Did you know there is a crypto currency called . . . Fartcoin? And that it is “worth” $1.5 billion? Yes, really. You can read a detailed article about it by David Stockman – Reagan’s director of the Office of Management and Budget (OMB) – here.

In German, there is something kind of similar. It is called the Geldscheisser. If you understand German, you will know what that means. Money that just kind of appears and – somehow – has value.

But at least the Geldscheisser’s coins are real. They drop out of you know where and into your hand. Fartcoins are vaporware – so to speak. Aren’t Bitcoins and other iterations of “crypto” currency the same?

They are created out of nothing – presto! – and via acceptance of their “value” they come to have it. But how can there be value behind nothing? Put another way: Isn’t the value entirely perceptual? Dependent upon lots of people agreeing there is – somehow – value – in medium of exchange that has no value except insofar as people agree that it does?

Weird, isn’t it?

In principle, people might agree that a Caligula has value – and I suppose then it would. Do you know the story? It goes roughly as follows: The Emperor Caligula decreed that his Caligulas were valuable. And so they were. Instead of flushing them as we do, they were treated as if they were precious. Of course, the people didn’t have much choice. It was not healthy to gainsay the value of a Caligula when Caligula was emperor.

Federal Reserve Notes – the pieces of paper we’re forced to accept as currency – are also Caligulas when you think about it in that their value is also dependent on people accepting that they’re valuable, even though they’re just piece of paper and the only real value they have is to wipe the aftermath of a Caligula.

How much value has a $1 million Reichsmark note from Weimar Germany? How about a Confederate dollar?

How about a Federal Reserve Note . . . in 50 years from now? Or perhaps a few months from now?

It is very unsettling to realize that the currency we use is – essentially – worthless. That whatever shaky value it possesses is entirely ephemeral because it is entirely dependent upon shifting perceptions of value and none of that is under our control.

Everything we have saved up in the bank (or under the mattress) and every penny of “value” we think we have in 401ks and so on could be of little-to-no-value just like that.

Federal Reserve Notes do have one thing in their favor, though. The “full faith and credit” of the federal government. That’s kind of funny, of course. But it is something. So long as people continue to have faith in the credit of the federal government.

What is the faith backing up Fartcoin? Or any other iteration of “crypto”? It seems far more ephemeral and is absolutely much more volatile.

I “hold” a small amount of Bitcoin. In italics because it’s strange to speak of holding anything you cannot get a hold of – with your hands. Its value fluctuates wildly, daily. One day – yesterday, for instance – my “assets” (this is the term used) are worth (ahem) $521. The very next day, they are worth $470. Say what you will about Federal Reserve Notes but while they lose value steadily, they generally do not lose that much value suddenly. It is the difference between a tire that’s leaking air and a blowout.

It is this sudden – and largely unpredictable – volatility that enables some people to make a fortune via Fartcoin and other iterations of crypto currency. It is, in other words, a form of gambling. You buy some “coin” chiefly in the hope that its value will spike and that you will be able to sell (and reap the difference) before its value plummets. Then you buy it again – when its value has plummeted – in the hope that you’ll be able to cash in again, when its value spikes again.

Other forms of currency can be gambled with in the same way, it’s true. But their physicality – their reality – does seem to serve as a check on the spikes (and the dips). If I have $500 in my checking account at the bank today, I can confidently write a check to pay a bill in that amount. But with crypto, that check might just bounce.

Of course, it could bounce up, too- and that appears to be the attraction or at least one of them.

Not to me, though. And maybe you feel the same. I’d rather just have sound money in my pocket. Maybe one day we will, again.

. . .

If you like what you’ve found here please consider supporting EPautos.

We depend on you to keep the wheels turning!

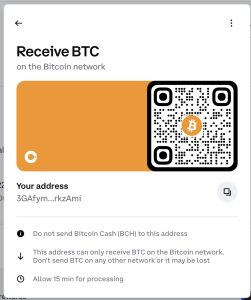

Our donate button is here. We also accept crypto (see below).

If you prefer not to use PayPal, our mailing address is:

EPautos

721 Hummingbird Lane SE

Copper Hill, VA 24079

PS: Get an EPautos magnet or sticker or coaster in return for a $20 or more one-time donation or a $10 or more monthly recurring donation. (Please be sure to tell us you want a magnet or sticker or coaster – and also, provide an address, so we know where to mail the thing!)

If you like items like the Baaaaaa! baseball cap pictured below, you can find that and more at the EPautos store!

The bitcoin code is: 3GAfymoqSUbaFvY8ztpSoDKJWCPLrkzAmi if you’re unable to scan the QR code above!

Fartcoin you say!? Bollocks! CumRocket (aka cummies) is where it’s at! Or maybe perhaps CumRocket is to…hmmm, conservative for your tastes? Well, then, how about some ElonSperm instead! Diamond Hands! To the moon! HODL!

Self-custody Bitcoin is the only way out of the political terrorist’s fiat slavery. Study up and think it through. Bitcoin is indestructible and capped at 21M coins. It is digital capital. Fartcoin has an issuer and therefore worthless except for speculation.

Makes it painfully obvious that coin isn’t a storehouse of wealth, only about “pumping and dumping”. That’s a good thing, at least it’s not disingenuous. Like buying stock in Kamala Harris’ odds of winning.

Sounds like another case of *them* rubbing it in our faces and giving us a big F.U. and saying “What are you going to do about it?”. And what most do about it is to just lap it up.

