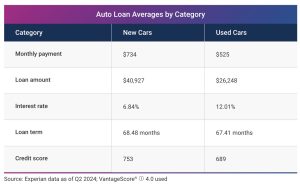

It is freeing – literally – to not have to come up with the average (with good credit!) $734 monthly new car payment (as of 2024).

But it’s not just that.

They – the lenders and those who rely on your willingness to buy this much debt – don’t want you to think about what else comes along for that ride, in addition to that monthly payment.

The insurance payment, for instance.

If you’re financing – that is, if you are borrowing – you also be paying for full-coverage policy that is based on the full replacement cost of the vehicle.

This is entirely reasonable – and justifiable – from the standpoint of the lender, who is in fact the actual owner of the vehicle you’re making payments on every month. (If you doubt who the actual owner is, irrespective of the name on the title, see what happens when you stop making those payments on what isn’t your vehicle until after you’ve paid off what you owe on it.)

If you wreck their vehicle, the lender would be left holding the bag. Hence the requirement – a condition of the loan and your conditional possession of what is not your vehicle in fact – irrespective of the etymological fiction – that you pay for a policy that will pay out whatever it takes to either repair the vehicle or replace it.

How about roughly $2,500 per year – on average? That’s – roughly – another $200 per month you’ll be paying, rounding out to just shy of $1,000 per month.

That used to be roughly enough to just about cover a mortgage on a modest single family home. It is still enough to cover about half the cost of a monthly mortgage payment on a modest single family home. Which explains why so many people cannot afford to make the monthly mortgage payment on a modest single family home anymore. How many can afford to pay roughly $2,000 a month for the mortgage and $1,000 (roughly) more for a new car payment plus the cost of insuring it?

That’s $36,000 per year – or roughly about half the average household income in this country. It doesn’t leave much for groceries – or gas – does it?

If you do own your vehicle, not only aren’t you making monthly payments, you can choose to pay less for insurance as well. Because you can choose to buy minimum, liability-only coverage. Regardless, you’ll pay much less to insure an older vehicle with a lower replacement cost than a new vehicle. So, zero monthly car payments – and perhaps only $500 annually in insurance payments.

Some states also have what are styled “personal property taxes” on vehicles that are – like insurance – are based on the value of the vehicle. The newer it is, the more expensive the tax is. This tax can add another couple hundred per month to the cost of owning – that is, making payments on – a new vehicle you don’t actually own yet.

But even if you are fortunate enough to not live in a state that taxes you each year just for owning a vehicle (so as to render ownership a farce, since even after you pay off the loan you must still pay the government for as long as you don’t actually own the car in order to be allowed to retain use/possession of it) the cost of those other payments is still so high very few can afford it.

Even if they can make the payments. Wait. Allow me to explain that one.

The opportunity cost of making all those payments – for years, in most cases – is extravagantly high. What else might you have done – what else might you not have had to do – if you didn’t have to come up with roughly $1,000 bucks each month to pay for the car you don’t actually own yet?

During the mass-panic event still referred to by pretty much everyone as “the pandemic,” those in debt – who lived with the knowledge that another payment was coming due at the beginning of the next month – were in a tough position when told by their employer that they’d have to wear a “mask” if they wanted to come to work. And if they refused? No more job! Then no more car, either. And very possibly, no more roof (or food) either.

But when you don’t owe anyone any money, you don’t need as much money and you aren’t owned. You can get by without that job because you have time to find another – and you’ll still be eating (and indoors) in the meanwhile.

You’ll also be able to take advantage of unexpected opportunities that come up because you’ll have the money to take advantage of them. If you haven’t had to pay $1,000 each month for even five months, say, you will have roughly $5,000 more in hand to pay for whatever you’d like. Maybe a nice vacation. Maybe a new water heater. The latter being one of those unexpected expenses that always seems to come up when you haven’t got the money to pay for it. They often lead to cascading debt because if you can’t pay cash for the new water heater – because you’ve got to pay that monthly payment – you’ll have to put the water heater on the card and then make monthly payments on that, too.

