchange money for something like securities or real estate, that money doesn’t somehow get locked up into that asset. That money is simply exchanged for that asset and it’s then used by the seller to purchase goods or services, or it gets deposited to a bank (which will lend it out) or loaned to others to spend it on goods and service. Thus, that newly-printed money keeps circulating in the economy, which allows buyers to continue to bid up prices with it. The only way for the money to be taken out of the system is for the Fed to sell off its assets for federal reserve notes and then not to recirculate them.

The $8000 “first time buyer” tax credit (loan) combined with 3% down mortgages and low interest rates put an effective floor of $260k under anything habitable short of a condo which could pass inspection in most places of the country where people would actually want to live.

I don’t see that floor being breached without a major economic calamity.

I remember Biden campaigning on a similar $20k credit/loan, which would mean a floor of ~$600k, but that won’t happen now.

Every three years Colorado municipal governments reassess property. This cycle houses have seen 30-200% increases in “value” thanks to the white flite from cities and rise of the remote workforce. My home’s Z-estimate went up over the last 10 years but peaked in 2021. Since then the market has begun to return to more reasonable values. It took me 5 minutes to find three examples of similar homes that sold for 10-20% less than the assessed value of mine. We’ll see if they take my appeal under consideration.

The bigger issue is what will happen to all these “investment instruments” now that the bulk of the population with any sort of wealth is no longer pushing money into the investments? The somewhat small percentage of boomers who retired during the pandemic, therefore no longer buying stocks, has tanked the market by 30% and it will be decades before it gets back. No buyers, just holders. What will happen when all those S&P index funds start selling and liquidating?

I have a friend who is counting down the days now. He’s talking about selling some land, looking to move to a lower cost state and generally downsizing/rightsizing. This conversation is happening in millions of families now.

And will they all retire to Boca Raton and buy Cadillacs? Will they be happy with junking their EVs every 5 years as the battery degrades? One reason old people bought expensive cars was because the thing would just sit in the garage 4 days a week, so why not splurge, right? An EV battery degrades just sitting there, driven or not. And more so if in a hot/cold unconditioned garage. That’s a new cost I’ll bet most retirees aren’t budgeting.

A lot of the EV early battery death horror stories are coming out of Florida in areas south of the hard freeze line (approximately I-4) which are popular with retirees such as Naples and … Boca.

Having grown up on the Peninsula and living there until I was in my early 40s, my first hand experience with anything electronic or mechanical is that the entire device must be kept in AC, preferably unplugged, or bad things happen over time much faster than in other climates in the continental US thanks to the intense humidity, heat, salt air — which is everywhere — and thunderstorms.

That reminds me of my grandparents’ house in Cape Coral. This was in the 1970s. Grandpa built a Heathkit electronic doorbell that played a song. Because he was mostly deaf the volume on the thing was cranked up to 11. We were there visisting one monsoon season and every afternoon about 3:00 the skies would darken and rains would start. Then a flash and thundercrack -and that doorbell would “chime” Westminster at 100dB or so. Then grandma would start yelling at George to shut that damn thing off!

Our poor dog would spend the rest of the afternoon under the bed.

I can’t say that I’d mourn the death of this host, which seems well-deserved. I’m afraid it can’t die though. It’s too important to the regime. They’ll keep propping it up as a blood-sucking, zombie company, which it might already be.

By the way, here’s a great 2-part recent interview of Bob Lutz (very much a car guy) discussing the downfall of GM and the death of Pontiac.

https://www.youtube.com/watch?v=_zlT8anTmAY

https://www.youtube.com/watch?v=PJ7fyx9yQAU

“What it is is profitable.“ The two “is” thing was batted around recently on another thread. I’m thinking a comma between the two? Just being a right brained word fetishist here.

As far as these “notably” profitable SUVs and trucks, I still see so many late model versions all around me. Sure, there are some conches conspicuously driving Cuba style 20+ year old rigs and some restos but they are outnumbered 10 to 1. I’m guessing the car companies can go on financing their (and their partner, Pauly, err… the gov’ts) EV fever dream longer than the rational of us on here could imagine. 65K at 8% interest for 10 years, what’s not to like? LOL.

Hi Funk,

The average new car loan currently costs $700/month. The payment on a $70k SUV is much higher. But even if – for the sake of discussion – we are “only” talking $700, there are only so many people who can come up with that kind of money every month for just a car payment. Keeping in mind they will also have to pay for insurance (probably at least $100/month on the very low end) and fuel (another $200/month at least if driven daily) so close to $1,000 per month in car expenses, alone. That’s $12k annually. Prolly close to as much as many people pay in rent/mortgage annually. It doesn’t leave much for food, utilities – and forget savings.

Who wants to live this way? How many can afford to?

I’d joke that Jim Farley wants us all living in the proverbial “van down by the river”, just like from his cousin’s (yes, cousin) most famous comedy routine, but Ford discontinued sales of the Transit Connect in this country, their most affordable van dwelling option.

I roll a ’14 Transit Connect and it’s a great grocery getter and can haul a bunch of kiddos but doubtful on living in it unless you’re tiny or truly a vagrant. To live “van life” proper, your best bet would be the full size Transit. I see a ton of guys living transiently in those and other tall Sprinters.