I hate to say it, but I’m almost starting to think that maybe *them* reducing the population might not be a bad thing.

Do you want “sound money” in your hands?

The (((money masters))) said it best…

“Gold is money. Everything else is credit…” JP Morgan

Precious metals, Gold, Silver, even platinum and palladium are redeemable worldwide today, and have been for thousands of years.

And once in your hands, not taxable by (((FEDGOV))) for property or capital gains tax….

Crypto anything is the ultimate Ponzi scheme!!

YMMV…

For those like me who are fascinated by crypto – here are an article and a podcast worth your time:

https://cryptadamus.substack.com/p/cryptocurrency-is-a-hideous-monstrosity

https://parallelsystems.substack.com/p/the-real-reason-the-us-wants-you

From 1st link:

“In a way I was correct – bitcoin’s actual undeniable utility is pretty much limited to crime.”

Stopped reading at that point.

This crap is simply laughable when the same old disproven talking points are regurgitated.

Ask Ross Ulbricht how “private” or how effective it was for financing that which the Government considers to be a crime.

Good thoughts about money. Most people don’t really understand money or the money system. For crypto to truly become a new currency — I think it has to be a stablecoin so that it’s ‘stock market price’ doesn’t fluctuate, so people can actually hold it and transition to it from the current dollar/etc system. Also stablecoins are better than other cryptos because they solve the supply problem — all cryptos have a limited supply so there is not enough of it for everyone to convert their dollars to — this is a big problem the crypto people have not addressed yet, but stablecoins have an ulimited supply to allow people to convert their other currencies to. A stablecoin (controlled by the people voting on any code changes) is the perfect currency. Bitcoin is not, nor is any other crypto.

Or we could all just stop using money and switch to a voluntaryism system, which would be so much more efficient than a money system, that we would all be millionaires and only have to work one day a month and retire in ~10 years. That is really the ultimate system — that is the future. I think we should all try to implement it now. Forget money — even if we got rid of the corruption with a stablecoin, it’s still too inefficient and unfair.

“..all cryptos have a limited supply so there is not enough of it for everyone to convert their dollars to..”

That’s a falacy, actually. Bitcoin, for example, is divisible to 1 hundred millionth of its units (0.00000001). This smallest unit is known as a satoshi.

There is no reason why in the future why full Bitcoins should be used for most transactions. Any amount of gold, after all, could serve as a unit of payment, too.

There are many interesting conversations just on this topic to be found on the internet.

It doesn’t matter what the smallest unit is. Money sometimes needs to be created to pay for projects or emergencies… for example a bridge needs to be fixed but if the local people can’t afford to pay taxes to fix it, then the treasury creates new money for it. Can’t do that with cryptos — unless they update the code, which they could do — they could fix this problem.

Story told was a car owner had mechanical problems, visited a mechanic, the car owner offered Bitcoin, the mechanic took it right now. The repair cost 3300 dollars, near there.

There is a Bitcoin ATM at a local gas station. Probably get a voucher, maybe American currency, don’t know for sure.

Somehow, people use the service for Bitcoin to receive some money.

The number of car buyer in Los Angeles will be off the charts.

Add an ‘s’ to the word ‘buyer’.

Sticky ‘s’ key, all it is.

I had some landscaping done in my garden in July 2023.

The landscaper, being a switched on sort of a young guy, asked me whether I would consider paying for half of the job, which came up t about $30K, in BTC.

He has since more than tripled his purchasing power on that payment.

He also proved that doing business with like-minded people, using non-government, private forms of payment, can work better than cash to keep the IRS’s grubby hands off at least some of his earnings.

By setting up parallel systems like these, good, proven crypto-currencies can help us preserve at least some freedoms that once upon a time used to be taken for granted.

“ . . keep the IRS’s grubby hands off at least some of his earnings.”

That is hilarious

Bitcoin is easily traceable and the IRS taxes that growth in a manner similar to capital gains

Dont belive this? Ask Ross Ulbricht or any of the other people convicted of not filing taxes on Bitcoin gains

FWIW,

Ross Ulbricht was not jailed on tax related issues, you may be thinking of Kim Dotcom. Ross was jailed for setting up a website…..truly a dystopian nightmare.

In an era when we have Nicola ‘hydrogen trucks’, rolling downhill without a motor and turning Trevor Milton into a multiple billionaire, is there any wonder there are ‘Fartcoins’ – or NFTs – in the crypto space, supposedly also worth billions?

Does the existence of Nicola Motors invalidate the general utility of a motor vehicle?

These days, fraud and scams are rife and pay very, very well. Starting from Joe & Hunter’s “10% for the Big Guy” and ending with Elon’s various efforts (Hyperloop, space tourism to Mars, Dogecoin, anyone?), there is little reason to fear any repercussions.

So someone has coded a silly meme coin? At least those who buy into it are not forced to do that via their taxes, or via increased prices for necessities – like those thanks to the government’s ‘price on carbon’.

I have seen the money used on Yap. I do not know if the naval officer who had it “liberated it” or actually bought it. He had several of various sizes and designs. It at least has substance, but would not be as convenient to use to get rid of residue from Caligulas as U.S. Currency.

As far as any digital money, have you ever had a hard drive crash? Then again, have you participated in the NYSE crash in the last few days? At one time you used to get a pretty piece of paper with your name and a number of shares belonging to you printed on it. Now all shares are held electronically in “street accounts”. Is Bitcoin any crazier than that? Or is it the “Full faith and credit of Goldman Sachs” that gives it value?