What often happens next is something else – and then that goes on the card, too. And before you know it, you’re owned by the credit card companies and you don’t even own the car you’re still making payments on.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

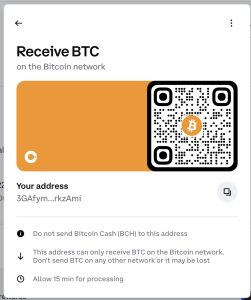

Our donate button is here. We also accept crypto (see below).

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you like items like the Baaaaaa! baseball cap pictured below, you can find that and more at the EPautos store!

The bitcoin code is: 3GAfymoqSUbaFvY8ztpSoDKJWCPLrkzAmi if you’re unable to scan the QR code above!

[…] Guest Post by Eric Peters […]

Places like Paradise, CA and the coastline of southern Florida have been experiencing homeowner’s insurance rates doubling year after year only to then discover that their insurance company has decided they can’t make any money there anymore so they’re leaving. Those who seek out insurance are then informed that to keep their home insured they will need to replace their roof, rewire or replumb the house and/or jack it up another 20′ into the air before they can obtain insurance.

I took a $40k loss selling my place in California because the same home in a better location in Florida was a fraction of the cost, and because it was under $30k I could homestead the place which allowed me to bypass paying ANY property taxes. No mortgage, no taxes, food growing all over and around my property so no taxes on any of my pesticide and herbicide free food.

so now you will live forever without paying out any money

Yes. For all practical intents and purposes, I will not only outlive anyone who consumes the processed byproducts slathered in sodium, sugar, and grease which passes for food these days, but will live a far better quality of life as well.

On a few occasions I’ve gotten my credit card statement down to zero which means that I’ve gone an entire billing cycle without spending a cent.

IMHO: The cost makes no sense to me for what, a tub-o-ware body with 4 wheels and a lightweight alloy drivetrain. The one thing the “assembly” car companies do well is, good looking with a nice ride and the cars are quiet and will generally get the new owner through the warranty period. However, the cars and trucks if the PM is kept up seem to last 150,000 to 300,000 miles. Here’s the deal so buyers understand. Most car sales are done by people who if they don’t cheat and lie to the customers even a little will walk away from the deal not knowing if they could have got more money out of the deal. So they can’t help themselves and must try.

The cost makes no sense to me for what, a tub-o-ware body with 4 wheels and a lightweight alloy drivetrain. The one thing the “assembly” car companies do well is, good looking with a nice ride and the cars are quiet and will generally get the new owner through the warranty period. However, the cars and trucks if the PM is kept up seem to last 150,000 to 300,000 miles. Here’s the deal so buyers understand. Most car sales are done by people who if they don’t cheat and lie to the customers even a little will walk away from the deal not knowing if they could have got more money out of the deal. So they can’t help themselves and must try.

I’ve been thinking about cars a lot lately. I’ve decided they’ve become a colossal racket. My 2006 Pontiact SUV ‘s transmission went out, and I had to decide what to do. I took one trip to the new car dealer and got the sticker shock thereof for a tarted up insanely overpriced vehicle, loaded up with very stupid mandated devices that I knew would cost even more money in repairs later. So… I spendt 3K for another transmission out of a junk yard with a 12,000 mile one year warranty. My plan is now to just keep the vehicle and replace the parts as long as the parts are available.

Gone are the days when newer meant better. Now it’s the opposite. Very sad, very stupid for our country, and infuriating.

Hi Jim,

Sorry to hear about the Pontiac’s transmission failure – but I think you did the right thing replacing it rather than replacing the Pontiac. That $3k you spent is much less than you would have spent on just one year’s worth of $500/month payments – and the odds are you will get several years more out of your car before anything else expensive fails.

My son had a good one. If you’re trying to get off a jammed up exit, find a new car in line, pull in front of it, and it will automatically brake for you. Unless the braking thingy is already broken of course. We drove to see our kids on Christmas and were shocked to see the number of broken down cars on the side of the interstate. A sign of the times?

Pretty much the whole shebang is a racket. Banks, auto sales, insurance, repairs. etc. You could easily shell out $50-60K over 10 years for a used vehicle that is constantly depreciating its value and then if you don’t have an auto claim over that time, that’s was a waste of money, not to mention the repairs and upkeep. Never mind about a new vehicle. The silly government doesn’t want you to buy one unless it is some funky EV that costs even more.