I don’t know how they do it, but it seems, at least to me, that a lot are doing it somehow. It is baffling. Lotsa worky worky propping up the system that enslaves them, I guess.

Those numbers just blow my mind! We bought a house for half that amount ($33k) in 1974; total monthly payment was $350, guess we can thank the Fed for inflating everything to the point that a car costs twice what a house did back in the day.

Hi Doc. The two “is” thing has always bugged me too. I don’t think there’s a correct way to do it because it’s fundamentally wrong. What’s needed is to reword the sentence to something like “what it becomes is profitable”, or “what we get is something profitable”. Just my two cents.

Hi Doc,

“What it is is profitable” is correct. The subject of the sentence is “What it is,” and the second “is” is the verb. This is entirely different than the double “is” that I have criticized:

“EVs suck. The reason is is they take too long to charge.”

Here, the word “is” is repeated for no apparent reason. It sounds dumb.

There is disagreement about using a comma in the first example. I prefer not to. If you replaced the “What it is” with something else, you would not use a comma: “The Tahoe is profitable” not “The Tahoe, is profitable.”

You are right Roland, there are instances where it is grammatically correct, (the example above, “what it is is profitable” being one of them) but I just find it clumsy, and most of the time it’s not correct. I usually try to rephrase and avoid it altogether.

Hi Floriduh,

Rephrasing is very often a good idea, but I’m somewhat sympathetic to the correct use of the double “is,” since the isn’t/is juxtaposition does add emphasis. Here is the context from Eric’s piece. He uses italics to make sure you put the stress where he wants it (hope I get the HTML tags right):

So why is it – the Tahoe – so expensive?

Well, it isn’t.

What it is is profitable.

You could rewrite that as: “The Tahoe isn’t expensive. It is profitable.” But it just doesn’t have the same zing.

Of course the automakers are thinking ahead. They don’t have to sell anything. Too big to fail. Bailouts ad infinitum.

A $40k+ vehicle is not even remotely affordable on a household income of $50k before taxes. Until recently, the F&I room could work magic with 2% interest rates and a willing bank accomplice, but those days are long gone.

Moving beyond the payments is the issue of long term maintenance and routine repairs, especially since many loans outlive the manufacturer’s warranty, requiring purchase of the extended plans just to make it through the payments before a breakdown.

Price a water pump replacement for a 2016 Explorer. Many of those financed with seven year loans are still seeing payments through of the end of this Summer.

Somebody like Vlad Zelensky has the 52,900 USD, in cash, to buy two.

A parasite that is killing its host, plus a few others. Hugs from Turdeau are special.

If you have to subsidize a portion of the production that needs subsidizing, you are being ripped-off. If you buy a Suburban, then you should get a free EV to boot. Have to get what you pay for.

You’ll have to take a detour if you are on I-95 near Philadelphia.

Philadelphia is beginning to resemble Kiev.

With inflation only, the same truck I bought in 2000 for $20K is now $35K. Good luck finding that package for $35K. When I search local GMC dealers’ websites, a roughly equivalent truck is closer to $65K. So $30K is split between GMC corporate & the local dealer. Of course that doesn’t include the myriad of taxes, fees, licenses from the tax looters nor does it include the bullshit fees dealers add on.

One thing is for sure, unless I win the lottery, there’s not a chance in hell I’d buy another new truck off the lot.

The solution is not to buy new. My $20K 2017 crosstrek will last a long time. The 2016 manual V6 Accord coupe sounds awfully appealing too if I was in the market. Great power and Honda awesomeness.

This has even spread to smaller SUVs like the beloved 4Runner. Toyota has long since profited greatly from the tooling, but now, you can’t get a 4Runner for less than $42K. I know inflation pays a part in this (thanks Orange Man and Creepy Joe and our useless Congress), but it’s absurd when just a few years ago you could get a 4Runner for $35K or less.

This is not sustainable.

Watch as the less carrot more stick eventually becomes “all stick”.

Just a little ratchet click at a time — don’t wanna startle any sheep:

https://www.zerohedge.com/markets/ford-pulls-apple-cuts-chargers-new-mustang-mach-e-purchases

That’s actually hilarious. imagine spending a $1000 for a phone and it doesn’t come with a $5 charger. Lol. Same with the car.

“The parasite that eventually kills its host.”

Even among living parasites, the most successful do NOT kill their host. They, like the rest of us, are subject to the law of natural selection. Better not to kill the host, and let it propagate more hosts.

It appears the car makers consider themselves immune to natural selection. Perhaps they should reconsider?

This is an absurd business plan. Raise prices on X, to the point no one can afford X, to subsidize Y, which few can afford, and even fewer actually want?

To appease an unelected alphabet bureaucracy that is far more concerned with its power and graft than with any just goal?

When .gov mandates an ever increasing percentage of vehicles be EVs; the people who can afford to buy ICE vehicles will still buy them. The only problem as Eric has indirectly pointed out is that it’s hard to afford anything when the value of the dollar goes down and the price of everything goes up. A new vehicle in most cases is a want and not a need. Automotive podcasts I’ve listened to show more vehicle owners willing to do major repairs rather than scrap it and buy a new one. A few more years of this and our roads may well look like a latter day version of Cuba’s; except with uglier looking cars. Of course with that bridge collapse on I-95 you might be driving a little less.

PS- Funny how most of the people pushing EV’s don’t own one themselves.