Recent story of a chap in Merry Olde who is suing his local government to let him dig for a hard drive that his “partner” discarded about 10 years ago. It has his bitcoin wallet on it. He claims it was worth “a million” then, $750,000,000 now. Seems to me he is delusional on several levels, the most obvious at this point are: that he can fiind a hard drive which has been burried in a landfill for 10 years; recover data from said drive.

One question I have had, and it has recently received some public attention, is whether the Bankruptor in Chief, come January 20, will declare the U.S. bankrupt. The argument is that most of the debt is held by foreigners or foreign governments. I don’t suppose China would be really, really annoyed, do you? “Tough Cookies” if you happen to hold T-Bills or T-Bonds, of course. Sounds good to me for the most part, but the effects on the total economy would likely be “heavy collateral damage”.

Take a look here if you might have an interest in sound money: https://mises.org/form/webform-64723 I presume the free copies are still available.

“As far as any digital money, have you ever had a hard drive crash?”

If you actually knew anything about this particular subject, you would know that decentralized crypto-currencies don’t reside on any hard drives.

The person looking for his old computer at the dump only needed to keep the cryptographic key – a list of 12 or 24 words – in a safe place. He would then have been able to recover all his funds even via just a cell phone.

In the early days, when Bitcoin was no more than an idea of interest to a few cryptography enthusiasts, quite a few people lost their stash – simply because they did not anticipate how valuable it would get one day, and consequently did not back up their keys.

As things stand now, as long as there is electricity and some form of internet, your Bitcoin will continue to be accessible. And if there is no electricity and no computers at all, we will have much more of a problem than how to recover our digital wallets.

About 5 years ago, my father died. I liquidated his estate, and bought Gold and Silver with it. I remain completely comfortable with that decision. while Silver remains nearly flat since then, Gold has taken off like a rocket, up more than 7k per oz.

I am a bit old school, and think that gold and silver are good commodities to have, as well, when the dollar collapses. Even if silver is flat right now, I cannot help but think it will sustain more value than a paper dollar, no matter what the number printed on it. I think of when hyperinflation hit (Weimer Germany, 1929), and you see the pictures of people with wheel barrows full of money just to buy a loaf of bread. While food prices doubled every 23 hours. I think we are going to see that here in the U.S. Orange Man will not save us from any of it. And when even gold and silver are worthless, well, I surmise that will level the playing field for all of us.

I think bitcoin operates on the bigger fool theory of all bubbles, as in yes I may be foolish for paying X amount of dollars for vaporware but I can find a bigger fool to sell it to for 2X dollars.

Fundamentally the same in the stock markets where P/E ratios are at absurd levels.

There are no fundamentals supporting Tesla valuation.

All value is subjective

Stick to your guns, Eric, despite what many commenters are spewing.

Another very important fact to know about so-called crypto “currencies” is the whales.

In crypto lingo, a “whale” is a person (or company or government) owning a very large percent of a particular crypto “currency.”

Whales control the “value.” Whales know when the price, the “value,” will go up or down by THEIR OWN buying or selling.

Now, who has the money to become whales? Our Rulers do. None of us do.

———————–

As an aside, I can’t help add one more bit of knowledge to counter some nonsense in the comment section. Somebody here names “Satoshi Nakamoto” (supposed inventor of bitcoin/blockchain) as if that’s a real and accountable person.

NOBODY has stepped forward to admit being “Satoshi Nakamoto.” So, who invented and glorified a supposed digital “currency” that is claimed to be “private” but isn’t, is claimed to be “safe” but isn’t (power outage, anyone), and the “value” of which is controlled by whales (our Rulers)?

– for anybody not afraid to learn, click on my name to visit my website. i am NOT an anonymouse.

“As an aside, I can’t help add one more bit of knowledge to counter some nonsense in the comment section. Somebody here names “Satoshi Nakamoto” (supposed inventor of bitcoin/blockchain) as if that’s a real and accountable person.”

Thank you.

Well, you SEE, I…EH…..think I know who Satoshi Nakamoto is……

The inventor of bitcoin is the (((CIA))), Canaanites In America.

The name “Satoshi Nakamoto” is who the companies are that the CIA worked with to create the cryptocurrency bitcoin.

“Sa” for Samsung…”toshi” for Toshiba…”Naka” for Nakamichi…and “moto” for Motorola.

It’s just one more way (((they))) like to rub our Goyim faces in the poop (((they’re))) trying to sell us to scam us out of our assets.

YMMM….

That’s what I’m saying. It’s a Jew scam. it’s always been a Jew scam.

Why of why is there a crypto coin mania (like Tulip mania)?

a real estate bubble?

a stock market bubble?

a classic car bubble?

art and collectible and non-fungible token bubble?

rent and food price inflation?

why did interest rates go to zero?

There is one main reason why and here is the chart, the Fed pumped the money supply from 4 Trillion to 20 TRILLION overnight:

https://fred.stlouisfed.org/series/M1SL

Starting in 2009, the rate of increase of the basic money supply curve doubled, from 2T to 4T (see chart), then they panicked and it went vertical to 20T

Wild speculation is caused by extremely loose money, which feeds on itself, millionaires are made overnight, a giddy feeling and lack of self restraint takes over the public’s imaginations of get rich quick, only fools works, etc. BTW Tesla was positioned to sell it’s overpriced devices at the peak of the mania, which is now fading fast.