$749 a month payments??

That’s all the SUVs and pickups and EVs, I guess. I just bought a full size sedan a couple years ago when my old one had squirrelly transmission issues that were *maybe* a $2k job but also *maybe* the whole thing was shot (and it had issues previously).

$5-8k down, $500/mo, 4 year loan. Car was a touch under $30k. 3% interest while high yield online savings was 5.25% so I didn’t mind as I came out ahead (recent rate cuts mean I might want to pay the rest off soon, though). Sadly they just discontinued the model for 2025… gotta sell overpriced SUVs, crossovers, and EVs, I guess.

I don’t follow why sp many people want to spend way more for a car that uses up way more gas AND can’t even carry as much stuff when the kids are in it as a vehicle with a real trunk (mine’s maybe 19 cubic feet… not as good as 80s-90s but still just barely big enough for most of my needs). I always hear coworkers complain about repair bills for those big vehicles. Plus thieves can see all your stuff.

I aim for 10+ years with my cars (about 150k miles) … no idea what I’ll be able to find in the 2030s. Every used car I ever had was a money pit (and a constant headache of breakdowns), so I prefer new sedans that I know the full history of.

Merry Christmas All. Courtesy of your friends at he Coca-Cola Company.

And I told you the Stargate was real!

https://www.dailymail.co.uk/sciencetech/article-14179243/cia-docs-reveal-life-mars-pyramids.html

Mele Kalikimaka!

I was cussing and swearing and bellyaching and enduring the misery of doing an unwanted task. You spend money to solve a problem. Has to be done. You save money by doing it yourself.

You do what you gotta do. After you have done that, the money is gone, don’t even know what it looks like.

Just a better world.

Government’s Shocking Proposal to Ban VINTAGE CARS in 2025!

https://www.youtube.com/watch?v=E-HfrIjWGkA

Clickbait

If you live in a state controlled by CARB you get what you deserve. No surprises there but certainly isn’t going to happen in 2025z

Even states like Scamifornia can’t take something off the road if it was legally put on the road and still runs. If it was legal to put into service when YOU got it, hey cannot then pass a new law making it NOT legal. That’s called an “ex post facto” law and our Constitution says naughty naughty musn’t do….”

they got off with it on commercial trucks (though SOMEONE should have gone into battle over it) on the phoney basis that they are “commercial” vehicles and thus somehow can be “regulated” by gummit even after being put into service.

But my old Didge pickup rom 1985 still runs like a Swiss watch and not even California can preven me drigving it.

Hi Tionico,

This assumes they play by the rules. Will they? Have they? At one time, it was legal for citizens to possess and carry arms in ever state. It is now a crime in many states.

Bullshit. Huawei and ZTE products are banned in the United States. The federal government is paying telecom companies to “rip and replace” equipment installed in their networks due to unseen evidence of the companies spying for the CCP. The telecom companies are being paid $4 billion to replace the equipment, a nice windfall for Cisco and Juniper, as well as a free upgrade cycle for the ISPs.

Part of the 2024 NDAA includes a requirement for the investigation of drone maker DJI for evidence of sending data off to China. If that investigation proves positive, the FCC will retroactively remove the certification for the control and telemetry radios, effectively grounding 302,000, about 75% commercial drones. That doesn’t sound like a big deal, but there are only 403,358 (as of 12/2) registered drones in the FAA database. These are perfectly functioning vehicles, arguably the best the industry has to offer. Certainly at the DJI price point. Replacing all 302,000 will be a massive effort, especially considering any of the competitors can’t work at DJI’s volume or reach even if they had the chance. Not to mention many of the parts for drones are only made on mainland China. The biggest US drone manufacturer, Skydio, is only able to ship drones with one battery (about 30 minutes flight time) because the CCP has decided to not allow their supplier to export batteries to the US in a tit-for-tat game. Expect an allocation similar to the Huawei buyout for drone owners, who will be expected to pay 10X more for US manufactured aircraft.

“So what! Drones suck and I’ll shoot yours out of the sky if you come within 20 yards of my house.” Well, that’s fine except that if they can come for drones they can come for pretty much anything. Keep this sort of thing up and pretty soon they’ll be shutting down blogs because of “evidence of spying” just because someone doesn’t want the competition.