Make no mistake the dream is about to become the nightmare when the world’s biggest bubble comes undone. Elliott Wave researcher and author Robert Prechter has proved in chart after chart that all manias end up LOWER than when they started. For instance, the DJIA went up in the Roaring Twenties to 1929, then crashed lower than the starting point in 1922 in 1932. Same for the South Sea Bubble, where Isaac Newton lost everything. (Newton was the smartest man on the planet at that time, invented Calculus, etc)

My favorite part of this mania are the Wojak cartoons of the McWage slaves losing everything in cryptos.

Isaac Newton LOST EVERYTHING in the South Sea Bubble. This is a big topic is the study Socionomics about the psychology of manias, which suck in everyone at an emotional level – causing their financial ruin – and something you should consider when we are living in the era of the biggest stock market bubble of all time.

Newton was one of the smartest people ever, lost everything, because his rational mind was superseded by his emotions and greed to get rich quick. Make no mistake, out of a population of billions of people, some people do win the lottery, but that is no reason to buy LOOTery tickets, a way for the state to fleece the public. If the chances of winning the lottery are 0.00000000001%, rounded off that number is zero, which means when you buy a lottery ticket your chances of winning are zero. Likewise, speculation in cyptos are equally grim.

HOW BIG IS THE CURRENT BUBBLE YOU ASK?

https://i.imgur.com/WuB7dbH.png

When does the this bubble burst? Now. Right now. The Dow has topped. it has just started it’s epic Biblical level decline. It will be the biggest crash in the history of the world, yet some of my best friends are fully invested in SPX triple leverage. I make an impassioned plea for them to GTFO of the market but they think I am crazy. LOLROFL Oh boy, this is going to be good watching 2025 unwind.

FART COIN is a temporal marker, the very tippy top of the chart will be labeled with FART COIN annotation. Get it? We are peak mania, in normal times no rational person would every trade their hard earned money for a god damned fart coin.

Here is the current macrotrends chart, which was the background chart above:

https://i.imgur.com/ZHgxy9P.png

See in you can locate the 1929, 1987 crashes. The crash that is coming will dwarf both of those, and probably wipe out most cryptos also.

“Newton was one of the smartest people ever, lost everything, because his rational mind was superseded by his emotions and greed to get rich quick.”

Uhm . . . No.

Did he lose about 1/3 of his net worth? Yes.

Did he lose everything? No. He died a wealthy man.

Two books worth reading IMO are Von Mises’ Theory of Money and Credit and When Money Dies: The Nightmare of Deficit Spending, Devaluation, and Hyperinflation in Weimar Germany by Adam Fergusson.

Money essentially is a commodity that the market decides on as a medium of exchange. As such, crypto currencies have market support as a means of exchange. I’m not sure why this is such a contentious issue. Yes CBDCs present a potential evil but that’s not what crypto currencies are. One thing about crypto is that participation is voluntary. Eric, as you know, I am a big fan of precious metals but they have no inherent value other than being used historically across the world in all cultures as money. Bitcoin has real flaws, IMO, but other crypto currencies address those issues. And, of course, blockchain technology depends on an operational internet. But let’s face facts, if the internet fails or is limited by government action, we will have much more severe existential issues to face.

Crypto currencies and blockchain technology are not some sort of Jewish plot, that kind of rhetoric leads to rise of tyrants…..not that the current state of Israel does not present a Nazi like conundrum.

I think you all realize that if you consider crypto currencies to be vapor, how can you not consider the FRNs that you use for money to be vapor as well? The effects of Modern Monetary Theory are rearing their ugly heads throughout western cultures…..

I used to post on an MMT-friendly website. To defend money-printing socialist regimes such as Maduro’s Venezuela and the Kirchners’ Argentina, the leftist proprietor regularly argued that inflation really isn’t all that bad.

Pointing out that millions voted with their feet to flee the inflationary hell of Maduro’s socialist Workers Paradise cut no ice. It was US sanctions impoverishing Venezuela, the proprietor claimed, not Maduro’s reckless printing of Bolivars, which stopped for awhile when a European supplier wouldn’t sell the central bank any more special rag paper.

MMT’s leftist elitists want the unchecked sole authority to print fiat currency to fund their pharaonic socialist programs. That society gets destabilized with crime and riots, and the poor suffer the most, is of zero consequence to MMT’s misanthropic, authoritarian ideologues.

Same story in the U.S.S.A……the cognitive dissonance required to support the ecological disaster of unlimited war around the world which burns real resources while supporting the real wealth transfer from middle class and poor citizens is staggering. I’ve come to the conclusion that people I once considered intelligent have entered into the realm of stupid, programmed sheep.

“I’ve come to the conclusion that people I once considered intelligent have entered into the realm of stupid, programmed sheep.”

Welcome!

Bingo, Big G…

I Cannot believe how many “credentialed”

people possess …..0 Critical Thinking skills!!

Yikes!…..

Jim H wrote: It was US sanctions impoverishing Venezuela, the proprietor claimed, not Maduro’s reckless printing of Bolivars…

Yet another reason why the solution to “rouge states’ misbehavior” isn’t sanctions, but commerce and information exchange. We stop allowing US firms to do business in Venezuela because of their socialist dictator. OK fine, now that’s the excuse for the left to use to explain away the shithole conditions.

All crypto is a big Jew scam.

Who programmed the blockchains?

Who holds the source codes?

Why is this information SECRET?

Maybe because it’s MOSSAD that wrote the code.

The source code for Bitcoin is freely available….

That is true, actually, but there are some real problems with financial platforms created by people operating under pseudonyms.

And then there’s perhaps the worst problem with digital currency (ALL digital currency) – the fact that they are ALL 100% dependent on layer after layer of supremely hackable infrastructure.

So let’s pretend for a second that “bitcoin” is 100% safe and secure and coded by Christian monks writing code in a monastery. What else comes into play? Cell phones. How many cell phones have compromised operating systems, malware apps they’re unaware of, backdoors into the software AND hardware.

Home computers. How many people have malware on their PC’s that they might also do bitcoin transactions on? Compromised operating systems? The ARC processor built into all Intel CPU’s and reporting all your activity back to “Israel”.

What about the routers the data travels over? How many of them are compromised or might be in the future?

What about the servers for the telecom companies?

The overall point about bitcoin, in fact ALL digital currency, is that it’s NOT SAFE NOR SECURE.

This is the whole point, that there is 1 path back to freedom. And it’s NOT crypto-currency. I can promise you this. This is the fastest path to ruin. The path to freedom comes from an elimination of the federal reserve bank (and likewise the IRS), and the return to METAL-BACKED MONEY. Only money that is based on a COMMODITY can RETAIN ITS VALUE. When money is based on a commodity, there is a natural incentive to maintain the value of the money because it maintains the value of your COMMODITY.

When money is based on DEBT (as our current FIAT dollars are), there is a natural incentive to DEVALUE the money so the suckers come running for more loans. More loans = more money for the lender. This is pretty basic.

I suggest running far and fast from crypto. It will be the death of us.

Nothing secret about Nakamoto’s paper. It’s posted here:

https://bitcoin.org/bitcoin.pdf

Hundreds of imitators indicate that Nakamoto’s peer-to-peer network, using a transparent blockchain rather than a trusted third party to combat fraud, is an important innovation.

The problem is Nakamoto isn’t his actual name. So who is he REALLY?

So I assume in your metal-back currency you’ll expect everyone to x-ray their coins and bars for tungsten cores and assay them for purity? Because inflation, counterfeiting and deception are unique to 21st century blockchain? Debasement and clipping of gold and silver coins were significant in the Roman fall. The problem is government money, not the mechanism.

Sorry, but you’re completely wrong here.

Saying counterfeiting exists is like declaring water to be wet.

Yeah. We know.

Declaring that it’s somehow a problem for gold and silver-backed money only and isn’t a problem for FIAT currency is…strangely disingenuous of you.

Inflation DOES NOT EXIST. Inflation is to money as viruses are to healthcare. It’s a PHANTOM placed before us used to control us. ONLY DEVALUATION EXISTS, and it EXISTS when money is CREATED AS DEBT, which the current system employs.

The problem is WHO CONTROL OUR MONEY AND WHAT IT IS BACKED WITH, PERIOD.

If the problem existed solely in “government”, then what Hitler did to enrage the Jews in the 1930’s when he came to power would have been IMPOSSIBLE.

Hitler did 2 things when he came to power. First, he OUTLAWED INTEREST AND TOOK CONTROL OF GERMANY’S MONEY SUPPLY.

This single act brought Germany out of the global great depression and turned them into a manufacturing and export powerhouse in LESS THAN 5 YEARS. THAT IS HOW POWFUL DEBT BASED MONEY IS, AND HOW POWERFUL IT IS TO ESCAPE IT. Debt-based money turns entire economies and nations into slaves. Outlawing interest frees civilizations and enables “Golden Ages” to occur.

The second thing Hitler did when he took power, btw, was to outlaw JEWISH PORN and HOMOSEXUALITY. All those “book burnings” of those mean, evil Nazis? They were burning Jew porn. Odd, we’re never told what book burnings were all about, eh?

Government CAN, if it does so correctly, issue money that is a TOOL of the people to be USED by the people. But it has to be BACKED BY COMMODITY if it is to RETAIN VALUE and avoid the natural incentive that exists when someone loans you money to LOAN YOU MORE.

You do realize that the “National Debt” EXISTS because of the issuance of our money as debt, right? That that is the ONLY place it comes from?

So are you done trying to claim utter falsehoods? Ones like “counterfeiting only exists with gold and silver money”?

Kind of curious who you work for.

I’m thinking we might have an agent here.

Calling out obvious logical fallacies would spur most real people to at least respond.

This one here is just kind of like, “I hope nobody reads this response and realizes my credibility is near 0.”

“Ally” might just be “Jewy”.

‘The problem is Nakamoto isn’t his actual name.’ — letmepicyou

Is that really a show-stopper? Most of the debate about the US constitution in the late 1700s was conducted by prominent Americans writing under pseudonyms.

https://en.wikipedia.org/wiki/List_of_pseudonyms_used_in_the_American_Constitutional_debates

These pseudonymous authors cobbled together a structure that lasted almost 250 years so far — though it might not survive to its 300th anniversary.

Got gold?

If you’re referring to “The Federalist Papers”, I have a copy here somewhere, I’ve read it.

I find it odd that you equate anonymity when putting forth a political idea as the same thing as anonymity when putting forth a global banking system.

Very odd. Very odd indeed. As though you’re HOPING THE PEOPLE READING THIS BELIEVE IT. What if they don’t?

What if I can look at political and philosophical ideas put forth anonymously and judge them on their merit alone, but when someone comes along and wants to put their hand into my wallet, I would like to know who they are.