Yeah.. our household doesn’t do loans. Never did.

Merry Christmas friends!

Timely post Eric. Front page of the Wall Street Journal echoing the exact same sentiment today.

https://www.wsj.com/economy/housing/home-insurance-property-tax-vs-mortgage-cost-43ab76ed

They are just bleeding us dry on taxes & insurance on all fronts basically.

I recently bought two new vehicles at two different dealerships. Both finance guys were nice enough, kinda got me figured out pretty fast, and cut the BS. Sign and get me out of here.

It might have helped that I waved a hundred dollar bill to cut the crap, and they did.

The interesting part to me was they both told me that a lot of people are now buying with 7,8,9 and even 10 yr loans!!!! They both told me that they advised the buyers that if you can’t buy a car with 48 months or less, you can’t afford it. Whether they actually did or not is questionable.

Good stuff, Chris –

It’s nice to know some car salesmen are ok!

My father was a Ford Credit lifer. The old rule of thumb was that the car was essentially valueless at 8 years and the max term of a loan shouldn’t be more than 84 months, 90 max, and those were only under extreme circumstances.

He’s probably doing cartwheels in his grave if they are really writing 10 year loans.

The typical EV will probably need a battery at 7-8 years, obligating the borrower to purchase the replacement regardless of cost or be held in default and sued by the party holding the car note.

For what it’s worth, I took out five year loans on my current car, and my previous car. The main reason was the lower interest rate, but I paid both off in three. I kept the previous car for 12 years, and am on year four with the current one.

who died and left you a ton money

That’s pretty sad that you would even be concerned over it. No one. I’ve earned every cent with blood, sweat and tears. quit a good paying job (after strike 3) and started a biz with 20K in the bank, and signed our house over for a biz loan. Our first kid had just been born and everyone, and I mean everyone, including my parents and my wife’s parents were very upset and mad at me. 6-8 years of relative poverty (and they all kept reminding me) which eventually turned into a prosperous biz with 18 people now. Cars are an expense to me, don’t care.

Pay cash. Have saved countless $10s of thousands on interest. House was paid off in 10 years (hence part of the poverty thing). Loans are scams where you pay all the interest up front.

It helps to be a honest hard-smart worker. Had customers taking a chance on me that will never be forgotten.

Thought about adding my two cents to the blog but then saw a family walking down the road obviously homeless. All I could think was wow, what a country!

Merry Christmas….

A penny saved is a penny earned, said Ben Franklin.

Today, it’s a dollar instead of a penny.

All (((governments))) are lying liars telling lies, stealing your monies and calling them taxes.

Realizing that the US government has declared war upon it’s citizens explains logically why the seemingly insane actions of the last 40 years male sense.

It’s going to get a lot worse before it gets better, so please plan accordingly.

Bigly… YMMV!

And Merry Christmas!!!

Hi Saxon. When you consider all the taxes we have now compared to Ben’s time it now means a penny saved is 1 1/3 pennies earned (at best).

I have lived my life by this- pay cash, buy used, waste nothing. I repaired everything myself and about the only thing I won’t do is human surgery.

Unfortunately the ability to do this is going away quickly. Cars are grossly over complicated and no longer worth the effort to repair. Household appliances are so cheaply made as to be in the same category, and electronics went all solid state so long ago that radio repair shops and Radio Shack no longer exist. And housing and structures are under the heavy fist and greedy eye of the gooberment.

The bumbledicks have finished their hog pen and are trying to close the gates. If you don’t want your ass to be ham, you need to plan and act accordingly.

“Unfortunately the ability to do this is going away quickly. Cars are grossly over complicated and no longer worth the effort to repair. Household appliances are so cheaply made as to be in the same category, and electronics went all solid state so long ago that radio repair shops and Radio Shack no longer exist. And housing and structures are under the heavy fist and greedy eye of the gooberment.”

Ernie all those are personal choices.

Plenty of vintage / modern cars around that are easy to service

Household appliances- go shop Goodwill, buy a vintage toaster without microchips and heating elements that don’t get hot because . . . Well lawyers. I still use my $5 goodwill toaster bought in college. Working fine and it s about 40 years old. No joke.