The problem is the hand in my wallet, in case you can’t figure that out. Publius wasn’t putting his hand in my wallet. Nakamoto IS.

I find it odd that you equate anonymity when putting forth a political idea as the same thing as anonymity when putting forth a global banking system.

Just going to skate out on this one, huh?

Have you looked at some of the privacy oriented coins like Monero XMR? At Porcfest, a big contingent of the crypto advocates were Monero advocates. Interestingly, none of them was interested in trading Monero for FRNs…..nice people though and willing to discuss technical details with an old fart like me….

There is reason to believe Bitcoin was launched by the military-intelligence complex but who or why isn’t obvious and that they still control it is debatable. There’s fundamental flaws in the model and application, although these will allow future blockchains to benefit. If Bitcoin itself is suspect the concept seeded wholly new thinking. They (whoever it is) may have jumped the shark by releasing something into the wild before they completely understood it. It may have created a problem and solution that fusion centers won’t be able to solve no matter how many brute force or even quantum tricks they have at hand. Trust is the economic elephant. How to earn it, how to prove it, how to transfer it is going to drive everything.

LOL @ “Trust is the economic elephant.”

I seem to recall Edison electrocuting an elephant.

I predict the same thing happening to the bitcoin elephants.

With cryptos, there seems to bge a logical disconnect that many fail to see: If it is “untraceable”, then how can one ultimately prove they possess anything, since it is not tangible? And if there is a way to prove ownership, then that proof is stored by, controlled by, and accessible to others. Others who aren’t you or me, and who may be *them* or other nefarious characters who ultimately can do whatever they want, since they are the ones in possession of only record of the existence of the product, which ultimately one can not even prove exists, except as a concept in the minds of it’s participants.

Show me a stock certificate. You own something which may be of value, as long as it is desirable in the eyes of others.

Show me an FRN. You own a depreciating asset, but at least you own it, by reason of being in possession of it; and it’s current value is known to all.

Show me you Shitcoin. Hmmmm, all I see are words and numbers, and someone saying “Yeah, but this is all tied to a record on some computers, somewhere. Where? I dunno. And if I had said computers assembled in mass before me, I still couldn’t prove anything; and I don’t know who controls that info. But trust me, this is legit and safe and can’t be seen by nefarious prying eyes. So just trust me. Here is your errr payment”. Purple Monkey Dishwasher.

I remember when I first saw bottled water. My grandparents lived in Florida. The tap water smelled like sulfur and tasted terrible. The reason (I was told) was because the water table was below sea level and so I guess it was hard to get those impurities out. It was safe to drink, but who would? Anyway she had 1 gallon jugs of water in the fridge that she used for drinks and probably cooking. She wasn’t the only one, as the Publix had a section of shelf space that was nothing but bottled water. I thought it odd, having come from Pennsylvania where the tap water was excellent, mostly because of all the mountain springs that are basically just filtered rainfall.

Then in the late 1980s or maybe 1990s we started to see water in 16 oz plastic soda bottles. It was cheaper than soda, but extremely expensive compared to tap water. We all laughed “who would buy such a thing” when there were water fountains everywhere, often with small refrigeration units, serving delicious chilled water for free. Sure, there might be wad of chewing gum jammed into the spigot by some jerk, but if you were careful you could still get a drink without getting your face wet. Funny how we used to be more worried about that while ignoring the potential of germs from the gum. Over time, more people bought bottled water, or at least bottled water took up more shelf space. At the same time, water fountains fell into disrepair. Servicing costs and regulatory requirements for refrigeration units made them too expensive to maintain in most commercial public buildings. Some still remain, which are actually very elaborate and have features such as spigots for refilling bottles, but most of them are in government owned buildings where cost control isn’t a factor.

Aside: As more companies got into the bottled water racket, suddenly “hydration” became a major health issue. Crypto backers are doing the same thing, talking up every currency issue as an existential threat.

Crypto currencies are a lot like bottled water. They’re not great, cost more, and are a hassle, but they might prove better than the stuff handed out by the establishment. If they get enough traction, eventually people will allow government backed currency to fall into disrepair. This was happening in China. When Hong Kong fell a lot of people bought BTC to get their money out the country. It isn’t happening so much in Central America because the dollar is still better than the local stuff (just like Florida tap water). As the dollar becomes less desirable, either through negligence or malice, the last best option will probably be crypto currency.

What hasn’t taken off, and I don’t understand why, is the idea of a public ledger backing up hard assets. A gold exchange where the record of ownership is logged in a blockchain style ledger seems like it would make a whole bunch of sense. Of course you still have to trust that the gold really is sitting in a vault somewhere, so the blockchain doesn’t really resolve the fundamental trust issue with a third party.

“Funny how we used to be more worried about that while ignoring the potential of germs from the gum. ”

I think they had a vaccine for that…

Smart investors are using Bitcoin to buy tulip bulbs…

What gives anything value? I’m a goldbug but why does it have any value. There’s the classic definition for money being relatively scarce, fungible, durable, divisible, minimal intrinsic value. Gold meets all the criteria and has for many centuries of human development.

But don’t also crypto currencies do have many of the traits of money? Just because we cannot touch it doesn’t mean it does not exist. Many things we cannot see or touch but we’re fairly sure they exist. Atoms, gaseous elements, sound and radio waves. You can no more eat gold than you can Bitcoin, both have to be part of a transaction to get what you need.

It’s not the job of Bitcoin or U.S. dollars or gold to prove it’s worth. We value things because we do. Fiat currency only has value because it’s dictated to have that utility. The real value of dollars is what it can buy. Since dollars are forced usage by convenience to the government but their real world value is that they can buy Trans Ams and gasoline. It always comes down the actual things, raw materials, finished products, services.

Exactly.

All value is subjective – including that of precious metals. There is no ‘intrinsic value’ – this is literally Economics 101.

The arguments presented by many here are the same old ‘argumentum ad ignorantiam’ that have been doing the rounds ever since Bitcoin became more than just an interesting idea at a cryptographer hobbyists mailing list.

In the meantime, the asset has gone from being able to buy 1/10 thousands of a pizza per unit to buying a third of a decent house. Sure, it’s been volatile – but much less so as time goes on, and the long-term trend has always been in one direction.

Being ignorant is no crime. But it is sad to see so many supposed ‘libertarians’ being so close minded toward one of the very few things that still offers some freedom from government overreach.

Why would you lie like this?

How can something 100% dependent on the internet’s infrastructure “offer some freedom from government overreach”?

When the “government” controls the DNS servers…

When the “government” controls the internet backbone and the protocols in use…

When the “government” can block WHATEVER IT WANTS (ahem…KASPERSKY ANTI-VIRUS SOFTWARE, ANYONE????), WHERE IS THAT FREEDOM FROM GOVERNMENT OVERREACH?

Because what I’m hearing from you, is that you’re FOR government overreach, you just want it hidden from view. As in, gee, that’s funny, MY internet is working fine…MY internet isn’t having any problems passing transactions along. Maybe YOUR social credit score is too low?

So when crypto-currency is 100% dependent on the infrastructure 100% under government control, please, demonstrate for us all won’t you how it offers “freedom from government overreach”.

Notice once again how logical arguments go un-addressed.

How odd.

One must wonder what John Bayley’s demographic is.

His nose may be slightly long and bent.

Here’s the difference.

Bitcoin’s value is officially 0 when the power is turned off. Or the internet.

Gold doesn’t give 2 shits if power even EXISTS.

Very true, Let. There is that saying that if something is not in your physical hand (gold, silver, dollars, whatever), you do not own it.

‘What is the faith backing up Fartcoin? Or any other iteration of “crypto”?’ — eric

The faith is based on transparency: the crypto blockchain is shared with all users. As Satoshi Nakamoto pointed out in his landmark 2009 paper, more than half of all crypto users would have to conspire to ‘double spend’ Bitcoin — the analogue to the Federal Reserve’s ‘keystroke currency’ fraud, which is quite real.

As for value being perceptual, this charge is often leveled against gold as well. Ordinary valuation metrics just don’t apply to a ‘pet rock.’ But we do know that because gold mining is difficult, dangerous and costly, the worldwide aboveground supply of gold increases only 1 percent per year. No fraudster has the means to change this.

Thus, the perceptual value humans assign to gold — which has been remarkably stable in purchasing power for millennia — can be confidently expected to endure. Bitcoin’s history is too short to say, but eventually its purchasing power in terms of goods and services should stabilize and endure too.

Whereas the ‘full faith and credit of the US clowngov’ has destroyed nearly half (over half, properly calculated) of the dollar’s purchasing power just in this quarter century.

Having made exorbitant social promises that it cannot possibly redeem, and with its back to the wall just to roll over its crushing debt, the US clowngov is headed for an inflationary tragedy which will send US living standards plummeting. You’ll know when our imperial legions come home from Syria and Iraq and little Shitrahell — because their paychecks bounced — that it’s ovahhhhhh.

I don’t want to hear your cheap promises

I know the truth and you’re lying

It’s all over, all over

Over but the cryin’

— Georgia Satellites, All Over But the Cryin’

Bitcoin’s value isn’t really that hard to understand when we consider how much faith we put in our computers, the internet, that phones and electrical grids work. Bitcoin’s value derives from the faith we put in technology and people who develop it. It will have value as long as people believe in the systems around us. I’m not opposed to arguments that this faith has waned with each hacking attack, grid blackout, slumping iPhone sales and bricked Tesla. But I don’t see any hint that people are willing to full stop the mindless screen scrolling and putting their money in electronic accounts on far away cloud computers.

In 1913 there was penny candy (which now costs over an “dollar” and a dollar was about 1/20th of an ounce of gold (which now costs $2700). The FRN has actually lost over 99% of its value.

Henry ford made cars for Americans, and paid a high enough wage that his workers could buy a $250 new model T. Which scandalized the Rockefellers and such. Nothing has changed except all that wealth which the commoners were able to accumulate has now been reclaimed by the (self) important people.

Hi Ernie.

American car companies are shipping most of the jobs off to Mexico. I wonder how many Mexicans can afford to buy a new F150 or Tahoe? For that matter how many people here can afford to buy one at the prices they charge.

I’m guessing Henry is rolling in his grave at this point. It’s almost like de-industrialization was the goal.

No need to wonder, just go to https://ford.mx and build one for yourself.

Base price for a 2024 F-150 in Mexican pesos: $976,900

ChatGPT claims the average annual salary for a Mexican is $220,908 pesos.

Hi RK. I guess they can afford to buy one. Wage does seem high though at about $128,000 a year.

In US dollars.

The Mexican Peso uses the same $ symbol according to the Internet.

MX$220,908 = USD$10,667, at 20.71 MX pesos per USD.