With respect to electronics – there are still tube amplifier stereo amplifiers being produced in 2024 so there’s that. If you want an 80” OLED Teeeveee . . . Well I can’t help you there.

With respect to affordable housing – move to a locality that doesn’t have building codes and zoning. If you want to stay where you’re at . . . Again a personal choice.

‘No more job! Then no more car, either. And very possibly, no more roof (or food) either.’ — eric

That’s the position our idiot Uncle Schmuel finds hisself in:

$36T fedgov debt / $29.375T nominal GDP = 122% debt-to-GDP ratio

Whereas Rogoff & Reinhart found that debt/GDP levels over 90% are like kryptonite for an economy, slowing it down to a shuffling crawl.

The founders clearly understood that democracy self-destructs when people with no stake in the system can vote themselves unlimited bennies. That’s why voting was restricted to property owners, at a time when corporations were rare and had to be individually chartered by the legislature.

Now lobbies push for corporate welfare (e.g. a trillion-dollar ‘defense’ [sic] budget), just as teeming hordes of Democrats push for $30,000 per pupil school budgets and universal basic income.

Restoring gold-backed currency would help. It’s very difficult for a country to live beyond its means when it’s obliged to maintain gold backing. But it’s also very unlikely to happen. We’ve already degenerated too far with unfunded promises, creating a culture of entitlement, narcissism and parasitism. Sic transit gloria americana.

In 2010 my wife and I moved to West Sacramento, California from Lane, Oklahoma. Bought a house for $305,000 (sold new in 2005 for $530,000). Borrowed $270,000. We paid it off in two years seven months, saved $150,000 in interest that we would have paid over the life of the loan. But, but, the interest is tax deductible, say the idiots. Do the math, idiots. Sold the house in 2020 for $620,00, moved back to Oklahoma (Midwest City), purchased a new, high-end home in a gated subdivision for $300,000, $300,000 in the bank. Alas, my wife won’t let me buy a helicopter with the profit. Or a flamethrower.

Hi Antoine, just have the retailer list the flamethrower as a de-weeding device on the invoice and she should be none the wiser.

You won’t get much helo for 300k. But the flamethrower these days can be had for $300. That’s not even high on the toy budget, though I confess I haven’t taken that plunge yet.

“Alas, my wife won’t let me buy a helicopter with the profit.” Even if she did your HOA might not like you parking it in your driveway.

CA wouldn’t let you buy “Spaceballs, the Flame-thrower”, but OK respects your inner pyromaniac.

We humans are an odd bunch. Unlike other mammals, we’re able to anticipate the future and plan for it. But it takes discipline. Otherwise we’re no more than whitetail deer, just randomly acting on impulse and getting hit by cars.

“I never saw it coming!”

Well, that’s because you’re an idiot. Everyone else saw it, and you probably see it now in hindsight. If you had spent 5 minutes thinking about just why someone would hand you the keys to an $80,000 pickup with no more than a signature and a smile, that’s on you. There’s a price to be paid and it will be much worse than cash up front.

I’ve had car loans over the years. Every one of them was paid off early because I got tired of cutting that check every month. It caused me great pain. Same thing with my mortgage, I wanted rid of that thing as soon as signed the paperwork. Insurance and taxes I’m stuck with though. The price of “freedom,” I guess…

Most of us are familiar with the concept of a “black swan” event. This is something that can’t be anticipated and comes out of nowhere. It’s usually applied to macroeconomic discussions, but I imagine some people’s lives are one black swan event after another. Then they start to compound. First they get too far over their skis on credit card bills. Then the water heater starts leaking. Then the car busts a timing chain. Then the refrigerator quits. Pretty soon all that credit adds up, and they start getting insurance for stupid stuff like home maintenance. If they’d just think for 10 minutes about how old the water heater is, or what the maintenance schedule is for their over-engineered engine, they could plan for replacement and do a little shopping around. I’d rather replace a perfectly fine water heater on my schedule than roll the dice on one that’s past its prime and could go at any moment.

Lately, the plumbers want you to buy the Japanese tankless “on demand” water heaters so they’re spec-ing traditional tank units which last no more than 3-4 years at about a third of the price of the tankless which *can* last more than 10 but, of course, no guarantees.

And the installation cost just keeps going up, especially for gas units.

Hi Roscoe. The hot water tank that was in my house when I bought it only lasted 42 years before a stuck thermostat took it out . The next one only lasted around 24 years before it sprung a leak as well. I’m on a well with very hard water for what it’s worth. All the tanks were electric.

Three to four years is crazy Roscoe. Your water may be science project worthy. Installed thousands of water heaters over all my years in plumbing. Average lifespan was fifteen to twenty years. Its almost always the raw water supply will make it fail. Usually over eighty grains of hardness will do that. In which case you should have at least a basic water softener/filter on your inlet supply. That level of hard water is enough to cause all kinds of skin problems as well as ruining your faucets.

Tankless are BS imo. Although they are superior for RV and off grid installation, for a standard home, not so much. The only thing you really save in the end is some space.

I got the hard sell on tankless, but I held out for the traditional water heater. We’ll see how long it really lasts.

The previous traditional unit lasted less than 12 years.

Texas municipal water is increasingly hard as surface water sources have been inadequate for close to a decade and the systems quietly tap the deep aquifer to accommodate population growth. No word on the long term plan as the aquifer recharges much more slowly than the current rates of witdrawal.

That was a wise choice. I took a tankless unit apart once before tossing it in the dumpster. The copper coil the water flowed though seemed small, even though there was no nineties reducing pressure, IIRC the lines were half inch diameter or less.

The aquifer seems to vary greatly even over short distances. Our well is about 25 grains hard, but cold from one hundred foot down, clean, no turbidity, or foul smell. A couple miles away they have a pocket thats down three hundred feet,6o-7o grains hard, comes out slow, sandy, and warm, with a nasty rotten egg oder. Our city place, has typical, over fluoridated, over chlorinated supply, which may be a reason why so many people shuffle around staring down at their shoes.

Bought this place i n May 1990. The water heater is out on the service porch, wrapped up in a thick blanket o glas wool, I found a date when that was itted.. 1967. hinking I should be prepared to replace that antique heater, I came across a new takeou rom a riend who was doing some upgrades on a home that was just purchased… ormer owners had put in new,then sold it. New owner wanted a bigger one. So I ended up with the “new’ usd one or the whopping price tossing the thing into my van.

I am now selling this and buying another… and will probably leave the “new” unit in the basement. I has been sitting there waiting to receive its marching orders, but in vain these past 25 years or so.

I’d lay about any stakes at loing odds that a brand new one from the Home CHeapo will not last more than five years……

I put one of those tankless in, only to gain some room in a very very small utility room.

I thought the same thing, about 5yrs, but it has gone 16 so far.

On-demand water heaters are designed for the designer bathrooms with the wife’s “long hot bath” tubs and multi-head showers. Not much use for them otherwise.

A modern tank water heater is really an efficient device, if it’s properly sized for your use. And if you follow a basic routine you can do things like run timers to save a few more bucks. When I lived in apartments the first thing I did was install a water heater timer and fiberglass blanket because I knew I wouldn’t be home all day so why keep the heat topped off? About dinner time I’d have it come on until 8:00, then kick on again about 4:00 AM. Never ran out of hot water but probably saved thousands over the years.

Demand water heaters need a lot of energy to heat up water as it passes through the core. Usually requires a large diameter gas line or 50A electric circuit.

Something to be said for thermal mass.

Hi Ready. In many ways it’s better to learn how to do it yourself rather than hiring someone to repair it for you. I know a mechanic who welded 3 patches on his oil fired hot water tank before he finally bought a new one. Heck I welded a patch on the hot water tank in my buddies RV and that repair outlasted the RV it was installed in.

In many cases the labor costs far exceeds the cost of the parts. What you save on the labor pays for the tools and the after job beer. Looked at YouTube and a guy commented they wanted $400 to replace his muffler and he ordered a direct fit replacement off Amazon for $50 plus the cost of a clamp. After a few small repairs you can save a lot of money.

In my case the former homeowner fancied himself a DYI guy. His plumbing skills were certainly interesting. So for both the new water heater and later the boiler I went with the pros even though it cost me about double. They undid all the bodge jobs and really cleaned it up nice. And they put a bunch of shutoff valves in (pretty much because of code, but still) so next time it will be a do it myself job.