So, even with lower living costs, only above-average income Mexicans can afford cars.

On $890 a month income in the US, one could barely afford food and utilities — much less rent and a car payment.

¡Ay, caramba!

“Put another way: Isn’t the value entirely perceptual? “

Yes, of course. Isn’t this the essence of what Ludwig Von Mises said?

For many, the “value” of an ice cream cone is higher in July vs. December? I.e. time preference of money.

Same for gold, same for Federal Reserve notes, bitcoin, or for Caligula’s. It’s all only worth what someone thinks it’s worth and is willing to exchange goods or services for it at a particular point in time.

Maybe we’ll get sound money again someday but I don’t think it will happen as long as the empire exists. Too many are 100% dependent on the status quo to allow a move away from Federal Reserve Notes.

Opening people’s thinking to what is money to me is the real value of Bitcoin. They’ve done such a good job of talking down gold for decades that people have forgotten that it’s not the thing per se but lack of competition leading to mismanagement and greed that ruins money and currency. The reason the dollar value can be driven to zero is legal tender laws that protect it, not that a paper money is absolutely good or bad.

At one time that faith of the U.S. people really did convey value. Probably up to Vietnam we could lay a claim to such a pedestal. Sure, behind the scenes the evil existed, but America as an example and the people who made her earned that trust. And it was We The People who threw away that faith allowing the evil and destruction without a whimper. We can externalize and blame bankers and politicians but it’s just as much the fault of wanting our Social Security and Medicare. Our government handouts and contracts.

[ it’s just as much the fault of wanting our Social Security and Medicare. Our government handouts and contracts.]

I wonder??? ……. If SS and Medicare are handouts after they have stolen 15%-20% of your lifetime earnings by the promise of a few survival dollars per month when your disabled by age wouldn’t your ‘tax refunds’ qualify as handouts? And the difference is?

Making it even worse…… The following is due to my anger for the situation in LA and around the planet caused by incompetence.

We watch ‘elected’ government officials ignore their duties as they have in LA and Maui then ‘we’ allow them to finish their term isn’t this a handout to the parasites which have paid nothing in the form of real income?

Is it a handout when government tells the california officials expenses are backed fully by the federal government printing press when on the other side of the nation they get a $700 loan,,, Have a nice day? Have we multiple tiers of citizens?

When the federal government hands out your stolen monies to friends like Genocide Bibi or Nazi Zelenski isn’t that a handout to folks that haven’t paid a plug nickel and are tyrants in their own nations constantly buying up million dollar mansions while our cities literally burn?

I am real careful when I use the term ‘handout’ especially when some recipients have been made to pay dearly for it their entire lives while tyrants and border hoppers merely demand it…… and get it!

rant over

Absolutely Ken,

FICA taxes for SS and Medicare were taken from my paycheck for my entire working life. When I hear people refer to them as “entitlements” I point out that yes, they are entitlements and I am entitled to them because money was stolen from me for many decades to (supposedly) fund that. And don’t anyone bother pointing out that FICA taxes just go into the general fund of Uncle’s maw, there is no separate trust fund, yada yada yada. I get all that, the point is money was taken from me personally but given out to parasites like Israhell and Keeeeev, not to mention migrants and assorted welfare leeches who are nothing but freeloaders.

Zelenski is a Bolshevik Jew. NOT a “Nazi”.

You WISH he was a Nazi.

That article got me to thinking how Martin Armstrong says the value of the Dollar is determined by the confidence people have in the government.

I know a few people irl who have lotsa confidence in the government,… & in the priest class in white robes & stethoscopes, etc. They all seem to share certain qualities I simply do not understand.

Went to USAWatchdog.com to see if Martin Armstrong had any other insights into the value of the Dollar & other things.

The titles of the recent interviews, whew:

‘Vast Devaluation of Dollar Coming in 2025 – Craig Hemke’

‘Embalmers Keep Finding Fibrous CV19 Vax Clots – Tom Haviland’

‘CV19 Bioweapon Shots are Democide on a Global Scale – Dr. Betsy Eads’

‘Trump Admin: Fight Between Freedom & Deep State Control – Catherine Austin Fitts’

‘Sugar Juice & Fraud Propped Up Failing Biden Economy – Ed Dowd’

‘Depression, Debt, Default & Destruction in 2025 -Martin Armstrong’

I cannot imagine anyone who has high confidence in the Dollar, the gobermint, or Western medicine & the educational system even watching interviews about those subjects. Is willful blindness a requirement to play all confidence games?

I think willful blindness is a given, Helot. But those who are joining the BRICS currency (159 out of 193 countries from what I have read) seem to have lost all confidence in the U.S. dollar, and are getting out. I think Americans are in for a rude awakening when those who would rather see a BRICS currency dump the dollar, and the U.S. can no longer use dollars as a weapon.

I’m having flashbacks of Ron Paul asking Ben Bernake if gold is money.

Channeling Dr. Paul, is fartcoin, bitcoin, or any other blockchain money?

Fake money begets the entire fake society & economy we now find ourselves in.

‘The consequences of inflation are malinvestment, waste, a wanton redistribution of wealth and income, the growth of speculation and gambling, immorality and corruption, disillusionment, social resentment, discontent, upheaval and riots, bankruptcy, increased government controls, and eventual collapse.’

— Henry Hazlitt, Economics in One Freaking Lesson

With a name like Fartcoin it’s getting obvious that our putative masters are laughing at us. Got gold or silver?