Good stuff RK,

I replace the battery in my cars every 5-6 years to avoid being stuck somewhere on a freezing cold night. I have a similar schedule for the water heater as you mentioned but last year it got me by starting to leak a month before I had planned to replace it, damn thing must’ve been clairvoyant.

My car battery is 7 years old and starting to go.

Maybe off topic but, I don’t know where it fits.

Eric, you mention the extortion of the Insurance Mafia and allude to it here. These parasitic organizations seem to be second only to Big Pharma in their teevee ad presence. I grant you all are annoying and would insult the intelligence of the average five year old. But, one campaign strikes me as particularly pernicious.

I’m referring to the ads by Progressive touting “we can’t prevent you from becoming your parents”. The horrific actions they deride include such things as light-hearted banter with strangers that shows human bonding in a simple way. Also, small acts of kindness and courtesy such as returning a shopping cart when you are done with it. Acting in a servant-like role toward guests in your home. And much, much more.

This just might be the most disgusting thing on the boob tube. I guess we can start with “Honor thy father and mother”. Gee, why would you want to do that? Most men respect and love their father and seek to develop traits to follow in his footsteps. I know our daughter loves her mother and wants to be like her. Why in Heaven’s name would a company try to denigrate such feelings and actions of children toward their parents? What is the bottom line they are pitching?

The family unit is the basis for Western Civilization. Is that what they seek to destroy? Perhaps “the love of money is the root of all evil” is spot on. These jokers will destroy an entire civilization to sell another policy.

For all those who have lost a parent in the last year, I say screw them.

Here is a montage of disgust: https://www.youtube.com/watch?v=HF4Qmah1CGk

Ironically, until the devices started catching fire, Capo Flo was in the forefront of requiring nanny tech monitoring of your behavior behind the wheel, parenting you regarding your driving habits at every renewal.

Flo doesn’t want you to become your parents. She wants to be your parent.

Lately Flo and that lizard are showing commercials that show white males as complete idiots and women and colored people as all knowing and brilliant.

Please Flo walk anywhere near my car and you’ll be taking a short flight to hell.

I’d gladly pay for the damage to my vehicle.

The sage of Omaha should have been strangled in the crib.

The only way White people will be shown in coonmercials is if they’re idiots married to some non-White. Thanks, jooz!

Hi Mark. Whether they know it or not they are just doing what communists have always done. Destroy the family to enhance the power of the state.

Exactly Landru,

That’s what’s behind all the tranny LGBTQABCDEFG “gender” nonsense, the PTB are trying to take control of the children, splitting them from their parents so they can fill their heads with garbage along the lines of having a 5 year old decide what gender he/she/they want to be. The 5 year old in ‘Kindergarten Cop’ got it right, “boys have a penis, girls have a vagina”.

Stop watching it. It’s called programming for a reason. Here is another trick for fun turn off all lights in a room leave the Jewvision box on and watch the light show.

My last truck and first house were the same sticker price 1994 and 2020, I haggled both prices .

Merry Christmas Eric and your significant other, thanks for all the great articles over the year. Have some Jameson whiskey.

Ps: Eric do not engage with idiots

Thank you. Your piece has once more confirmed that the decision I made in 1972 to kill my TeeVee set is, all these years later, a good one.

My son was at fault in what I thought was a relatively minor collison where he rear ended a 2022 Camry in heavy traffic on the freeway. When I recently inquired about the payout which resulted in a $1000/year rate increase to our insurance, I was told that the Camry had been totaled by Capo Gecko and a $23,000 check issued to the driver to pay off his finance company.

Channeling my dad –there’s no such thing as good debt. There’s only debt.

Best advice I’ve ever received. And have passed it down to my sons & grandkids.

Agree. My consistent advice to the youngins is to save & pay cash. Don’t buy crap you don’t need. Don’t borrow money.

Banks will gladly keep you in hock for the rest of your life. When you owe, you are easily controlled.

I could easily decline the jab because I don’t owe anybody anything and can find another job if I had to.

Hi Dan. I agree, the debtor is a slave to the lender, sadly most people fail to grasp what this entails. Hopefully more people will realize this before it’s too late.